Trump's China Tariffs: Projected Impact Through 2025

Table of Contents

Economic Impact of Trump's China Tariffs

The economic consequences of Trump's tariffs on imported Chinese goods are complex and far-reaching. The impact is felt across various sectors, influencing consumer spending, business operations, and the US trade deficit.

Impact on US Consumers

Trump's tariffs directly translated into increased prices for numerous imported goods. This price hike affected consumer purchasing power and shifted spending habits. Sectors particularly impacted include:

- Electronics: Increased costs on smartphones, laptops, and other electronics.

- Apparel: Higher prices for clothing and footwear.

- Furniture: More expensive home furnishings.

Specific examples of price increases include:

- Smartphones: Average price increase of 5-10%.

- Washing machines: Price increases averaging 12-15%.

- Certain types of clothing: Price increases ranging from 5% to 20%, depending on the material and origin.

This led to a reduction in discretionary spending in some sectors, while consumers sought cheaper alternatives, potentially boosting domestic production in certain areas. However, the overall impact on consumer well-being remains a subject of ongoing economic analysis.

Impact on US Businesses

Businesses heavily reliant on imported goods from China faced increased production costs. This negatively impacted profitability for many companies. The impact on US manufacturing and job creation is a contentious point. While some sectors experienced increased domestic production and job growth due to tariff-induced shifts in supply chains, others faced reduced competitiveness and job losses.

- Positive Impacts: Certain US manufacturing sectors saw increased demand and job creation as consumers and businesses sought domestically-produced alternatives.

- Negative Impacts: Companies heavily reliant on imported Chinese components experienced increased costs, reduced profitability, and, in some cases, layoffs. Supply chain disruptions added to these difficulties.

Examples include:

- The furniture industry faced higher input costs for imported materials, leading to increased prices and reduced sales.

- The electronics industry, initially impacted by higher component costs, gradually adapted by sourcing components from other countries, although this often meant longer lead times and increased logistical costs.

Impact on the US Trade Deficit

The effectiveness of Trump's tariffs in reducing the US trade deficit with China is a matter of ongoing debate. While some initial reduction was observed, it's difficult to isolate the impact of tariffs from other factors influencing trade balances.

- Data shows a temporary decline in the trade deficit following tariff implementation, but this trend reversed in subsequent periods.

- Alternative explanations for changes in the trade deficit include fluctuations in global demand, currency exchange rates, and other economic factors.

In summary, the effects of Trump's tariffs on the US trade deficit are complex and not definitively attributable solely to the tariffs themselves. The data requires sophisticated economic modeling to account for other contributing variables.

Geopolitical Ramifications of Trump's China Tariffs

The imposition of tariffs had significant geopolitical consequences, primarily affecting US-China relations and global trade patterns.

US-China Relations

Trump's tariffs dramatically escalated trade tensions between the US and China, impacting bilateral negotiations and diplomatic efforts. The resulting trade war fostered a period of significant distrust and strained communication between the two global powers.

- Key events included retaliatory tariffs from China, public statements criticizing trade practices, and disruptions to established trade agreements.

- The long-term effects on the relationship remain to be seen, but the initial impact was undeniably negative, affecting diplomatic communication and cooperation on other global issues.

Global Trade Implications

The trade war between the US and China had far-reaching global implications. Disruptions to global supply chains and increased uncertainty affected international trade flows and economic growth worldwide.

- Many countries experienced ripple effects, as businesses adjusted their supply chains to navigate the shifting trade landscape.

- The overall impact on global economic growth was negative, with estimates varying across different economic models.

The interconnected nature of the global economy made it difficult for any nation to remain completely unaffected by the trade dispute between the US and China.

Long-Term Projections Through 2025

Predicting the long-term consequences of Trump's China tariffs requires considering various economic and geopolitical scenarios.

Economic Forecasting

Forecasting inflation and economic growth in both the US and China is a complex process that depends on a number of interconnected factors.

- Predictions vary widely depending on the economic models used and the assumptions made about future trade policies and global economic conditions.

- Potential future trade agreements could significantly alter the economic landscape, mitigating or exacerbating the impact of the tariffs.

Different economic scenarios are possible, ranging from continued trade tensions to renewed cooperation and the establishment of new trade agreements. Each scenario would produce different outcomes for inflation and economic growth.

Geopolitical Outlook

Predicting future US-China relations and global power dynamics is equally challenging.

- The potential for further trade disputes or a shift towards increased cooperation remains uncertain.

- Other global actors, such as the European Union, will continue to play a role in shaping the global trade landscape.

Several scenarios are possible, ranging from continued geopolitical competition to a gradual easing of tensions and increased collaboration on global issues. These varying scenarios will produce widely different outcomes for the global political climate.

Conclusion

Trump's China tariffs have had a profound and lasting impact on the US economy and global trade relations. The short-term consequences included increased prices for consumers, disrupted supply chains for businesses, and escalated trade tensions with China. Long-term projections through 2025 suggest that the effects will continue to be felt, influencing inflation, economic growth, and geopolitical dynamics. The full consequences remain uncertain, depending on evolving trade policies, economic conditions, and the trajectory of US-China relations.

To delve deeper into this multifaceted issue, we encourage further research. Consult reputable sources such as the Congressional Research Service, the Peterson Institute for International Economics, and the World Trade Organization for detailed analysis and data on Trump's China tariffs and their ongoing consequences. Understanding the complexities of Trump's China tariffs is crucial for navigating the evolving landscape of global trade and economic relations.

Featured Posts

-

Mlb Game Tonight Yankees Vs Mariners Prediction And Betting Odds

May 17, 2025

Mlb Game Tonight Yankees Vs Mariners Prediction And Betting Odds

May 17, 2025 -

Is Severance Renewed For Season 3 Lehigh Valley Live Com Update

May 17, 2025

Is Severance Renewed For Season 3 Lehigh Valley Live Com Update

May 17, 2025 -

Koriun Descongelamiento De Cuentas E Inversion Recuperada

May 17, 2025

Koriun Descongelamiento De Cuentas E Inversion Recuperada

May 17, 2025 -

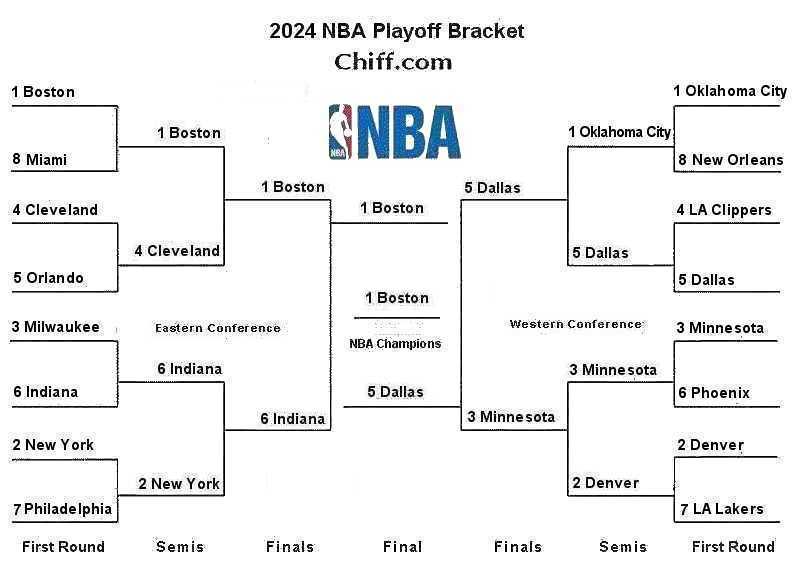

Nba Playoffs 2024 Zeygaria Imerominies And Provlepseis

May 17, 2025

Nba Playoffs 2024 Zeygaria Imerominies And Provlepseis

May 17, 2025 -

New Orleans Jazz And Heritage Festival A Comprehensive Guide

May 17, 2025

New Orleans Jazz And Heritage Festival A Comprehensive Guide

May 17, 2025