Trump's China Trade Negotiation: Focus On Tariff Relief And Rare Earth Minerals

Table of Contents

The Context of Tariff Relief in Trump's China Trade Strategy

Trump's approach to trade with China was characterized by aggressive tariff imposition, aiming to pressure China into concessions. Understanding the impact of these tariffs is crucial to evaluating the overall strategy.

The Impact of Tariffs on US Businesses and Consumers

The escalating tariff war had significant repercussions for both US businesses and consumers:

- Increased Prices: Tariffs increased the cost of imported goods from China, leading to higher prices for consumers on a wide range of products, from electronics to furniture.

- Job Losses: While some argued tariffs protected domestic industries, others experienced job losses due to decreased exports to China and disruptions in global supply chains. Industries like agriculture and manufacturing felt the brunt of these effects.

- Supply Chain Disruptions: The reliance on China for numerous intermediate goods led to significant supply chain disruptions, affecting production schedules and increasing costs for many US companies.

Specific sectors like soybeans, steel, and textiles faced particularly severe challenges due to retaliatory tariffs imposed by China. Data from the US Census Bureau and the Bureau of Economic Analysis reveal a significant contraction in certain sectors during the height of the trade war.

Trump's Negotiation Tactics Regarding Tariffs

Trump's negotiation tactics were often characterized by:

- Aggressive Posturing: Public threats of further tariffs and escalating trade disputes were a hallmark of his approach.

- "Deal-Making": Trump prioritized bilateral deals, aiming for quick wins and specific concessions from China.

- Fluctuating Tariffs: Tariff rates were frequently altered, reflecting the dynamic and unpredictable nature of the negotiations.

For instance, the imposition of tariffs on $200 billion worth of Chinese goods in 2018 was followed by periods of negotiation and temporary tariff suspensions, illustrating the volatile nature of the process. The effectiveness of these strategies remains a subject of ongoing debate among economists and political analysts.

The Significance of Rare Earth Minerals in US-China Relations

The trade war brought into sharp focus the strategic importance of rare earth minerals, highlighting China's dominance in their production and processing.

What are Rare Earth Minerals and Why are they Important?

Rare earth minerals are a group of 17 elements crucial for numerous high-tech applications:

- Electronics: Used in smartphones, computers, and other electronic devices.

- Defense: Essential components in guided missiles, radar systems, and other military technologies.

- Renewable Energy: Critical for the production of wind turbines and electric vehicle batteries.

China controls a significant portion of the global rare earth mining and processing capacity, giving it considerable leverage in the global market. This dominance raises concerns about supply chain security and national security for countries heavily reliant on Chinese imports.

Securing Access to Rare Earth Minerals: A Key Negotiation Point

Trump's administration aimed to:

- Diversify Sources: The administration sought to diversify rare earth mineral sourcing, reducing reliance on China. This involved exploring alternative sources and investing in domestic rare earth mining and processing.

- Develop Domestic Production: Efforts were made to incentivize domestic production of rare earth minerals to bolster national security and reduce reliance on foreign suppliers.

- Strategic Partnerships: Negotiations with allies aimed to establish cooperative agreements to secure access to rare earth minerals and mitigate China's dominance.

However, achieving significant progress in diversifying rare earth mineral sources proved challenging due to the complexities of mining, processing, and environmental regulations.

The Outcomes and Long-Term Implications of Trump's Trade Negotiations

Assessing the long-term effects of Trump's China trade negotiations requires careful consideration of both tariff relief and rare earth mineral access.

Assessment of Tariff Relief Agreements

While some tariff reductions were achieved, the overall impact remains complex:

- Partial Success: Some tariffs were reduced or removed, providing limited relief to certain industries.

- Economic Costs: The trade war inflicted substantial economic costs on both the US and Chinese economies.

- Long-term Effects: The long-term effects on supply chains, trade relationships, and global economic stability are still unfolding.

The "Phase One" trade deal, for example, offered some tariff relief but fell short of addressing all the concerns raised by the Trump administration.

The Future of US-China Relations Regarding Rare Earths

The quest to secure reliable access to rare earth minerals continues:

- Ongoing Diversification Efforts: The US is actively pursuing diversification strategies, including investment in domestic production and exploration of alternative sources.

- Geopolitical Implications: China's control over rare earth resources continues to have significant geopolitical implications.

- Future Strategies: Developing resilient and diversified supply chains will require substantial investment and international cooperation.

Conclusion: Trump's Legacy on China Trade Negotiations: Tariff Relief and Rare Earth Minerals

Trump's China trade negotiations, characterized by aggressive tariff policies and a focus on securing rare earth mineral access, left a lasting mark on US-China relations. While some tariff relief was achieved, the overall impact of the trade war remains a subject of debate. The quest to reduce reliance on China for rare earth minerals continues, highlighting the complexities of decoupling from a dominant global supplier. Continue learning about the complexities of Trump's China trade negotiations and the ongoing challenges of securing rare earth minerals by exploring [link to relevant resource, e.g., a government report or academic study].

Featured Posts

-

Ufc Featherweight Aldos Return And Road To Redemption

May 12, 2025

Ufc Featherweight Aldos Return And Road To Redemption

May 12, 2025 -

Top 10 Films That Channel The John Wick Vibe

May 12, 2025

Top 10 Films That Channel The John Wick Vibe

May 12, 2025 -

Ipswich Town Chaplins Winning Strategy

May 12, 2025

Ipswich Town Chaplins Winning Strategy

May 12, 2025 -

Landmark 10 Year Deal Ottawa And Indigenous Capital Group Partner

May 12, 2025

Landmark 10 Year Deal Ottawa And Indigenous Capital Group Partner

May 12, 2025 -

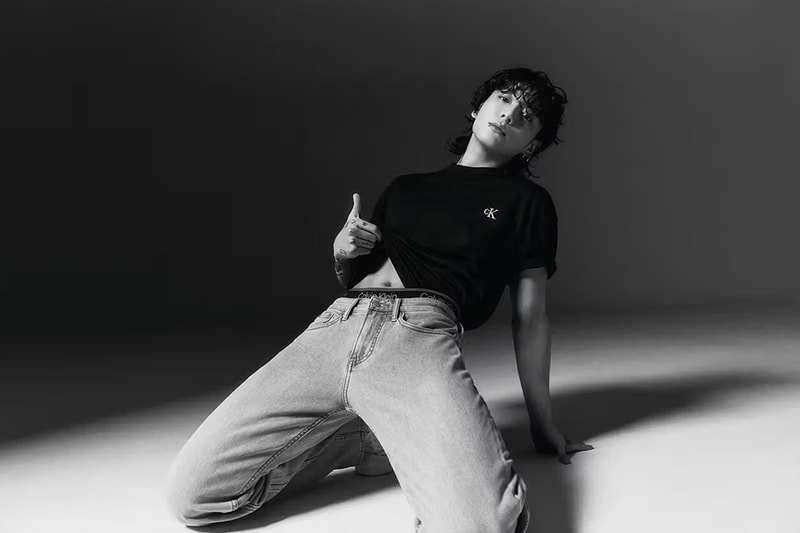

Lily Collins Stars In A New Calvin Klein Campaign See The Photos

May 12, 2025

Lily Collins Stars In A New Calvin Klein Campaign See The Photos

May 12, 2025