Trump's Oil Price Preference: Goldman Sachs Analyzes Social Media Posts

Table of Contents

Goldman Sachs' Methodology: Analyzing Social Media for Sentiment on Oil Prices During the Trump Administration

Goldman Sachs employed a sophisticated methodology to analyze social media data and understand its correlation with Trump's oil price preferences. Their analysis focused primarily on Twitter, a platform known for its real-time commentary and significant reach within political and financial circles. The firm leveraged natural language processing (NLP) and sentiment scoring algorithms to quantify the emotional tone expressed in tweets related to oil prices and the Trump administration's energy policies.

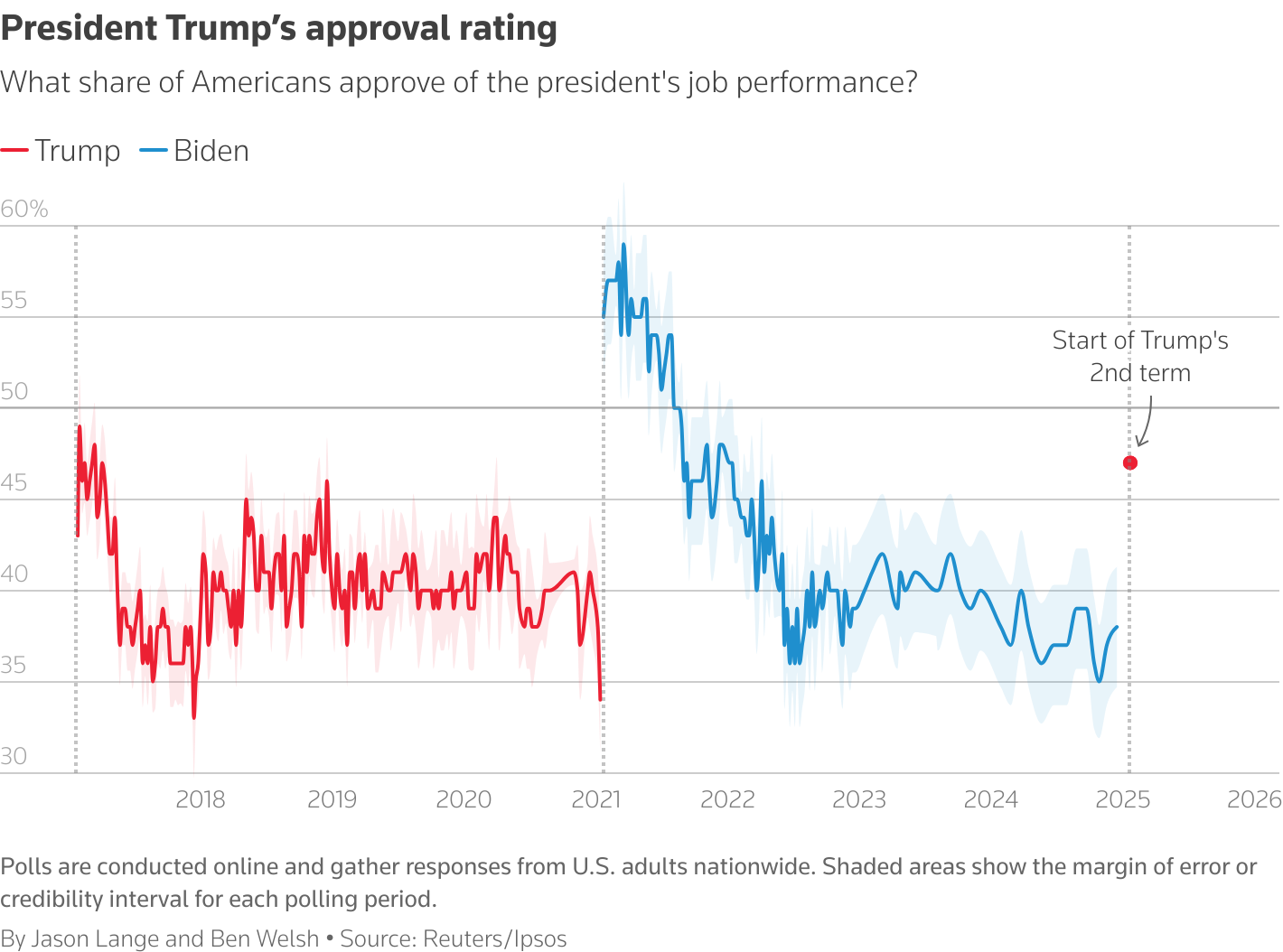

- Data Collection Timeframe: The analysis spanned from January 2017 to January 2021, encompassing Trump's entire presidency.

- Keywords and Hashtags: The researchers utilized a range of keywords and hashtags, including #oilprices, #Trump, #energypolicy, #crude oil, and related terms to filter relevant tweets.

- Sentiment Metrics: Each tweet was assigned a sentiment score, categorized as positive, negative, or neutral, based on the algorithms' interpretation of the text. This provided a quantifiable measure of the overall sentiment surrounding oil prices during specific periods.

This rigorous approach aimed to capture the nuanced public perception of oil prices, influenced by Trump's pronouncements and actions.

Key Findings: Trump's Stated Preferences and Their Correlation with Social Media Sentiment

Goldman Sachs' analysis revealed a notable correlation between Trump's public statements on oil prices and the ensuing social media sentiment. While the exact nature of the correlation varied depending on the specific statement and context, a general trend emerged.

- Specific Examples: For instance, following Trump's tweets expressing support for lower oil prices, the analysis often revealed a surge in negative sentiment among users concerned about potential impacts on the energy industry. Conversely, announcements supportive of domestic oil production tended to correlate with positive sentiment.

- Quantifiable Results: The study quantified these observations, indicating that, in several instances, Trump's pronouncements on oil prices resulted in a statistically significant shift in the percentage of positive or negative social media sentiment. Specific numbers would require access to the Goldman Sachs report.

- Identified Trends: The analysis also highlighted recurring trends. For instance, periods of increased uncertainty regarding Trump's energy policy often coincided with increased volatility in both social media sentiment and oil prices.

This suggests a direct link between political rhetoric, social media reactions, and market dynamics.

Implications for the Energy Market: The Influence of Political Rhetoric on Oil Prices

The Goldman Sachs study has significant implications for understanding the interplay between political rhetoric and oil price volatility.

- Investor Confidence: The findings suggest that political statements, amplified by social media, can significantly influence investor confidence, leading to price fluctuations. Negative sentiment, driven by uncertain or controversial policies, can trigger sell-offs and price drops.

- Future Oil Price Forecasting: The research highlights the need to incorporate social media sentiment analysis into existing oil price forecasting models. This could improve the accuracy of predictions by accounting for the influence of political factors and public perception.

- Considerations for Policymakers and Energy Companies: Policymakers and energy companies need to consider the potential influence of social media on market dynamics when formulating and communicating their strategies. Understanding and managing the narrative surrounding energy policy is crucial for maintaining stability and investor confidence.

Criticisms and Limitations of the Goldman Sachs Study

While groundbreaking, the Goldman Sachs study is not without its limitations.

- Sample Bias: The analysis relies on publicly available Twitter data, which might not be fully representative of the broader public opinion. The sample may over-represent certain demographics or viewpoints, leading to potential biases.

- Limitations of Sentiment Analysis: Sentiment analysis algorithms are not perfect. Sarcasm, irony, or nuanced language can be misinterpreted, potentially affecting the accuracy of sentiment scores.

- Other Influencing Factors: Oil prices are influenced by a multitude of factors beyond political rhetoric. Geopolitical events, supply chain disruptions, and global economic conditions all play a significant role.

Conclusion:

Goldman Sachs' analysis provides valuable insight into the influence of Trump's oil price preference, demonstrating a tangible link between political pronouncements, social media sentiment, and oil price fluctuations. This underscores the importance of understanding the complex intersection of political rhetoric, social media, and energy markets. To fully grasp the dynamics of oil prices in the future, we must consider the evolving relationship between political statements and the rapid dissemination of information and sentiment analysis within the digital sphere. Learn more about the impact of Trump's oil price preference and delve deeper into the analysis of social media sentiment and oil prices to gain a comprehensive understanding of this dynamic relationship.

Featured Posts

-

S Bahn And Bvg Update Strike Resolved But Residual Disruptions Remain

May 16, 2025

S Bahn And Bvg Update Strike Resolved But Residual Disruptions Remain

May 16, 2025 -

Tampa Bay Rays Sweep Padres In Commanding Fashion

May 16, 2025

Tampa Bay Rays Sweep Padres In Commanding Fashion

May 16, 2025 -

Trumps Second Term An Examination Of Presidential Pardons

May 16, 2025

Trumps Second Term An Examination Of Presidential Pardons

May 16, 2025 -

Left Handed Hitters Slump How The Dodgers Can Reignite Their Offense

May 16, 2025

Left Handed Hitters Slump How The Dodgers Can Reignite Their Offense

May 16, 2025 -

Chandlers Defeat Gordon Ramsays Expert Opinion On Training And The Fight

May 16, 2025

Chandlers Defeat Gordon Ramsays Expert Opinion On Training And The Fight

May 16, 2025