Trump's Shift In Tone Leads To Gold Price Increase

Table of Contents

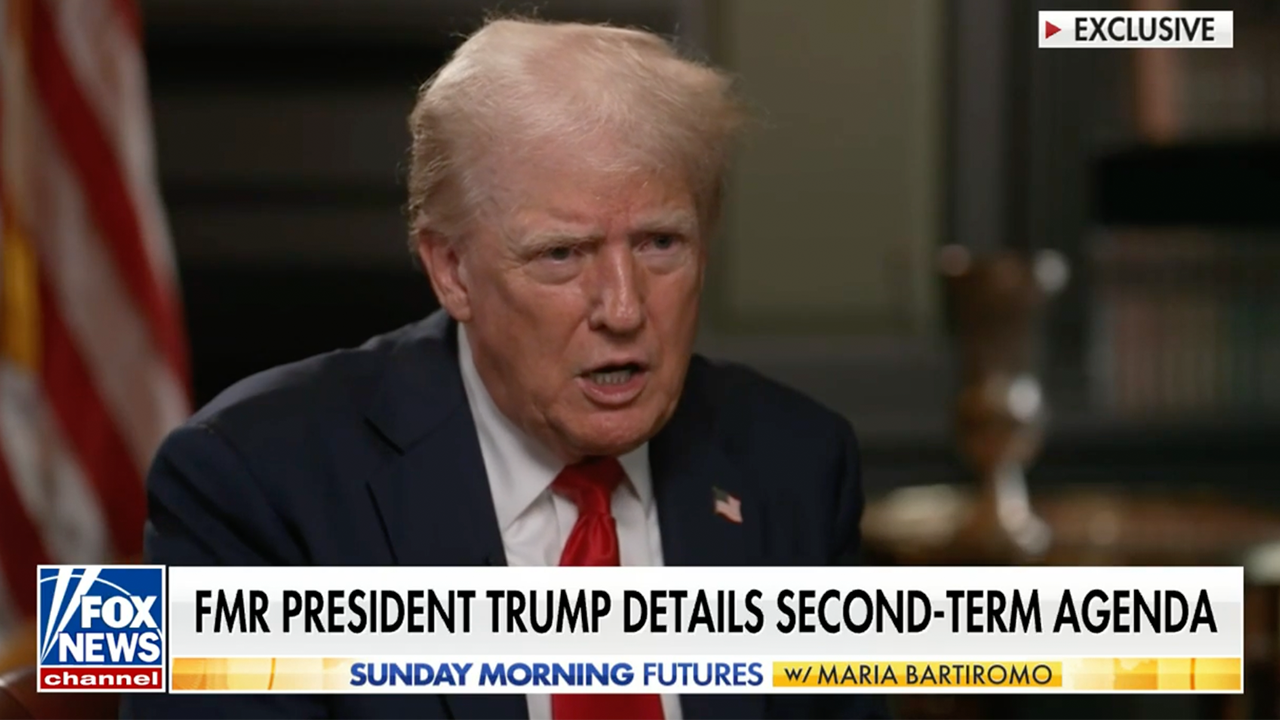

Trump's Rhetorical Shift and Market Reaction

The shift in Trump's public pronouncements, characterized by more inflammatory statements and less predictable policy pronouncements, has injected a significant dose of uncertainty into the market. This unpredictable rhetoric, deviating from his previous patterns, created a sense of unease among investors. This contributed to increased market uncertainty, prompting a reassessment of risk and investment strategies.

- Increased political risk perception: Trump's statements often challenged established norms and international alliances, increasing the perceived risk of political instability.

- Heightened uncertainty about future policies: The lack of clear policy direction created ambiguity about the economic landscape, making investment planning more challenging.

- Potential impact on international relations: Trump's rhetoric frequently strained relationships with key allies, adding to the global political uncertainty impacting investor confidence.

- Investor flight to safety: Faced with increased uncertainty, investors sought refuge in safe-haven assets like gold, driving up its price.

Gold as a Safe Haven Asset

Gold's historical role as a safe haven asset during times of crisis is well-documented. When economic or political uncertainty rises, investors often flock to gold as a store of value and a hedge against risk. This is largely due to its inherent properties and its performance during past periods of turmoil.

- Gold's inherent value and limited supply: Gold's scarcity and intrinsic value make it a reliable asset, unlike fiat currencies susceptible to inflation and devaluation.

- Lack of correlation with other asset classes: Gold often behaves differently from stocks and bonds, providing diversification benefits to a portfolio during market downturns.

- Gold's historical performance during periods of political turmoil: Throughout history, gold has demonstrated its resilience during times of political instability, making it a preferred refuge for investors.

- Its role as a hedge against inflation: Gold is often seen as a protection against inflation, as its price tends to rise when the value of fiat currencies declines.

Economic Factors Contributing to Gold Price Increase

While Trump's rhetoric played a role, other significant economic factors contributed to the increase in gold prices. These factors independently, and in conjunction with political uncertainty, created a perfect storm driving demand for gold.

- Rising inflation rates globally: Inflation erodes the purchasing power of money, increasing the attractiveness of gold as a store of value.

- Low interest rates and quantitative easing policies: These monetary policies, while intended to stimulate economic growth, can also lead to inflation and a weakening of currency, making gold more desirable.

- Slowing global economic growth: Concerns about a global economic slowdown often push investors towards the safety of gold.

- Geopolitical instability in other regions: Global political instability beyond Trump's influence also adds to the overall uncertainty, further boosting demand for gold.

Analyzing the Correlation Between Trump's Actions and Gold Prices

Establishing a direct causal link between Trump's specific statements and gold price movements is complex. While correlation doesn't equal causation, analyzing gold price fluctuations alongside significant Trump news events reveals a noticeable trend.

- Chart showing gold price fluctuations and corresponding Trump news events: (Ideally, this section would include a chart visually demonstrating this correlation). Such a chart would require data analysis and visualization tools.

- Discussion of other market factors that might influence gold prices: It's crucial to acknowledge other simultaneous market factors influencing gold prices, preventing oversimplification of the relationship.

- Analysis of cause-and-effect relationships: While a direct link is difficult to prove, the observed correlation strongly suggests that Trump's rhetoric contributed to increased market uncertainty, influencing investor behavior and the demand for gold.

Conclusion

In conclusion, the rise in gold prices following a shift in Trump's rhetoric underscores the complex interplay between political and economic factors in shaping the gold market. While several economic factors contributed, Trump's unpredictable statements exacerbated market uncertainty, pushing investors towards the safety and perceived stability of gold. Gold, a proven safe-haven asset, once again demonstrated its role as a hedge against political and economic instability.

Considering the impact of Trump's shifting rhetoric on the gold market, investors should carefully monitor political developments and consider diversifying their portfolios with gold and other precious metals to mitigate risk. Stay informed about the latest developments impacting the gold price and Trump's influence on the gold market. Learn more about investing in precious metals and managing your financial portfolio during times of political uncertainty.

Featured Posts

-

Heartthrobs Accent Revealed Netflixs Steamy New Hit

Apr 25, 2025

Heartthrobs Accent Revealed Netflixs Steamy New Hit

Apr 25, 2025 -

Stagecoach 2025 Livestream Options And Viewing Information

Apr 25, 2025

Stagecoach 2025 Livestream Options And Viewing Information

Apr 25, 2025 -

Japanese Assets Record Inflows Signal Us Capital Flight

Apr 25, 2025

Japanese Assets Record Inflows Signal Us Capital Flight

Apr 25, 2025 -

Frankfurts Victory In Bochum A Return To Winning Form

Apr 25, 2025

Frankfurts Victory In Bochum A Return To Winning Form

Apr 25, 2025 -

Dope Thief Episode 7 Review Ray And Manny Take Center Stage

Apr 25, 2025

Dope Thief Episode 7 Review Ray And Manny Take Center Stage

Apr 25, 2025