Trump's Tariff Relief Hint Boosts European Stocks; LVMH Shares Fall

Table of Contents

Positive Market Reaction to Tariff Relief Hints

Broader European Market Gains

The news of potential tariff relief triggered a surge in several key European stock market indices. The DAX (Germany), CAC 40 (France), and FTSE 100 (UK) all saw significant gains, indicating a broader wave of investor optimism.

- DAX: Experienced a 1.5% increase in the hours following the announcement.

- CAC 40: Rose by approximately 1.2%, exceeding expectations.

- FTSE 100: Showed a gain of 0.8%, reflecting a positive sentiment across various sectors.

Several sectors benefited disproportionately from this positive sentiment:

- Automotive: Automakers experienced significant gains, likely due to the expectation of reduced trade barriers.

- Industrials: Companies in the industrial sector also showed robust performance, reflecting a belief in increased economic activity.

These gains were supported by increased trading volumes, indicating strong investor participation and conviction. Closing prices reflected the positive momentum, demonstrating the immediate market response to the news.

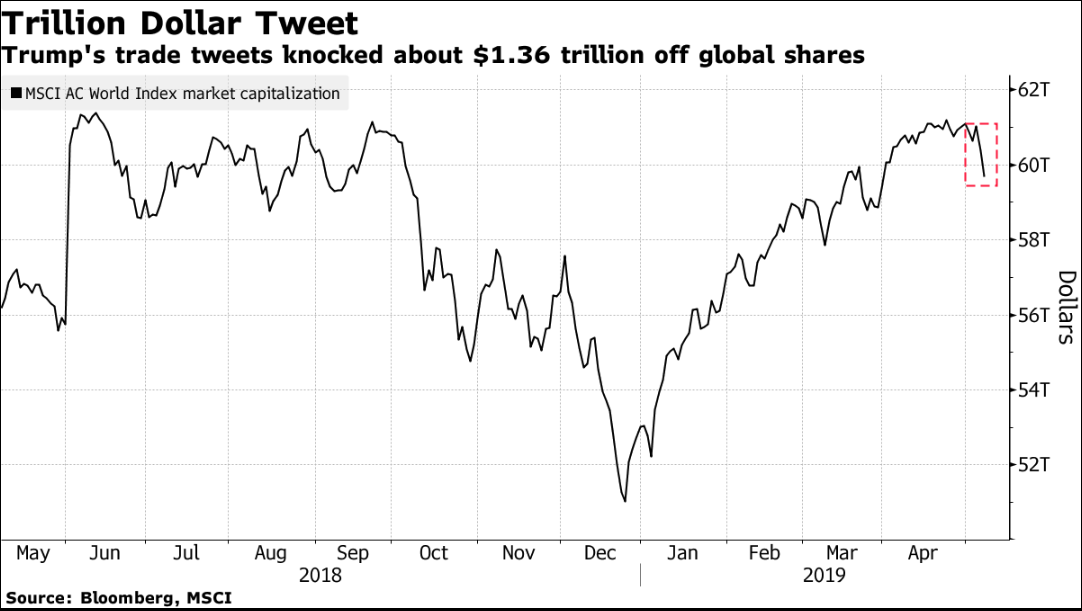

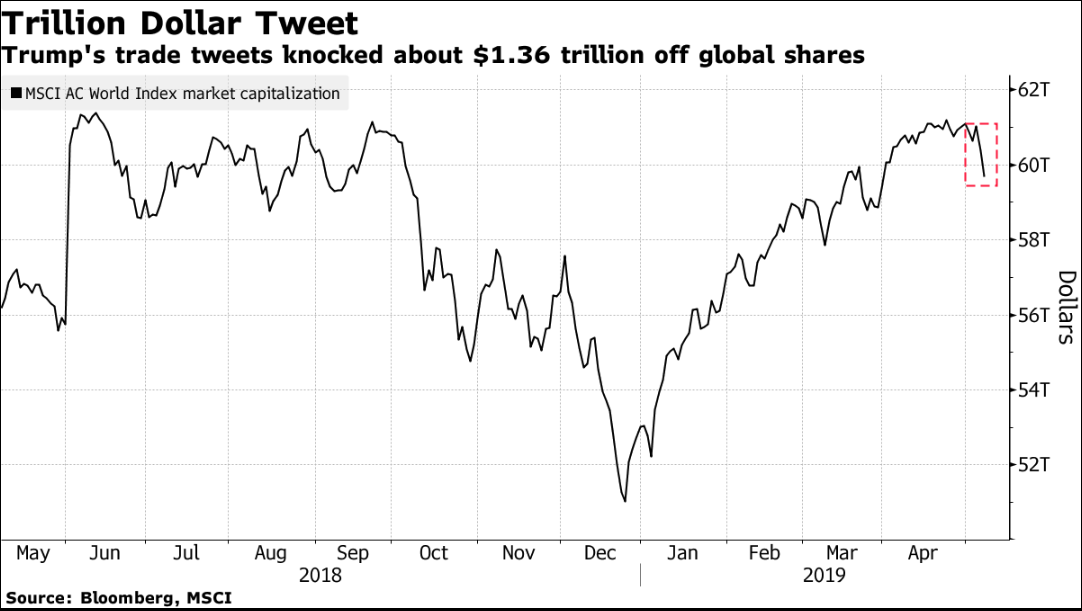

Analysis of the Market's Response

The positive reaction stems from several key factors:

- Reduced Trade Uncertainty: The hint of tariff relief lessened the uncertainty surrounding future trade relations, allowing investors to breathe a sigh of relief.

- Improved Investor Sentiment: The news boosted investor confidence, encouraging investment in European assets.

- Economic Growth Expectations: Many analysts believe that reduced tariffs could stimulate economic growth across Europe.

Market analyses from leading financial news sources such as the Financial Times and Bloomberg echoed this sentiment, citing the potential for increased global trade and economic expansion as key drivers behind the positive market reaction. The overarching narrative is one of cautious optimism, with analysts emphasizing the need for concrete action from the Trump administration to solidify these gains.

LVMH's Declining Stock Performance: A Contrasting Trend

Understanding LVMH's Vulnerability

While the broader European market celebrated the potential for tariff relief, LVMH's stock experienced a downturn. This contrasting performance highlights the sector-specific nuances of Trump's tariff policies.

Luxury goods, a significant portion of LVMH's business, are particularly susceptible to tariff changes. Increased import tariffs on luxury goods could negatively impact both import costs and consumer demand.

- Supply Chain Disruptions: Tariffs could disrupt LVMH's complex global supply chain, increasing production costs and reducing profitability.

- Reduced Consumer Demand: Higher prices resulting from tariffs could deter consumers, especially in price-sensitive markets.

- Increased Competition: Tariffs could disadvantage LVMH compared to domestic competitors in certain markets.

These factors contributed to the negative market sentiment surrounding LVMH, despite the generally positive broader market trend.

Analyzing LVMH's Future Prospects

Despite the current setback, LVMH's long-term prospects remain relatively strong. The company has a robust brand portfolio and a history of adapting to market challenges. However, navigating the uncertainty created by Trump's trade policies will require strategic planning and adaptation.

- Diversification Strategies: LVMH may explore diversifying its supply chains and production bases to mitigate the impact of future tariff changes.

- Pricing Strategies: Careful price management will be crucial to maintain consumer demand in the face of potential price increases.

- Investor Relations: Maintaining strong investor confidence will be key to bolstering the stock price in the face of volatility.

The future success of LVMH hinges on effectively managing these challenges and capitalizing on emerging opportunities in the global luxury market.

Conclusion: Navigating the Unpredictability of Trump's Tariff Policies

Trump's tariff relief hints created a paradoxical market reaction: a broad upswing in European markets offset by a decline in luxury goods stocks, exemplified by LVMH's performance. The overall positive sentiment reflects the market’s hope for reduced trade uncertainty, while LVMH's experience underlines the sector-specific impact of such policies. The unpredictable nature of Trump's trade policies underscores the importance of continuous monitoring of future developments and their potential effect on global markets. To stay informed about Trump's tariff relief and its effects, follow updates on financial news websites and subscribe to market analysis services for insights into tariff relief updates and Trump's trade policies. Understanding the impact of tariffs is crucial for navigating this period of economic uncertainty.

Featured Posts

-

Escape To The Country Nicki Chapmans Chiswick Garden Revealed

May 24, 2025

Escape To The Country Nicki Chapmans Chiswick Garden Revealed

May 24, 2025 -

Costi Moda Usa Importazione E Prezzi Al Dettaglio

May 24, 2025

Costi Moda Usa Importazione E Prezzi Al Dettaglio

May 24, 2025 -

Amundi Msci World Ii Ucits Etf Usd Hedged Dist Nav Analysis And Tracking

May 24, 2025

Amundi Msci World Ii Ucits Etf Usd Hedged Dist Nav Analysis And Tracking

May 24, 2025 -

Posthumous Honor For Alfred Dreyfus French Parliament Debates Symbolic Act Of Rehabilitation

May 24, 2025

Posthumous Honor For Alfred Dreyfus French Parliament Debates Symbolic Act Of Rehabilitation

May 24, 2025 -

Stijgende Kapitaalmarktrentes Euro Boven 1 08

May 24, 2025

Stijgende Kapitaalmarktrentes Euro Boven 1 08

May 24, 2025

Latest Posts

-

Mia Farrow On Trump Imprisonment Necessary After Venezuelan Deportation Controversy

May 24, 2025

Mia Farrow On Trump Imprisonment Necessary After Venezuelan Deportation Controversy

May 24, 2025 -

Actress Mia Farrow Seeks Legal Action Against Trump For Venezuela Deportation Policy

May 24, 2025

Actress Mia Farrow Seeks Legal Action Against Trump For Venezuela Deportation Policy

May 24, 2025 -

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025 -

Sinatras Four Marriages An Examination Of His Romantic Life

May 24, 2025

Sinatras Four Marriages An Examination Of His Romantic Life

May 24, 2025 -

Farrow Seeks Trumps Incarceration Focus On Venezuelan Deportations

May 24, 2025

Farrow Seeks Trumps Incarceration Focus On Venezuelan Deportations

May 24, 2025