Trump's Tax Bill: A Test Of Republican Unity And Economic Policy.

Table of Contents

The Provisions of the Trump Tax Bill

The Trump Tax Bill encompassed sweeping changes to both corporate and individual taxation, along with adjustments to the tax treatment of pass-through businesses. Understanding these provisions is crucial to assessing the bill's overall impact.

Corporate Tax Cuts

The most significant change was the reduction of the corporate tax rate from 35% to 21%. Proponents argued this would boost corporate profits, leading to increased investment, job creation, and ultimately, economic growth.

- Claimed Impacts: Increased investment, job creation, higher wages.

- Actual Impacts: While corporate profits did increase, the impact on investment and job creation was debated, with some studies showing limited effects and others suggesting a more positive impact. The increase in the national debt also became a significant concern.

- Downsides: The significant reduction contributed to the increased national debt. Critics also argued that the benefits disproportionately favored large corporations over small businesses and did not translate into widespread wage increases for workers. Data on this varies, with some reporting minimal wage growth following the tax cuts.

Individual Tax Cuts

The Trump Tax Bill also altered individual income tax brackets, standard deductions, and child tax credits.

- Changes: The bill lowered individual income tax rates across several brackets, increased the standard deduction, and expanded the child tax credit.

- Impact on Income Groups: While many taxpayers saw a reduction in their tax burden, the benefits were not evenly distributed. Lower and middle-income taxpayers generally saw smaller reductions than higher-income taxpayers, potentially exacerbating income inequality. The temporary nature of some tax cuts also meant that future tax increases were inevitable for some individuals.

- Temporary Nature: Several provisions of the individual tax cuts were temporary, with sunset clauses built into the legislation. This means that certain tax benefits were only temporary, leading to potential tax increases for taxpayers in subsequent years. Economic analyses on the long-term impact vary considerably depending on assumptions about economic growth and government spending.

Pass-Through Business Tax Changes

The TCJA also introduced changes to the taxation of pass-through businesses—businesses that don't pay corporate income tax but pass their income through to their owners.

- Impact on Small Businesses: The bill created a new deduction for qualified business income (QBI) from pass-through entities, intended to benefit small business owners and entrepreneurs.

- Effectiveness: The effectiveness of this deduction in stimulating economic growth is a subject of ongoing debate. Some economists argue it had a positive impact, while others claim its effect was minimal or even negative due to complexity and limitations.

- Unintended Consequences: The complexity of the QBI deduction led to confusion and difficulties in implementation, potentially resulting in unintended consequences and creating loopholes for some businesses.

Republican Unity and the Trump Tax Bill

The passage of the Trump Tax Bill was far from a unified Republican effort. Intra-party divisions significantly shaped the final legislation.

Intra-Party Divisions

Despite controlling both houses of Congress, Republicans faced internal disagreements, particularly regarding the state and local tax (SALT) deduction.

- Points of Contention: The limitation of the SALT deduction was a significant point of contention, particularly among Republican representatives from high-tax states. Other points of contention included the individual income tax cuts and the corporate tax rate.

- Lobbying and Political Pressure: Intense lobbying efforts from various interest groups significantly influenced the final bill's shape.

- Impact on Final Version: These internal divisions resulted in compromises and concessions, leading to a final bill that didn't fully satisfy all Republican factions.

Legislative Strategy and Compromises

Republicans employed a reconciliation process to pass the bill with a simple majority in the Senate, bypassing the filibuster.

- Key Players: Key figures in the legislative process included Senator Mitch McConnell and Speaker Paul Ryan, who played crucial roles in navigating the complexities of the process and securing enough votes.

- Reconciliation: The use of reconciliation was a controversial strategy but ultimately proved essential for the bill's passage.

- Effectiveness of Strategy: The use of reconciliation was effective in ensuring passage, although it also led to accusations of rushing the process and overlooking potential consequences.

Economic Impact of the Trump Tax Bill

Assessing the economic impact of the Trump Tax Bill requires analyzing both its short-term and long-term effects.

Short-Term Economic Effects

In the short term, the bill led to an increase in GDP growth, but determining the specific contribution of the tax cuts is difficult due to other simultaneous economic factors.

- Economic Indicators: While GDP growth increased, inflation remained relatively subdued, and the employment rate showed only modest improvement. The correlation between these improvements and the Tax Cuts and Jobs Act is highly debated.

- Other Economic Factors: It's important to consider other factors impacting the economy during this period, such as global economic conditions and monetary policy, to isolate the specific contribution of the tax bill.

Long-Term Economic Consequences

The long-term consequences of the Trump Tax Bill remain uncertain and are still being debated.

- National Debt: The tax cuts significantly increased the national debt, raising concerns about long-term fiscal sustainability. Projections vary widely, and their validity is tied to assumptions about future economic growth.

- Income Inequality: Some economists believe that the tax cuts exacerbated income inequality, as higher-income individuals benefited disproportionately. Studies on this topic are ongoing and their conclusions vary considerably.

- Investment: The extent to which the corporate tax cuts stimulated investment remains a subject of ongoing research and debate. Some analyses demonstrate minimal impact, while others posit a more meaningful contribution to business investment.

Conclusion

The Trump Tax Bill remains a highly debated piece of legislation, with significant implications for both Republican party unity and the US economy. While proponents point to short-term economic growth and corporate investment, critics highlight the bill's contribution to the national debt and its potential to exacerbate income inequality. Understanding the complexities of the Trump Tax Bill requires a thorough examination of its provisions, the political maneuvering behind its passage, and the ongoing assessment of its economic impact. Further research and analysis are crucial for a complete understanding of its long-term consequences. To delve deeper into the intricacies of this landmark legislation, explore additional resources and analyses on the Trump Tax Bill, Tax Cuts and Jobs Act, and related economic analyses.

Featured Posts

-

Luis Enriques Alisson Verdict Adding To Slots Liverpool Comments

May 22, 2025

Luis Enriques Alisson Verdict Adding To Slots Liverpool Comments

May 22, 2025 -

Lancaster County Shooting Under Investigation Police Seek Answers

May 22, 2025

Lancaster County Shooting Under Investigation Police Seek Answers

May 22, 2025 -

Choosing And Storing Cassis Blackcurrant

May 22, 2025

Choosing And Storing Cassis Blackcurrant

May 22, 2025 -

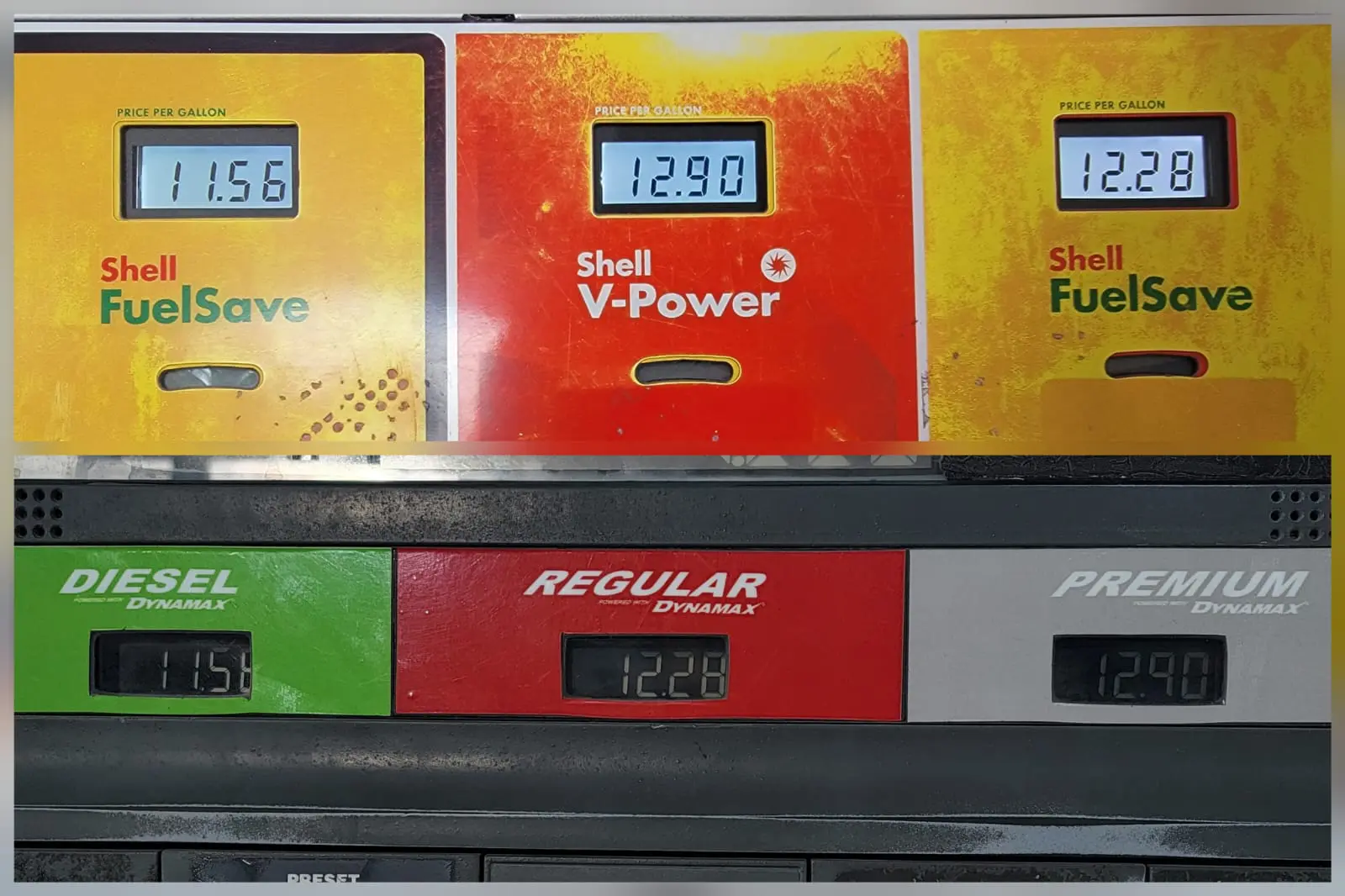

Understanding The 20 Cent Gas Price Jump

May 22, 2025

Understanding The 20 Cent Gas Price Jump

May 22, 2025 -

Falling Gas Prices In Illinois A National Trend Analysis

May 22, 2025

Falling Gas Prices In Illinois A National Trend Analysis

May 22, 2025