Trump's XRP Endorsement: A Catalyst For Institutional Adoption?

Table of Contents

The Trump Factor: Analyzing the Impact of Political Endorsements on Crypto

Historical Precedent: How have past political endorsements influenced asset prices?

Political endorsements, particularly from high-profile figures like Donald Trump, can significantly influence asset prices. While direct causation is difficult to prove, a correlation often exists.

- Examples: Endorsements by politicians have historically boosted stock prices of companies in their favored sectors. Similarly, comments from influential figures can impact commodity markets.

- Trump's Influence: Trump's vast following and significant influence on various investor demographics could translate into increased interest in XRP. His endorsement could attract a new wave of retail investors, potentially impacting the price and overall market sentiment.

- However, it is important to remember that Trump’s pronouncements on financial matters have been inconsistent and sometimes controversial. This unpredictable nature can be a double-edged sword for XRP. The question remains whether this translates into sustained institutional interest. Keywords: Political influence crypto, celebrity endorsement crypto, Trump crypto investment.

The Speculative Surge: Immediate Market Reactions to Trump's Statements

Trump's comments on XRP caused an immediate surge in trading activity and price fluctuations.

- Price Movements: Following Trump's statements, XRP experienced a [Insert specific percentage] increase in price within [Insert timeframe].

- Trading Volume: Trading volume on major exchanges spiked significantly, indicating heightened market interest and speculation.

- Market Sentiment: Social media platforms and crypto news sites reflected a mix of excitement and skepticism. While some celebrated the potential boost to XRP's price, others remained cautious, pointing to the inherent volatility of the cryptocurrency market and the need for further analysis. Was it simply a short-lived pump, or a sign of things to come? Keywords: XRP price analysis, XRP trading volume, crypto market sentiment.

Institutional Adoption: Navigating the Hurdles

Regulatory Uncertainty: The Ongoing Battle for Crypto Clarity

Regulatory uncertainty remains a major obstacle to widespread institutional adoption of cryptocurrencies, including XRP.

- Current Landscape: The regulatory landscape for XRP and other cryptocurrencies is still evolving, with ongoing legal battles and differing interpretations across jurisdictions. The SEC vs. Ripple case is a prime example.

- Impact on Institutions: Institutional investors are generally risk-averse and require regulatory clarity before making significant investments. Trump's endorsement, while impactful on retail investors, might not be enough to overcome these regulatory hurdles for institutional players. Keywords: XRP regulation, SEC vs Ripple, cryptocurrency regulation USA.

Risk Tolerance and Due Diligence: What Institutions Look For

Institutional investors conduct thorough due diligence before investing, considering various factors:

- Risk Assessment: They analyze the risks associated with the asset, including market volatility, regulatory uncertainty, and technological risks.

- Security: Security protocols and the overall robustness of the blockchain network are crucial considerations.

- Scalability: The ability of the cryptocurrency to handle a large volume of transactions efficiently is another key factor.

- Trump's Influence on Due Diligence: While Trump's endorsement might increase visibility, it's unlikely to supersede the rigorous due diligence process required by institutional investors. Keywords: Institutional investors crypto, risk management crypto, due diligence cryptocurrency.

Technological Advantages and Use Cases: XRP's Intrinsic Value

XRP's technological features could attract institutional investors:

- Speed and Efficiency: XRP boasts significantly faster transaction speeds and lower fees compared to some other cryptocurrencies.

- Cross-Border Payments: XRP's potential for facilitating efficient and cost-effective cross-border payments is a compelling use case for institutions involved in international finance.

- Attractiveness to Institutions: These advantages, alongside a growing ecosystem of partnerships and applications, contribute to XRP's intrinsic value proposition and could sway institutional investors. Keywords: XRP technology, XRP use cases, cross-border payments.

Conclusion

This article explored the potential impact of Trump's XRP endorsement on institutional adoption. While the endorsement undeniably generated short-term market excitement, the long-term effects remain uncertain due to regulatory complexities and institutional risk assessment protocols. The intrinsic value of XRP and its technological advantages will ultimately play a crucial role in determining its future success.

Call to Action: The future of XRP remains to be seen. Stay informed about the ongoing developments in XRP regulation and market trends to make informed investment decisions regarding Trump XRP and other cryptocurrencies. Further research into institutional adoption XRP is encouraged to fully understand the nuances of this complex and dynamic market.

Featured Posts

-

Kripto Para Wall Street In Degisen Tutumu Ve Gelecegi

May 08, 2025

Kripto Para Wall Street In Degisen Tutumu Ve Gelecegi

May 08, 2025 -

April 12th Lotto Results Winning Numbers For Saturdays Draw

May 08, 2025

April 12th Lotto Results Winning Numbers For Saturdays Draw

May 08, 2025 -

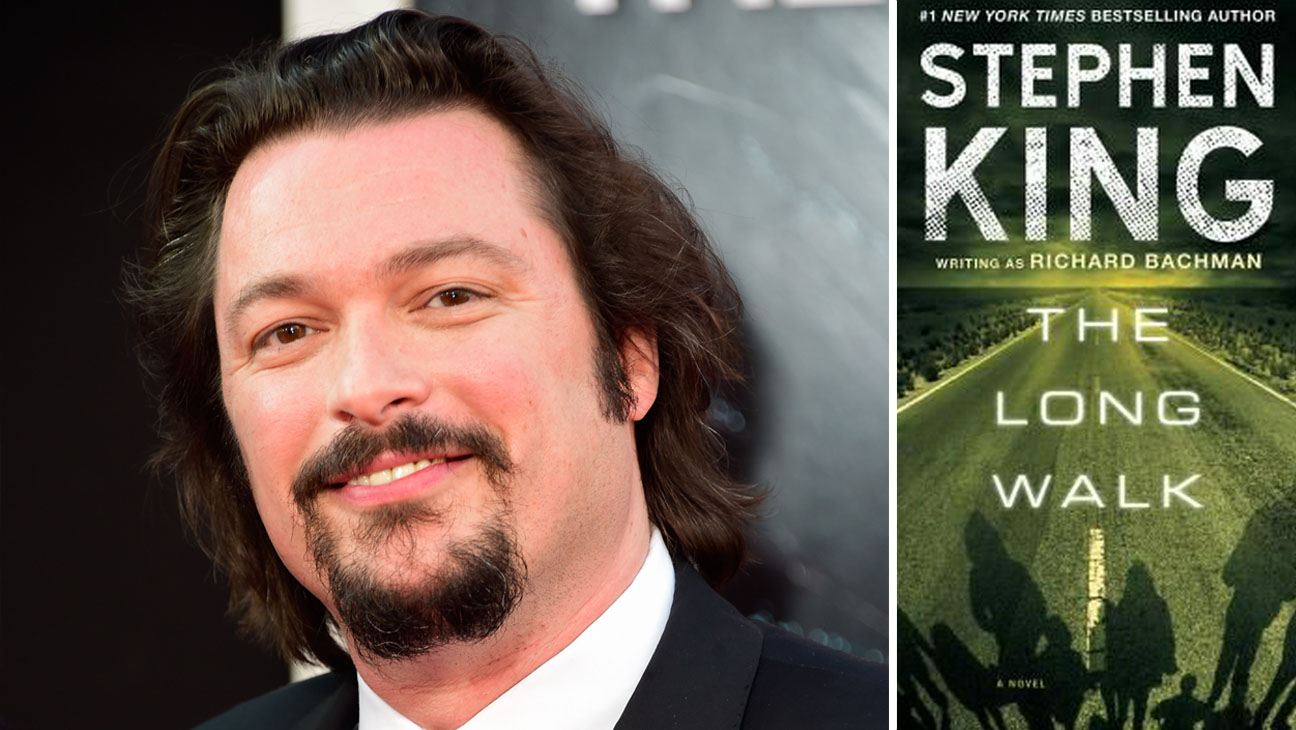

New Trailer For Stephen Kings The Long Walk Adaptation

May 08, 2025

New Trailer For Stephen Kings The Long Walk Adaptation

May 08, 2025 -

Cinema Con 2024 The Long Walk Movie Release Date Revealed

May 08, 2025

Cinema Con 2024 The Long Walk Movie Release Date Revealed

May 08, 2025 -

Zlzal Marakana Tfasyl Isabt Barbwza Bfqdan Alasnan

May 08, 2025

Zlzal Marakana Tfasyl Isabt Barbwza Bfqdan Alasnan

May 08, 2025