Tuesday's CoreWeave (CRWV) Stock Rally: A Detailed Analysis

Table of Contents

2.1. Pre-Rally Market Sentiment and CRWV Stock Performance

Before Tuesday's dramatic increase in CoreWeave stock price, the overall market sentiment was a mix of optimism and caution. While the NASDAQ, a key indicator for technology stocks, had shown some volatility in the preceding weeks, a general positive trend persisted. Analyzing the CoreWeave stock chart leading up to the rally reveals a period of consolidation, with CRWV stock price fluctuating within a relatively narrow range. Trading volume, however, was notably higher than average in the days leading up to the surge, suggesting accumulating interest in the stock. Several analysts had issued positive ratings for CRWV, with some setting ambitious price targets, potentially contributing to the pre-rally anticipation.

- NASDAQ Performance: The NASDAQ Composite Index showed moderate growth in the weeks preceding the rally, reflecting broader positive sentiment in the tech sector.

- CRWV Trading Volume: A significant increase in CRWV trading volume was observed in the days before the surge, indicating growing investor interest.

- Analyst Ratings and Price Targets: Several financial analysts had issued "buy" ratings for CRWV stock, with price targets suggesting further upside potential.

2.2. Potential Catalysts for the CoreWeave (CRWV) Stock Rally

Several potential catalysts likely contributed to the CoreWeave (CRWV) stock rally. The surge in interest in AI and cloud computing, driven by advancements in large language models and increased adoption rates, undoubtedly played a significant role. While no single event directly caused the rally, several factors likely combined to create the perfect storm:

- Positive News Releases: Any significant news related to CoreWeave, such as securing major contracts with high-profile clients in the AI sector, could have fuelled the rally. Any press releases announcing partnerships or expansion plans would also positively impact investor confidence.

- AI Investment Boom: The ongoing investment boom in the artificial intelligence sector undoubtedly benefited CoreWeave, a major player in the provision of cloud computing infrastructure crucial for AI development and deployment. The company's strong position in this rapidly growing market certainly attracted more investment.

- Competitor Performance: Positive performance by competitors in the cloud computing market could have had a spillover effect, boosting investor confidence in the sector as a whole, benefitting CoreWeave in the process.

2.3. Technical Analysis of the CoreWeave (CRWV) Stock Chart

A technical analysis of the CoreWeave (CRWV) stock chart on Tuesday reveals a significant price breakout. The trading volume surged dramatically, confirming the strength of the move. Candlestick patterns indicated a strong bullish momentum, surpassing previous resistance levels. The sharp increase suggests a rapid shift in market sentiment, with a large number of investors buying the stock simultaneously.

- Key Technical Indicators: Indicators like Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) likely showed strong bullish signals on Tuesday.

- Graphical Representation: The chart displayed a clear upward trend, with the price breaking through significant resistance levels.

- Future Price Movements: While predicting future price movements is speculative, the technical analysis suggests a potential continuation of the upward trend, provided that further positive news and strong investor sentiment persist.

2.4. Fundamental Analysis of CoreWeave (CRWV) and its Future Prospects

A fundamental analysis of CoreWeave reveals a company well-positioned within the rapidly expanding cloud computing and AI markets. While specific financial details require review of their financial reports (e.g., CRWV revenue, earnings, and profit margins), the company’s growth prospects are considerable. CoreWeave's competitive advantages lie in its specialized infrastructure tailored for AI workloads, allowing it to target a high-growth segment of the market. However, increased competition, economic downturns, and technological disruptions pose significant risks.

- Key Financial Metrics: Analyzing key financial metrics such as revenue growth, profit margins, and debt levels is crucial for a comprehensive fundamental assessment.

- Competitive Advantages: CoreWeave’s specialization in AI-focused cloud computing gives it a competitive edge in this rapidly growing market.

- Long-Term Growth Forecasts: The long-term growth outlook for CRWV is positive, contingent upon maintaining its technological leadership and successfully navigating market challenges.

3. Conclusion: Interpreting the CoreWeave (CRWV) Stock Rally and Future Outlook

Tuesday's CoreWeave (CRWV) stock rally was likely driven by a confluence of factors, including positive market sentiment, the growing interest in AI, and potentially positive company-specific news. Technical analysis revealed a strong bullish momentum, while fundamental analysis suggests a promising long-term outlook, although with inherent risks. While this analysis offers valuable insights, it's crucial to conduct thorough independent research before making any investment decisions. The future performance of CRWV stock depends on various factors, including continued innovation, successful execution of its business strategy, and macroeconomic conditions. Consider investing in CoreWeave (CRWV) stock only after careful consideration of your personal risk tolerance and financial goals. Remember, responsible investing is paramount.

Featured Posts

-

The Rum Trade And Kartel Involvement Analyzing Stabroek News Reports

May 22, 2025

The Rum Trade And Kartel Involvement Analyzing Stabroek News Reports

May 22, 2025 -

Significant Property Damage Two Alarm Fire In York County Pa

May 22, 2025

Significant Property Damage Two Alarm Fire In York County Pa

May 22, 2025 -

Wordle 1407 April 26 2025 Hints Solution And Tips

May 22, 2025

Wordle 1407 April 26 2025 Hints Solution And Tips

May 22, 2025 -

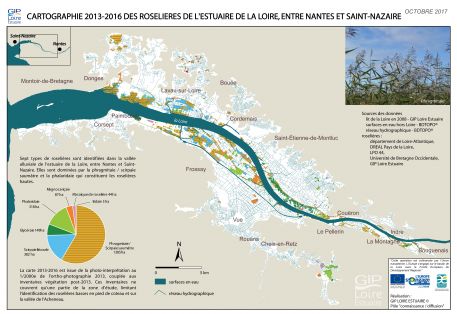

Decouverte A Velo De La Loire Nantes Et Son Estuaire 5 Itineraires

May 22, 2025

Decouverte A Velo De La Loire Nantes Et Son Estuaire 5 Itineraires

May 22, 2025 -

Wordle 367 Hints And Answer For March 17th Monday

May 22, 2025

Wordle 367 Hints And Answer For March 17th Monday

May 22, 2025