U.S.-China Tariff Rollback: Impact On The American Economy

Table of Contents

Impact on Consumer Prices and Inflation

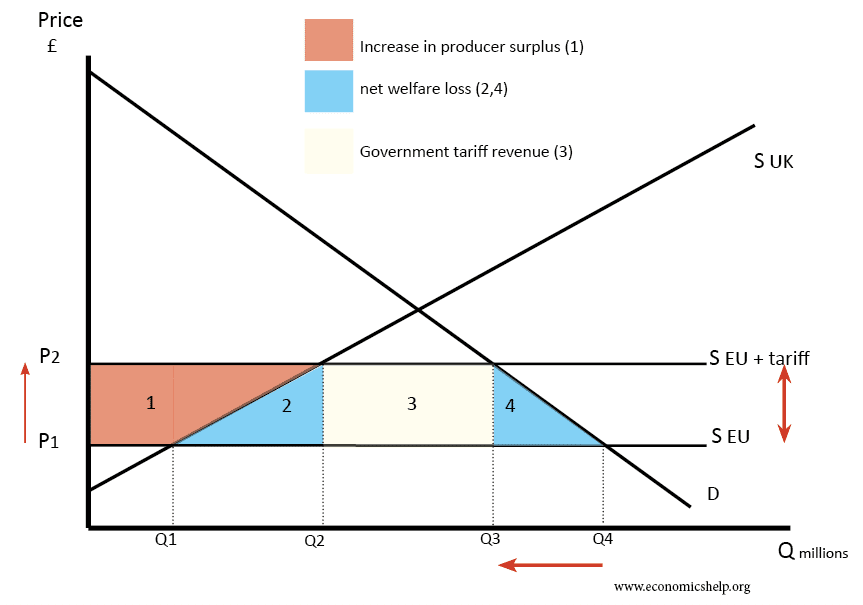

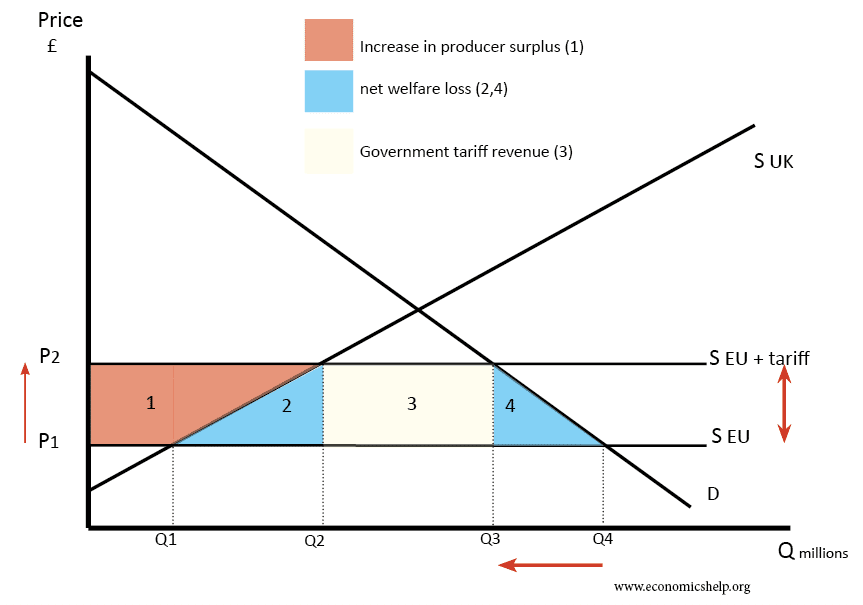

A key area of concern regarding U.S.-China tariffs has been their contribution to inflation. The impact of a tariff rollback on consumer prices and inflation is therefore a crucial consideration.

Reduced Import Costs

A significant reduction or elimination of tariffs would directly translate to lower import costs for a wide range of consumer goods. This could have a tangible impact on household budgets.

- Lower prices on electronics, clothing, furniture, and other consumer goods: Many everyday items are subject to tariffs, and a rollback could lead to noticeably lower prices at the retail level.

- Increased consumer purchasing power: With more disposable income, consumers might increase spending, boosting economic activity in other sectors.

- Potential easing of inflationary pressures: Reduced import costs could contribute to a decrease in overall inflation, providing much-needed relief to American households struggling with rising prices.

Inflationary Relief or Limited Impact?

While the prospect of lower import costs is appealing, the extent to which a tariff rollback would alleviate inflation is a subject of debate. Several factors could mitigate the impact:

- Supply chain bottlenecks: Persistent supply chain disruptions could limit the ability of lower import costs to translate into lower consumer prices.

- Corporate pricing strategies: Companies might absorb some cost savings rather than fully passing them on to consumers, impacting profit margins instead.

- Other factors contributing to inflation: Inflation is a complex phenomenon influenced by many factors beyond import costs, including energy prices, labor costs, and monetary policy. A tariff rollback might not address these underlying issues.

Analyzing the elasticity of demand for different goods is crucial to predict the impact. For goods with inelastic demand (where demand doesn't change much with price changes), the price reduction might be less impactful for consumers.

Effects on American Manufacturing and Businesses

The impact of a U.S.-China tariff rollback on American manufacturing and businesses is multifaceted, presenting both challenges and opportunities.

Increased Competition

Reduced tariffs would inevitably increase competition from Chinese imports. This could pose a significant challenge for domestic manufacturers in certain sectors.

- Potential job losses in certain sectors: Industries directly competing with cheaper Chinese imports might experience job losses or reduced production.

- Need for American businesses to adapt and innovate: American manufacturers will need to enhance their competitiveness through innovation, efficiency improvements, and focusing on niche markets or higher-value products.

- Opportunities for increased efficiency and cost reduction: The pressure of increased competition might force American businesses to streamline operations and become more efficient.

Supply Chain Restructuring

A tariff rollback could trigger a significant restructuring of global supply chains, impacting American businesses' sourcing and logistics.

- Potential for reduced reliance on China for certain goods: Businesses might diversify their sourcing to reduce dependence on a single supplier.

- Increased diversification of supply chains: This could enhance resilience against disruptions but also increase complexity and costs.

- Potential challenges in managing complex global supply networks: Navigating a more complex and geographically dispersed supply chain requires sophisticated logistics and management capabilities.

Geopolitical Implications and Trade Relations

Beyond economic considerations, a U.S.-China tariff rollback has significant geopolitical implications.

Improved U.S.-China Relations

A rollback could symbolize a de-escalation of trade tensions and pave the way for improved diplomatic relations between the two superpowers.

- Potential for increased cooperation on global issues: Reduced trade friction could create a more conducive environment for cooperation on climate change, pandemics, and other global challenges.

- Reduced uncertainty in international trade: A more stable trade relationship could boost investor confidence and promote global economic growth.

- Long-term benefits for bilateral economic relations: Improved relations could unlock new opportunities for trade and investment, fostering mutual economic growth.

Strategic Considerations

However, the decision to maintain or reduce tariffs involves strategic considerations beyond immediate economic gains.

- Analysis of the benefits and drawbacks of relying on China for certain goods: Reducing reliance on China for critical goods is a key strategic goal for the U.S., particularly in sensitive sectors like technology and defense.

- Considerations of protecting sensitive industries: The government might need to implement measures to protect strategically important industries from unfair competition.

- Balancing economic interests with national security priorities: Finding the right balance between economic growth and national security is a crucial challenge for policymakers.

Conclusion

The potential rollback of U.S.-China tariffs presents a complex scenario with far-reaching consequences for the American economy. While reduced import costs could provide relief from inflationary pressures and benefit consumers, the increased competition could negatively impact American manufacturers. The ultimate impact will vary across different sectors, requiring businesses to adapt and policymakers to make careful strategic choices. A thorough assessment, considering both economic and geopolitical factors, is essential to navigate the complexities of this crucial trade relationship. Further research and analysis of the U.S.-China tariff rollback are vital to fully understand its potential impact and develop effective strategies to manage the evolving dynamics of the global economy. Staying informed about developments concerning U.S.-China tariff rollbacks is critical for businesses and policymakers alike.

Featured Posts

-

The Unending Nightmare Gaza Hostage Crisis And Its Impact On Families

May 13, 2025

The Unending Nightmare Gaza Hostage Crisis And Its Impact On Families

May 13, 2025 -

Islanders Claim No 1 Pick In Nhl Draft Lottery Sharks Pick Second

May 13, 2025

Islanders Claim No 1 Pick In Nhl Draft Lottery Sharks Pick Second

May 13, 2025 -

Arestovan Stalker Ugrozhavshiy Teraktom Seme Skarlett Yokhansson

May 13, 2025

Arestovan Stalker Ugrozhavshiy Teraktom Seme Skarlett Yokhansson

May 13, 2025 -

Leonardo Di Caprio 30 Eve Bucsut Intett A Heroinnak

May 13, 2025

Leonardo Di Caprio 30 Eve Bucsut Intett A Heroinnak

May 13, 2025 -

50 Evesen Is Bombazo Eva Longoria Bikinifotoi

May 13, 2025

50 Evesen Is Bombazo Eva Longoria Bikinifotoi

May 13, 2025