U.S. Dollar Performance: A Troubling First 100 Days Under Current Presidency

Table of Contents

The U.S. dollar serves as the world's primary reserve currency, playing a crucial role in global trade and finance. Its strength significantly impacts international markets, influencing everything from import and export costs to the value of foreign investments. A weakening dollar can have far-reaching consequences, impacting global economies and individual financial portfolios. This analysis argues that the first 100 days of the current presidency have demonstrably negatively impacted U.S. dollar performance through a confluence of interconnected factors.

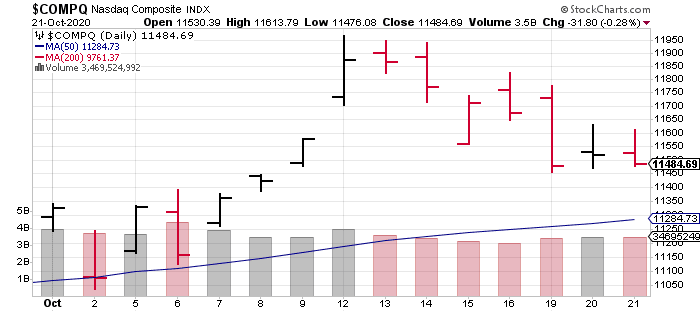

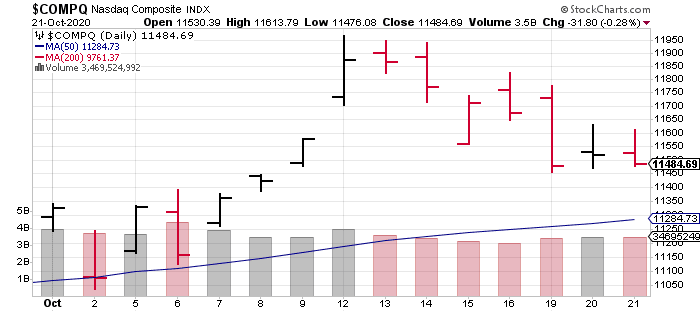

Inflationary Pressures and the Weakening Dollar

The surge in inflation has been a major contributor to the weakening U.S. dollar performance. This inflationary environment has forced the Federal Reserve to take aggressive action, impacting the dollar's value in several ways.

Rising Interest Rates and their Impact

The Federal Reserve's response to soaring inflation has involved significant increases in interest rates. This is a double-edged sword.

- Higher interest rates attract foreign investment: Higher rates make U.S. assets more attractive to international investors, potentially increasing demand for the dollar.

- Higher rates also increase borrowing costs: This can stifle economic growth, potentially leading to decreased demand for the dollar.

- The relationship between interest rates and currency value is complex and not always straightforward. While higher rates can initially boost the dollar, persistent increases can slow economic activity, ultimately weakening the currency. Data from the first 100 days shows a correlation between interest rate hikes and a subsequent, albeit delayed, depreciation of the dollar. Businesses face higher borrowing costs, impacting investment and hiring, while consumers grapple with increased costs for goods and services.

Supply Chain Disruptions and Commodity Prices

Global supply chain disruptions, exacerbated by geopolitical events, have fueled inflation and put downward pressure on the U.S. dollar performance.

- The rising price of crucial commodities, such as oil, directly impacts inflation. Higher energy costs increase production costs across the board, driving up prices for consumers and businesses.

- This inflationary pressure erodes the purchasing power of the dollar, making it less attractive to foreign investors compared to currencies in countries with more stable price levels. The Consumer Price Index (CPI) and Producer Price Index (PPI) figures from the period clearly reflect this inflationary surge.

Geopolitical Uncertainty and its Effect on the U.S. Dollar

Geopolitical uncertainty is another significant factor influencing U.S. dollar performance. International tensions and shifting global power dynamics contribute to investor anxieties.

International Tensions and Investor Sentiment

Global political instability creates uncertainty in financial markets, impacting investor confidence.

- Specific geopolitical events, such as [insert specific example of a geopolitical event that negatively impacted the dollar during the first 100 days], directly impacted investor sentiment and led to a sell-off of dollar-denominated assets.

- This capital flight, as investors seek safer havens, contributed to the weakening of the U.S. dollar. The resulting volatility in the foreign exchange market further underscores the impact of geopolitical risks.

Shifting Global Power Dynamics

The rise of alternative global currencies and the potential decline of the dollar's dominance as a reserve currency also play a role.

- The increasing use of the Euro and the Chinese Yuan in international trade poses a challenge to the dollar's hegemony.

- This shift in global power dynamics could, in the long term, negatively impact the U.S. dollar's value and its status in the global financial system. The potential for diversification away from the dollar is a growing concern for policymakers.

Domestic Economic Policies and the Dollar's Trajectory

Domestic economic policies also contribute to the U.S. dollar performance. Fiscal spending and regulatory changes significantly influence investor confidence and the overall economic health of the nation.

Fiscal Spending and its Consequences

Increased government spending can contribute to inflation and weaken the dollar.

- The connection between increased government spending, inflation, and currency devaluation is a well-established economic principle. When the government spends more without a corresponding increase in productivity, it can lead to inflationary pressures.

- These inflationary pressures, in turn, weaken the dollar's purchasing power and its attractiveness to foreign investors. Moreover, increased government spending can lead to higher national debt, raising concerns about the long-term fiscal health of the nation and further negatively impacting the dollar's value.

Regulatory Changes and Business Confidence

Regulatory changes can affect business investment and the overall health of the economy, indirectly influencing the dollar.

- [Insert an example of a regulatory change during the first 100 days and its potential impact on business]. Such changes can influence business confidence, impacting investment levels and economic growth.

- A decline in business confidence can lead to a decrease in investment, potentially slowing economic growth and weakening the dollar.

Conclusion

In summary, the first 100 days under the current presidency have presented a complex and concerning picture for U.S. dollar performance. Inflationary pressures, driven by supply chain disruptions and rising interest rates, have combined with geopolitical uncertainties and domestic economic policy choices to create a perfect storm for a weakening dollar. The interconnectedness of these factors highlights the multifaceted nature of this challenge. The key takeaway is the urgent need for comprehensive and coordinated strategies to address inflation, stabilize geopolitical relations, and promote policies that foster strong economic growth and business confidence. Continue monitoring the U.S. dollar performance closely to make informed decisions about your investments and financial planning. Understanding the factors affecting U.S. dollar performance is crucial for navigating the current economic landscape.

Featured Posts

-

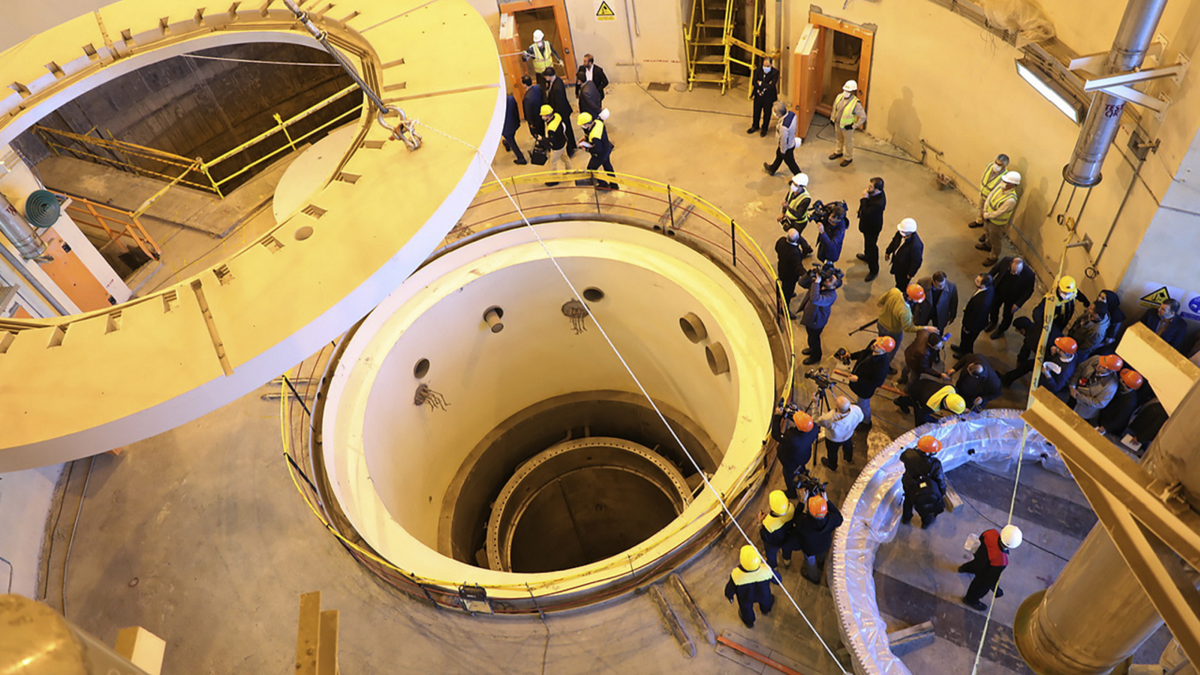

Latest Us Iran Nuclear Talks A Summary Of The Disagreements

Apr 28, 2025

Latest Us Iran Nuclear Talks A Summary Of The Disagreements

Apr 28, 2025 -

Another Devin Williams Meltdown Leads To Yankees Defeat

Apr 28, 2025

Another Devin Williams Meltdown Leads To Yankees Defeat

Apr 28, 2025 -

Heads Of State Attend Pope Francis Funeral Mass

Apr 28, 2025

Heads Of State Attend Pope Francis Funeral Mass

Apr 28, 2025 -

A Comprehensive Guide To The Countrys New Business Hot Spots

Apr 28, 2025

A Comprehensive Guide To The Countrys New Business Hot Spots

Apr 28, 2025 -

Red Sox Vs Blue Jays Lineups Walker Buehler Starts Outfielder Returns

Apr 28, 2025

Red Sox Vs Blue Jays Lineups Walker Buehler Starts Outfielder Returns

Apr 28, 2025

Latest Posts

-

Reduced Seismic Activity On Santorini Analysis And Future Predictions

May 12, 2025

Reduced Seismic Activity On Santorini Analysis And Future Predictions

May 12, 2025 -

Uruguays Offshore Energy Future The Search For Black Gold

May 12, 2025

Uruguays Offshore Energy Future The Search For Black Gold

May 12, 2025 -

Santorini Quakes Scientists Report Decrease Future Outlook Unclear

May 12, 2025

Santorini Quakes Scientists Report Decrease Future Outlook Unclear

May 12, 2025 -

Declining Earthquake Rates On Santorini A Scientists Perspective

May 12, 2025

Declining Earthquake Rates On Santorini A Scientists Perspective

May 12, 2025 -

Is Black Gold Within Reach Analyzing Uruguays Offshore Drilling Prospects

May 12, 2025

Is Black Gold Within Reach Analyzing Uruguays Offshore Drilling Prospects

May 12, 2025