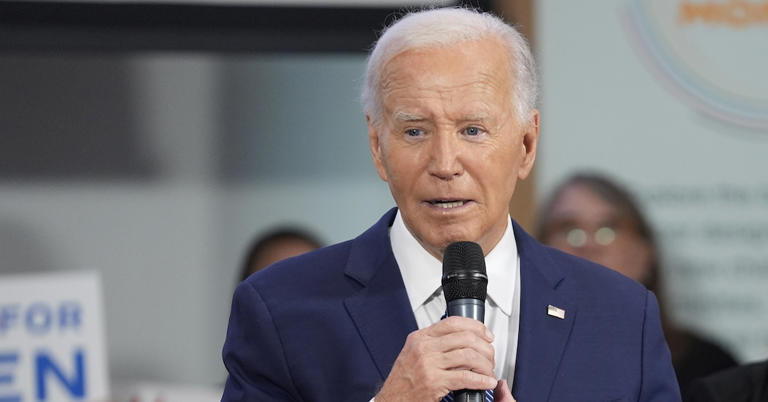

U.S. Dollar's Weak Start: Worst 100 Days Since Nixon?

Table of Contents

The Current State of the U.S. Dollar: A Deep Dive

Analyzing the Dollar's Performance Against Major Currencies

Over the past 100 days, the U.S. dollar has experienced a notable decline against several major currencies. This dollar devaluation is evident in the following percentage changes (as of [Insert Today's Date]):

- Euro (EUR/USD): Increased by approximately X% (Source: [Cite reputable source like Bloomberg or Reuters])

- Japanese Yen (JPY/USD): Increased by approximately Y% (Source: [Cite reputable source])

- British Pound (GBP/USD): Increased by approximately Z% (Source: [Cite reputable source])

These figures represent significant shifts in currency exchange rates and highlight the current weakness of the U.S. dollar. Further analysis, including charts and graphs illustrating these trends over time, would provide a more comprehensive picture. [Insert chart/graph here if possible].

Identifying Key Factors Contributing to Dollar Weakness

Several factors contribute to the U.S. dollar's current weakness:

- High Inflation Rates: Persistent inflation in the United States erodes the purchasing power of the dollar, making it less attractive to foreign investors.

- Federal Reserve Policy: The Federal Reserve's monetary policy, including interest rate hikes and quantitative easing, impacts the dollar's value. Aggressive interest rate increases aim to curb inflation, but can also strengthen the dollar in the short term, while simultaneously impacting economic growth. Conversely, quantitative easing can weaken the dollar.

- Global Economic Uncertainty: Geopolitical instability and global economic slowdowns create uncertainty, pushing investors toward safer haven currencies like the Swiss Franc or Japanese Yen, thus weakening the dollar.

- Geopolitical Events: Major global events, such as the war in Ukraine, significantly influence investor sentiment and currency markets.

- Investor Sentiment: Negative investor sentiment toward the U.S. economy can lead to capital flight and a weakening of the dollar.

Impact on Global Markets and the U.S. Economy

A weak dollar has significant ramifications for both the global and U.S. economies:

- Increased Import Costs: A weaker dollar makes imports more expensive for U.S. consumers, potentially contributing to inflation.

- Boosted Exports: Conversely, U.S. exports become cheaper for foreign buyers, potentially benefiting U.S. businesses.

- Inflationary Pressures: Increased import costs can exacerbate existing inflationary pressures within the U.S. economy.

- Impact on Foreign Investment: A weaker dollar can attract foreign investment into U.S. assets, but also makes it more expensive for U.S. companies to invest abroad.

- Changes in Purchasing Power: A weaker dollar reduces the purchasing power of U.S. consumers when buying foreign goods and services.

Historical Parallels: The Nixon Shock and its Aftermath

Understanding the Bretton Woods System and its Collapse

The Bretton Woods system, established after World War II, pegged the value of the U.S. dollar to gold, creating a relatively stable international monetary system. President Nixon's decision to decouple the dollar from gold in 1971 marked the end of this system, leading to significant volatility in currency exchange rates and impacting the global economy.

Comparing the Current Situation to the Post-Nixon Era

While there are similarities between the current situation and the post-Nixon era (high inflation, shifts in global power dynamics), there are also crucial differences:

- Inflation Rates: Inflation rates in both periods were high, but the underlying causes and policy responses differ significantly.

- Global Economic Landscape: The global economy is vastly more interconnected today than it was in the 1970s.

- Technological Advancements: Today's financial markets are far more sophisticated and interconnected, influencing the speed and impact of currency fluctuations.

[Insert table comparing key economic indicators from both periods here].

Future Outlook: Predicting the Trajectory of the U.S. Dollar

Expert Opinions and Market Forecasts

Leading economists and financial analysts offer diverse predictions regarding the U.S. dollar's future. Some anticipate a continued period of weakness, while others foresee a rebound or further devaluation. [Cite specific forecasts from reputable sources].

Potential Scenarios and Their Implications

Several scenarios are possible:

- Sustained Weakness: Continued weakness could lead to higher inflation and increased import costs in the U.S. It may also spur greater foreign investment into the U.S. as assets become cheaper.

- Dollar Rebound: A rebound could stabilize the economy, but may also negatively impact U.S. exporters.

- Further Devaluation: Continued devaluation could cause economic instability and disrupt international trade.

Strategies for Navigating Dollar Volatility

Investors and businesses can employ several strategies to mitigate risks:

- Diversification: Diversifying investments across different currencies and asset classes reduces exposure to dollar volatility.

- Hedging Techniques: Using financial instruments like currency futures or options can help hedge against currency fluctuations.

- Risk Management Strategies: Implementing robust risk management plans is crucial in navigating currency uncertainty.

Conclusion

The U.S. dollar's recent weakness is a significant development with potentially far-reaching consequences. While parallels can be drawn to the post-Nixon era, the current global economic and political landscape presents unique challenges. Monitoring U.S. dollar weakness and understanding its implications for the global economy is crucial for investors, businesses, and policymakers alike. To stay updated on the latest currency exchange rates and learn more about mitigating risks associated with U.S. dollar volatility, continue researching reputable financial news sources and consult with financial advisors. Stay informed and navigate the fluctuating landscape of the U.S. dollar effectively.

Featured Posts

-

Tyran Alerbyt Yrbt Abwzby Bkazakhstan Brhlat Mbashrt

Apr 28, 2025

Tyran Alerbyt Yrbt Abwzby Bkazakhstan Brhlat Mbashrt

Apr 28, 2025 -

Bubba Wallaces Inspiring Visit To Austin Teens Before Cota

Apr 28, 2025

Bubba Wallaces Inspiring Visit To Austin Teens Before Cota

Apr 28, 2025 -

Boosting Canadian Energy Exports The Southeast Asia Trade Mission

Apr 28, 2025

Boosting Canadian Energy Exports The Southeast Asia Trade Mission

Apr 28, 2025 -

Yukon Politicians Cite Contempt Over Mine Managers Evasive Testimony

Apr 28, 2025

Yukon Politicians Cite Contempt Over Mine Managers Evasive Testimony

Apr 28, 2025 -

Navigating The High Cost Of Gpus A Buyers Guide

Apr 28, 2025

Navigating The High Cost Of Gpus A Buyers Guide

Apr 28, 2025

Latest Posts

-

John Wicks Most Underrated Character A Comeback After A Decade

May 11, 2025

John Wicks Most Underrated Character A Comeback After A Decade

May 11, 2025 -

John Wick 5 Why Another Film Could Harm The Franchises Legacy

May 11, 2025

John Wick 5 Why Another Film Could Harm The Franchises Legacy

May 11, 2025 -

Is John Wick 5 Necessary A Case Against Another Sequel

May 11, 2025

Is John Wick 5 Necessary A Case Against Another Sequel

May 11, 2025 -

John Wick Chapter 5 New Developments Revealed Release Date Unconfirmed

May 11, 2025

John Wick Chapter 5 New Developments Revealed Release Date Unconfirmed

May 11, 2025 -

John Wick 5 Update Thrilling Developments But Release Date Remains A Mystery

May 11, 2025

John Wick 5 Update Thrilling Developments But Release Date Remains A Mystery

May 11, 2025