U.S. Federal Reserve Maintains Rates: Weighing Inflationary Pressures And Unemployment

Table of Contents

Inflationary Pressures: A Persistent Challenge

Core Inflation Remains Elevated

The Consumer Price Index (CPI) and Personal Consumption Expenditures (PCE) index, key measures of inflation, remain elevated, signaling persistent inflationary pressures. While the headline inflation rate may fluctuate due to volatile energy and food prices, core inflation—which excludes these volatile components—provides a more accurate picture of underlying price trends. Core inflation continues to exceed the Fed's target, indicating that inflationary pressures are deeply embedded in the economy.

- Specific examples of rising prices: Rent, healthcare, and used cars continue to show significant price increases, impacting household budgets considerably.

- Impact on consumer spending and business investment: High inflation erodes purchasing power, potentially dampening consumer spending and causing businesses to postpone investment plans due to uncertainty.

- Comparison to historical inflation rates: Current inflation rates, while showing signs of easing, remain significantly higher than the average inflation rates seen over the past several decades. This necessitates a cautious and measured approach by the Federal Reserve. Keywords: core inflation, CPI, PCE, inflation rate, supply chain disruptions.

The Fed's Inflation Targets and Strategies

The Federal Reserve aims for an inflation rate of approximately 2%. To achieve this target, the Fed utilizes several monetary policy tools, including:

-

Interest rate hikes: Increasing interest rates makes borrowing more expensive, cooling down economic activity and reducing inflationary pressures.

-

Quantitative tightening (QT): This involves reducing the Fed's balance sheet by allowing Treasury securities and agency mortgage-backed securities to mature without reinvestment. This reduces the money supply and helps curb inflation. Keywords: Federal Reserve monetary policy, quantitative easing, quantitative tightening, interest rate hikes, inflation target.

-

Explanation of how interest rate changes affect inflation: Higher interest rates increase borrowing costs for businesses and consumers, leading to reduced spending and investment, thus slowing inflation.

-

Potential risks and side effects of aggressive interest rate hikes: Aggressive interest rate hikes risk triggering a recession by significantly slowing economic growth.

-

Discussion of the Fed's communication strategies: Clear and transparent communication about the Fed's intentions is crucial to managing market expectations and ensuring stability.

Unemployment: A Key Economic Indicator

Current Unemployment Rate and Labor Market Dynamics

The unemployment rate remains relatively low, indicating a tight labor market. This low unemployment rate, while positive for workers, also contributes to upward pressure on wages, potentially fueling further inflation. The labor market continues to be dynamic, with job growth occurring in certain sectors even as others experience some contraction. Keywords: unemployment rate, labor market, job growth, wage growth, employment rate.

- Statistics on job creation and job losses: Tracking job creation and losses across various sectors gives a clearer picture of the overall health of the labor market.

- Analysis of different sectors of the economy: Some sectors may experience higher job growth than others, highlighting shifts in economic activity.

- Discussion of labor force participation rates: Understanding changes in labor force participation rates helps paint a more comprehensive picture of the labor market dynamics.

The Fed's Dual Mandate and Balancing Act

The Federal Reserve operates under a dual mandate: to promote maximum employment and price stability. These two goals are often at odds. Lowering inflation through higher interest rates might lead to job losses and slower economic growth. Balancing these competing goals requires careful consideration of economic indicators and potential risks. Keywords: dual mandate, Federal Reserve goals, maximum employment, price stability.

- Potential trade-offs between inflation control and employment: The Fed faces the difficult decision of choosing between slowing inflation and potentially causing job losses or accepting higher inflation to maintain employment levels.

- Risks of triggering a recession by raising interest rates too aggressively: Raising interest rates too quickly can stifle economic growth and potentially trigger a recession.

- Discussion of the Fed's forward guidance: The Fed's communication about its future policy intentions is crucial in managing market expectations and economic stability.

Future Outlook: The Path Forward for U.S. Federal Reserve Interest Rates

Predicting the future path of U.S. Federal Reserve interest rates is challenging due to the uncertain global economic outlook. Several factors, including geopolitical events and evolving inflation data, will influence future decisions. Keywords: interest rate projections, economic forecast, monetary policy outlook, future interest rates.

- Predictions for inflation and unemployment in the coming months and years: Economic forecasts offer varying predictions, highlighting the inherent uncertainties.

- Potential impacts of geopolitical events on the US economy: Global events can significantly impact the U.S. economy and influence the Fed’s decisions.

- Discussion of different economic models and their predictions: Various economic models offer different perspectives, highlighting the complexity of forecasting.

Conclusion: Understanding the Fed's Decision on U.S. Federal Reserve Interest Rates

The Fed's recent decision to maintain interest rates reflects the challenging task of balancing inflation control and employment goals. The current economic climate remains uncertain, with persistent inflationary pressures and a tight labor market creating complexities. Understanding the factors influencing U.S. Federal Reserve interest rates is crucial for navigating the current economic landscape. To stay informed about future announcements regarding U.S. Federal Reserve interest rates and their implications, follow reputable economic news sources, subscribe to economic newsletters, and follow leading economic experts. Staying abreast of changes in U.S. Federal Reserve interest rates is key to making informed financial decisions.

Featured Posts

-

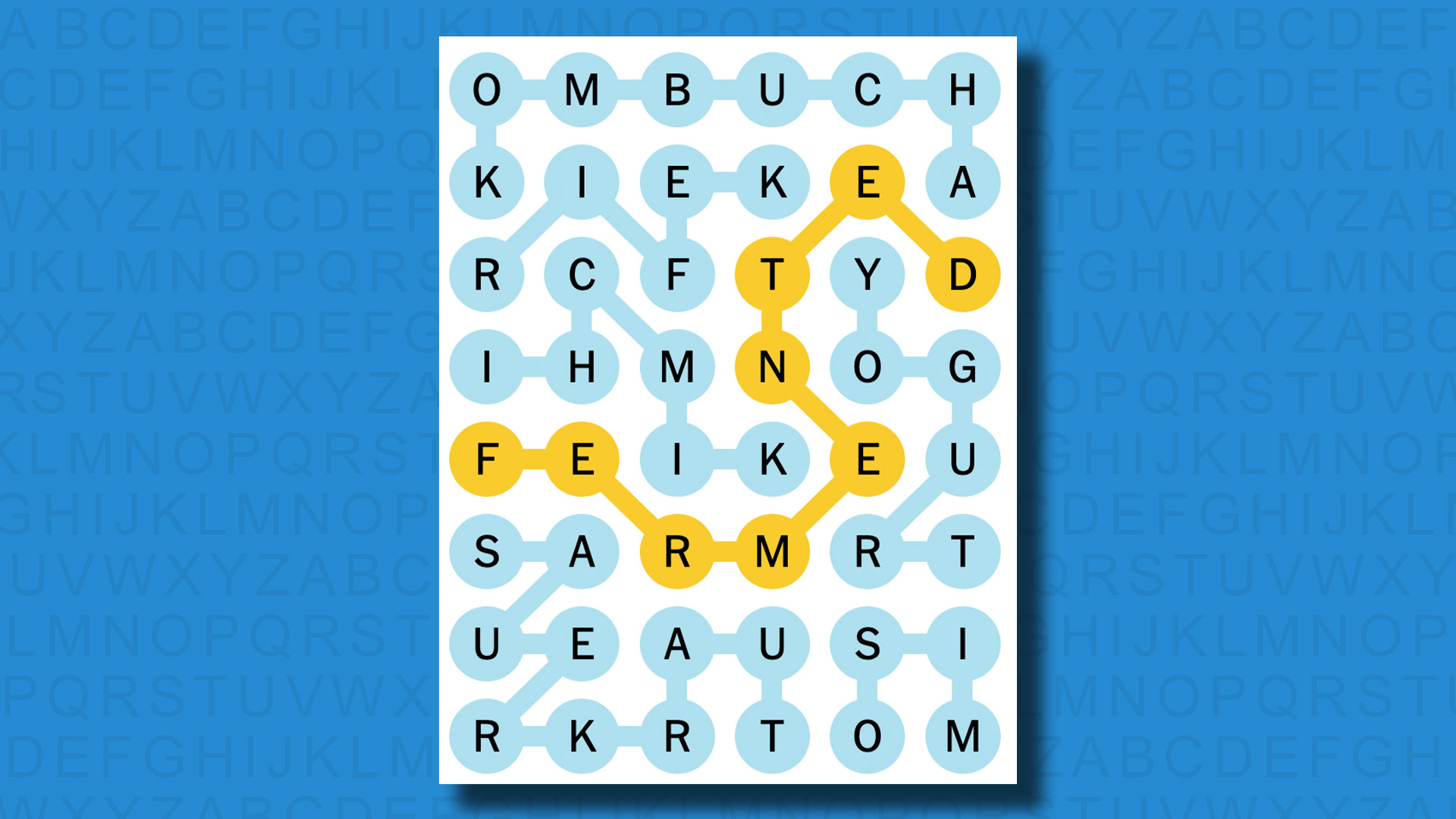

Strands Nyt Game 366 Answers And Hints Tuesday March 4

May 10, 2025

Strands Nyt Game 366 Answers And Hints Tuesday March 4

May 10, 2025 -

Legal Challenges To Migrant Detention Trumps Potential Action

May 10, 2025

Legal Challenges To Migrant Detention Trumps Potential Action

May 10, 2025 -

Trumps Attorney General Delivers Stark Message To Political Foes

May 10, 2025

Trumps Attorney General Delivers Stark Message To Political Foes

May 10, 2025 -

Pam Bondi Laughs Reaction To James Comers Epstein Files Accusations

May 10, 2025

Pam Bondi Laughs Reaction To James Comers Epstein Files Accusations

May 10, 2025 -

Elizabeth City Police Investigate Wave Of Car Break Ins At Apartment Complexes

May 10, 2025

Elizabeth City Police Investigate Wave Of Car Break Ins At Apartment Complexes

May 10, 2025