U.S. Federal Reserve Rate Decision: Economic Uncertainty And The Path Forward

Table of Contents

Inflation and the Fed's Response

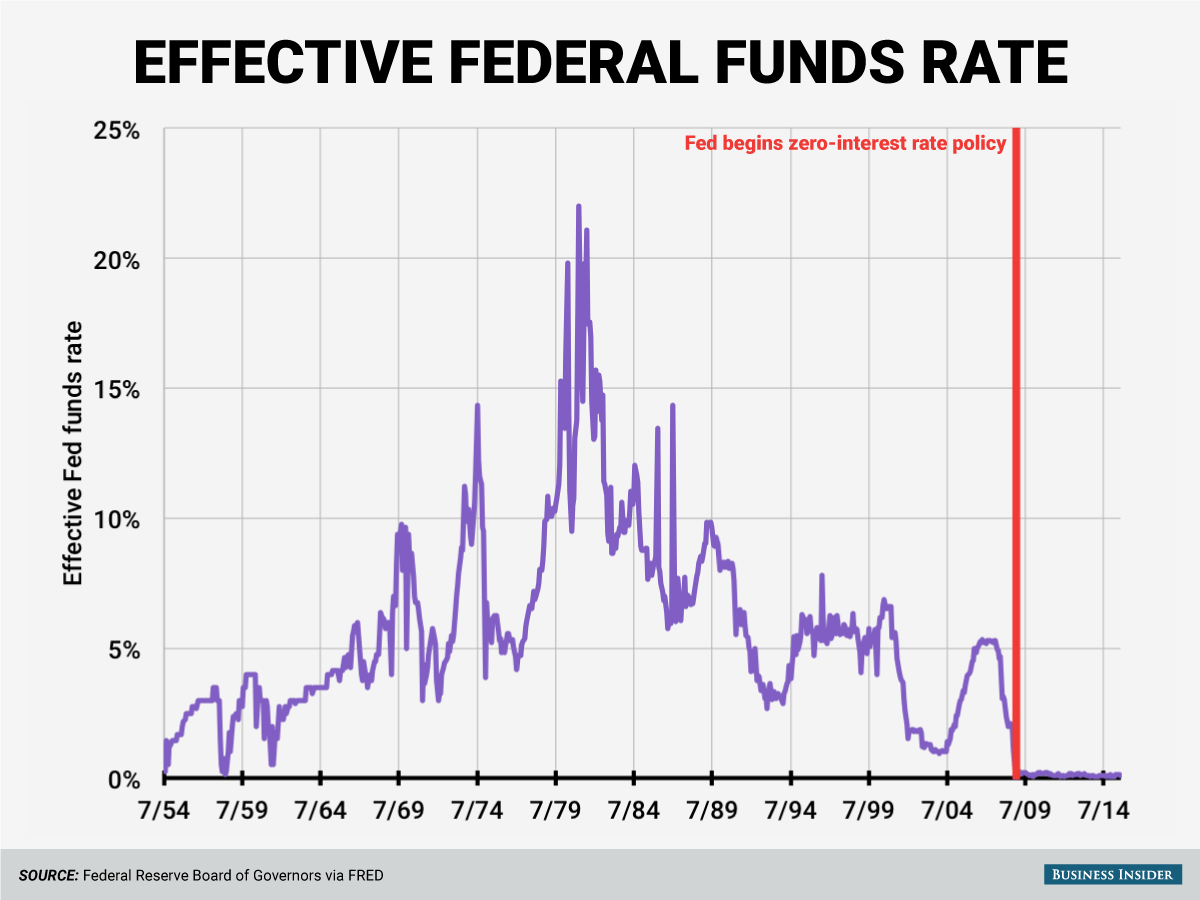

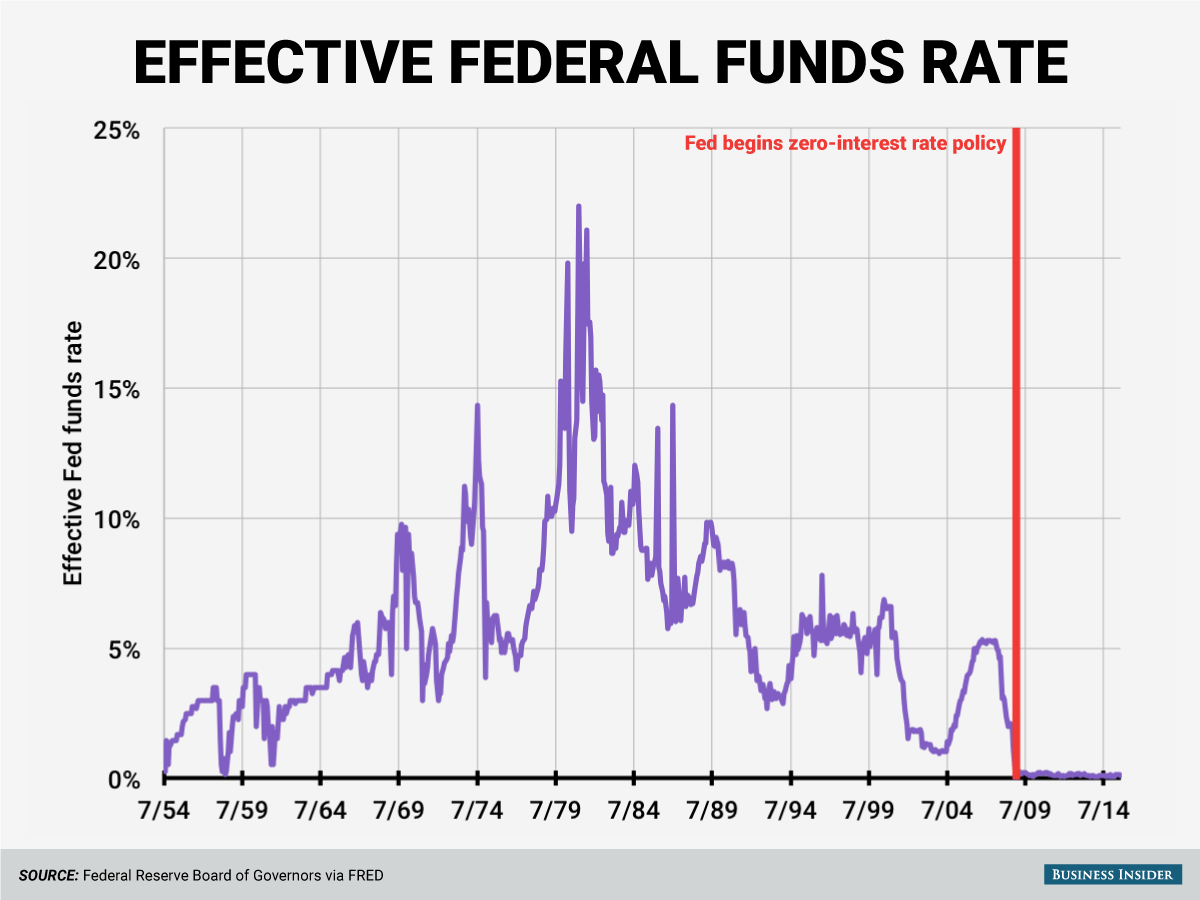

The current inflation rate, measured by indicators such as the Consumer Price Index (CPI) and Producer Price Index (PPI), remains a primary concern for the Federal Reserve. Persistently high inflation erodes purchasing power and destabilizes the economy. The Fed's response involves monetary tightening, primarily through raising interest rates. This strategy aims to cool down the economy by making borrowing more expensive, thus reducing consumer spending and business investment.

- Interest Rates and Inflation: Higher interest rates increase the cost of borrowing, leading to decreased demand and potentially slowing price increases.

- Effectiveness of Past Rate Hikes: While previous rate hikes have shown some success in curbing inflation, their full impact often takes time to materialize, leading to a lag effect.

- Future Rate Increases or Pauses: The future path of interest rates depends heavily on incoming economic data, particularly inflation figures and employment reports. The FOMC will carefully assess these indicators to determine whether further rate increases are necessary or if a pause is warranted.

- Global Inflation's Impact: Global factors, such as supply chain disruptions and geopolitical instability, contribute to inflation and complicate the Fed's efforts to control it.

Economic Growth and Recessionary Risks

The U.S. economy's growth trajectory is another critical factor influencing the Fed's decisions. While recent GDP growth figures might paint a mixed picture, the risk of a recession remains a significant concern. The Fed walks a tightrope – aiming to curb inflation without triggering a sharp economic slowdown.

- Recent GDP Growth and Forecasts: Analyzing recent GDP growth figures and future projections helps gauge the overall health of the economy and the potential for a recession. Slowing growth often precedes a recessionary period.

- Impact of Interest Rate Hikes on Growth: Interest rate hikes, while combating inflation, can dampen economic growth by reducing investment and consumer spending. The Fed must carefully calibrate its actions to find the right balance.

- Unemployment Rate and its Implications: The unemployment rate is a crucial economic indicator. Rising unemployment can signal an impending recession, influencing the Fed's monetary policy approach.

- Effectiveness of the Fed's Tools: The effectiveness of the Fed's tools in managing economic growth varies depending on the prevailing economic conditions and the responsiveness of businesses and consumers to interest rate changes.

The Federal Open Market Committee (FOMC) and its Decision-Making Process

The Federal Open Market Committee (FOMC) is the body responsible for setting the U.S. monetary policy. Its decisions directly impact interest rates and influence the overall direction of the economy. The FOMC's decision-making process is complex, considering a wide range of economic indicators and forecasts.

- FOMC Composition and Voting: The FOMC comprises members of the Federal Reserve Board of Governors and presidents of several Federal Reserve Banks. Voting procedures ensure a balanced approach to monetary policy decisions.

- Monetary Policy Tools: The FOMC employs various tools, including adjusting the federal funds rate (the target rate for overnight lending between banks), conducting quantitative easing (QE) or quantitative tightening (QT) to influence the money supply.

- FOMC Transparency and Communication: The FOMC strives for transparency through public statements, press conferences, and the publication of economic projections to manage market expectations and guide economic actors.

- Impact of Dissenting Opinions: Dissenting opinions within the FOMC highlight the complexities of economic forecasting and the challenges in reaching a consensus on the optimal monetary policy course.

Impact on Financial Markets and Investors

The Fed's rate decision reverberates throughout financial markets, impacting stock prices, bond yields, and the value of the U.S. dollar, influencing investment strategies globally.

- Interest Rates and Stock Prices: Higher interest rates generally lead to lower stock prices as investors seek safer, higher-yielding investments.

- Impact on Bond Yields and Investment Returns: Interest rate hikes increase bond yields, impacting returns for fixed-income investors.

- Effects on the U.S. Dollar: Changes in U.S. interest rates can influence the value of the dollar relative to other currencies, affecting international trade and investment.

- Implications for Global Financial Markets: The U.S. Federal Reserve's decisions have significant spillover effects on global financial markets due to the dollar's role as a global reserve currency.

Conclusion

The U.S. Federal Reserve's rate decision reflects a delicate balancing act between curbing inflation and avoiding a recession. The economic uncertainty underscores the complexity of monetary policy and the challenges faced by policymakers. Staying informed about future U.S. Federal Reserve rate decisions and their implications is crucial. Monitoring future economic indicators and FOMC announcements will be key to navigating this period of uncertainty. Learn more about the impact of interest rate changes and understand how the U.S. Federal Reserve’s actions affect your financial future. Consult with a financial professional for personalized advice on managing your portfolio in light of the U.S. Federal Reserve's monetary policy. Stay updated on future U.S. Federal Reserve rate decisions to make informed financial choices.

Featured Posts

-

The Trump Factor How Threats Reshaped Greenlands Relationship With Denmark

May 10, 2025

The Trump Factor How Threats Reshaped Greenlands Relationship With Denmark

May 10, 2025 -

Jan 6th Conspiracy Theories Ray Epps Sues Fox News For Defamation

May 10, 2025

Jan 6th Conspiracy Theories Ray Epps Sues Fox News For Defamation

May 10, 2025 -

El Bolso Practico De Dakota Johnson La Funcionalidad De Hereu

May 10, 2025

El Bolso Practico De Dakota Johnson La Funcionalidad De Hereu

May 10, 2025 -

Edmonton Oilers Leon Draisaitl A Hart Trophy Finalists Banner Season

May 10, 2025

Edmonton Oilers Leon Draisaitl A Hart Trophy Finalists Banner Season

May 10, 2025 -

Manchesters Stunning Castle The Venue For A Major Olly Murs Music Festival

May 10, 2025

Manchesters Stunning Castle The Venue For A Major Olly Murs Music Festival

May 10, 2025