Uber Stock: A Recession-Resistant Investment? Analyzing The Arguments

Table of Contents

Uber's Resilience During Economic Downturns

Can Uber withstand a recession? The argument for its resilience rests on several key pillars.

Essential Service Argument

Uber provides essential transportation and delivery services. People still need rides and food deliveries, even during recessions. This inherent demand offers a level of protection against complete collapse.

- Unwavering Demand: Even during economic hardship, individuals and businesses require transportation and food delivery. This consistent demand forms the bedrock of Uber's resilience.

- Gig Economy Growth: Recessions often see a surge in gig work as people seek supplementary income. This could potentially boost the supply of Uber drivers and delivery personnel.

- Strategic Pricing: Uber's ability to adjust its pricing model – offering lower-cost options and promotions – allows them to attract price-sensitive consumers during tougher economic times. This maintains ridership and order volume.

Pricing Flexibility and Demand Elasticity

Uber's dynamic pricing model is a key strength. This allows for adaptation to fluctuating demand. During economic downturns, lower prices can help maintain ridership and delivery volume, mitigating the impact of reduced spending.

- Dynamic Pricing Advantages: The ability to lower prices during periods of lower demand helps to maintain profitability and market share.

- Historical Performance: Examining Uber's historical performance during previous economic slowdowns offers valuable insight into its resilience and ability to adapt its pricing strategy. (Further research into this historical data is recommended for serious investors.)

- Demand Response: Understanding the elasticity of demand for Uber services during recessions is crucial in predicting future performance.

Diversification Across Services

Uber's diversification beyond just ride-sharing is a significant factor in its potential recession-resistance.

- Uber Eats as a Buffer: Uber Eats provides a significant and largely separate revenue stream, less directly impacted by reduced personal travel during economic hardship.

- Freight Services: Uber Freight offers further diversification, tapping into a market less sensitive to typical consumer spending patterns.

- Continuous Expansion: Uber's ongoing expansion into new markets and services further mitigates risk and enhances its overall resilience.

Arguments Against Uber's Recession-Resistance

While the case for Uber's resilience is compelling, several factors suggest it may not be entirely recession-proof.

Discretionary Spending

Ride-sharing is often considered a discretionary expense. During recessions, consumers tend to cut back on non-essential services, directly impacting Uber's ridership.

- Reduced Non-Essential Spending: People may opt for cheaper alternatives like public transport or carpooling when budgets tighten.

- Past Recessionary Trends: Analysis of consumer behavior during previous economic downturns shows a clear reduction in spending on discretionary services like ride-sharing.

- Impact on Revenue: This reduced demand can significantly impact Uber's revenue and profitability during economic uncertainty.

Driver Dependence and Labor Costs

Uber's reliance on independent contractors significantly influences its cost structure. Fluctuations in driver supply and wages can affect profitability.

- Driver Supply and Demand: Economic hardship may impact the number of drivers available, affecting service availability and potentially increasing costs.

- Wage Competition: Competition from other gig economy platforms for drivers could drive up labor costs for Uber.

- Profit Margin Pressure: These cost pressures can significantly impact Uber's profitability, particularly during challenging economic periods.

Technological Disruption

The threat of new entrants and technological advancements is ever-present. Competition from autonomous vehicles and other transportation solutions poses a significant risk.

- Autonomous Vehicle Threat: The widespread adoption of autonomous vehicles could drastically alter the ride-sharing landscape, posing a major challenge to Uber.

- New Competitors: The emergence of innovative transportation solutions and competing platforms can erode Uber's market share.

- Adaptability is Key: Continuous innovation and adaptation to changing technology will be crucial for Uber's long-term survival and success.

Analyzing Uber's Financial Performance During Previous Recessions

A thorough analysis of Uber's financial performance during previous economic downturns is crucial. This involves:

- Historical Revenue and Profitability: Examining past trends in revenue, profitability, and key financial indicators provides valuable insights.

- Sectoral Comparison: Comparing Uber's performance to other companies in the transportation and technology sectors during past recessions provides context and a benchmark.

- Key Metrics for Future Analysis: Identifying key financial indicators (e.g., revenue growth, operating margins, customer acquisition costs) to monitor during future recessionary periods is essential.

Conclusion

Uber stock's recession-resistance is a complex issue with compelling arguments on both sides. While its essential services and pricing flexibility offer potential resilience, discretionary spending patterns and competition pose significant risks. Analyzing historical performance and considering future market trends is crucial. Before investing in Uber stock, carefully weigh these factors against your own risk tolerance and investment strategy. Consider further research into Uber's financial reports and market analysis to make informed decisions regarding Uber stock as a recession-resistant investment. Keywords: Uber stock investment, recession-proof investments, Uber stock analysis, investing in Uber, economic outlook.

Featured Posts

-

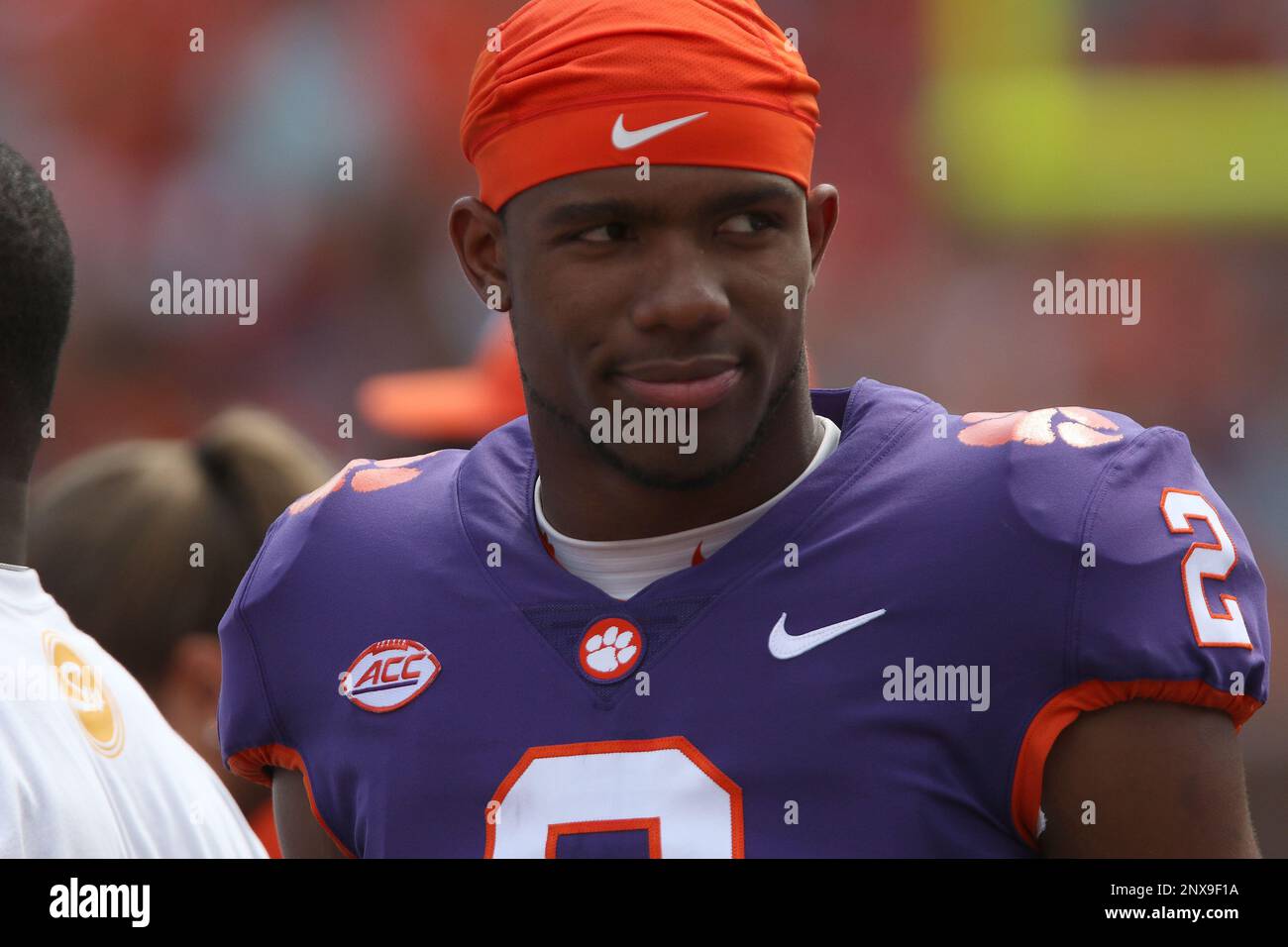

Clemson Spring Football Distractions And Expectations

May 19, 2025

Clemson Spring Football Distractions And Expectations

May 19, 2025 -

Michael Morales Knockout Victory At Ufc Vegas 106 A New Challenger Rises

May 19, 2025

Michael Morales Knockout Victory At Ufc Vegas 106 A New Challenger Rises

May 19, 2025 -

Understanding Sovereign Bond Market Trends With Swissquote Bank

May 19, 2025

Understanding Sovereign Bond Market Trends With Swissquote Bank

May 19, 2025 -

Hamburgo Jannik Sinner Compete Novamente Apos Suspensao

May 19, 2025

Hamburgo Jannik Sinner Compete Novamente Apos Suspensao

May 19, 2025 -

Recent Photos Of Jennifer Lawrence And Cooke Maroney Fuel Baby No 2 Rumors

May 19, 2025

Recent Photos Of Jennifer Lawrence And Cooke Maroney Fuel Baby No 2 Rumors

May 19, 2025