Uber Stock's Recession Resistance: A Deep Dive Into Analyst Predictions

Table of Contents

The global economy is facing uncertainty, and investors are scrambling to find recession-resistant stocks. Uber, a giant in ride-sharing and food delivery, is attracting significant attention as a potential safe haven. But is Uber stock truly recession-proof? This in-depth analysis delves into analyst predictions and examines whether Uber's business model can withstand an economic downturn. We'll explore the factors that contribute to its potential recession resistance and the crucial considerations for investors contemplating adding Uber stock to their portfolios.

Uber's Business Model and Recessionary Resilience

Uber's success hinges on its unique business model, offering potential resilience during economic hardship. Let's explore the key elements:

The Dual-Sided Marketplace Advantage

Uber operates a powerful dual-sided marketplace, connecting riders/customers with drivers and customers with restaurants via Uber Eats. This model exhibits several recession-resistant characteristics:

- Lower barriers to entry for drivers/restaurants: During tough economic times, individuals may seek supplemental income, leading to an increase in driver and restaurant partners on the platform. This influx of supply can help maintain service levels even with fluctuating demand.

- Increased demand for affordable transportation and delivery: Recessions often see consumers curtailing discretionary spending. This can lead to increased demand for cost-effective transportation options like Uber, as well as food delivery services like Uber Eats, to reduce expenses on eating out.

- Potential for increased driver engagement: Facing economic pressures, many individuals may actively seek additional income streams, resulting in a higher number of active drivers on the Uber platform.

Pricing Dynamics and Demand Elasticity

Uber's dynamic pricing model, adjusting fares based on real-time demand (surge pricing), plays a crucial role in its resilience.

- Surge pricing mechanisms during peak demand: During periods of high demand, surge pricing helps to incentivize more drivers to come online, ensuring service availability and potentially mitigating revenue losses.

- Potential for price sensitivity impacting both rider/customer and driver/restaurant behavior: However, price sensitivity is a double-edged sword. During a downturn, riders might be more sensitive to price increases, while drivers may be less willing to work if fares are too low.

- Analysis of historical pricing data during previous economic downturns: Examining Uber's performance during past economic slowdowns provides valuable insights into how its pricing model has reacted and adapted to changing market conditions.

Diversification Across Ride-Sharing and Delivery

Uber's diversification into both ride-sharing and food delivery (Uber Eats) mitigates risk.

- Uber Eats performance during periods of reduced ride-sharing demand: While ride-sharing demand may soften during a recession, the demand for food delivery often remains relatively stable or even increases as people cut back on dining out.

- Geographical diversification mitigating regional economic impacts: Uber's global presence helps to cushion the blow of any single region experiencing an economic downturn. A slowdown in one market can be offset by stronger performance in others.

- Potential for future diversification into new sectors: Uber's ongoing exploration of new sectors, like freight and other delivery services, further enhances its resilience and reduces reliance on any single revenue stream.

Analyst Predictions and Forecasts for Uber Stock

Understanding analyst sentiment towards Uber stock is crucial for potential investors.

Consensus View on Recessionary Impact

The overall consensus among financial analysts regarding Uber's recessionary resilience is mixed, with a wide range of predictions.

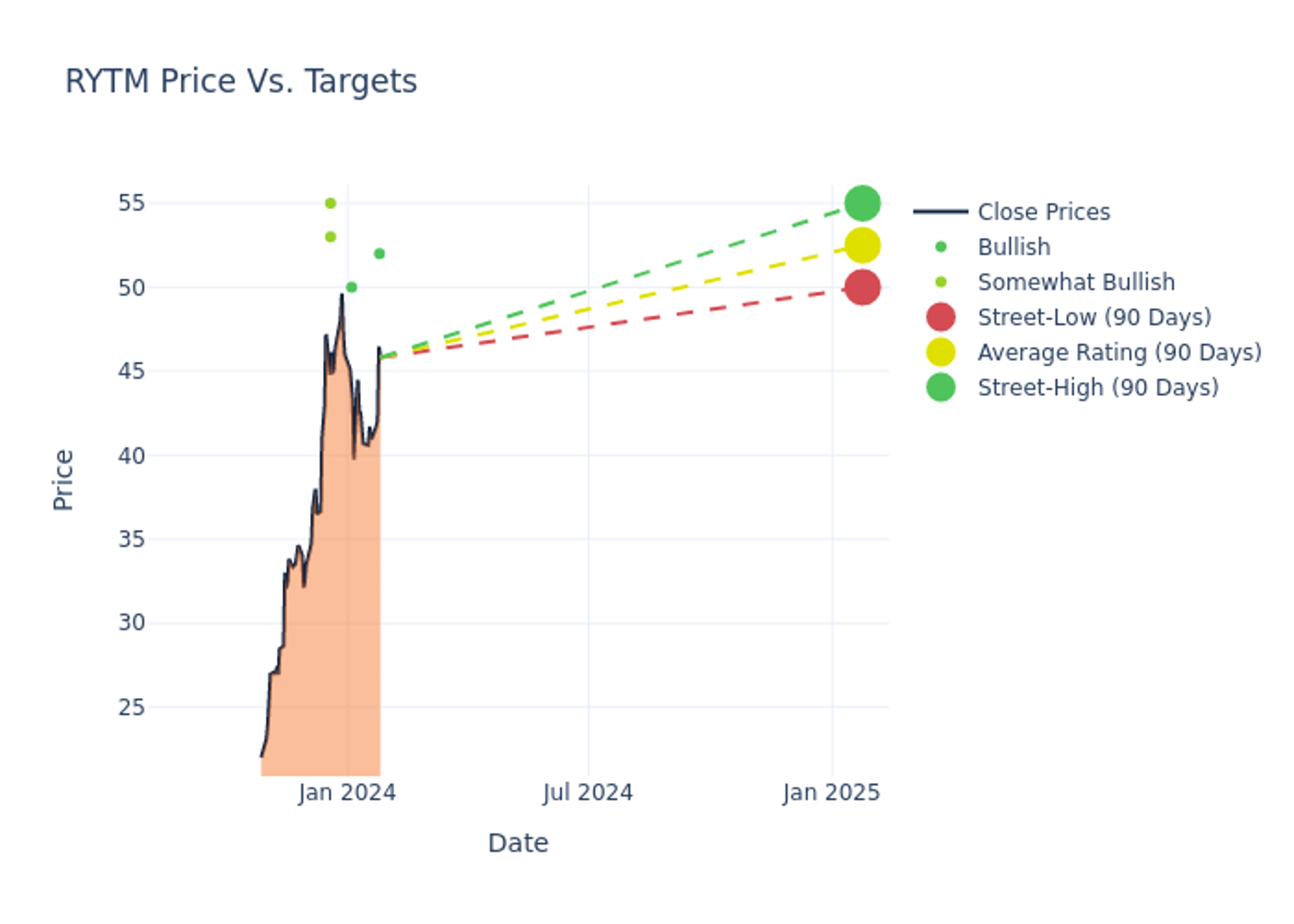

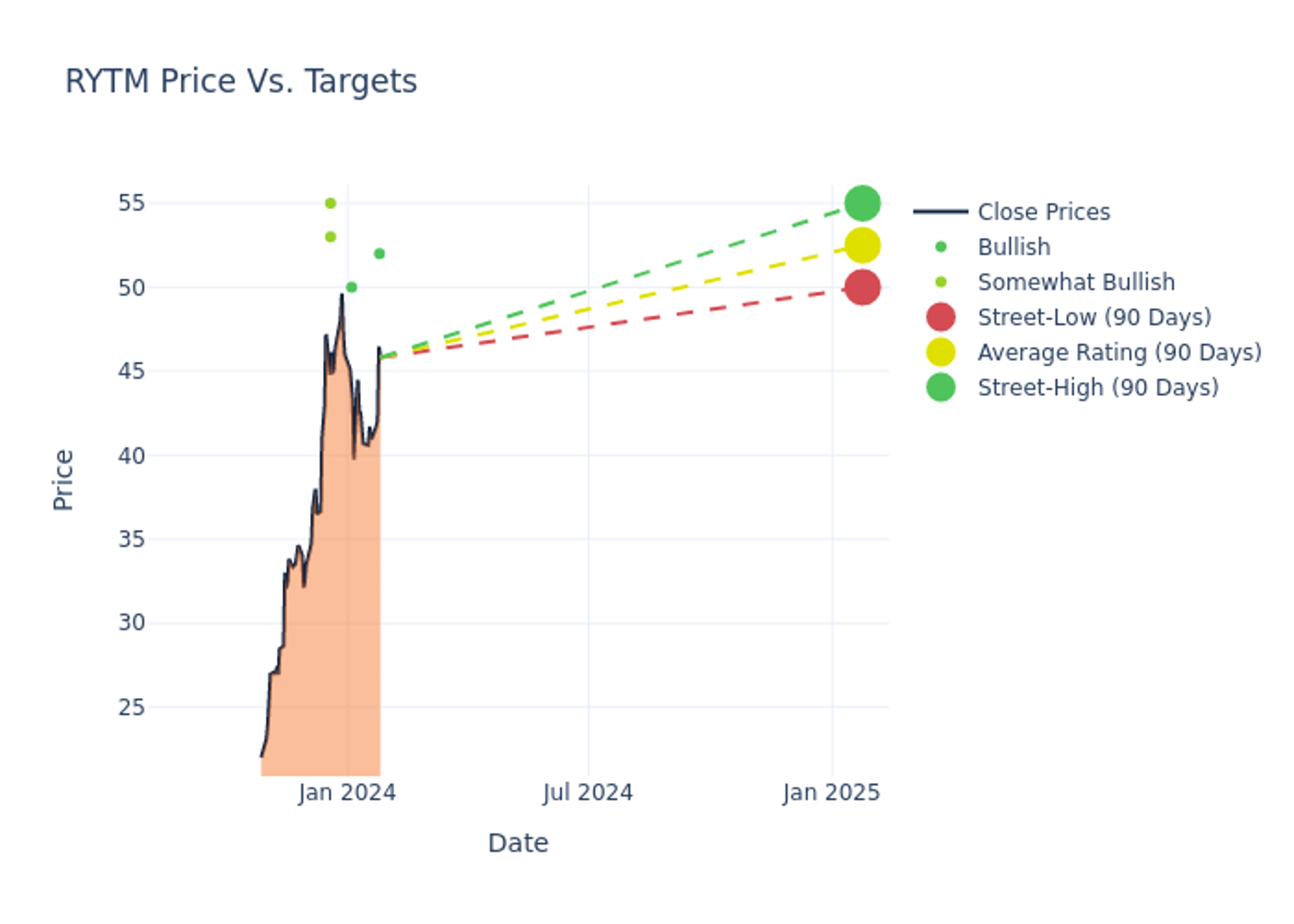

- Range of price targets from various investment banks: Different investment banks offer varying price targets for Uber stock, reflecting the diversity of opinion and the complexities of forecasting.

- Summary of bullish and bearish arguments: Bullish analysts highlight the inherent resilience of Uber's business model, while bearish analysts point to potential headwinds such as increased competition and price sensitivity.

- Consideration of factors influencing analyst forecasts: Analysts consider numerous factors including revenue growth, profitability, market share, and the overall macroeconomic environment.

Key Factors Influencing Analyst Ratings

Several key elements drive analyst ratings and forecasts for Uber stock.

- Projected revenue growth across segments: Analysts carefully analyze projected revenue growth in both ride-sharing and delivery segments, assessing the potential impact of an economic downturn.

- Profitability and margin expansion prospects: Achieving profitability and expanding margins are crucial for positive stock performance, and these factors are central to analyst assessments.

- Impact of inflation and fuel prices on operating costs: Rising inflation and fuel costs directly impact Uber's operating expenses, affecting profitability and potentially influencing analyst ratings.

- Competitive landscape and market share dynamics: Intense competition from rivals in both ride-sharing and food delivery significantly impacts Uber's market share and overall performance, affecting analyst predictions.

Alternative Perspectives and Contrarian Views

It's vital to consider less mainstream viewpoints on Uber's stock outlook.

- Arguments for and against Uber's recession resistance: Some analysts argue that Uber's model is inherently recession-resistant, while others highlight potential vulnerabilities.

- Potential for unexpected disruptions impacting stock performance: Unexpected events, such as regulatory changes or technological disruptions, can significantly impact Uber's stock performance.

- Analysis of risks and uncertainties associated with the predictions: All analyst predictions carry inherent risks and uncertainties. Understanding these limitations is crucial for informed investment decisions.

Investing in Uber Stock During Uncertain Times

Investing in Uber stock requires a careful evaluation of your risk tolerance and investment strategy.

Assessing Risk Tolerance and Investment Strategy

Before investing, carefully assess your risk tolerance.

- Diversification within a broader investment portfolio: Never put all your eggs in one basket. Diversify your portfolio to mitigate the risk associated with any single investment.

- Long-term versus short-term investment horizons: Uber stock is better suited for long-term investors who can withstand short-term market fluctuations.

- Importance of conducting thorough due diligence: Thoroughly research Uber's financial performance, competitive landscape, and overall market outlook before investing.

Evaluating Valuation and Potential Returns

Analyzing Uber's valuation is crucial in determining its investment potential.

- Comparison to competitor valuations: Compare Uber's valuation metrics (such as P/E ratio) to those of its competitors to assess its relative attractiveness.

- Analysis of discounted cash flow models: Use discounted cash flow (DCF) models to project Uber's future cash flows and estimate its intrinsic value.

- Potential for capital appreciation and dividend income: Consider the potential for capital appreciation (stock price increase) and the possibility of future dividend payments.

Considering Macroeconomic Factors

Macroeconomic conditions significantly influence Uber's prospects.

- Impact of interest rate changes on the stock market: Interest rate hikes can negatively affect stock market valuations, including Uber's stock price.

- Effect of inflation on consumer spending: High inflation can reduce consumer spending, impacting demand for Uber's services.

- Geopolitical risks and their potential influence: Global geopolitical events can create uncertainty and volatility in the stock market, affecting Uber's performance.

Conclusion

Uber stock's resilience during a recession remains a complex question. While its dual-sided marketplace and diversification offer a degree of protection, factors like pricing sensitivity and macroeconomic conditions will heavily influence its performance. Investors considering Uber stock should carefully weigh the potential benefits against inherent risks, aligning their investment strategy with their risk tolerance. Conduct thorough research and consult with a financial advisor before making any investment decisions regarding Uber stock and its potential recession resistance. Remember to always diversify your portfolio for optimal risk management.

Featured Posts

-

Lotto Results For Saturday April 12th

May 18, 2025

Lotto Results For Saturday April 12th

May 18, 2025 -

Spring Breakout Rosters 2025 Player Spotlights And Team Previews

May 18, 2025

Spring Breakout Rosters 2025 Player Spotlights And Team Previews

May 18, 2025 -

West Palm Beach Students Hopes For The Catholic Church Under The New Pope

May 18, 2025

West Palm Beach Students Hopes For The Catholic Church Under The New Pope

May 18, 2025 -

Brooklyn Bridge City Hall Subway Stabbing Details Of The Rush Hour Incident

May 18, 2025

Brooklyn Bridge City Hall Subway Stabbing Details Of The Rush Hour Incident

May 18, 2025 -

Ram Fest 2024 Marcello Hernandezs Hilarious Snl Style Hosting

May 18, 2025

Ram Fest 2024 Marcello Hernandezs Hilarious Snl Style Hosting

May 18, 2025