Uber's Autonomous Vehicle Future: Investing In ETFs

Table of Contents

Uber's Autonomous Vehicle Technology and its Market Potential

Uber's commitment to self-driving car technology is undeniable. They've invested heavily in research and development, aiming to integrate autonomous vehicles into their ride-hailing platform. This ambitious goal represents a significant market disruption, potentially revolutionizing transportation efficiency, safety, and accessibility. The market for autonomous vehicles is projected to experience explosive growth in the coming decades.

- Market size projections: Reports predict the global autonomous vehicle market will reach hundreds of billions, if not trillions, of dollars in the coming years.

- Uber's competitive advantages: Uber's existing network and vast user base offer a significant advantage in deploying autonomous vehicles at scale. However,

- Uber's competitive disadvantages: Intense competition from other tech giants and established automakers presents a considerable challenge.

- Challenges and risks: Regulatory hurdles, public safety concerns, and the need for robust technological advancements are key risks associated with the widespread adoption of autonomous vehicles.

Identifying Relevant ETFs for Exposure to the Autonomous Vehicle Sector

Gaining exposure to the autonomous vehicle sector through individual company stock picking can be risky. ETFs provide a diversified approach, spreading risk across multiple companies involved in various aspects of the industry – from technology development to automotive manufacturing and robotics. Therefore, identifying ETFs with significant holdings in these sectors offers a more strategic investment approach for exposure to "Uber's autonomous vehicle future."

- Specific ETF Examples: While specific holdings change, look for ETFs that include companies like Alphabet (GOOGL), Tesla (TSLA), Mobileye (MBLY), and others involved in autonomous driving technology and related sectors. Consider researching ETFs with a focus on technology, robotics, or the automotive industry. Always check the fund's prospectus for the most current information.

- Expense Ratios: Compare the expense ratios of different ETFs; lower expense ratios translate to greater returns over time.

- Diversification Benefits: ETFs offer diversification, mitigating risk by spreading your investment across multiple companies, reducing dependence on any single company's performance.

Analyzing ETF Holdings and Weightings

Before investing in any ETF, thoroughly analyze its holdings and weightings. Understanding which companies contribute most significantly to the fund's performance is crucial for assessing its alignment with your investment goals regarding "Uber's autonomous vehicle future".

- Checking ETF Holdings: Websites such as ETF.com or the ETF provider's website provide detailed information about ETF holdings, allowing investors to assess the level of exposure to autonomous vehicle companies.

- Sector Weighting: Pay close attention to sector weighting within the ETF. A fund heavily weighted in a single sector might be more volatile than a more diversified fund.

- Risk Profile: Each ETF has a specific risk profile. Understanding this profile is essential for aligning your investment with your risk tolerance.

Managing Risk in Autonomous Vehicle ETF Investments

Investing in emerging technologies like autonomous vehicles inherently involves risks. Regulatory changes, technological setbacks, intense competition, and unexpected market shifts can all impact returns.

- Potential Risks: Government regulations could significantly affect the pace of autonomous vehicle adoption. Technological glitches and safety concerns could lead to delays or setbacks. The competitive landscape is highly dynamic, with many players vying for market share.

- Diversification Strategies: Diversify your investment portfolio beyond autonomous vehicle ETFs. Include assets like bonds or real estate to reduce overall portfolio volatility.

- Long-Term Investment Horizon: Investing in this sector requires a long-term perspective. Short-term market fluctuations are expected.

The Future of Autonomous Vehicles and Long-Term Investment Strategies

The future of autonomous vehicles looks promising, with potential for transformative impact on various sectors. This long-term perspective is key for successful investments related to "Uber's autonomous vehicle future."

- Future Scenarios: The widespread adoption of autonomous vehicles could lead to increased efficiency in transportation, reduced traffic congestion, and new business models.

- Potential Long-Term Returns: While risk is involved, the potential long-term returns from investing in this innovative sector could be substantial.

- Staying Informed: Keep abreast of technological advancements, regulatory changes, and market developments in the autonomous vehicle sector to make informed investment decisions.

Conclusion: Investing in Uber's Autonomous Vehicle Future Through ETFs – A Smart Move?

Investing in Uber's autonomous vehicle future through ETFs offers a compelling strategy for participating in this potentially lucrative market. While risk is inherent in any investment, particularly in emerging technologies, ETFs provide a diversified approach to mitigating this risk. By carefully analyzing ETF holdings and understanding the sector's potential, investors can strategically position themselves to capitalize on the autonomous vehicle revolution. Consider researching and selecting ETFs that align with your investment goals and risk tolerance. Start exploring your options for investing in self-driving car technology and capitalizing on the autonomous vehicle revolution today!

Featured Posts

-

Seguridad Reforzada En Las Instalaciones Del Cne Presencia Policial En La Capital

May 19, 2025

Seguridad Reforzada En Las Instalaciones Del Cne Presencia Policial En La Capital

May 19, 2025 -

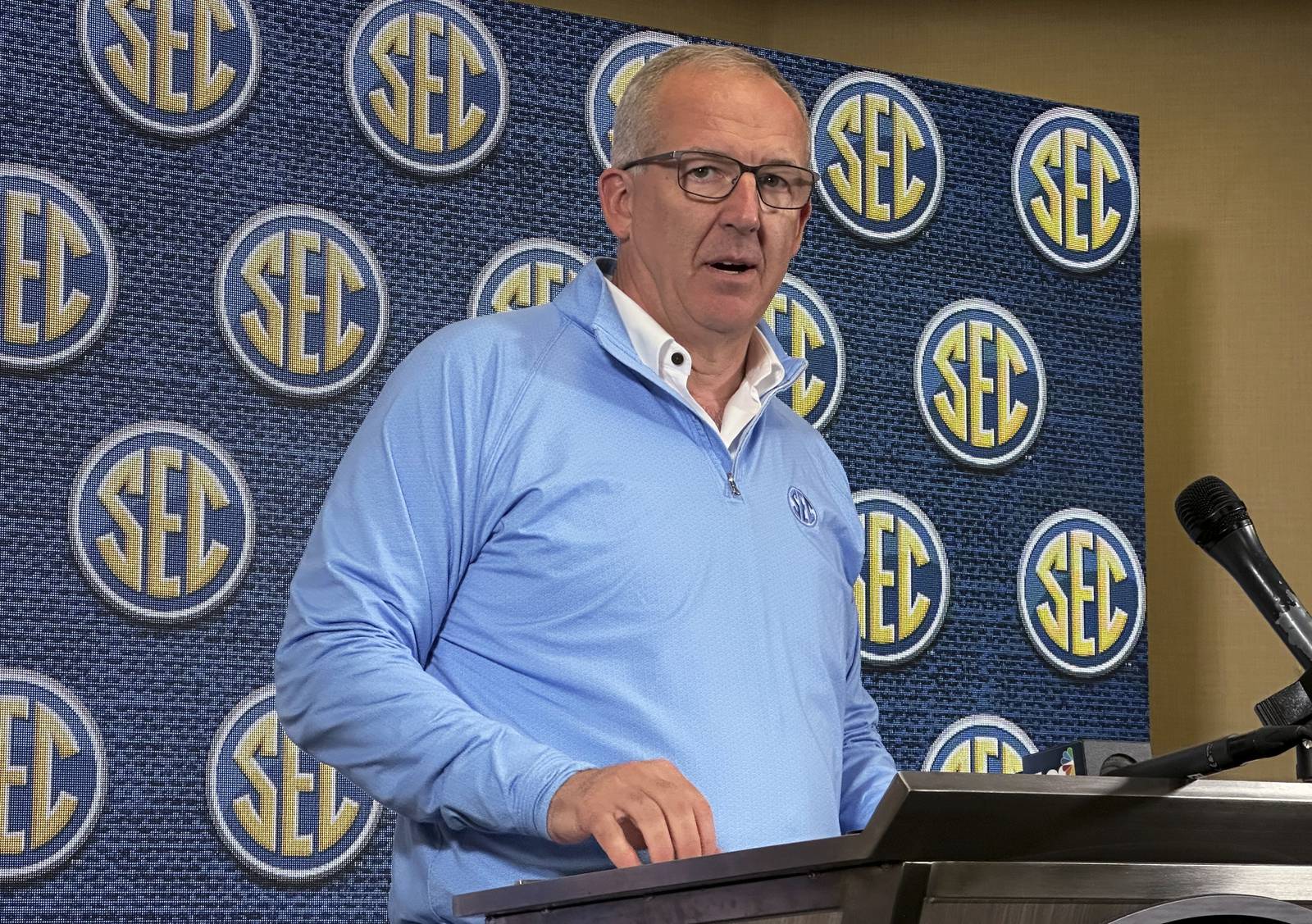

Sec Nine Game Schedule Sankeys Support For Longhorns And Others

May 19, 2025

Sec Nine Game Schedule Sankeys Support For Longhorns And Others

May 19, 2025 -

Nueva Corriente Quienes Son Los Aspirantes A Diputados

May 19, 2025

Nueva Corriente Quienes Son Los Aspirantes A Diputados

May 19, 2025 -

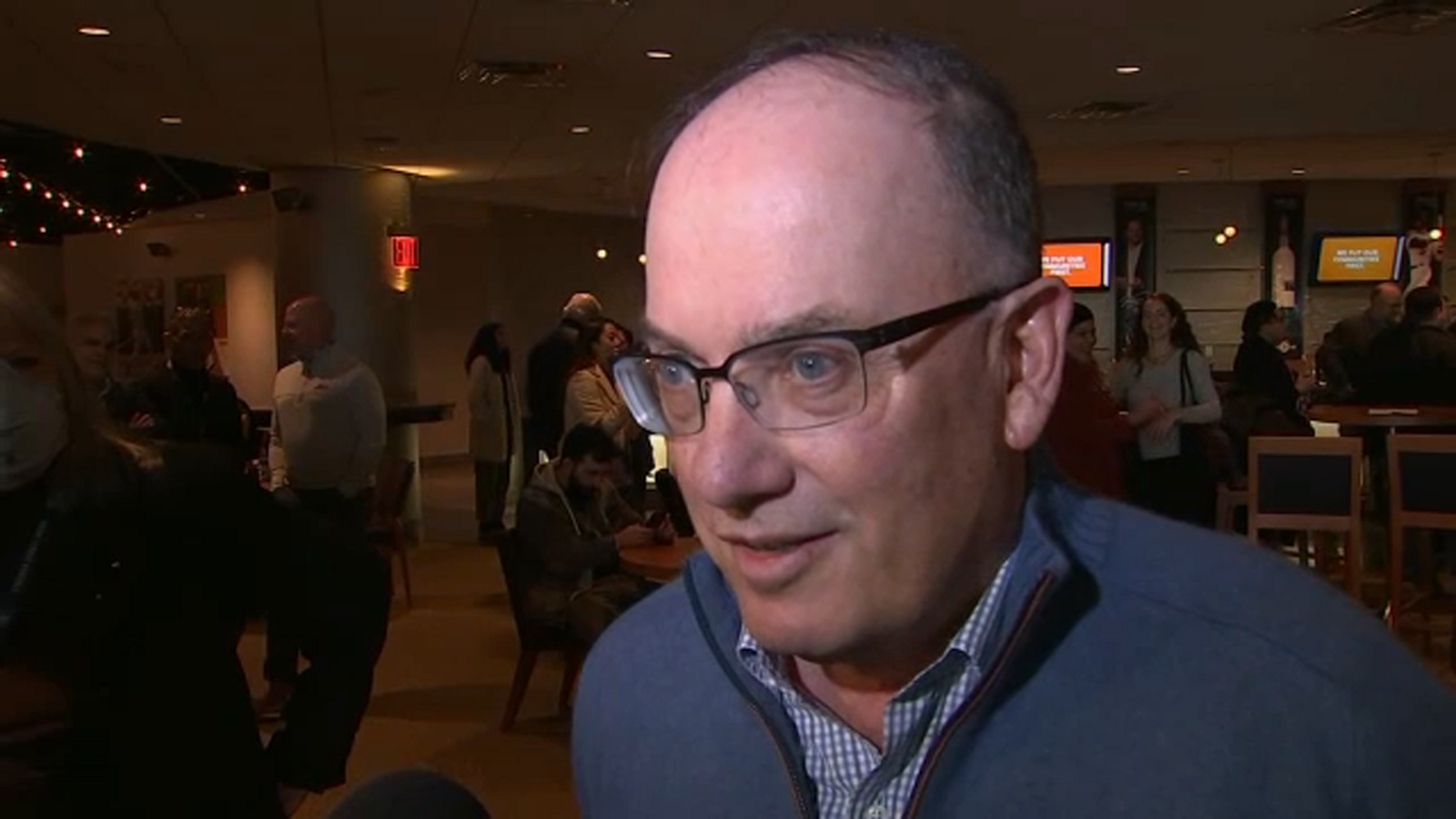

New York Mets Owner Steve Cohen Addresses Alonsos Contract Sotos Struggles

May 19, 2025

New York Mets Owner Steve Cohen Addresses Alonsos Contract Sotos Struggles

May 19, 2025 -

Eurovision 2025 Will Jamala Perform

May 19, 2025

Eurovision 2025 Will Jamala Perform

May 19, 2025