Uber's Foodpanda Taiwan Acquisition Fails Amidst Regulatory Delays

Table of Contents

The Proposed Acquisition: A Look at the Deal's Potential

The initial announcement of Uber's intention to acquire Foodpanda's Taiwanese operations generated considerable excitement. The anticipated synergies were substantial, promising significant benefits for both companies.

- Increased Market Share: Combining Uber Eats' existing presence with Foodpanda's strong market share in Taiwan would have created a dominant player, significantly expanding their reach and customer base.

- Enhanced Delivery Network: Integrating both companies' delivery networks would have optimized logistics, potentially leading to faster delivery times and broader coverage across Taiwan.

- Improved Technology Integration: Merging technological platforms could have streamlined operations, resulting in cost efficiencies and a more user-friendly experience for customers.

Consumers stood to benefit from potentially lower prices due to increased competition and a wider selection of restaurants and cuisines available through a combined platform. Foodpanda held a significant market share in Taiwan prior to the proposed acquisition, and Uber's global ambitions in the food delivery sector positioned this deal as a key strategic move. The failure of the Uber Foodpanda Taiwan acquisition therefore represents a significant setback for both companies' expansion plans in the region.

Regulatory Delays and Obstacles: Unforeseen Roadblocks

The primary reason for the deal's collapse was the protracted and ultimately unsuccessful navigation of regulatory hurdles. These obstacles proved insurmountable, effectively killing the acquisition.

- Antitrust Concerns: The Fair Trade Commission (FTC) of Taiwan, the primary regulatory body, expressed concerns about the potential monopolistic impact of a merged Uber-Foodpanda entity.

- Data Privacy Regulations: The handling of user data and compliance with Taiwan's stringent data privacy laws also played a role in the regulatory review process.

- Foreign Investment Restrictions: Specific regulations surrounding foreign investment in the Taiwanese market might have added complexity to the approval process.

The regulatory review process stretched over several months, with crucial delays occurring during the evaluation of antitrust concerns. Official statements from the FTC and both companies, while often vague, confirmed the increasing difficulties in obtaining regulatory approval.

The Role of Antitrust Concerns in the Deal's Failure

The FTC's antitrust concerns were central to the deal's failure. The commission likely worried that a combined Uber-Foodpanda would stifle competition in the already competitive Taiwanese food delivery market. This concern was valid given the presence of other significant players like Deliveroo and local competitors. The potential for reduced pricing competition and diminished innovation post-merger was a key point of contention for the FTC.

Impact on the Taiwanese Food Delivery Market: Ripple Effects

The failed Uber Foodpanda Taiwan acquisition has created ripples throughout the Taiwanese food delivery landscape.

- Market Share Dynamics: The market share distribution among existing players remains largely unchanged, although the potential for increased competition remains.

- Pricing Strategies: Without the merged entity, existing companies might maintain their current pricing strategies or even engage in more aggressive competition.

- Service Offerings: Companies will likely continue to focus on improving their services, such as delivery speeds and restaurant selection, to maintain a competitive edge.

Consumers might not experience the immediate benefits originally anticipated, such as lower prices or broader choices. Competitors have likely observed the failure of this merger as an opportunity to strengthen their own positions within the market.

Future Prospects for Uber and Foodpanda in Taiwan: Next Steps

Following the failed acquisition, both Uber and Foodpanda must reassess their strategies in Taiwan.

- Uber Eats: May focus on organic growth and improving its current service offerings to gain a stronger foothold in the market.

- Foodpanda: Will likely continue to operate independently, focusing on strengthening its market position and possibly exploring strategic partnerships.

The future for both companies in Taiwan remains uncertain but will undoubtedly involve adapting to the competitive landscape in the absence of the merger. Official statements from both companies suggest a continued commitment to the Taiwanese market, albeit through alternative approaches.

Conclusion

The failure of the Uber Foodpanda Taiwan Acquisition primarily resulted from significant regulatory delays, particularly concerning antitrust issues. This outcome significantly impacts the Taiwanese food delivery market, leaving the competitive landscape largely unchanged. Both Uber and Foodpanda will need to formulate new strategies for growth in Taiwan. To stay informed on further developments in this dynamic market and the future strategies of Uber and Foodpanda, follow reputable news sources covering the tech and food delivery industries. Stay tuned for more updates on the evolving Uber Foodpanda Taiwan Acquisition saga and its ongoing implications.

Featured Posts

-

High Rtp Online Casinos In Ontario Mirax Casino Leads The Pack

May 17, 2025

High Rtp Online Casinos In Ontario Mirax Casino Leads The Pack

May 17, 2025 -

Major Fortnite Cosmetic Changes Possible Following Refunds

May 17, 2025

Major Fortnite Cosmetic Changes Possible Following Refunds

May 17, 2025 -

New York Knicks 37 Point Loss Prompts Thibodeaus Call For More Determination

May 17, 2025

New York Knicks 37 Point Loss Prompts Thibodeaus Call For More Determination

May 17, 2025 -

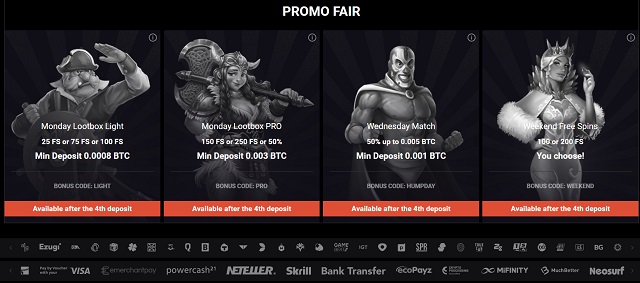

Best Crypto Casinos In The United States Is Jackbit Number One

May 17, 2025

Best Crypto Casinos In The United States Is Jackbit Number One

May 17, 2025 -

Florida School Shootings The Impact On Lockdown Procedures And A Generation

May 17, 2025

Florida School Shootings The Impact On Lockdown Procedures And A Generation

May 17, 2025