Uber's Self-Driving Gamble: Investing In The Future With ETFs

Table of Contents

Understanding Uber's Autonomous Vehicle Strategy

Uber's investment in self-driving technology represents a significant commitment to reshaping the transportation landscape. While the journey has faced its share of challenges, including accidents and regulatory hurdles, Uber's Advanced Technologies Group (ATG) continues to make strides in developing its autonomous vehicle capabilities.

- Uber's ATG: The ATG is the core of Uber's self-driving efforts, responsible for the research, development, and testing of autonomous vehicle technology.

- Key Partnerships: Uber has collaborated with various companies across the automotive and technology sectors, leveraging expertise and resources to accelerate its autonomous vehicle development. These partnerships are crucial for overcoming technical challenges and navigating the regulatory landscape.

- Deployment Plans: Uber aims to deploy self-driving vehicles in various cities globally, initially focusing on ride-sharing services but with potential expansion into other areas like delivery and logistics.

- Regulatory and Ethical Considerations: The deployment of self-driving cars faces significant regulatory hurdles, including safety standards, liability issues, and ethical dilemmas concerning accident scenarios. These considerations greatly impact the timeline and feasibility of widespread adoption.

The Risks and Rewards of Investing in Self-Driving Technology

Investing in self-driving technology presents a high-risk, high-reward proposition. The potential rewards are substantial, driven by the enormous potential of the autonomous vehicle market.

- Market Dominance: Successful autonomous vehicle companies stand to achieve significant market dominance, revolutionizing transportation and logistics. Early investment in this sector could yield substantial returns.

- Technological Risks: The development of autonomous driving technology is complex and faces significant technological risks, including software glitches, sensor failures, and unforeseen safety challenges.

- Regulatory and Legal Risks: Government regulations and legal liabilities related to accidents involving autonomous vehicles pose considerable uncertainty and could significantly impact investment returns.

- Intense Competition: The self-driving industry is highly competitive, with numerous established automakers and tech giants vying for market share. This competition could pressure profit margins and limit the potential for extraordinary returns.

Diversification through ETFs

Instead of directly investing in Uber stock, which carries significant company-specific risk, Exchange Traded Funds (ETFs) offer a compelling alternative for exposure to the autonomous vehicle market.

- Diversification Benefits: ETFs provide diversification by spreading investments across multiple companies within the sector, reducing the impact of a single company's underperformance. This is crucial given the nascent stage of the autonomous vehicle industry.

- Lower Costs: ETFs generally have lower expense ratios compared to actively managed mutual funds or individual stock purchases.

- Ease of Access: ETFs are easily traded through most brokerage accounts, offering investors convenient access to a diversified portfolio in this complex sector.

- Relevant ETFs: Several ETFs offer exposure to companies involved in autonomous vehicle technology, robotics, and related sectors. Examples include ETFs focused on technology, transportation, and industrial automation. Specific examples should be researched based on your individual risk tolerance and investment strategy. Always thoroughly investigate any ETF before investing.

Identifying Suitable ETFs for Autonomous Vehicle Exposure

Several ETFs provide exposure to companies actively involved in the development and deployment of autonomous vehicle technologies. It's crucial to conduct thorough research before selecting any ETF.

- Specific ETF Examples: [Insert examples of relevant ETFs here, including ticker symbols, brief descriptions of their investment strategies, expense ratios, and links to provider websites. Disclaimer: This is not financial advice. Always conduct thorough research before making any investment decisions.]

- Investment Strategy: Carefully review the ETF’s investment strategy to ensure it aligns with your investment goals and risk tolerance.

- Expense Ratio: Pay attention to the expense ratio, as it represents the annual cost of owning the ETF.

- Holdings: Examine the ETF's holdings to understand the specific companies in which your investment will be allocated.

Due Diligence and Risk Management

Investing in any ETF, especially those related to emerging technologies like self-driving vehicles, requires thorough due diligence and a careful assessment of risk.

- Financial Advisor Consultation: Consult a qualified financial advisor to determine your risk tolerance and align your investment choices with your overall financial goals.

- Prospectus Review: Always review the ETF's prospectus and fact sheet before investing to understand the investment strategy, fees, and risks involved.

- Emerging Technology Risks: Investing in emerging technologies like autonomous vehicles inherently carries higher risk than more established sectors. Be prepared for volatility.

- Portfolio Diversification: Diversify your investment portfolio beyond just autonomous vehicle ETFs to mitigate overall risk.

Conclusion

Investing in Uber's self-driving future, and the broader autonomous vehicle market, offers substantial potential but carries significant risks. ETFs offer a strategic way to participate in this transformative sector while mitigating some of the inherent risks through diversification. By carefully researching appropriate ETFs, understanding associated risks, and seeking professional financial advice, you can make informed investment decisions and potentially benefit from the opportunities presented by the self-driving revolution. Remember to conduct thorough due diligence and consult with a financial advisor before making any investment decisions related to Uber's self-driving gamble or any other investment strategy involving ETFs.

Featured Posts

-

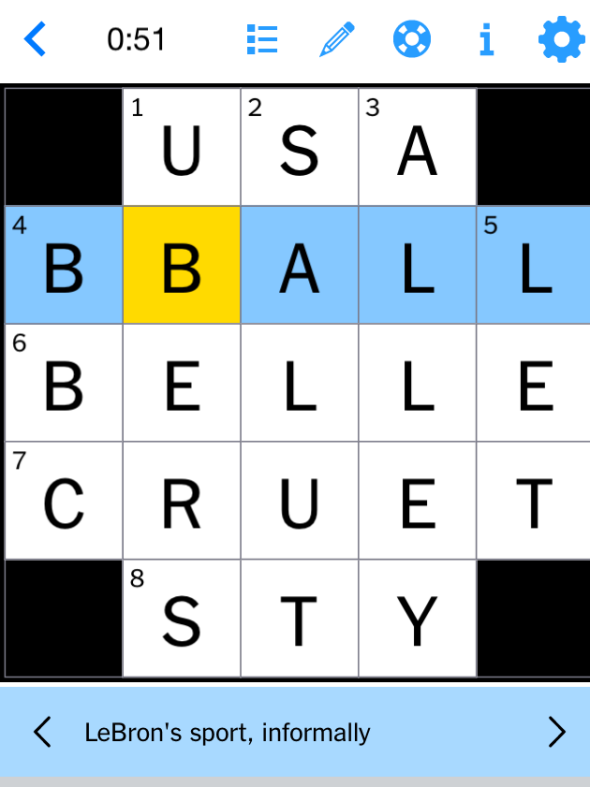

Solve The Nyt Mini Crossword Hints For March 3 2025

May 18, 2025

Solve The Nyt Mini Crossword Hints For March 3 2025

May 18, 2025 -

Metas Defense Takes Center Stage In Ftc Monopoly Lawsuit

May 18, 2025

Metas Defense Takes Center Stage In Ftc Monopoly Lawsuit

May 18, 2025 -

Is Damiano David Joining Eurovision 2025 The Latest Rumours

May 18, 2025

Is Damiano David Joining Eurovision 2025 The Latest Rumours

May 18, 2025 -

Playing At Bitcoin And Crypto Casinos In 2025 What To Consider

May 18, 2025

Playing At Bitcoin And Crypto Casinos In 2025 What To Consider

May 18, 2025 -

Astmrar Alsrae Altwyl Dwr Htb Alhrb Fy Italth

May 18, 2025

Astmrar Alsrae Altwyl Dwr Htb Alhrb Fy Italth

May 18, 2025