UK Households: Don't Ignore New HMRC Letters

Table of Contents

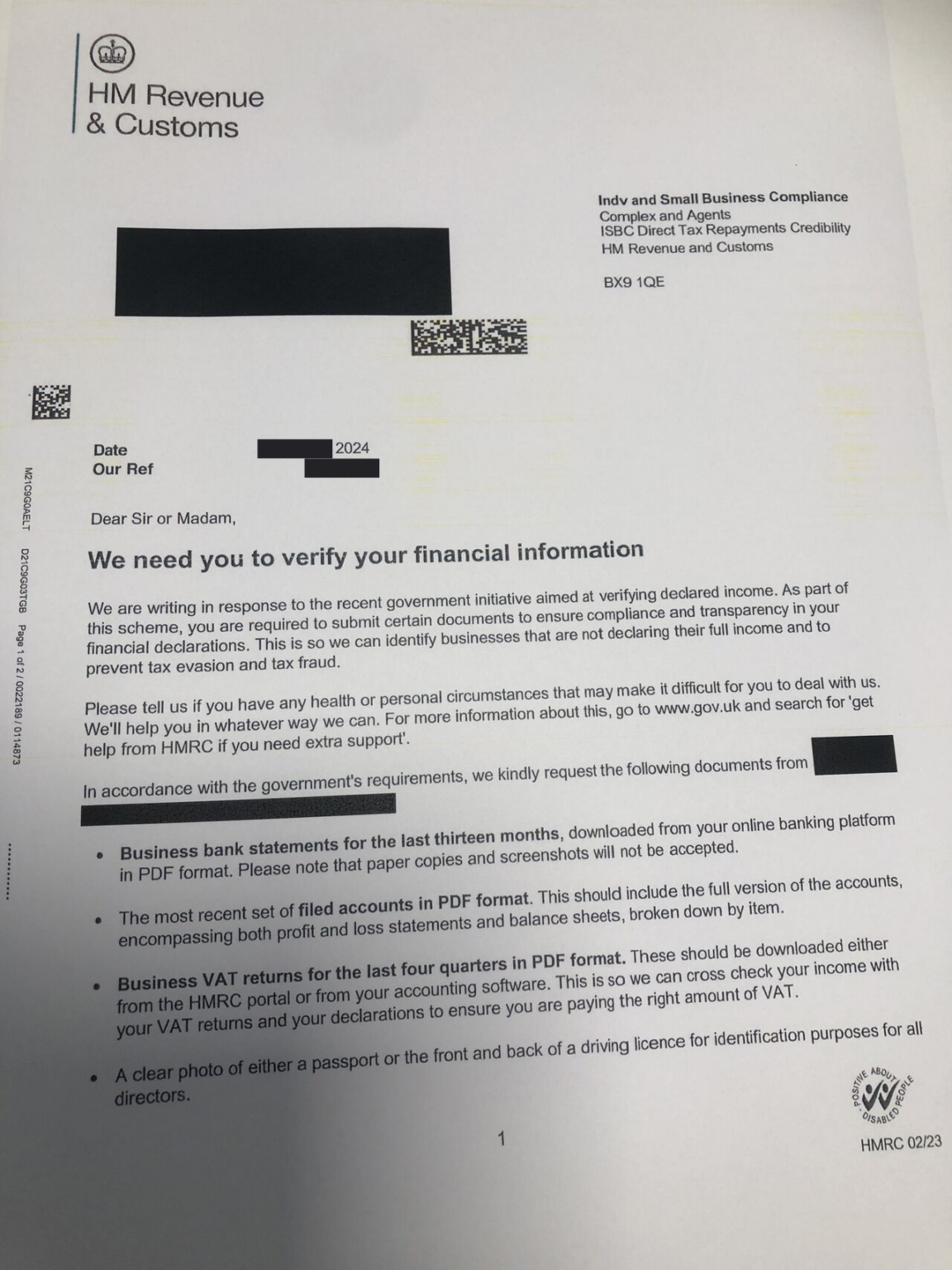

Identifying Legitimate HMRC Correspondence

Receiving a letter from HMRC can be concerning, but it's crucial to identify whether it's genuine before taking any action. Fraudulent HMRC letters (often phishing scams) attempt to steal your personal and financial information. Therefore, verifying the authenticity of any HMRC letter is the first critical step.

- Official Letterhead and Address: Genuine HMRC letters will feature the official HMRC logo and address, clearly printed on the letterhead. Look for inconsistencies or unprofessional formatting.

- Unique Reference Numbers: Each HMRC letter will include a unique reference number. This number allows HMRC to track your communication and helps you to verify the letter's authenticity. You can use this number to track the letter's progress through the HMRC system.

- Verification of Contact Details: Check the contact details (phone number, address, website) listed on the letter against the official HMRC website. Any discrepancies should raise a red flag.

- Beware of Emails: HMRC rarely sends crucial information via email. If you receive an email seemingly from HMRC requesting personal or financial details, treat it with extreme caution. It's likely a phishing scam.

Understanding the Content of Your HMRC Letter

Once you've confirmed the letter's legitimacy, carefully read every section. Understanding the content is vital to responding appropriately and avoiding penalties.

Common reasons for receiving an HMRC letter include:

- Tax Bills: These letters outline your tax liability for a specific tax year. They will state the amount owed, the payment deadline, and payment methods.

- Tax Refunds: Good news! This letter confirms you're due a refund and details the amount and how it will be paid.

- Tax Assessment Notices: These letters inform you of the tax assessment determined by HMRC, including any adjustments or corrections to your previously submitted tax return.

- Enquiry Letters: HMRC may contact you to request further information or clarification regarding your tax return or tax affairs.

When reviewing your HMRC letter, pay close attention to:

- Tax Year/Period: Identify the specific tax year or period to which the letter refers.

- Deadlines and Required Actions: Note all deadlines and precisely what actions you need to take (e.g., submitting a tax return, making a payment).

- Implications of Non-Compliance: Understand the potential penalties for failing to comply with the letter's requests.

- Contact Information: Note down all reference numbers and contact numbers provided for any further inquiries.

Responding to HMRC Letters – What to Do

Responding to HMRC letters promptly and correctly is crucial. The method of response will depend on the type of letter.

For example, responding to a tax return request involves completing and submitting your return through the online HMRC portal. Responding to a payment demand requires making a payment within the given timeframe using one of the specified methods.

- Gather Documentation: Before responding, gather all relevant documentation (payslips, invoices, bank statements, etc.) to support your response.

- Respond Within Timeframe: Always respond within the deadline stated in the letter to avoid penalties.

- Utilize Appropriate Contact Method: Use the contact methods specified in the letter (phone, post, online portal).

- Keep Records: Keep copies of all correspondence, including the original letter, your response, and any proof of payment. This will be invaluable if any disputes arise later.

What to Do If You Suspect a Scam

HMRC scams are prevalent, so it’s important to be vigilant. If you suspect a letter is fraudulent, do not respond directly to it.

- Never Click Links: Never click on any links in suspicious emails or letters.

- Never Share Information Unsolicited: Never provide your personal or financial information unless you've initiated the contact with HMRC through official channels.

- Contact HMRC Directly: Contact HMRC using their official contact details found on the GOV.UK website to verify the legitimacy of any communication.

- Report to Action Fraud: Report any suspected fraudulent communication to Action Fraud, the UK's national reporting centre for fraud and cybercrime.

Taking Action on Your HMRC Letters – Avoid Penalties

Promptly responding to your HMRC letters is essential to avoid penalties and maintain your tax compliance. Ignoring HMRC correspondence can lead to late payment penalties, interest charges, and ultimately, debt collection action. Don't delay – review your HMRC letters today and take the necessary action. For further information and support, visit the official HMRC website: [Insert HMRC Website Link Here].

Featured Posts

-

Bundesliga Leverkusen Upsets Bayern Postponing Title Celebrations Kane Sidelined

May 20, 2025

Bundesliga Leverkusen Upsets Bayern Postponing Title Celebrations Kane Sidelined

May 20, 2025 -

Cote D Ivoire Le Diletta Plus Grand Navire Jamais Accueilli Au Port D Abidjan

May 20, 2025

Cote D Ivoire Le Diletta Plus Grand Navire Jamais Accueilli Au Port D Abidjan

May 20, 2025 -

L Ia Revele Les Techniques D Ecriture D Agatha Christie

May 20, 2025

L Ia Revele Les Techniques D Ecriture D Agatha Christie

May 20, 2025 -

Leclercs Future At Ferrari The Hamilton Comfort Conundrum

May 20, 2025

Leclercs Future At Ferrari The Hamilton Comfort Conundrum

May 20, 2025 -

Unraveling The Mysteries A Look At Agatha Christies Poirot Stories

May 20, 2025

Unraveling The Mysteries A Look At Agatha Christies Poirot Stories

May 20, 2025