UK Inflation Data Spurs Pound Rally, Traders Pare BOE Cut Wagers

Table of Contents

Lower-Than-Expected UK Inflation Figures

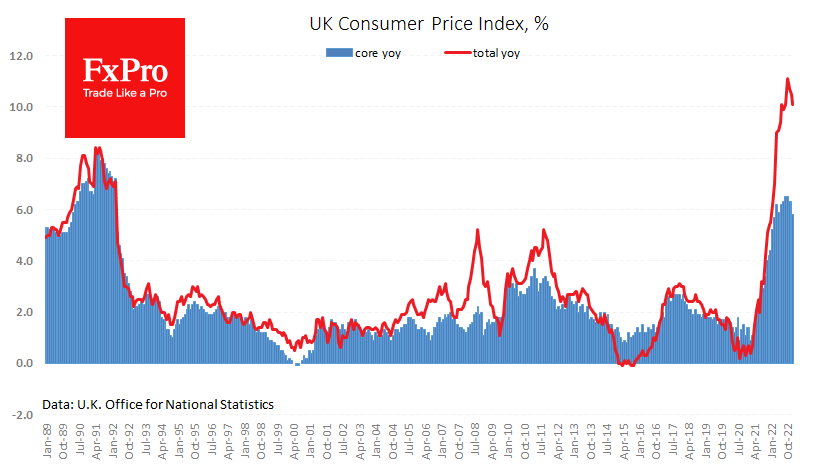

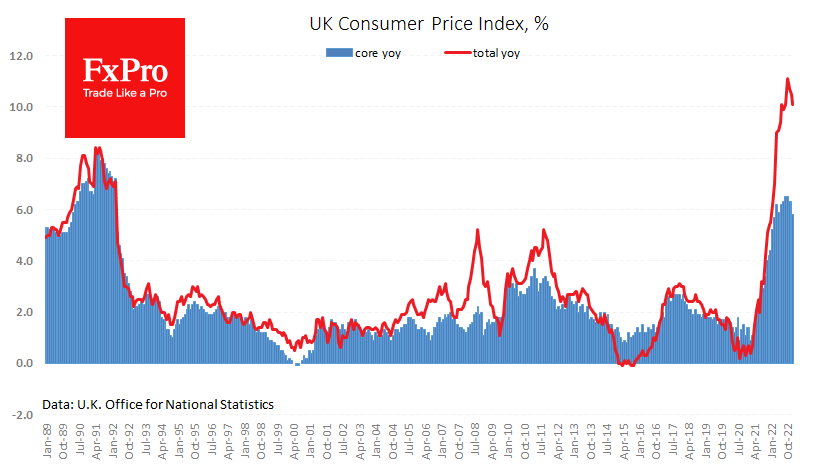

The recent release of UK inflation figures revealed a lower-than-anticipated inflation rate, sparking a positive reaction in the markets. The Consumer Price Index (CPI) for [Insert Month, Year] came in at [Insert Percentage], lower than the market consensus forecast of [Insert Percentage] and down from [Insert Percentage] the previous month. Similarly, the Retail Price Index (RPI) also showed a decrease, indicating a potential easing of inflationary pressures within the UK economy.

Several factors contributed to this unexpectedly positive data:

- Easing energy prices: A decline in global energy prices, particularly natural gas, played a crucial role in dampening inflationary pressures.

- Supply chain improvements: Ongoing improvements in global supply chains have eased some of the bottlenecks that fueled inflation in previous periods.

- Moderating consumer spending: A slowdown in consumer spending, possibly due to the cost-of-living crisis, also contributed to lower inflation.

This positive UK inflation rate data, reflected in the CPI data UK and RPI figures, suggests that the worst of the inflationary surge might be behind the UK, signaling a potential turning point in the fight against inflation. The inflation easing UK trend is a welcome sign for both policymakers and consumers. [Include a relevant chart visualizing the CPI/RPI data].

The Pound's Response to Positive Inflation News

The market's response to the lower-than-expected UK inflation rate was immediate and significant. The Pound Sterling experienced a notable Pound Sterling rally, appreciating against both the US Dollar (USD) and the Euro (EUR). The GBP/USD exchange rate saw a [Insert Percentage]% increase, while the GBP/EUR rate rose by [Insert Percentage]%. This significant GBP exchange rate movement reflects a renewed confidence in the UK economy.

The drivers behind this currency trading UK strength include:

- Reduced BOE rate cut expectations: The positive inflation data reduced fears of aggressive interest rate cuts UK by the BOE.

- Increased investor confidence: The better-than-expected inflation numbers boosted investor confidence in the UK's economic outlook.

This surge in the foreign exchange market highlights the strong correlation between UK economic data and the Pound's performance. [Include a chart showing the Pound's performance against USD and EUR].

Reduced Expectations of BOE Interest Rate Cuts

The positive UK inflation data has dramatically altered market sentiment regarding the Bank of England interest rates. The likelihood of further BOE interest rate cuts in the near term has significantly diminished. This shift in expectation has significant implications:

- Borrowing costs: Reduced expectations of rate cuts mean borrowing costs are likely to remain relatively stable, benefiting businesses and consumers.

- Investment decisions: The more predictable interest rate environment may encourage increased business investment and economic growth.

- Bond yields: The shift in BOE monetary policy expectations has impacted bond yields, with yields potentially rising as investors anticipate less easing.

This altered outlook on BOE rate predictions showcases the significant influence of inflation data on the UK economic outlook and the BOE's BOE monetary policy.

Implications for UK Investors and Businesses

The Pound Sterling rally and reduced likelihood of BOE rate cuts have far-reaching consequences for UK investors and businesses.

- Exporters: A stronger Pound can make UK exports more expensive in international markets, potentially impacting competitiveness.

- Importers: Conversely, a stronger Pound benefits importers, as imported goods become cheaper.

- Businesses with international operations: Companies with significant international dealings will need to carefully manage currency risks.

- Consumer spending: The easing of inflationary pressures may boost consumer confidence and spending.

- Business investment: A stable interest rate environment could encourage increased business investment and capital expenditures.

The overall UK economic impact is complex, with both positive and negative effects depending on the specific sector and business model. The consumer spending UK and business investment UK trends will be crucial in determining the long-term UK economic growth.

Conclusion: Understanding the Impact of UK Inflation Data on the Pound

In conclusion, the recent UK inflation data has played a pivotal role in the Pound's strong performance. The lower-than-expected inflation figures have significantly reduced market expectations for further BOE interest rate cuts, boosting investor confidence and driving a rally in the Pound Sterling. Understanding the interplay between UK inflation data and the Pound's value is crucial for both investors and businesses operating within the UK economy. The implications for various sectors are varied, necessitating careful analysis and strategic planning. Stay tuned for further updates on UK inflation data and its impact on the Pound. Monitor the latest economic news to make informed decisions about your investments and financial planning.

Featured Posts

-

Rio Tintos Defence Of Its Pilbara Mining Operations

May 25, 2025

Rio Tintos Defence Of Its Pilbara Mining Operations

May 25, 2025 -

Amsterdam Stock Exchange Suffers Third Consecutive Major Loss Down 11 Since Wednesday

May 25, 2025

Amsterdam Stock Exchange Suffers Third Consecutive Major Loss Down 11 Since Wednesday

May 25, 2025 -

Budget Friendly Country Living Escape To The Country Under 1m

May 25, 2025

Budget Friendly Country Living Escape To The Country Under 1m

May 25, 2025 -

Flood Alerts Explained How To Prepare For And Respond To Floods

May 25, 2025

Flood Alerts Explained How To Prepare For And Respond To Floods

May 25, 2025 -

The Countrys Top Business Locations Trends And Projections

May 25, 2025

The Countrys Top Business Locations Trends And Projections

May 25, 2025