UK Luxury Exports To The EU: A Brexit-Induced Slowdown?

Table of Contents

The Impact of New Trade Barriers on Luxury Goods

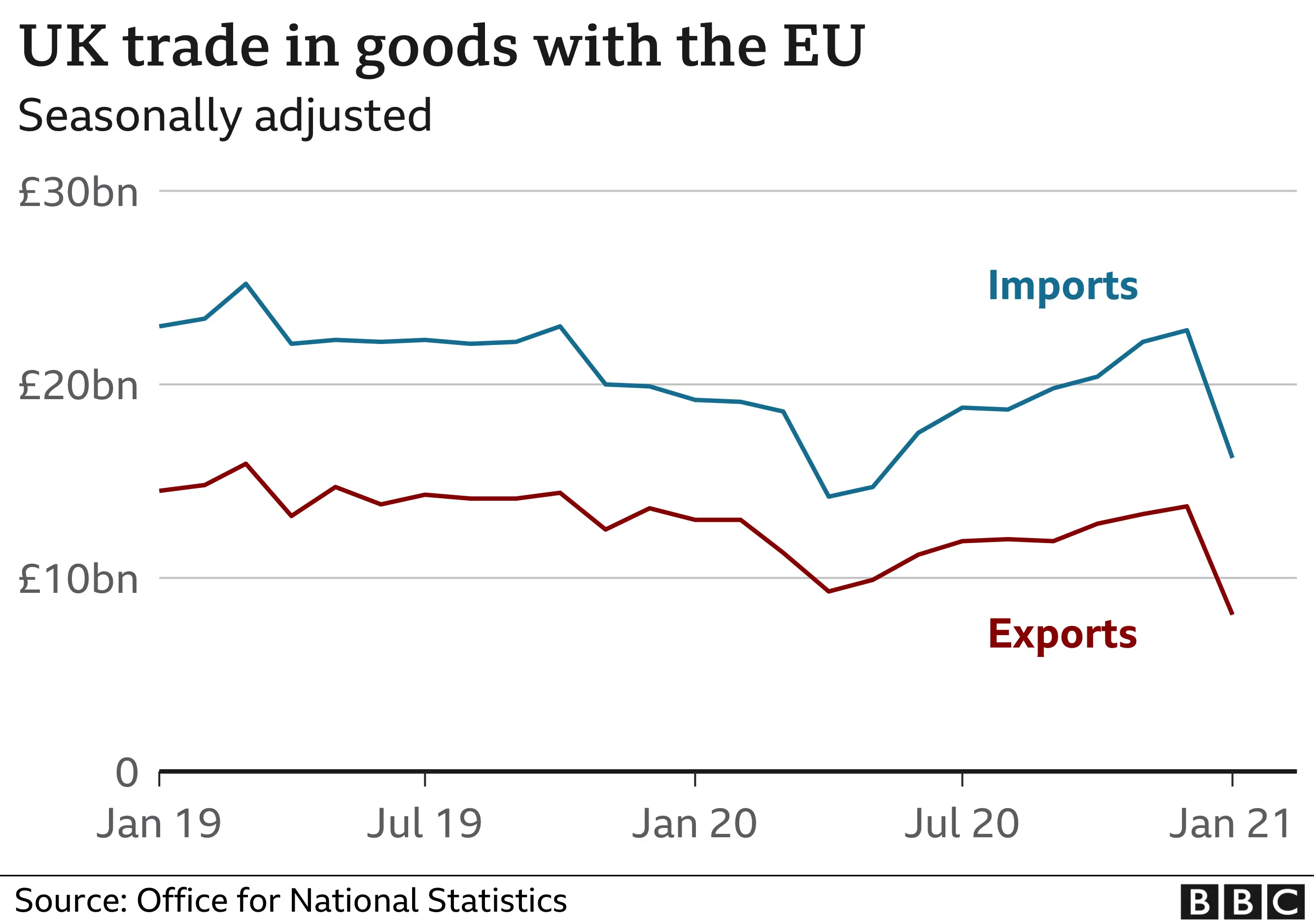

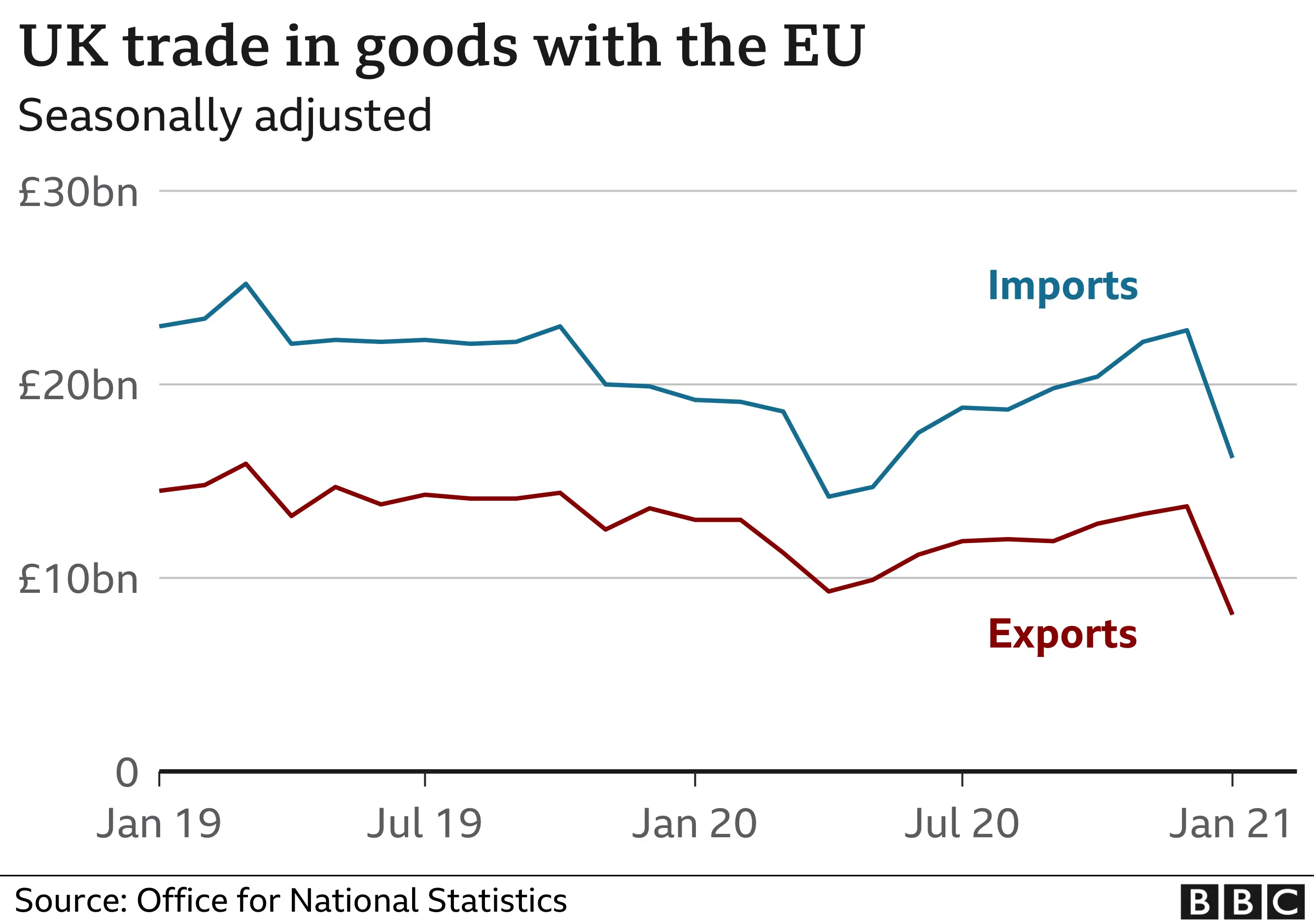

Brexit introduced significant new trade barriers, impacting the competitiveness and profitability of UK luxury exports to the EU. These challenges fall broadly into three categories: increased tariffs and duties, non-tariff barriers, and changes in VAT and excise duties.

Increased Tariffs and Duties

Post-Brexit, many UK luxury goods now face increased tariffs and duties when imported into the EU. This directly impacts pricing and competitiveness.

- Examples: A 10% tariff on high-end British wool suits, a 5% duty on premium Scotch whisky, and a 3% tariff on luxury sports cars.

- These increased costs reduce the price competitiveness of UK luxury brands against their European counterparts who enjoy tariff-free access to the EU single market. Consumers may opt for similar products from within the EU, impacting sales volumes for UK exporters.

Non-Tariff Barriers

Beyond tariffs, significant non-tariff barriers have emerged, adding complexity and cost to the export process.

- Examples: Increased customs checks leading to delays at borders, stringent documentation requirements resulting in administrative burdens, and significantly longer transit times impacting just-in-time delivery models crucial for high-value, perishable goods.

- These delays disrupt supply chains, increase logistical costs, and damage the reputation of businesses reliant on speed and efficiency. The increased complexity also acts as a significant barrier to entry for smaller luxury brands.

Changes in VAT and Excise Duties

The complexities of VAT and excise duty regulations have also become considerably more challenging post-Brexit.

- Examples: Difficulties in reclaiming VAT on exports, inconsistencies in applying excise duties across different EU member states, and the increased administrative burden associated with complying with diverse EU regulations.

- These changes directly impact pricing strategies, profitability, and the administrative resources required by exporters, disproportionately affecting smaller businesses with fewer resources dedicated to navigating these complexities.

Shifting Market Dynamics and Consumer Behaviour

Brexit has not only introduced new trade barriers but has also altered market dynamics and consumer behaviour, creating additional challenges for UK luxury exporters.

Changes in Consumer Demand

The EU market for UK luxury goods has experienced a shift since Brexit, influenced by several factors.

- Statistical Data: While comprehensive data is still emerging, initial reports suggest a decline in market share for some UK luxury brands in specific EU markets. Further research using consumer surveys and sales data is needed to draw definitive conclusions.

- Factors like brand loyalty, increased price sensitivity due to tariffs, and the substitution effect (consumers opting for comparable EU products) are all playing a role in shaping consumer demand.

Competition from Other Luxury Brands

The post-Brexit landscape has intensified competition from other European and global luxury brands.

- Examples: French fashion houses and Italian automotive manufacturers have benefited from easier access to the EU market compared to their UK counterparts.

- Brexit has arguably inadvertently created opportunities for competitors, as the increased complexities and costs associated with exporting from the UK have potentially levelled the playing field for some established EU brands.

Government Initiatives and Support for UK Luxury Exporters

The UK government has implemented several initiatives to support luxury exporters navigating the post-Brexit landscape.

Trade Deals and Agreements

The government has actively pursued new trade deals and agreements to mitigate the negative effects of Brexit.

- Examples: Specific trade agreements with individual EU countries or broader trade blocs could reduce tariffs or streamline customs processes for certain luxury goods. However, the effectiveness of these agreements varies depending on the specific sector and the details of the deal.

- The success of these agreements in truly supporting luxury exporters hinges on their scope, the extent to which they reduce trade friction, and their accessibility to businesses.

Government Support Schemes and Funding

Several government programs and financial assistance schemes are designed to aid UK luxury exporters.

- Examples: Grants for export development, subsidies to offset the increased costs of trade barriers, and financial assistance for complying with new regulations.

- The accessibility and impact of these schemes are crucial. Their efficacy needs ongoing evaluation to ensure they effectively reach and benefit luxury exporters of all sizes.

The Future of UK Luxury Exports to the EU – A Path Forward

Brexit has undeniably presented significant challenges for UK luxury exports to the EU. Increased tariffs, non-tariff barriers, and shifting market dynamics have created a complex and competitive environment. However, the potential for recovery and growth remains. Government support schemes, alongside adaptability and strategic planning by individual businesses, are key to navigating this new reality. A focus on building strong relationships with EU distributors, adapting to changing consumer preferences, and efficiently managing the new trade procedures are crucial for success. Learn more about navigating the complexities of UK luxury exports to the EU and discover support schemes available to help your business thrive post-Brexit. [Link to relevant government resource]

Featured Posts

-

Thousands Of Uk Households Receiving Hmrc Letters Income Tax Update

May 20, 2025

Thousands Of Uk Households Receiving Hmrc Letters Income Tax Update

May 20, 2025 -

Jutarnji List Slike S Premijere Poznati Redatelji Glumci I Voditelji

May 20, 2025

Jutarnji List Slike S Premijere Poznati Redatelji Glumci I Voditelji

May 20, 2025 -

Richard Mille And Charles Leclerc Launch The Rm 72 01

May 20, 2025

Richard Mille And Charles Leclerc Launch The Rm 72 01

May 20, 2025 -

The Leclerc Hamilton Dynamic Ferraris Team Orders And Its Impact

May 20, 2025

The Leclerc Hamilton Dynamic Ferraris Team Orders And Its Impact

May 20, 2025 -

High Wind Warnings What To Do When Fast Moving Storms Approach

May 20, 2025

High Wind Warnings What To Do When Fast Moving Storms Approach

May 20, 2025