UK Luxury Sector: Brexit's Role In Reduced EU Sales

Table of Contents

Increased Trade Barriers and Bureaucracy

Brexit introduced substantial trade barriers and bureaucratic hurdles, significantly impacting the UK luxury sector's ability to seamlessly export to the EU.

Tariff and Non-Tariff Barriers

New tariffs and customs duties on luxury goods, previously traded freely under the EU single market, have increased costs considerably. This is particularly damaging for high-value items where even a small percentage increase represents a substantial financial burden.

- Increased Costs: Tariffs, ranging from 3% to 10% depending on the product, add directly to the price, making UK luxury goods less competitive against their EU counterparts.

- Customs Delays: Increased paperwork, customs checks, and port congestion have led to significant delays in delivery, impacting just-in-time inventory management crucial for high-end brands. Luxury watches, for example, often face lengthy delays, impacting sales and customer satisfaction.

- Examples: High-end fashion apparel, bespoke tailoring services, and handcrafted jewelry have all been affected by the increased costs and delays imposed by new tariffs and customs processes.

Supply Chain Disruptions

Brexit has significantly complicated supply chains for luxury goods, leading to delays and increased costs. The reliance on intricate, often cross-border, supply networks has been severely tested.

- Labor Shortages: Post-Brexit immigration restrictions have led to labor shortages within the UK, affecting manufacturing and distribution of luxury products.

- Logistical Challenges: Navigating new customs procedures and regulations has added complexity and cost to the logistical operations involved in transporting luxury goods across borders.

- Brand Examples: Several high-profile UK luxury brands have reported supply chain disruptions, impacting production schedules and customer deliveries.

Weakening Pound and Exchange Rate Fluctuations

The weakening pound since Brexit has significantly impacted the UK luxury sector’s competitiveness in the EU market.

Currency Volatility’s Impact on Pricing

The pound's depreciation against the euro has made UK luxury goods more expensive for EU consumers. This price increase directly affects demand, reducing sales and profitability.

- Price Sensitivity: Luxury goods are price-sensitive; increased costs due to currency fluctuations can easily deter purchases.

- Profit Margin Erosion: Fluctuating exchange rates make it challenging to accurately predict costs and maintain profit margins.

- Data: Statistics showing the correlation between the pound's value and sales of UK luxury goods in the EU can be used here to support this point.

Reduced Consumer Confidence

Uncertainty surrounding Brexit and its economic consequences have negatively impacted consumer confidence within the EU. This impacts purchasing decisions, particularly for discretionary luxury goods.

- Hesitant Spending: EU consumers may postpone large purchases, including luxury items, during times of economic uncertainty.

- Shift in Spending Priorities: Consumers may prioritize essential spending over discretionary items like luxury goods.

- Market Research: Data from market research firms illustrating reduced consumer confidence in the EU post-Brexit can strengthen this point.

Loss of Frictionless Trade and Ease of Access

Brexit eliminated the frictionless trade previously enjoyed under EU membership, impacting UK luxury brands significantly.

Impact on Just-in-Time Delivery Models

Just-in-time delivery models, crucial for efficient inventory management in the luxury sector, have been disrupted by increased customs checks and delays.

- Increased Inventory Costs: Brands need to hold larger inventories to mitigate the risk of delays, increasing storage and insurance costs.

- Reduced Responsiveness: Delays in delivery make it more difficult for luxury brands to respond quickly to changing consumer demands.

Impact on Cross-Border E-commerce

Brexit has added complexities to cross-border e-commerce for UK luxury brands selling to EU customers.

- Increased Shipping Costs: Shipping costs and customs duties for online orders have increased significantly.

- Regulatory Challenges: Navigating diverse EU regulations and tax rules for online sales adds complexity and cost.

- Digital Marketing Adaptation: UK luxury brands need to adapt their digital marketing strategies to account for new trade barriers and reach EU consumers effectively.

Changes in Consumer Preferences and Brand Perception

Brexit has potentially influenced EU consumer preferences and perceptions of UK luxury brands. Further research is needed to quantify this impact.

- Nationalism and Brand Loyalty: A shift in consumer preference towards domestic or other EU brands may have occurred.

- Brexit-Related Sentiment: Negative perceptions of Brexit may have indirectly impacted the desirability of UK luxury brands.

Conclusion: Navigating the Post-Brexit Landscape for UK Luxury Businesses

Brexit has undeniably played a significant role in reducing UK luxury sales to the EU. The combination of increased trade barriers, currency fluctuations, disruption to frictionless trade, and potential shifts in consumer perception presents considerable challenges for the sector. To mitigate these challenges, UK luxury brands must consider strategic adaptations, including diversifying markets beyond the EU, optimizing supply chains for efficiency, investing in digital marketing strategies to reach EU consumers effectively, and proactively addressing any shifts in brand perception. Further research into the evolving dynamics of the UK luxury sector post-Brexit, and the effects of Brexit's impact on luxury exports, is crucial for developing effective strategies for future success in the EU and global markets. Understanding the complexities of the UK luxury sector post-Brexit is vital for navigating the changed trading environment.

Featured Posts

-

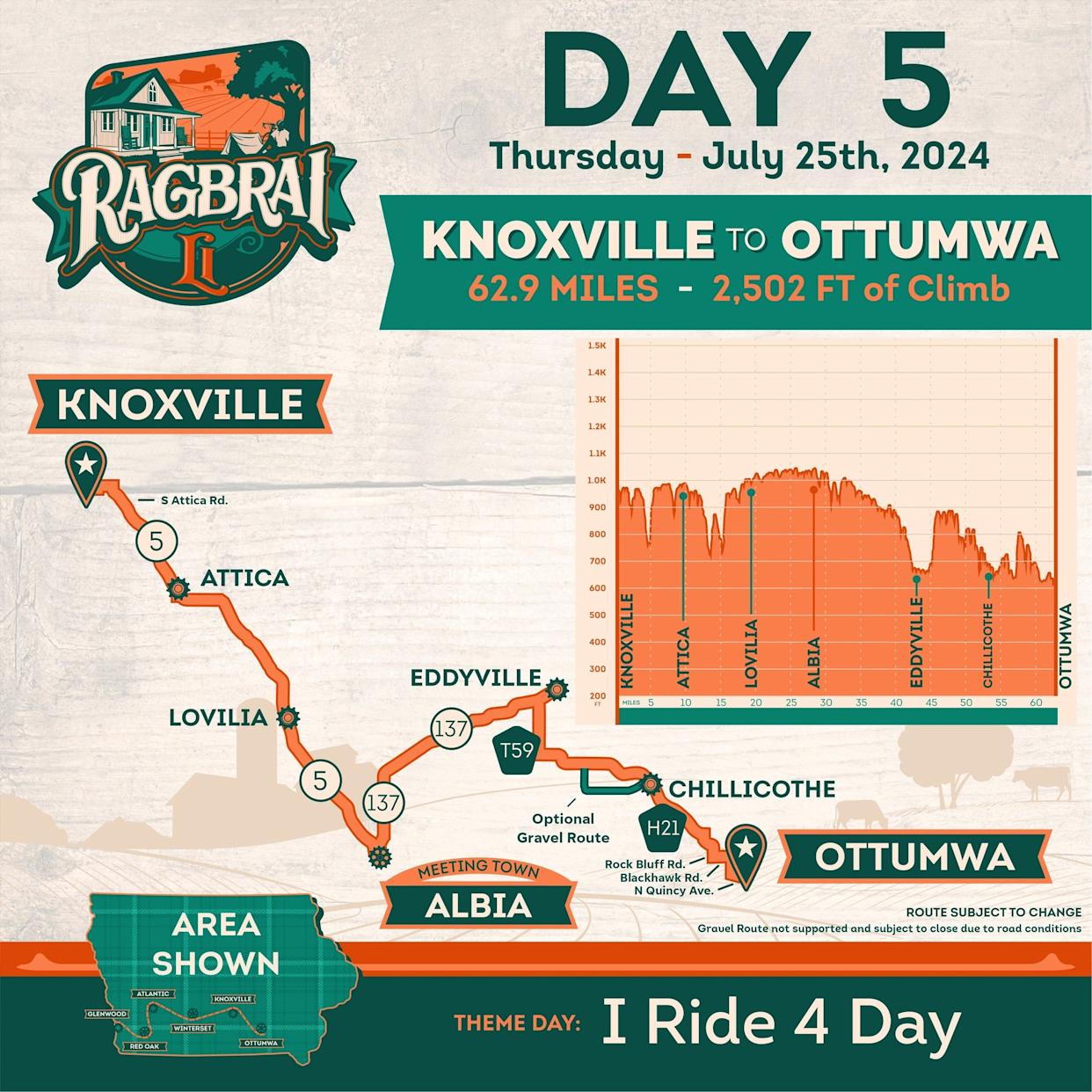

Ragbrai And Daily Rides Scott Savilles Enduring Love Of Cycling

May 20, 2025

Ragbrai And Daily Rides Scott Savilles Enduring Love Of Cycling

May 20, 2025 -

Dealerships Step Up Opposition To Electric Vehicle Regulations

May 20, 2025

Dealerships Step Up Opposition To Electric Vehicle Regulations

May 20, 2025 -

Vyskum 79 Manazerov Uprednostnuje Osobny Kontakt Buducnost Pracovneho Prostredia

May 20, 2025

Vyskum 79 Manazerov Uprednostnuje Osobny Kontakt Buducnost Pracovneho Prostredia

May 20, 2025 -

Ferrarilta Jaei Hamilton Saamatta Analyysi Epaeonnistuneista Neuvotteluista

May 20, 2025

Ferrarilta Jaei Hamilton Saamatta Analyysi Epaeonnistuneista Neuvotteluista

May 20, 2025 -

Dywan Almhasbt Ykshf En Mkhalfat Rd Fel Mjls Alnwab

May 20, 2025

Dywan Almhasbt Ykshf En Mkhalfat Rd Fel Mjls Alnwab

May 20, 2025