Understanding Bitcoin's Record High: The Influence Of US Regulations

Table of Contents

The Rollercoaster Ride of Bitcoin Price

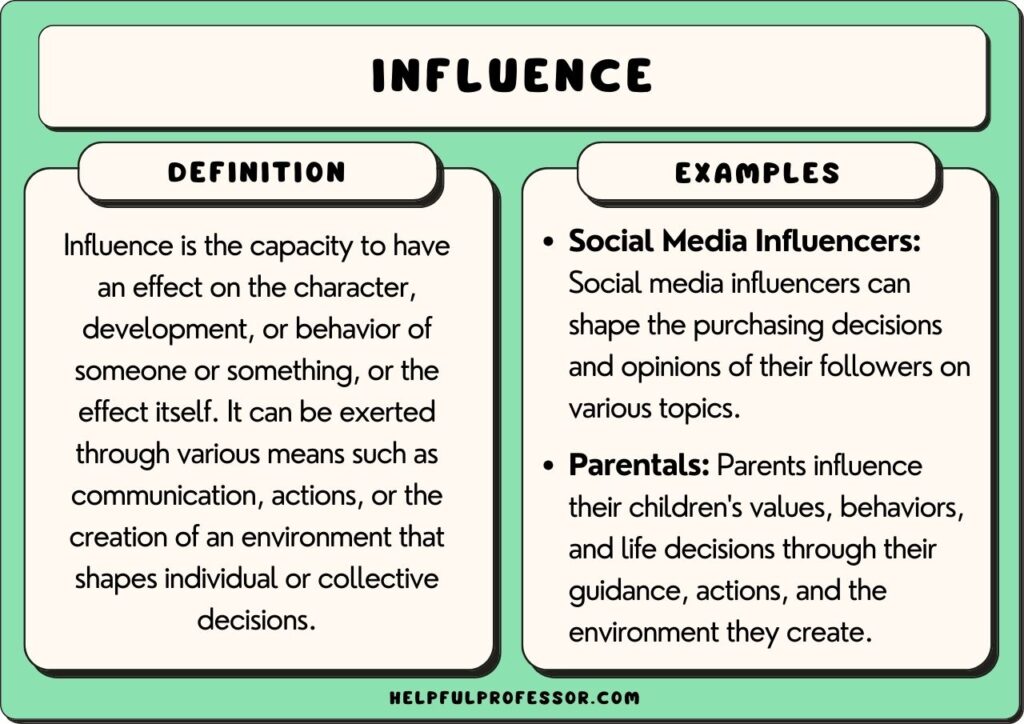

Bitcoin's price history is a dramatic rollercoaster, punctuated by periods of explosive growth and sharp corrections. Understanding this volatility requires examining the interplay between market forces and regulatory announcements. The term "Bitcoin price volatility" is frequently used to describe this behavior.

Historical Price Fluctuations and Regulatory Events

Several key regulatory events have significantly impacted Bitcoin's price. For example:

- 2017 Bull Run: The surge in Bitcoin's price to nearly $20,000 in late 2017 coincided with increasing media attention and speculation, but also lacked significant regulatory clarity, contributing to the eventual crash. This highlights the impact of "regulatory uncertainty" on market sentiment.

- SEC Rejection of Bitcoin ETFs: Repeated rejections of Bitcoin exchange-traded funds (ETFs) by the Securities and Exchange Commission (SEC) have, at times, negatively affected Bitcoin's price, indicating the powerful influence of regulatory decisions on investor confidence.

- CFTC Actions: Actions by the Commodity Futures Trading Commission (CFTC) to regulate Bitcoin futures trading have, in contrast, provided a degree of legitimacy, potentially stabilizing the market and encouraging institutional investment.

[Insert chart/graph here illustrating correlation between regulatory events and Bitcoin price movements]

US Regulatory Landscape and its Impact

The US regulatory landscape surrounding Bitcoin is complex and ever-evolving. This regulatory ambiguity, or lack thereof, significantly affects Bitcoin's price and its overall market stability.

The Evolving Definition of Bitcoin

A crucial aspect is the ongoing debate about Bitcoin's legal classification. Is it a security, a commodity, or something else entirely? The SEC's stance on this question has significant implications for how Bitcoin is regulated and perceived by investors. Differing classifications under the law create varying degrees of "regulatory clarity".

The Role of the SEC and CFTC

The SEC and CFTC share responsibility for overseeing different aspects of the Bitcoin market. The SEC focuses on whether Bitcoin is a security, while the CFTC regulates Bitcoin futures trading. Their actions – or inactions – directly influence market stability and investor behavior.

- SEC pronouncements on ICOs: The SEC's crackdown on Initial Coin Offerings (ICOs) in 2017-2018, classifying many as unregistered securities, highlighted the regulatory risks within the crypto space and impacted overall investor confidence.

- CFTC oversight of futures markets: The CFTC's regulation of Bitcoin futures contracts provided a degree of regulatory clarity and helped to legitimize Bitcoin in the eyes of some institutional investors. This contributed to the increased "institutional adoption" of Bitcoin.

Increased Institutional Investment and Regulatory Certainty

A key factor driving Bitcoin's record highs is the increasing participation of institutional investors. This surge in institutional interest is, in part, a response to increasing regulatory clarity and a perceived reduction in risk.

The Influence of Institutional Adoption

Hedge funds, pension funds, and even publicly traded corporations are now allocating a portion of their portfolios to Bitcoin. This substantial influx of capital helps stabilize the market and push prices upward. This can be quantified by analyzing the growth in "market capitalization" of Bitcoin.

Grayscale Bitcoin Trust and other examples

The Grayscale Bitcoin Trust (GBTC) is a prime example of a successful institutional investment vehicle. GBTC offers a relatively straightforward way for institutional investors to gain exposure to Bitcoin, contributing to its price stability and potentially boosting its price. Other examples include the emergence of regulated cryptocurrency exchanges and custodians.

- Increased liquidity: Institutional investment has dramatically increased the liquidity of the Bitcoin market, making it less volatile and more attractive to institutional investors.

- Reduced counterparty risk: The development of reputable custodians reduces counterparty risk, making it safer for institutional players to hold significant amounts of Bitcoin.

Conclusion

Understanding Bitcoin's record high requires understanding the regulatory environment. The US regulatory landscape, although still evolving, has played a significant role in shaping Bitcoin's price trajectory. Increased regulatory clarity, while not always immediately positive in the short term, has fostered greater institutional adoption, leading to increased price stability and, ultimately, contributing to Bitcoin's record highs. The interplay between regulatory actions, institutional investment, and market sentiment remains a crucial driver of Bitcoin's price.

Key Takeaways:

- Regulatory clarity, although slow to emerge, is a key factor in attracting institutional investment into Bitcoin.

- The actions of the SEC and CFTC directly influence investor confidence and market stability.

- Institutional adoption significantly impacts Bitcoin's price and reduces volatility.

Call to Action: Staying updated on Bitcoin's regulatory landscape is crucial for anyone considering Bitcoin investment. Conduct thorough research and understand the factors influencing Bitcoin's price before making any investment decisions. Understanding Bitcoin's record high requires a comprehensive understanding of its regulatory context. Learn more about the factors influencing Bitcoin's price and the ever-evolving regulatory environment.

Featured Posts

-

Jack Draper Wins Indian Wells A Masters 1000 Breakthrough

May 24, 2025

Jack Draper Wins Indian Wells A Masters 1000 Breakthrough

May 24, 2025 -

Airplane Safety Statistics Visualizing The Risk Of Flying

May 24, 2025

Airplane Safety Statistics Visualizing The Risk Of Flying

May 24, 2025 -

Fyrsta Rafutgafa Porsche Macan Upplysingar Og Eiginleikar

May 24, 2025

Fyrsta Rafutgafa Porsche Macan Upplysingar Og Eiginleikar

May 24, 2025 -

Eurovision Village Esc 2025 Conchita Wurst And Jj Live Concert

May 24, 2025

Eurovision Village Esc 2025 Conchita Wurst And Jj Live Concert

May 24, 2025 -

Profun A Fyrstu 100 Rafutgafu Porsche Macan

May 24, 2025

Profun A Fyrstu 100 Rafutgafu Porsche Macan

May 24, 2025

Latest Posts

-

Memorial Day 2025 Date Observance And Weekend Plans

May 24, 2025

Memorial Day 2025 Date Observance And Weekend Plans

May 24, 2025 -

When Is Memorial Day 2025 Your Guide To The May Holiday Weekend

May 24, 2025

When Is Memorial Day 2025 Your Guide To The May Holiday Weekend

May 24, 2025 -

Memorial Day 2025 Date And Three Day Weekend Information

May 24, 2025

Memorial Day 2025 Date And Three Day Weekend Information

May 24, 2025 -

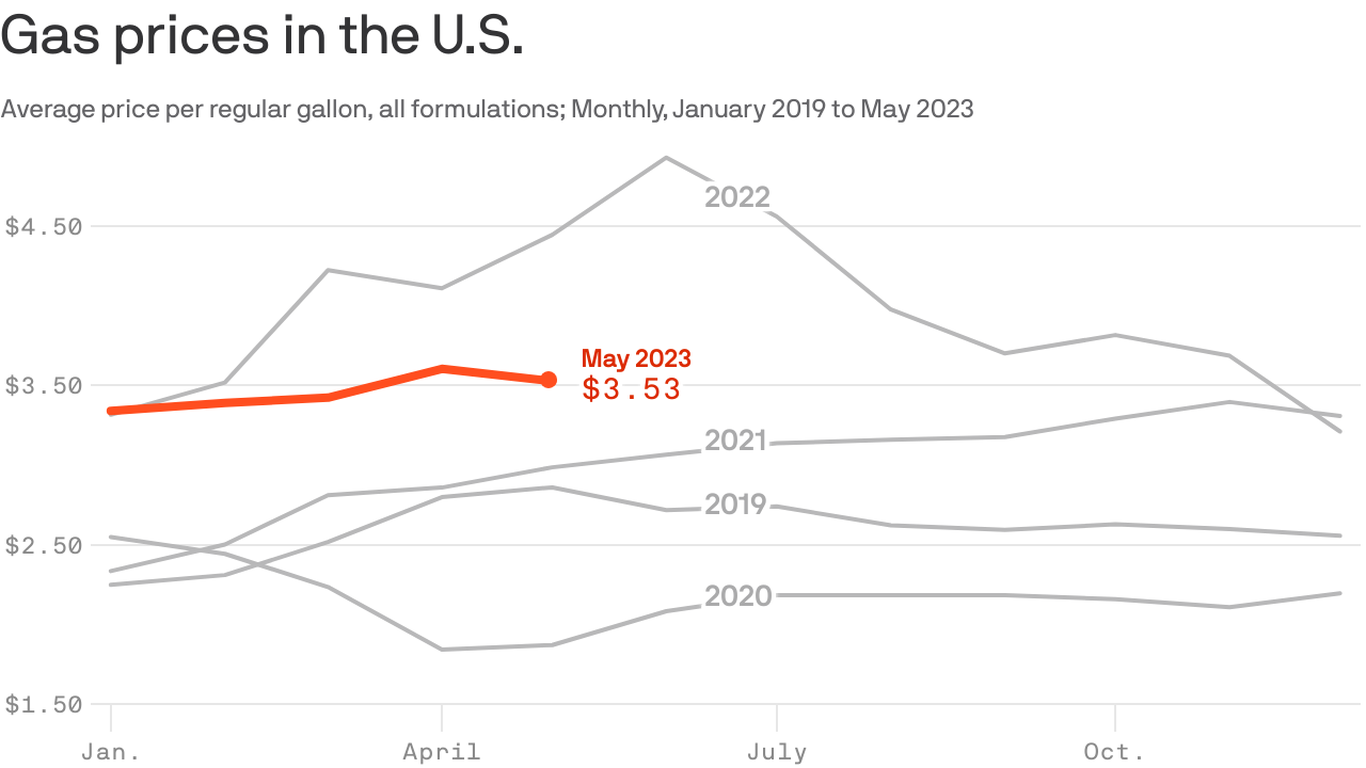

Memorial Day Gas Prices A Decade Low Forecast

May 24, 2025

Memorial Day Gas Prices A Decade Low Forecast

May 24, 2025 -

Record Low Gas Prices Predicted For Memorial Day Weekend

May 24, 2025

Record Low Gas Prices Predicted For Memorial Day Weekend

May 24, 2025