Understanding Global Tariff Fluctuations: An FP Video Analysis

Table of Contents

Causes of Global Tariff Fluctuations

Several interconnected factors contribute to the unpredictable nature of global tariff fluctuations. Understanding these root causes is crucial for anticipating and mitigating their economic and geopolitical effects.

Trade Wars and Geopolitical Tensions

Protectionist policies and escalating trade disputes are major drivers of tariff increases. Governments often employ tariffs as tools to protect domestic industries from foreign competition, leading to retaliatory measures from other nations. This cycle can quickly escalate into full-blown trade wars, significantly disrupting global trade flows.

- Examples of recent trade wars: The US-China trade war (2018-present), the EU-US disputes over Airbus and Boeing subsidies, and various regional trade conflicts.

- Impact on specific industries: The US-China trade war heavily impacted the agricultural sector in the US and various manufacturing industries in China, leading to job losses and production shifts.

- Retaliatory tariffs: The imposition of tariffs by one country often triggers retaliatory tariffs from affected trading partners, further exacerbating the situation and creating uncertainty for businesses. This creates a cycle of import tariffs and export tariffs, harming global trade. Understanding geopolitical risk is essential in predicting these events.

Domestic Economic Policies

Domestic economic goals significantly influence tariff decisions. Governments might use tariffs to protect nascent industries, boost domestic employment, or address perceived unfair trade practices. These policies, while aiming for domestic economic benefit, can have far-reaching international consequences.

- Examples of countries using tariffs to support specific sectors: Many countries have used tariffs to protect their agricultural sectors or strategically important manufacturing industries.

- Subsidies and their relationship to tariffs: Government subsidies can be used in conjunction with tariffs to bolster domestic industries. Subsidies can offset the impact of tariffs on domestic producers, allowing them to remain competitive even with higher import costs. However, these subsidies are often at the center of international trade disputes.

- Economic protectionism and industrial policy are frequently intertwined with tariff decisions, often leading to friction in international trade relations. Tariff barriers are a key instrument in both.

Currency Fluctuations and Exchange Rates

Changes in exchange rates indirectly influence the price of imports and exports, thereby affecting the effectiveness of tariffs. A weakening domestic currency can make imports more expensive, even without changes in tariffs, while strengthening currency has the opposite effect.

- Examples of how currency devaluation or appreciation can impact tariff effectiveness: A devaluation of a country's currency can make its exports cheaper and imports more expensive, potentially reducing the need for high tariffs. Conversely, appreciation might necessitate increased tariffs to protect domestic industries.

- Hedging strategies: Businesses employ hedging strategies to mitigate the risks associated with currency fluctuations and their impact on tariff effectiveness. These strategies aim to manage the exposure to exchange rate changes and stabilize import and export costs. Understanding foreign exchange markets is critical. The interplay between import prices and export prices is directly influenced by these fluctuations.

Consequences of Global Tariff Fluctuations

The consequences of global tariff fluctuations extend far beyond the immediate impact on targeted industries. They ripple through the global economy, affecting consumers, businesses, and geopolitical stability.

Impact on Consumer Prices

Tariffs directly increase the price of imported goods, reducing consumer purchasing power. This can lead to higher inflation, especially if the tariffs affect essential goods. Consumers often bear the brunt of tariff increases through higher prices at the checkout.

- Examples of specific goods affected by tariff increases: The US-China trade war significantly impacted the price of consumer electronics, furniture, and agricultural products.

- Inflation: Tariffs can contribute to higher inflation rates as the cost of imported goods increases.

- Consumer behavior changes: Consumers may respond to higher prices by reducing their consumption or shifting their purchasing habits towards domestically produced goods. Price volatility becomes a significant concern.

Effects on Businesses and Industries

Businesses face significant challenges due to the unpredictability of tariffs. Supply chain disruptions, increased costs, and reduced competitiveness are common consequences. This uncertainty can inhibit investment and economic growth.

- Examples of industries significantly impacted by tariff changes: Industries heavily reliant on imported components or materials, such as electronics, automotive, and textiles, are especially vulnerable.

- Relocation of production: Businesses may relocate production to avoid tariffs, leading to job losses in some countries and job creation in others.

- Business adaptation strategies: Businesses are forced to develop adaptation strategies, such as sourcing alternative suppliers, increasing automation, or innovating to offset higher input costs. Understanding global supply chains and managing supply chain disruptions is critical.

Geopolitical Implications

Tariff disputes can severely strain international relations. They can undermine trade agreements, lead to the formation of new trade blocs, and contribute to broader geopolitical instability.

- Examples of how tariffs have affected international relations: Trade wars have led to diplomatic tensions, sanctions, and retaliatory measures between countries.

- Trade agreements: Tariffs can threaten the stability of existing trade agreements and create uncertainty about future agreements.

- Regional trade: Tariffs can affect the formation and stability of regional trade blocs, potentially leading to the fragmentation of global trade.

Analyzing Global Tariff Fluctuations: The FP Video Perspective

Our accompanying FP video provides a detailed analysis of current global tariff fluctuations, using data visualization and expert insights. It offers a deeper understanding of market trends and provides valuable economic forecasting.

- Key findings from the video: [Summarize key findings from the video here. For example: The video highlights the increasing frequency and intensity of tariff disputes, the impact on specific sectors, and the growing trend of regional trade agreements].

- Specific examples used in the video: [Mention specific examples discussed in the video, such as specific tariff changes, their impact on businesses, or geopolitical consequences].

- Data visualizations explained: [Briefly explain how the video uses data visualization to illustrate key trends and findings].

Conclusion

Understanding global tariff fluctuations is crucial for navigating the complexities of the modern global economy. By analyzing the causes—from trade wars and domestic policies to currency fluctuations—and the wide-ranging consequences, including impacts on consumer prices, businesses, and geopolitical stability, we can better prepare for and mitigate the risks associated with these shifts. Our in-depth analysis, coupled with the insightful perspective offered in the accompanying FP video on global tariff fluctuations, provides a comprehensive understanding of this critical subject. Watch the FP video now to gain a deeper understanding of global tariff fluctuations and how to navigate this volatile landscape.

Featured Posts

-

Winter Weather Advisory School Delays And Closures

May 20, 2025

Winter Weather Advisory School Delays And Closures

May 20, 2025 -

Michael Schumacher Viaje En Helicoptero De Mallorca A Suiza Para Ver A Su Nieta

May 20, 2025

Michael Schumacher Viaje En Helicoptero De Mallorca A Suiza Para Ver A Su Nieta

May 20, 2025 -

Festival Da Cunha Uma Experiencia Imersiva Na Cultura Amazonica De Manaus Isabelle Nogueira

May 20, 2025

Festival Da Cunha Uma Experiencia Imersiva Na Cultura Amazonica De Manaus Isabelle Nogueira

May 20, 2025 -

Texas Legislature Debates Social Media Age Limits

May 20, 2025

Texas Legislature Debates Social Media Age Limits

May 20, 2025 -

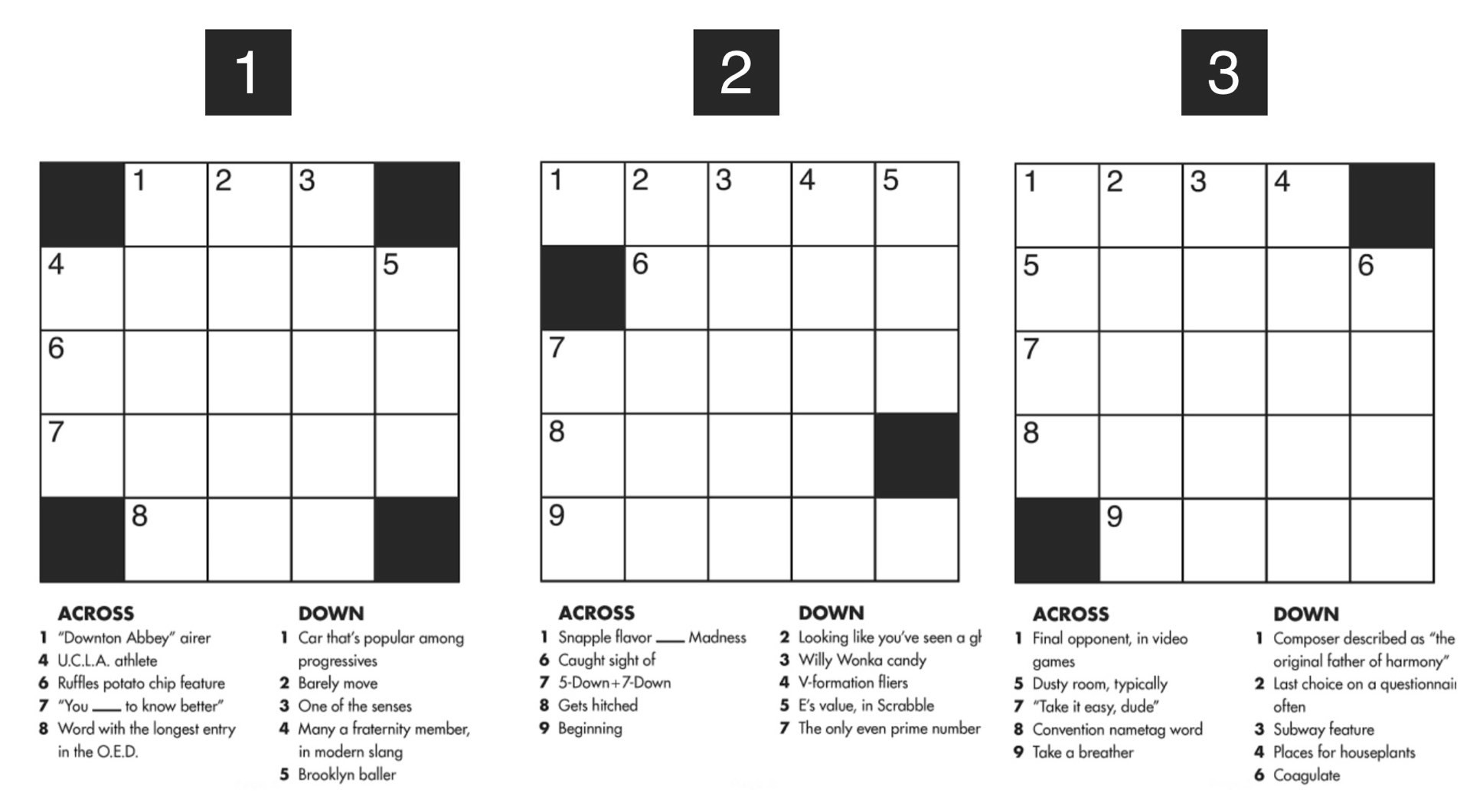

March 24 2025 Nyt Mini Crossword Solutions And Hints

May 20, 2025

March 24 2025 Nyt Mini Crossword Solutions And Hints

May 20, 2025