Understanding High Stock Market Valuations: A BofA Perspective

Table of Contents

Factors Contributing to High Stock Market Valuations

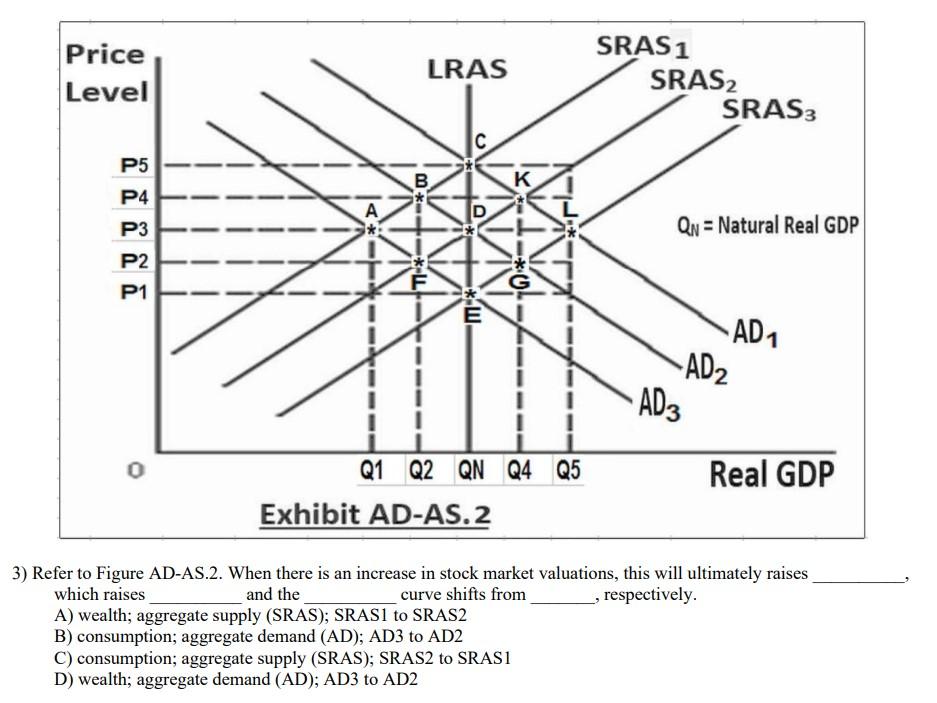

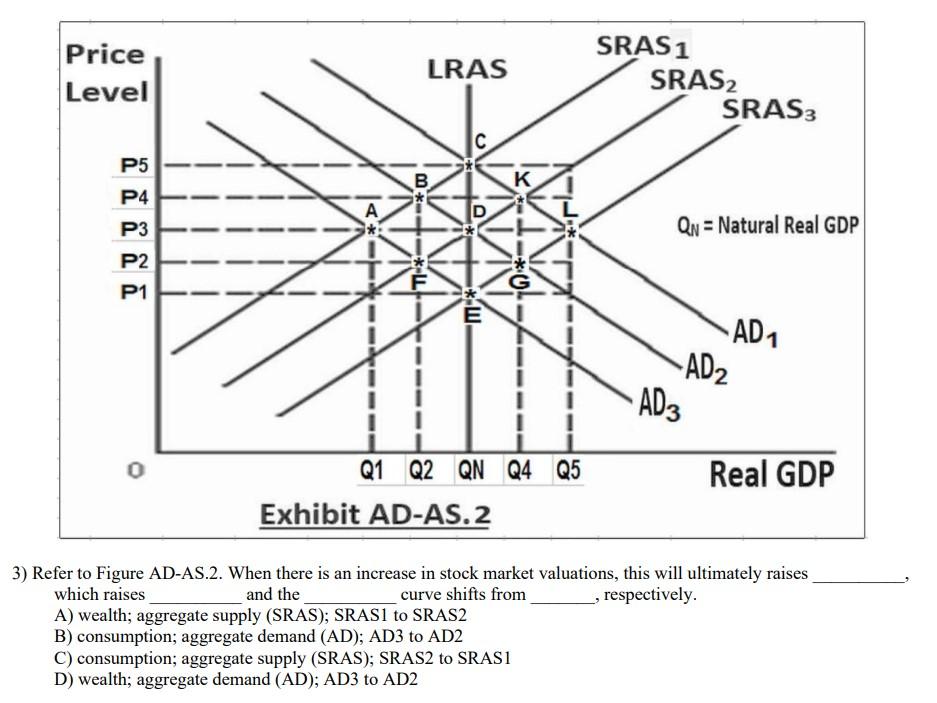

Several key factors contribute to the current environment of high stock market valuations. Understanding these drivers is essential for developing a sound investment strategy.

Low Interest Rates and Monetary Policy

Low interest rates significantly impact stock market valuation. The Federal Reserve's (and other central banks') policy of near-zero interest rates and quantitative easing (QE) has dramatically lowered the cost of borrowing for corporations. This encourages increased investment and expansion, fueling corporate earnings growth and, consequently, higher stock prices. Lower interest rates also decrease the attractiveness of fixed-income investments, driving capital into the equity market.

- Lower discount rates: Lower interest rates reduce the discount rate used in discounted cash flow (DCF) models, increasing the present value of future earnings and thus increasing valuations.

- Increased demand for equities: With lower returns on bonds and other fixed-income securities, investors seek higher returns in the equity market, increasing demand and pushing up prices.

- Potential for inflation: While low interest rates stimulate economic growth, they also carry the risk of inflation, which can impact future earnings and potentially erode the real value of stock market gains.

Strong Corporate Earnings and Profitability

Robust corporate earnings are a key driver of high stock market valuations. Companies across various sectors have reported strong profit growth, fueled by several factors. Technological advancements have increased efficiency and productivity, leading to improved margins. Globalization has opened up new markets and reduced production costs. These factors contribute to increased earnings per share (EPS), attracting investors and driving up stock prices.

- Increased earnings per share (EPS): Higher EPS signifies greater profitability and shareholder value, making stocks more attractive to investors.

- Improved margins: Increased efficiency and cost-cutting measures contribute to higher profit margins, leading to stronger earnings growth.

- Strong revenue growth: Expansion into new markets and product innovation contribute to consistent revenue growth, which translates to higher profits.

Technological Innovation and Growth Sectors

Technological innovation plays a significant role in shaping stock market valuations. The rise of tech giants and the emergence of disruptive technologies in sectors like artificial intelligence, biotechnology, and renewable energy have fueled substantial investment and significantly boosted market valuations. These growth sectors often command higher price-to-earnings (P/E) ratios due to their high growth potential.

- Tech giants: Large technology companies with dominant market positions significantly influence overall market valuations.

- Disruptive innovation: New technologies creating entirely new markets and disrupting existing ones can lead to rapid growth and higher valuations.

- Growth potential: Investors are willing to pay higher prices for companies with strong growth potential, even if current earnings are relatively low.

- Higher P/E ratios: Growth stocks typically trade at higher P/E ratios than value stocks due to their expected future growth.

Investor Sentiment and Market Psychology

Positive investor sentiment and market optimism heavily influence stock market valuations. Periods of exuberance, driven by factors such as fear of missing out (FOMO) and herd behavior, can lead to speculative buying and inflated asset prices. This can create a feedback loop where rising prices further fuel optimism and buying, potentially leading to unsustainable market valuations.

- Speculative buying: Investors may buy stocks based on expectations of future price increases rather than fundamental analysis, driving prices beyond intrinsic value.

- Market exuberance: Overly optimistic expectations about future market performance can lead to inflated valuations.

- Potential for bubbles: When speculative buying and market exuberance become extreme, it can lead to asset bubbles that eventually burst, resulting in sharp market corrections.

Assessing the Risks Associated with High Valuations

While strong fundamentals can support high stock market valuations, it's crucial to acknowledge associated risks.

Valuation Metrics and Their Limitations

Several valuation metrics, such as the price-to-earnings (P/E) ratio, price-to-sales (P/S) ratio, and Shiller PE ratio (CAPE), help assess whether stocks are overvalued or undervalued. However, these metrics have limitations. Comparing valuations across different sectors and time periods can be challenging due to variations in growth rates, industry dynamics, and accounting practices.

- P/E ratio: Compares a company's stock price to its earnings per share.

- PEG ratio: Adjusts the P/E ratio for the company's growth rate.

- Shiller PE ratio (CAPE): Uses average inflation-adjusted earnings over the past ten years to smooth out short-term earnings fluctuations.

- Limitations of using historical data: Past performance is not necessarily indicative of future results.

Potential for Market Corrections or Crashes

Overvalued markets are susceptible to sharp corrections or even crashes. Historically, market bubbles have burst, leading to significant price declines. These events are often triggered by unexpected economic shocks, changes in monetary policy, or a loss of investor confidence.

- Market volatility: High valuations often correlate with increased market volatility, meaning prices can fluctuate significantly in short periods.

- Risk of a correction: A market correction is a significant price decline, typically 10% or more, from recent highs.

- Potential triggers for a downturn: Unexpected economic events, rising interest rates, geopolitical instability, or a significant shift in investor sentiment can trigger a market downturn.

Inflationary Pressures and Interest Rate Hikes

Rising interest rates pose a threat to high stock market valuations. Higher rates increase borrowing costs for companies, potentially impacting their profitability and earnings growth. Moreover, increased interest rates make fixed-income investments more attractive, potentially diverting capital away from the equity market. Inflation erodes purchasing power and can negatively affect corporate profits and investor sentiment.

- Impact of rising interest rates on discount rates: Higher interest rates increase the discount rate, lowering the present value of future earnings and reducing valuations.

- Potential for lower earnings: Higher borrowing costs can squeeze corporate margins and reduce profitability.

- Impact on investor confidence: Rising interest rates and inflation can erode investor confidence, leading to selling pressure and lower stock prices.

BofA's Perspective and Investment Strategies

BofA's analysis of current stock market valuations considers the interplay of these factors. While acknowledging the risks associated with elevated valuations, BofA's outlook also considers the positive impact of technological innovation and strong corporate earnings in specific sectors. Investment strategies should focus on diversification, thorough due diligence, and risk management. This includes identifying undervalued assets, investing in companies with robust balance sheets, and potentially hedging against market downturns.

- BofA's recommendations: (Specific recommendations would be included here based on BofA's current market analysis).

- Diversification strategies: Diversifying across asset classes and sectors can reduce overall portfolio risk.

- Risk management: Employing risk management techniques, such as stop-loss orders, can help mitigate potential losses during market corrections.

- Potential investment opportunities: Focus on companies with strong fundamentals, competitive advantages, and growth potential within sectors less susceptible to interest rate hikes.

Conclusion

Understanding high stock market valuations requires a nuanced perspective, considering the interplay of monetary policy, corporate earnings, technological innovation, and investor sentiment. While strong earnings and innovation can support high valuations, the risks of market corrections and inflationary pressures are significant. BofA's perspective, incorporating a balanced view of these factors, offers valuable insights for navigating this complex market environment. By understanding these factors and implementing a diversified, risk-managed investment strategy, investors can better position themselves. Remember to consult with a financial advisor before making any investment decisions related to high stock market valuations.

Featured Posts

-

11 Minciu Apie M Ivaskeviciaus Isvaryma Filmas Priesistore Keiksmai Ir Daugiau

Apr 29, 2025

11 Minciu Apie M Ivaskeviciaus Isvaryma Filmas Priesistore Keiksmai Ir Daugiau

Apr 29, 2025 -

Nine Fatalities Reported After Car Crash At Vancouvers Filipino Festival

Apr 29, 2025

Nine Fatalities Reported After Car Crash At Vancouvers Filipino Festival

Apr 29, 2025 -

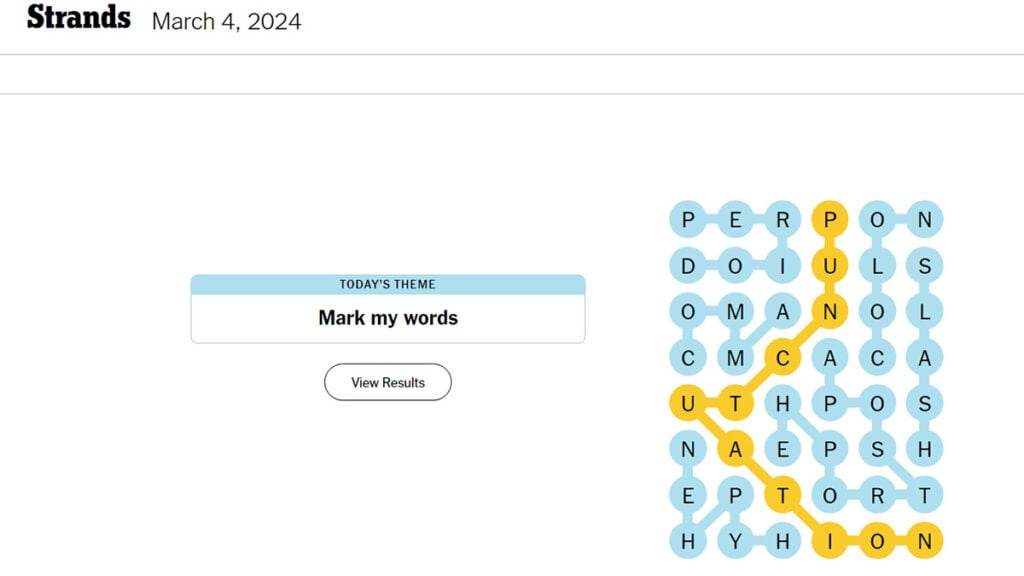

Nyt Strands Game 393 Solutions Monday March 31 Hints And Answers

Apr 29, 2025

Nyt Strands Game 393 Solutions Monday March 31 Hints And Answers

Apr 29, 2025 -

Shen Yuns Elegant Performance Coming To Mesa

Apr 29, 2025

Shen Yuns Elegant Performance Coming To Mesa

Apr 29, 2025 -

Austria Klagenfurt Jancker Uebernimmt Traineramt

Apr 29, 2025

Austria Klagenfurt Jancker Uebernimmt Traineramt

Apr 29, 2025