Understanding High Stock Market Valuations: BofA's Perspective For Investors

Table of Contents

BofA's Current Market Outlook and Valuation Metrics

BofA's market outlook, as reflected in recent research reports (specific reports and dates should be inserted here if available, linking to them if possible), reveals concerns about current stock market valuations. Their analysis heavily utilizes key valuation metrics to gauge market health and potential risks. These metrics are crucial for understanding the current market environment and making informed investment decisions in the face of high stock market valuations.

-

Price-to-Earnings Ratio (P/E): BofA likely analyzes the current P/E ratios of broad market indices (e.g., the S&P 500) and compares them to historical averages. High P/E ratios suggest that investors are paying a premium for current earnings, indicating potentially higher risk. (Insert data and comparison to historical averages here, using a chart or graph if possible).

-

Price-to-Sales Ratio (P/S): This metric provides another perspective on valuation, especially useful for companies with fluctuating or negative earnings. A high P/S ratio might signal that the market anticipates substantial future revenue growth, but it also carries higher risk if that growth doesn't materialize. (Insert data and comparison to historical averages here, using a chart or graph if possible).

-

Cyclically Adjusted Price-to-Earnings Ratio (CAPE): BofA likely considers the CAPE ratio, which smooths out earnings fluctuations over a longer period (typically 10 years), offering a potentially more stable valuation metric. A high CAPE ratio compared to historical norms suggests potentially overvalued markets. (Insert data and comparison to historical averages here, using a chart or graph if possible).

By analyzing these metrics, BofA provides insights into whether the market is fairly valued, overvalued, or undervalued, helping investors assess the potential risks and rewards of various investment strategies in the context of high stock market valuations.

Identifying Potential Risks Associated with High Stock Market Valuations

Investing in a market with high valuations presents inherent risks that investors must carefully consider. BofA's analysis likely highlights several key concerns:

-

Increased Volatility: High valuations often precede periods of increased market volatility. Sharp corrections or even crashes become more probable when asset prices are significantly inflated.

-

Market Correction: A significant drop in stock prices is a real possibility in a highly valued market. The magnitude of the correction is difficult to predict, but the higher the valuations, the greater the potential for a substantial decline.

-

Inflation Risk: High inflation erodes purchasing power and can lead to central banks raising interest rates. This can negatively impact company earnings and stock valuations. BofA likely assesses the current inflation environment and its potential impact on the stock market.

-

Interest Rate Risk: Rising interest rates increase borrowing costs for businesses and reduce the attractiveness of stocks compared to bonds. BofA's analysis likely considers the Federal Reserve's monetary policy and its projected impact on interest rates and the stock market.

-

Recession Risk: High valuations can sometimes precede economic slowdowns or recessions. BofA likely evaluates economic indicators to assess the probability of a recession and its potential impact on stock prices. Understanding these potential risks is critical for mitigating losses during periods of high stock market valuations.

BofA's Recommended Investment Strategies for High Valuation Environments

Given the current high valuations, BofA's recommended investment strategies likely emphasize risk management and diversification.

-

Portfolio Diversification: Spreading investments across different asset classes (stocks, bonds, real estate, etc.) and sectors reduces the impact of any single investment's underperformance. This is crucial in a high-valuation environment where the risk of a market correction is elevated.

-

Asset Allocation: Adjusting the allocation of assets within a portfolio based on risk tolerance and market conditions is vital. In a high-valuation environment, a more conservative allocation with a higher proportion of less volatile assets might be prudent.

-

Value Investing: Focusing on undervalued companies with strong fundamentals and low P/E ratios can offer potential protection against market downturns. This strategy aims to profit from companies whose intrinsic value is greater than their current market price.

-

Defensive Investing: Investing in companies considered relatively stable and less susceptible to economic downturns (e.g., consumer staples, utilities) can help mitigate risks during market corrections or recessions.

Considering Sector-Specific Opportunities and Challenges

BofA's sector-specific analysis likely identifies opportunities and challenges within various industries. For example:

-

Growth Sectors: While some growth sectors might continue to perform well, the high valuations within these sectors could make them more vulnerable to corrections. Careful selection and due diligence are necessary.

-

Defensive Sectors: Sectors typically viewed as defensive (utilities, consumer staples) might offer relative stability in a high-valuation environment but might not offer the same high growth potential as other sectors.

-

Sector Rotation: BofA might suggest a strategic rotation from higher-valuation growth sectors to more reasonably valued sectors with stronger fundamentals, offering investors an opportunity for better risk-adjusted returns.

Conclusion

Understanding high stock market valuations is crucial for informed investing. BofA's analysis provides valuable insights into current market conditions, potential risks, and strategic approaches. By carefully considering BofA's perspectives on valuation metrics, market risks, and recommended investment strategies, investors can better navigate the complexities of the current market and position themselves for success. Stay informed about the latest market trends and BofA's insights to make well-informed decisions regarding your investments. Understanding high stock market valuations is key to navigating this dynamic environment successfully. Continue your research and stay updated on BofA’s perspectives on high stock market valuations.

Featured Posts

-

Caso Elias Rodriguez Acusacion En La Libertad Y Las Sospechas De Represalia Politica De App

May 23, 2025

Caso Elias Rodriguez Acusacion En La Libertad Y Las Sospechas De Represalia Politica De App

May 23, 2025 -

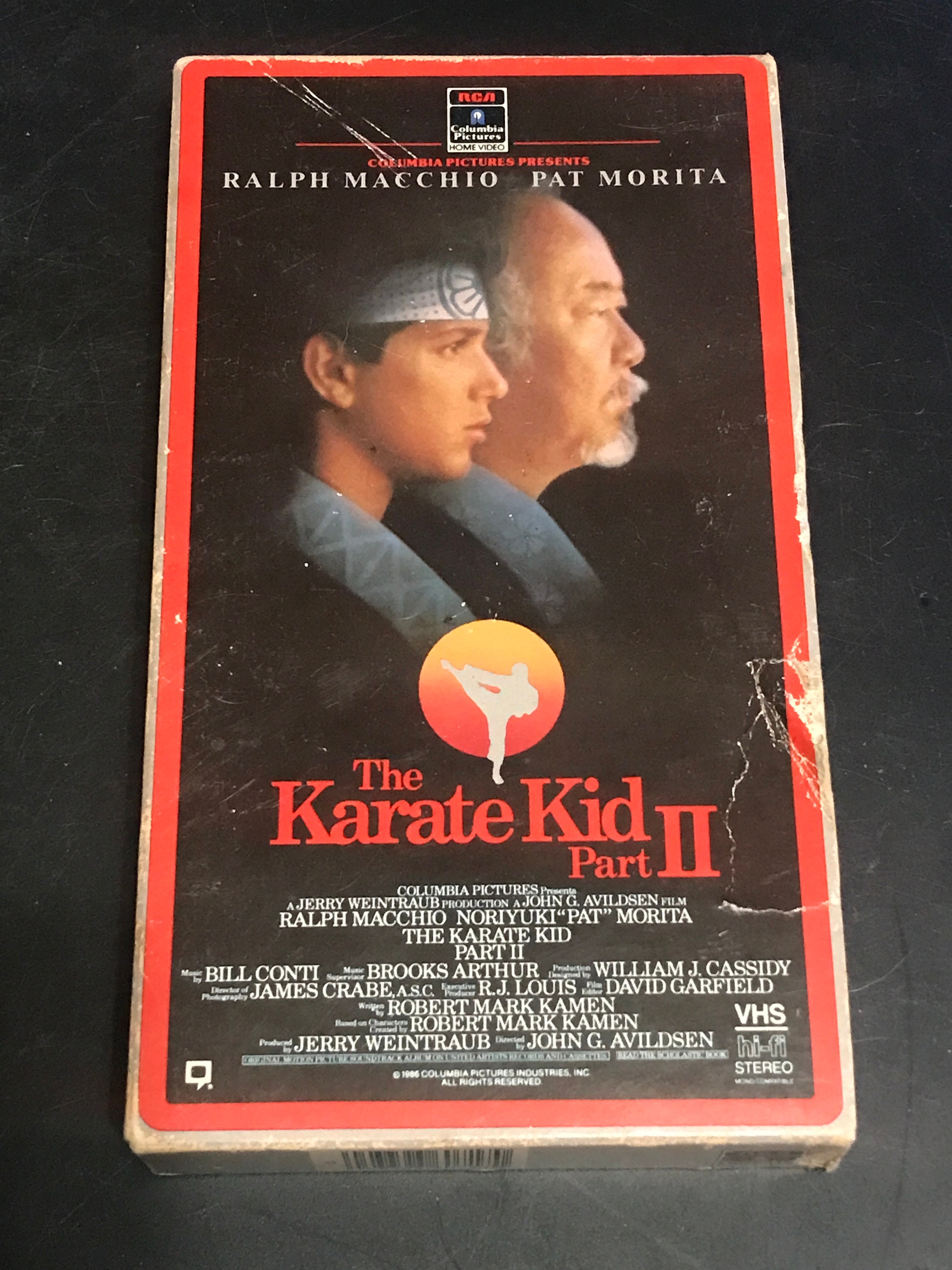

The Karate Kid Part Ii Locations Cast And Cultural Influences

May 23, 2025

The Karate Kid Part Ii Locations Cast And Cultural Influences

May 23, 2025 -

The Who The Untold Story Behind Their Iconic Name

May 23, 2025

The Who The Untold Story Behind Their Iconic Name

May 23, 2025 -

Shpani A Shampion Na Ln Bolna Pobeda Protiv Khrvatska

May 23, 2025

Shpani A Shampion Na Ln Bolna Pobeda Protiv Khrvatska

May 23, 2025 -

Freddie Flintoff A Month Off After Devastating Top Gear Crash

May 23, 2025

Freddie Flintoff A Month Off After Devastating Top Gear Crash

May 23, 2025

Latest Posts

-

Jonathan Groff A Tony Awards Milestone With Just In Time

May 23, 2025

Jonathan Groff A Tony Awards Milestone With Just In Time

May 23, 2025 -

Broadways Best Jonathan Groff Celebrated By Lea Michele And Fellow Actors

May 23, 2025

Broadways Best Jonathan Groff Celebrated By Lea Michele And Fellow Actors

May 23, 2025 -

Jonathan Groff Could He Win A Tony Award For Just In Time

May 23, 2025

Jonathan Groff Could He Win A Tony Award For Just In Time

May 23, 2025 -

The Story Behind Joe Jonass Viral Response To A Couples Fight

May 23, 2025

The Story Behind Joe Jonass Viral Response To A Couples Fight

May 23, 2025 -

Joe Jonass Reaction To A Couples Dispute

May 23, 2025

Joe Jonass Reaction To A Couples Dispute

May 23, 2025