Understanding High Stock Market Valuations: BofA's Reassuring Analysis For Investors

Table of Contents

BofA's Key Arguments for Current Market Valuations

BofA's analysis suggests that while valuations appear high, several factors support the current market levels and suggest a more optimistic outlook than initially perceived.

Long-Term Growth Potential

BofA highlights the significant long-term growth potential underpinning current market valuations. Despite seemingly elevated price-to-earnings ratios (P/E), the firm believes several sectors are poised for substantial expansion.

- Examples of high-growth sectors: Technology (particularly AI and cloud computing), renewable energy, and healthcare (biotechnology and pharmaceuticals).

- Driving factors: Technological advancements continue to disrupt industries, creating new opportunities and driving efficiency gains. Furthermore, demographic shifts, such as an aging global population, are fueling demand in specific sectors. For example, the increasing adoption of AI is projected to add trillions to global GDP in the coming decades, creating immense market growth opportunities for investors in the long-term.

Interest Rate Environment

BofA's assessment of the interest rate environment is crucial to understanding their valuation perspective. While interest rate hikes impact borrowing costs and can influence stock valuations, BofA's analysis suggests a nuanced view.

- Interest rate predictions: BofA's projections (specific numbers would need to be sourced from their actual report) suggest a potential peak in interest rates followed by a period of stabilization or even potential rate cuts.

- Impact on valuations: While higher interest rates initially put downward pressure on stock valuations (as investors seek higher returns in bonds), the projected rate stabilization and potential future cuts could lessen this impact and potentially support further market growth. The impact is complex and depends on various economic factors.

Inflation's Role in Stock Market Valuations

Inflation significantly impacts stock market valuations, primarily by influencing corporate earnings and investor sentiment. BofA's analysis incorporates inflation projections into its valuation assessment.

- Inflation projections and earnings: BofA’s inflation projections (again, specific numbers need to be sourced) indicate a gradual decline in inflationary pressure, which should positively impact corporate profit margins and lead to stronger earnings growth.

- Impact on P/E ratios: While high inflation initially erodes earnings, the projected decline suggests that P/E ratios, a key valuation metric, might become more sustainable over time. Strong earnings growth relative to the interest rate environment can justify current, or even higher, valuations in the long term.

Risks and Considerations Highlighted by BofA

While BofA presents a relatively positive outlook, the analysis acknowledges several potential risks.

Potential for Market Corrections

BofA doesn't ignore the possibility of market corrections or even a more significant downturn. Several factors could trigger such an event.

- Potential triggers: Unexpected economic shocks, a more aggressive-than-expected tightening of monetary policy, or escalating geopolitical tensions could all contribute to market volatility and potential corrections.

- Impact mitigation: Diversification, hedging strategies, and a robust risk management plan are crucial for navigating market corrections. Investors should avoid panic selling and stick to their long-term investment plans.

Geopolitical Uncertainty and its Impact

Geopolitical uncertainty remains a significant factor influencing market sentiment and valuations.

- Specific geopolitical risks: BofA likely highlights ongoing geopolitical risks such as the war in Ukraine, tensions in the South China Sea, or other potential global conflicts impacting supply chains and the global economy (specific examples from their report need to be included).

- Impact on market sentiment: Such uncertainties introduce volatility and negatively impact investor confidence, potentially leading to market corrections or slower growth.

BofA's Recommendations for Investors

Based on their analysis, BofA likely provides recommendations for investors seeking to navigate the current market environment.

Strategic Asset Allocation

BofA likely suggests a strategic asset allocation strategy that balances risk and reward.

- Asset class recommendations: Specific recommendations for overweighting or underweighting certain asset classes, such as equities, bonds, and alternatives, would need to be included here based on BofA's actual report.

- Rationale: The reasoning behind these recommendations will likely be tied to the long-term growth outlook, interest rate expectations, and inflation projections.

Long-Term Investment Approach

BofA likely emphasizes the importance of a long-term investment approach when dealing with high stock market valuations.

- Reasons for a long-term perspective: A long-term approach allows investors to ride out short-term market fluctuations and benefit from the long-term growth potential identified by BofA.

- Importance of patience: Avoiding impulsive trading decisions based on short-term market movements is crucial. Patience and a disciplined investment strategy are key to success.

Conclusion: Understanding High Stock Market Valuations – A Call to Action

BofA's analysis presents a nuanced perspective on high stock market valuations, highlighting both the potential for long-term growth and the risks inherent in the current market environment. The key takeaway is the need for a balanced approach – recognizing the potential for future growth while acknowledging potential market corrections. Investors should focus on strategic asset allocation, diversification, and a long-term investment horizon. Conduct further research into BofA’s full report, consult with a qualified financial advisor, and develop a well-informed investment strategy to effectively navigate the complexities of high stock market valuations and make sound investment decisions. Remember, understanding high stock market valuations is crucial for successful long-term investing.

Featured Posts

-

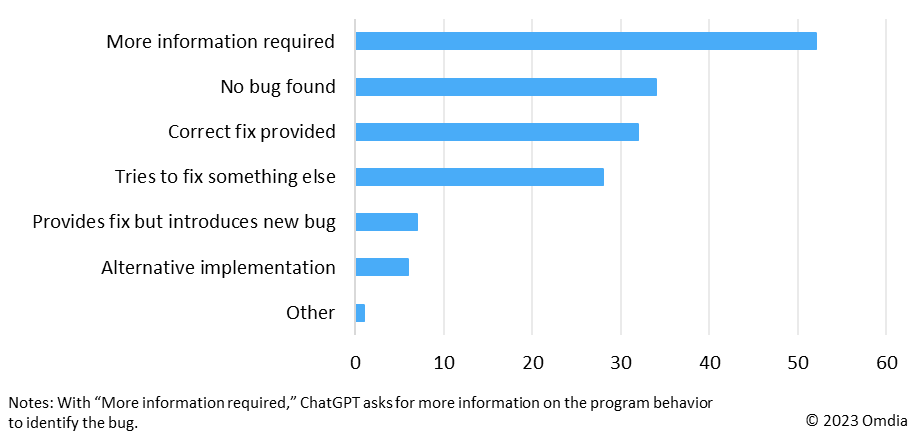

The Impact Of Chat Gpts Ai Coding Agent On Software Development

May 18, 2025

The Impact Of Chat Gpts Ai Coding Agent On Software Development

May 18, 2025 -

Najnowszy Ranking Zaufania Ib Ri S Dla Onetu Analiza Wynikow

May 18, 2025

Najnowszy Ranking Zaufania Ib Ri S Dla Onetu Analiza Wynikow

May 18, 2025 -

Open Ai Under Ftc Scrutiny Implications Of The Chat Gpt Probe

May 18, 2025

Open Ai Under Ftc Scrutiny Implications Of The Chat Gpt Probe

May 18, 2025 -

La Angels Ben Joyce Lessons In Closing From Kenley Jansen

May 18, 2025

La Angels Ben Joyce Lessons In Closing From Kenley Jansen

May 18, 2025 -

Kanye Wests Super Bowl Ban Taylor Swift Feud Explained

May 18, 2025

Kanye Wests Super Bowl Ban Taylor Swift Feud Explained

May 18, 2025