Understanding High Stock Market Valuations: Insights From BofA

Table of Contents

BofA's Assessment of Current Market Conditions

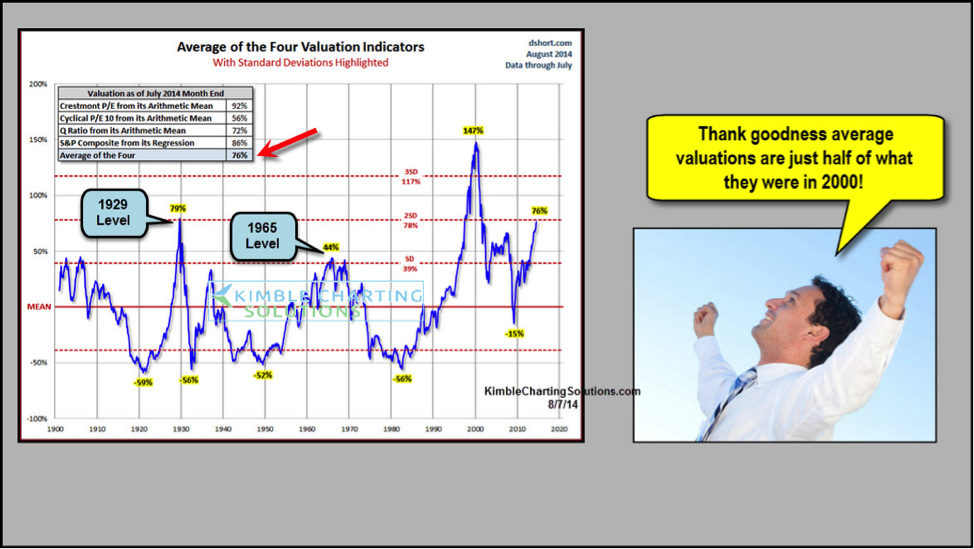

BofA's assessment of current high stock market valuations is nuanced, acknowledging both positive and negative aspects. While the bank recognizes the impressive growth seen in certain sectors, they also highlight concerns about the sustainability of these valuations given certain key metrics. For instance, while specific P/E ratios and market cap to GDP ratios fluctuate and are not publicly stated consistently across all BofA reports, their analysis often points to valuations exceeding historical averages in some sectors, indicating potential overvaluation.

- Key metrics used by BofA to assess valuations: BofA utilizes a range of metrics, including Price-to-Earnings (P/E) ratios, Price-to-Sales (P/S) ratios, market capitalization to GDP ratios, and various discounted cash flow models to assess valuations across different sectors and the market as a whole.

- BofA's commentary on the sustainability of current valuations: BofA's commentary often cautions against assuming the current pace of growth is indefinitely sustainable. Their analysts typically emphasize the need for continued strong earnings growth to justify current valuations, highlighting potential risks if this growth falters.

- Comparison of current valuations to historical averages: BofA's analysis frequently compares current valuations to historical averages, pointing out instances where certain sectors or the overall market are trading at levels significantly above their long-term means. This comparison underscores the potential for a market correction if valuations don't align with future performance.

Factors Contributing to High Stock Market Valuations

Several factors have contributed to the current high stock market valuations, many of which are highlighted in BofA's research. These factors create a complex interplay that makes assessing the situation challenging.

- Low interest rates and their impact on valuations: Prolonged periods of low interest rates have made equities more attractive relative to bonds, driving increased demand and pushing up valuations. This low-cost borrowing environment also fuels corporate investments and thus growth.

- Strong corporate earnings (or lack thereof, depending on BofA's analysis): BofA's analysis focuses on sector-specific performance. While some sectors demonstrate impressive earnings growth, justifying their valuations, other sectors show less compelling results, raising concerns about overall market sustainability.

- Impact of technological advancements and growth sectors: The rapid growth of technology companies and other high-growth sectors has significantly contributed to the overall market's upward trajectory and inflated certain valuations.

- Role of investor sentiment and market psychology: Positive investor sentiment and a "fear of missing out" (FOMO) mentality can drive up asset prices regardless of underlying fundamentals, contributing to inflated valuations.

- Government stimulus and its effects on the market: Government stimulus packages, such as those implemented during economic downturns, can inject liquidity into the market, temporarily boosting asset prices and potentially leading to inflated valuations.

Potential Risks Associated with High Valuations

BofA's analysis consistently identifies risks associated with high stock market valuations, underscoring the need for cautious investment strategies.

- Vulnerability to interest rate hikes: A rise in interest rates can significantly impact valuations, making bonds more attractive and potentially leading to a sell-off in equities.

- Potential for market corrections or crashes: High valuations inherently increase the potential for market corrections or even crashes if investor sentiment shifts or economic conditions deteriorate.

- Risk of asset bubbles bursting: Certain sectors might be experiencing asset bubbles, where prices are driven by speculation rather than fundamentals, increasing the risk of a sharp price decline.

- Impact of geopolitical events and economic uncertainty: Geopolitical instability and unexpected economic shocks can negatively impact market sentiment and trigger a correction in high-valuation markets.

BofA's Recommendations for Investors

Given the current high stock market valuations, BofA typically advocates for a cautious and diversified approach to investing.

- Diversification strategies: BofA usually emphasizes the importance of diversifying across different asset classes, sectors, and geographies to mitigate risk.

- Sector-specific recommendations (if applicable): BofA may provide sector-specific recommendations based on their valuation analysis, identifying sectors that appear undervalued or those that warrant caution.

- Suggestions for risk management: Risk management strategies, such as stop-loss orders and hedging techniques, are typically recommended to protect against potential market downturns.

- Advice on long-term vs. short-term investment horizons: BofA often advises investors to adopt a long-term investment horizon, avoiding impulsive decisions based on short-term market fluctuations.

Understanding High Stock Market Valuations: Key Takeaways and Next Steps

BofA's analysis of high stock market valuations indicates a complex situation with both opportunities and risks. High valuations are driven by several interconnected factors, including low interest rates, strong (but uneven) corporate earnings, technological advancements, investor sentiment, and government stimulus. However, these high valuations also increase vulnerability to interest rate hikes, market corrections, asset bubbles, and unforeseen economic events. Therefore, BofA typically recommends a diversified, risk-managed investment strategy, emphasizing a long-term perspective. Understanding high stock market valuations is crucial for making informed investment decisions. Continue your research by exploring BofA's latest market reports and other reputable sources to refine your investment strategy, looking into further analysis on stock market valuation analysis and BofA's market outlook for a clearer picture.

Featured Posts

-

T Mobile Data Breaches Cost 16 Million A Detailed Look At The Penalties

Apr 22, 2025

T Mobile Data Breaches Cost 16 Million A Detailed Look At The Penalties

Apr 22, 2025 -

Jan 6 Committee Witness Cassidy Hutchinson To Publish Memoir

Apr 22, 2025

Jan 6 Committee Witness Cassidy Hutchinson To Publish Memoir

Apr 22, 2025 -

Mapping The Countrys Emerging Business Hotspots

Apr 22, 2025

Mapping The Countrys Emerging Business Hotspots

Apr 22, 2025 -

Are Tik Toks Just Contact Us Videos Enabling Tariff Evasion

Apr 22, 2025

Are Tik Toks Just Contact Us Videos Enabling Tariff Evasion

Apr 22, 2025 -

Why Investors Shouldnt Fear High Stock Market Valuations Bof As Perspective

Apr 22, 2025

Why Investors Shouldnt Fear High Stock Market Valuations Bof As Perspective

Apr 22, 2025