Understanding High Stock Market Valuations: Insights From BofA For Investors

Table of Contents

BofA's Current Assessment of Stock Market Valuations

BofA's recent reports indicate a cautious outlook on current stock market valuations. While acknowledging strong corporate earnings and positive economic indicators in certain sectors, they generally view the market as overvalued, particularly when considering traditional valuation metrics. This assessment isn't a blanket statement of impending doom, but rather a call for prudence and strategic decision-making.

- Key metrics BofA uses to assess valuations: BofA utilizes a range of metrics including the Price-to-Earnings ratio (P/E), the cyclically adjusted price-to-earnings ratio (Shiller PE), and other fundamental analyses to gauge market valuation. They also consider factors like interest rates and economic growth projections.

- BofA's outlook on specific sectors or market segments: BofA's reports often highlight specific sectors they view as relatively overvalued versus those that present better value propositions. For instance, they may highlight technology stocks as potentially overvalued due to high growth expectations, while expressing more cautious optimism towards more cyclical sectors.

- Specific warnings or cautions issued by BofA: BofA frequently cautions investors about the potential for market corrections, emphasizing the importance of risk management and diversification in a market characterized by high valuations. They consistently stress the need for thorough due diligence and a long-term investment horizon.

Factors Contributing to High Stock Market Valuations

Several interconnected economic and market factors contribute to the current high stock market valuations. Understanding these elements is vital for informed investing.

- Low interest rates and their impact on valuations: Historically low interest rates have made borrowing cheaper for companies, boosting investment and driving up earnings. This also encourages investors to seek higher returns in the stock market, pushing valuations higher. Low interest rates also reduce the attractiveness of bonds, driving capital into equities.

- Strong corporate earnings and their effect on stock prices: Robust corporate earnings, fueled by economic growth and technological advancements, support higher stock prices. However, investors need to scrutinize the sustainability of these earnings in light of current economic conditions and potential future headwinds.

- Investor sentiment and market psychology: Positive investor sentiment and market exuberance can lead to higher valuations, even if fundamental metrics suggest otherwise. This "irrational exuberance" can create bubbles, increasing the risk of a subsequent market correction.

- The role of quantitative easing and other monetary policies: Central banks' actions, such as quantitative easing (QE), have injected massive liquidity into the markets, driving up asset prices, including stocks. These policies, while aimed at stimulating economic growth, can inflate asset bubbles.

- Technological advancements and their influence on growth stocks: The rapid pace of technological innovation, particularly in areas like artificial intelligence and cloud computing, has significantly boosted the valuations of growth stocks. These high-growth companies often command premium valuations due to their future potential, but this also presents increased risk.

The Role of Inflation in High Valuations

Inflation, or the anticipated increase in inflation, plays a crucial role in influencing stock valuations.

- How inflation affects interest rates and discount rates used in valuation models: Higher inflation generally leads to higher interest rates, which in turn increase discount rates used in valuation models. This reduces the present value of future earnings, potentially dampening stock valuations.

- The impact of inflation on corporate earnings and profitability: Inflation can erode corporate profitability if companies struggle to pass on increased input costs to consumers. This can negatively impact stock prices.

- The potential for inflation to erode the value of future earnings: Inflation diminishes the purchasing power of future earnings, impacting the present value of those earnings and potentially affecting stock prices.

Investment Strategies for High Stock Market Valuations

Given BofA's cautious assessment, investors need to adapt their strategies.

- Diversification strategies to mitigate risk: Diversifying across different asset classes (stocks, bonds, real estate) and sectors is crucial to mitigate risk in a high-valuation market. This reduces exposure to any single sector or market segment.

- Sector-specific investment opportunities: BofA's research can identify sectors with relatively lower valuations or stronger growth potential, allowing for selective investments within a diversified portfolio.

- The importance of value investing: Value investing, focusing on undervalued companies with strong fundamentals, becomes increasingly attractive during periods of high market valuations.

- Considering alternative asset classes: Allocating a portion of your portfolio to alternative investments such as real estate or precious metals can provide diversification and potentially hedge against inflation.

- Importance of long-term investing and risk tolerance: Maintaining a long-term perspective and understanding your own risk tolerance are essential for successful investing in any market environment, especially one with high valuations.

Risks Associated with High Stock Market Valuations

Investing in a highly valued market carries inherent risks.

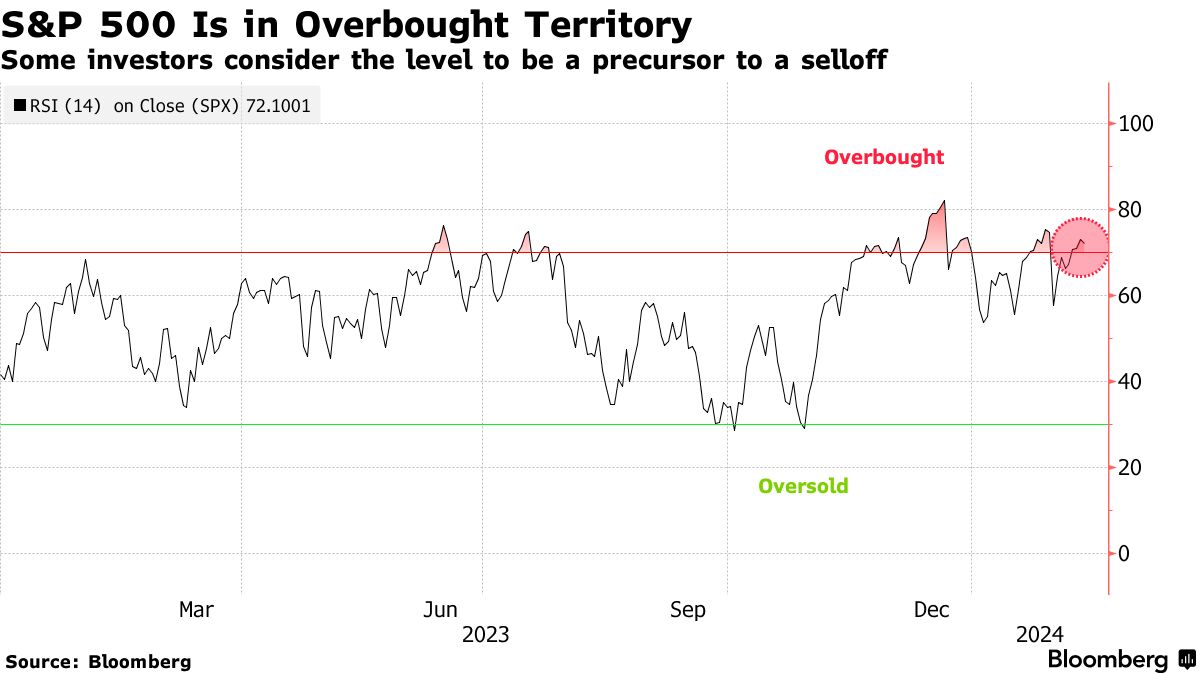

- Potential for market corrections or crashes: Overvalued markets are susceptible to sharp corrections or even crashes, leading to significant losses.

- Increased risk of losses due to higher valuations: The higher the valuation, the greater the potential for losses if the market corrects. Returns are inherently lower when starting from a higher price.

- The impact of rising interest rates on stock prices: Rising interest rates tend to negatively impact stock prices, particularly for growth stocks, which are more sensitive to changes in discount rates.

- Geopolitical risks and their impact on the market: Unexpected geopolitical events can trigger market volatility and negatively affect valuations, regardless of underlying economic conditions.

Conclusion

Understanding high stock market valuations, as analyzed by BofA, is crucial for informed investment decisions. While opportunities exist, it's essential to acknowledge the associated risks and adopt a diversified and strategic approach. BofA's insights provide a valuable framework, but remember to conduct your own thorough research and consider your personal risk tolerance before making any investment decisions. By carefully considering these factors and staying informed about current market trends, you can navigate the complexities of high stock market valuations and make sound investment choices. Don't hesitate to consult with a financial advisor to develop a personalized strategy tailored to your specific needs and goals.

Featured Posts

-

Rethinking The Middle Manager Their Vital Contribution To A Thriving Workplace

Apr 23, 2025

Rethinking The Middle Manager Their Vital Contribution To A Thriving Workplace

Apr 23, 2025 -

Attacco Ai Ristoranti Palestinesi 200 Manifestanti Chiedono Giustizia

Apr 23, 2025

Attacco Ai Ristoranti Palestinesi 200 Manifestanti Chiedono Giustizia

Apr 23, 2025 -

Turning Poop Into Prose An Ai Powered Podcast Revolution

Apr 23, 2025

Turning Poop Into Prose An Ai Powered Podcast Revolution

Apr 23, 2025 -

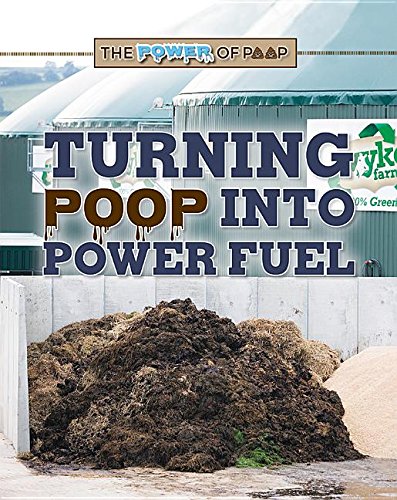

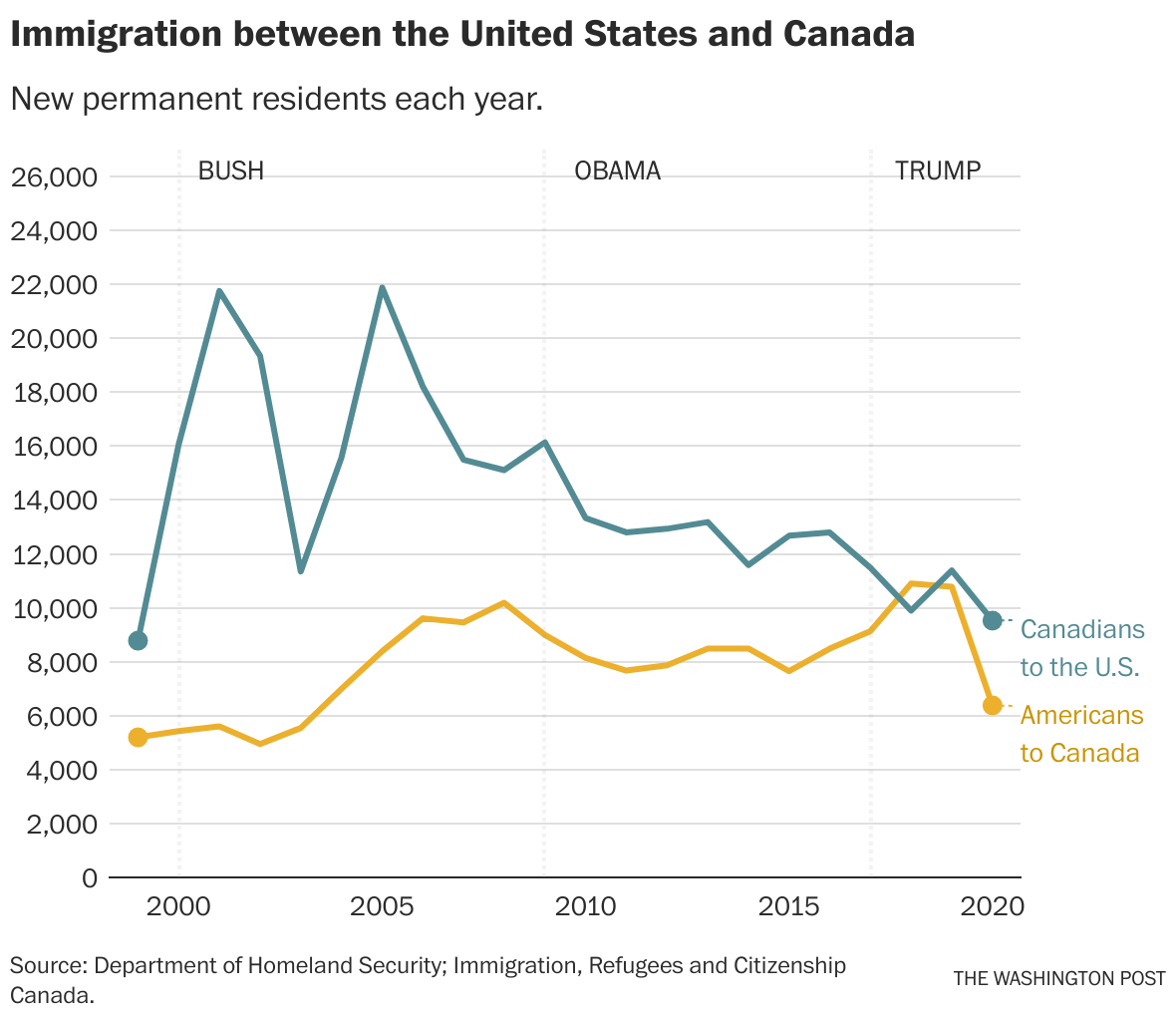

Survey Shows Decline In Canadian Interest In Us Relocation Under Trump

Apr 23, 2025

Survey Shows Decline In Canadian Interest In Us Relocation Under Trump

Apr 23, 2025 -

Lehigh Valley Power Outages Continue Amid Strong Winds Photo Gallery

Apr 23, 2025

Lehigh Valley Power Outages Continue Amid Strong Winds Photo Gallery

Apr 23, 2025