Understanding High Stock Valuations: BofA's Argument For Investor Confidence

Table of Contents

BofA's Key Arguments for Justifying High Stock Valuations

BofA's bullish stance on the market, even with high stock valuations, rests on several pillars. They believe that current prices are supported by a confluence of factors indicating underlying economic strength and future growth potential.

Strong Corporate Earnings and Profitability

One of BofA's core arguments centers on the robust performance of corporate earnings. Many sectors have reported exceeding expectations, demonstrating strong profitability and resilience. For example, the technology sector continues to show impressive growth, fueled by the ongoing digital transformation and cloud computing adoption. Similarly, certain segments within the consumer staples industry have demonstrated consistent performance, indicating a degree of insulation from economic downturns. This sustained profitability, BofA argues, justifies the current elevated stock prices.

- Example: Data from Q[insert quarter] 2024 shows a [insert percentage]% increase in S&P 500 earnings compared to the same period last year. [Insert citation to source].

- Key Sectors: Technology, Healthcare, Consumer Staples

Low Interest Rates and Monetary Policy

The prevailing environment of low interest rates, a consequence of accommodative monetary policies implemented by central banks globally, plays a significant role in supporting high stock valuations. Low interest rates reduce the cost of borrowing for corporations, encouraging investment and expansion. Furthermore, they make equities a more attractive investment compared to bonds, driving capital flows into the stock market and thus increasing demand and valuations. However, the potential for future interest rate hikes remains a wildcard. BofA's analysis likely accounts for potential rate increases and assesses their likely impact on stock valuations.

- Impact: Lower borrowing costs stimulate business investment and expansion, leading to increased earnings and higher stock prices.

- Future Outlook: BofA's analysis likely incorporates various scenarios for interest rate adjustments and their effects on market performance.

Technological Innovation and Growth Sectors

BofA emphasizes the transformative power of technological innovation, particularly in sectors like technology and renewable energy. These sectors are characterized by high growth potential and disruptive innovation, attracting significant investment and driving up valuations. The long-term growth prospects of these sectors are seen as a key justification for high stock prices.

- Key Growth Areas: Artificial intelligence, renewable energy, biotechnology.

- Long-Term Potential: These sectors are poised for significant expansion, driving long-term value creation.

Resilient Consumer Spending and Economic Growth (or lack thereof)

While acknowledging potential economic headwinds, BofA's assessment suggests that consumer spending remains relatively resilient, supporting continued economic growth. However, a nuanced perspective is crucial. While consumer spending may be holding up, various economic indicators suggest a slowing global economy. This presents a clear challenge to BofA's optimistic viewpoint. The divergence between these indicators needs careful consideration.

- Counterarguments: High inflation, rising interest rates, and geopolitical uncertainties pose significant threats to consumer confidence and spending.

- BofA's Perspective: BofA's analysis likely incorporates mitigating factors and considers the resilience of certain consumer segments.

Addressing Concerns About Overvaluation and Market Risks

While BofA presents a positive outlook, it's crucial to acknowledge the counterarguments and potential risks associated with high stock valuations.

Potential for Market Corrections

The possibility of a market correction, or even a more significant downturn, remains a valid concern. High valuations inherently increase the vulnerability to price adjustments. BofA likely addresses this by highlighting the underlying strength of the economy and corporate earnings, suggesting that any correction would be temporary and relatively contained.

- BofA's Counterargument: Underlying economic fundamentals support current valuations, minimizing the likelihood of a severe correction.

- Risk Mitigation: BofA's recommendations likely include strategies for navigating potential market volatility.

Inflationary Pressures and Their Impact

Inflationary pressures pose a significant threat to stock valuations. Rising prices erode corporate profitability and can lead to increased interest rates, negatively impacting stock market performance. BofA’s perspective likely acknowledges this risk, potentially suggesting that the current inflationary pressures are transitory or that the Federal Reserve will manage them effectively.

- Inflationary Impacts: Reduced consumer spending, higher borrowing costs, decreased corporate profitability.

- BofA's Mitigation: Analysis likely includes assessment of central bank actions and their impact on inflation.

Geopolitical Risks and Uncertainty

Geopolitical events and uncertainties invariably influence market sentiment. Global conflicts, trade wars, and political instability can trigger market volatility and negatively impact stock valuations. BofA's analysis must incorporate these risks and provide a perspective on their potential impact.

- Geopolitical Factors: Trade disputes, international conflicts, political instability.

- BofA's Assessment: A comprehensive analysis should incorporate scenario planning to account for various geopolitical developments.

BofA's Investment Strategies and Recommendations

Based on their analysis, BofA likely provides specific recommendations for investors.

Sector-Specific Investment Opportunities

BofA’s recommendations will likely highlight specific sectors they believe are well-positioned for growth despite high stock valuations. These might include sectors with strong earnings growth, innovative technologies, or defensive characteristics.

- Examples: Technology (AI, cloud computing), Healthcare (biotechnology, pharmaceuticals), Consumer Staples (essential goods).

Risk Management Strategies for Investors

Given the inherent risks associated with high stock valuations, BofA will likely emphasize the importance of risk management strategies. These might include portfolio diversification, hedging techniques, and careful position sizing.

- Diversification: Investing across multiple asset classes and sectors to reduce risk.

- Hedging: Using financial instruments to protect against potential losses.

Long-Term vs. Short-Term Investment Horizons

BofA's stance on investment time horizons is crucial. They might advise investors to adopt a longer-term perspective, emphasizing the potential for growth despite short-term market fluctuations, while acknowledging the need for careful monitoring of economic indicators.

- Long-Term Focus: Focusing on long-term growth potential can mitigate the impact of short-term market volatility.

- Monitoring: Regularly reviewing market conditions and adjusting investment strategies as needed.

Conclusion: Understanding High Stock Valuations and Navigating Market Uncertainty

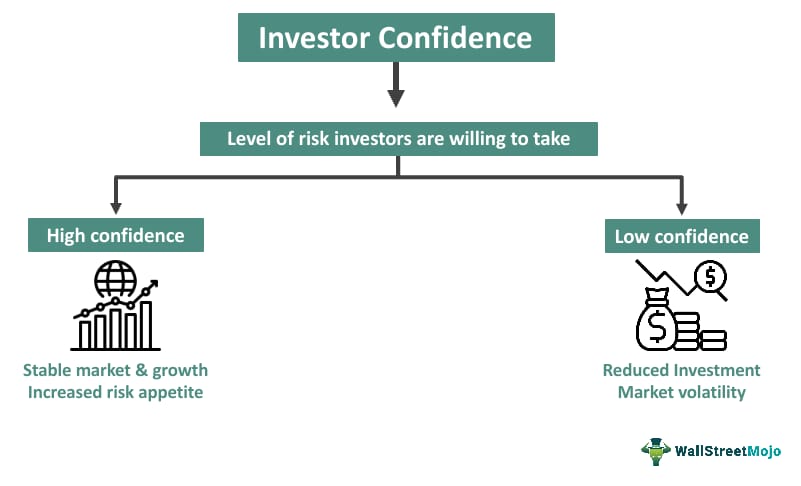

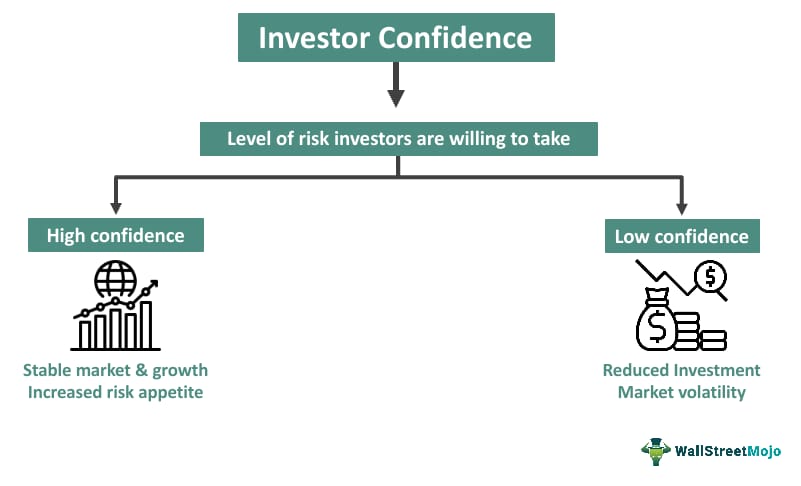

BofA's argument for maintaining investor confidence despite high stock valuations rests on several key factors: strong corporate earnings, accommodative monetary policy, technological innovation driving growth in key sectors, and a relatively resilient consumer sector (though this is subject to considerable debate). However, it's crucial to acknowledge potential risks including market corrections, inflationary pressures, and geopolitical uncertainty. Understanding high stock valuations requires a nuanced perspective, considering both the positive and negative aspects. BofA’s analysis provides a framework for navigating this complexity, but investors should conduct their own thorough research and develop a strategy aligned with their risk tolerance and investment goals. Review BofA's full report and develop a strategy that aligns with your risk tolerance and investment goals. Understanding high stock valuations is crucial for informed investment decisions.

Featured Posts

-

Lynas Rare Earths Seeks Us Aid For Texas Refinery Amid Rising Costs

Apr 29, 2025

Lynas Rare Earths Seeks Us Aid For Texas Refinery Amid Rising Costs

Apr 29, 2025 -

British Paralympian Missing In Las Vegas Urgent Search Underway

Apr 29, 2025

British Paralympian Missing In Las Vegas Urgent Search Underway

Apr 29, 2025 -

The Pete Rose Pardon Question Trumps Stance And Baseballs Reaction

Apr 29, 2025

The Pete Rose Pardon Question Trumps Stance And Baseballs Reaction

Apr 29, 2025 -

Minnesota Immigrant Job Market Shift Towards Higher Paying Positions Revealed

Apr 29, 2025

Minnesota Immigrant Job Market Shift Towards Higher Paying Positions Revealed

Apr 29, 2025 -

Put A Finger Down Has Tik Tok Misdiagnosed My Adhd

Apr 29, 2025

Put A Finger Down Has Tik Tok Misdiagnosed My Adhd

Apr 29, 2025