Understanding ING Group's 2024 Results: The Form 20-F Report

Table of Contents

The Form 20-F is an annual report filed by foreign private issuers with the U.S. Securities and Exchange Commission (SEC). It provides a detailed overview of a company's financial performance, including its revenue, profitability, balance sheet, and risk factors. For investors, it's an invaluable resource for assessing a company’s financial health and making informed investment decisions.

Main Points: Key Insights from ING Group's 2024 Form 20-F Filing

ING Group's 2024 Revenue and Profitability

Revenue Analysis:

ING Group's revenue streams are diverse, encompassing Wholesale Banking, Retail Banking, and Investment Management. Analyzing the ING Group revenue figures from the 20-F report reveals important trends.

- Year-over-year comparison: A detailed comparison of 2024 revenue with 2023 figures will highlight growth or decline in key areas. This comparison should account for any one-time events that could skew the numbers.

- Regional performance breakdown: The report will likely provide a regional breakdown of revenue, showing the contribution of each geographic market to the overall performance. Strong performance in specific regions may indicate successful expansion strategies.

- Impact of economic factors: Macroeconomic factors, such as interest rate changes and inflation, will have significantly impacted ING Group's revenue. The 20-F will likely discuss these impacts and their influence on the financial results. Keywords: ING Group revenue, ING Group profits, ING Group financial performance, 2024 financial results.

Profitability Metrics:

Key profitability indicators provide a deeper understanding of ING Group's financial health.

- Net Income: Analyzing the net income figures provides a clear picture of the company's overall profitability after accounting for all expenses.

- Return on Equity (ROE): ROE measures the profitability of a company in relation to its shareholder equity. A higher ROE suggests efficient use of shareholder capital. Keywords: ING Group net income, ROE ING, ROA ING, profitability analysis.

- Return on Assets (ROA): ROA indicates how efficiently a company utilizes its assets to generate earnings. This metric is crucial for assessing overall operational efficiency.

- Comparison with previous years and industry benchmarks: Comparing these metrics to previous years and industry averages provides context and helps evaluate ING Group's performance relative to competitors.

Analysis of ING Group's 2024 Balance Sheet

Assets and Liabilities:

The 20-F report will detail the composition of ING Group's assets and liabilities.

- Key asset classes: Understanding the distribution of assets across various classes, such as loans, securities, and cash, is crucial for assessing risk exposure.

- Debt levels: The report will disclose the level of debt held by ING Group, providing insight into its financial leverage.

- Liquidity position: The analysis of liquidity, reflecting the ability to meet short-term obligations, is a vital component of financial health assessment. Keywords: ING Group balance sheet, ING Group assets, ING Group liabilities, capital adequacy.

- Capital adequacy ratios: These ratios demonstrate ING Group's ability to absorb potential losses. Adequate capital is critical for maintaining financial stability.

Capital Structure and Leverage:

Analyzing ING Group's capital structure and leverage ratios reveals its financial risk profile.

- Debt-to-equity ratio: This ratio showcases the proportion of debt financing compared to equity. A higher ratio suggests higher financial risk. Keywords: ING Group capital structure, ING Group leverage, ING Group debt.

- Financial risk assessment: A thorough evaluation of the balance sheet data helps in assessing the financial risks faced by ING Group.

- Impact on credit rating: The capital structure and leverage directly influence the company's credit rating, impacting borrowing costs and investor confidence.

Key Risks and Opportunities Highlighted in the ING Group 2024 Form 20-F

Risk Factors:

The 20-F report will transparently disclose significant risk factors affecting ING Group's operations.

- Economic conditions: Global economic downturns or regional recessions can significantly impact ING Group's financial performance.

- Regulatory changes: Changes in financial regulations can create uncertainty and impact profitability. Keywords: ING Group risk factors, ING Group regulatory risks, ING Group economic risks.

- Geopolitical risks: Geopolitical instability and international conflicts pose risks to ING Group's global operations.

- Detailed explanation of each risk, potential impact, and mitigation strategies: The 20-F will likely detail each risk, its potential impact on the company's performance, and the mitigation strategies implemented by ING Group to manage these risks.

Growth Opportunities:

The ING Group 20-F report will likely discuss potential growth opportunities.

- Expansion into new markets: ING Group may be pursuing expansion into new geographical markets to broaden its customer base and revenue streams. Keywords: ING Group growth strategy, ING Group market expansion, ING Group digital transformation.

- New product offerings: The introduction of innovative financial products and services will contribute to revenue growth and market share expansion.

- Digital transformation initiatives: Investing in digital technologies will help enhance operational efficiency and customer experience.

Conclusion: Understanding the Implications of ING Group's 2024 Form 20-F Report

This analysis of ING Group's 2024 Form 20-F report highlights key aspects of the company's financial performance, revealing both strengths and weaknesses. A thorough understanding of the revenue streams, profitability metrics, balance sheet composition, and risk factors is essential for investors and stakeholders. The report provides crucial insights into ING Group's financial stability and its future growth prospects. Key takeaways include a comprehensive overview of ING Group’s financial health, including its profitability, liquidity, and exposure to various risks. The identified growth opportunities also provide a perspective on the company's future strategic direction.

For a complete understanding of ING Group's financial performance, download and thoroughly review the full 2024 Form 20-F report. Stay informed about ING Group's 2024 results and future prospects by regularly reviewing these crucial filings. Analyzing the ING Group 20-F report is vital for making informed investment decisions related to ING Group's future.

Featured Posts

-

Wordle Puzzle 358 Saturday March 8th Help And Answer

May 22, 2025

Wordle Puzzle 358 Saturday March 8th Help And Answer

May 22, 2025 -

The Impact Of Low Self Esteem Vybz Kartels Skin Bleaching Journey

May 22, 2025

The Impact Of Low Self Esteem Vybz Kartels Skin Bleaching Journey

May 22, 2025 -

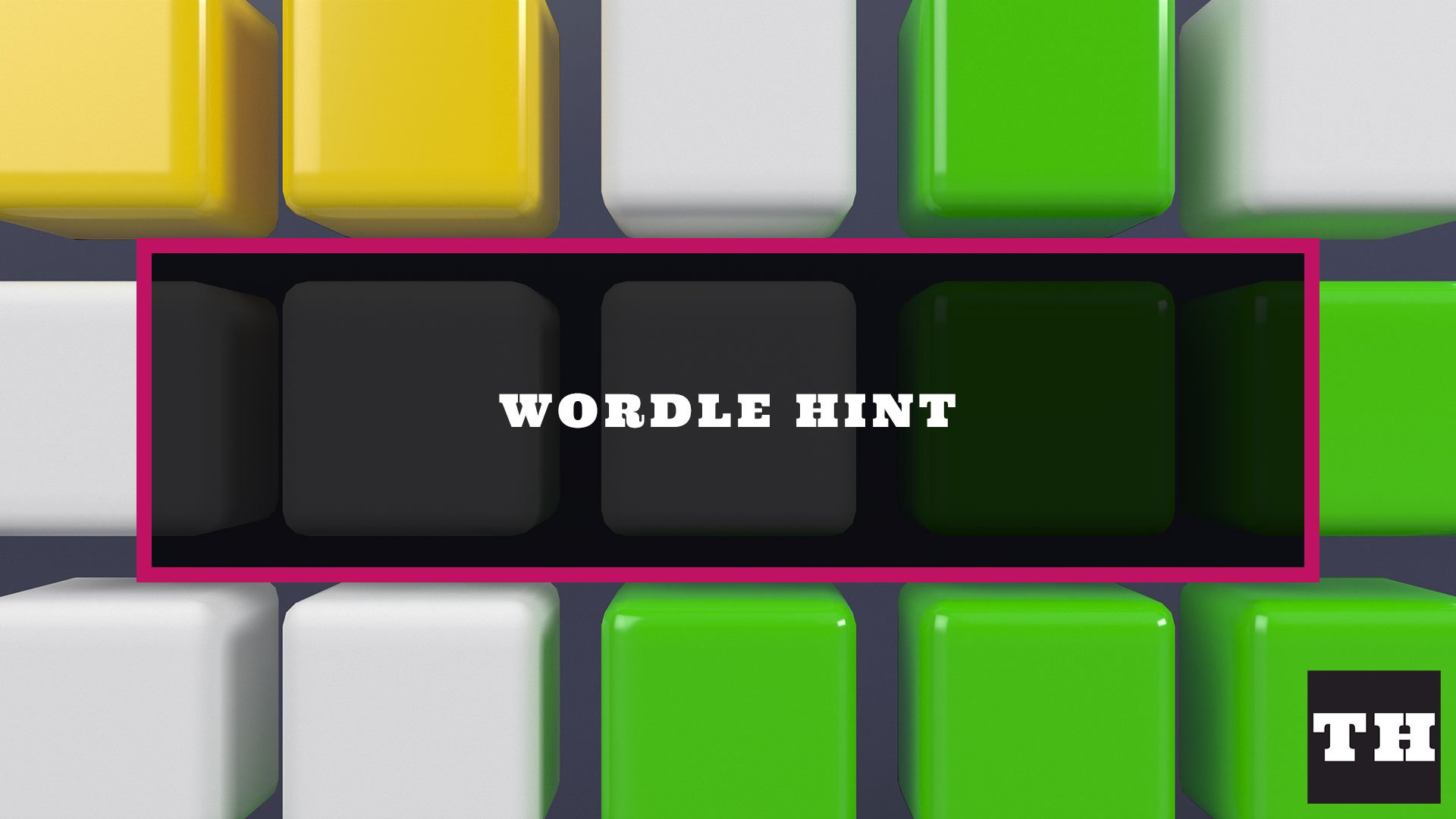

Average Gas Price Increase A 20 Cent Jump And Its Impact

May 22, 2025

Average Gas Price Increase A 20 Cent Jump And Its Impact

May 22, 2025 -

Core Weave Inc Crwv Soars Analyzing Last Weeks Stock Performance

May 22, 2025

Core Weave Inc Crwv Soars Analyzing Last Weeks Stock Performance

May 22, 2025 -

Mother Imprisoned Following Southport Stabbing Tweet Unable To Return Home

May 22, 2025

Mother Imprisoned Following Southport Stabbing Tweet Unable To Return Home

May 22, 2025