Understanding Principal Financial Group (PFG): An Analysis Of 13 Analyst Ratings

Table of Contents

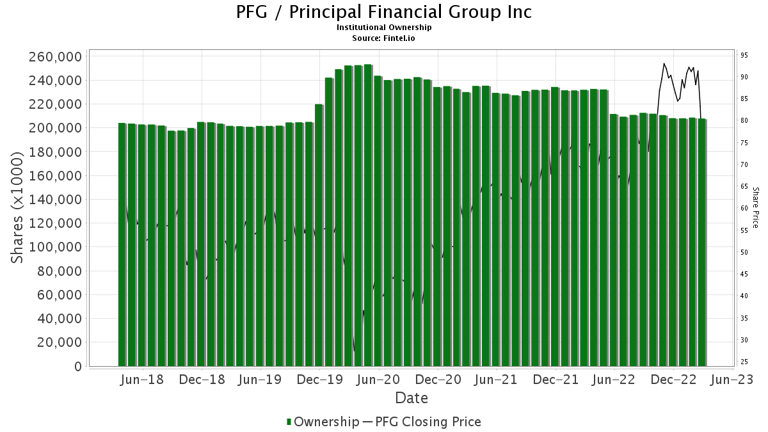

Investing in the stock market can be daunting. Before committing your hard-earned money, understanding the perspectives of financial experts is crucial. This in-depth analysis examines 13 analyst ratings for Principal Financial Group (PFG), a major player in the financial services industry, to provide you with a comprehensive overview of its current standing and future prospects. This review will equip you with the insights needed to make informed decisions regarding PFG stock.

Summary of Analyst Ratings for Principal Financial Group (PFG):

To get a clear picture of the market sentiment surrounding Principal Financial Group (PFG), we've compiled data from 13 different analyst reports. This comprehensive look at PFG stock provides a more robust understanding than relying on a single source. The following table summarizes the distribution of ratings:

| Rating | Number of Analysts |

|---|---|

| Buy | 5 |

| Hold | 6 |

| Sell | 2 |

This data shows an average rating leaning towards "Hold," suggesting a relatively cautious outlook among analysts. The average price target across all 13 analysts sits at (Insert Average Price Target Here). However, it's important to note the divergence of opinions. The two "Sell" ratings highlight potential concerns that warrant further investigation. These discrepancies often stem from differing assessments of PFG's future growth potential and risk profile.

Key Factors Influencing Analyst Ratings of PFG:

Analyst ratings for PFG are shaped by a multitude of factors, reflecting the complex nature of the financial services sector. These factors include:

-

Financial Performance Analysis: Key metrics like revenue growth, net income, return on equity (ROE), and the P/E ratio are closely scrutinized. Consistent growth in these areas typically leads to positive ratings, while declines or stagnation can trigger more cautious assessments. PFG's dividend yield is also an important factor for income-focused investors.

-

Competitive Landscape: Analysts evaluate PFG's competitive positioning within the financial services industry. This includes considering its market share, the strength of its brand, and its ability to compete effectively against established rivals.

-

Management Quality and Strategy: The quality of PFG's management team, its long-term strategic vision, and its ability to adapt to changing market conditions significantly influence analyst opinions. A strong management team with a clear strategy is generally viewed favorably.

-

Risk Factors and Mitigation Strategies: Analysts consider potential risks facing PFG, such as regulatory changes, economic downturns, and cybersecurity threats. How effectively PFG manages and mitigates these risks directly impacts its rating.

Strengths and Weaknesses of Principal Financial Group (PFG) Based on Analyst Reviews:

Based on the 13 analyst reports, several recurring themes emerged regarding PFG's strengths and weaknesses:

Top 3 Strengths Identified by Analysts:

- Strong market presence and brand recognition: PFG benefits from a long history and established presence within the financial services industry.

- Diversified product portfolio: The company's offerings span several areas of the financial services sector, reducing its reliance on any single segment.

- Robust financial foundation: Analysts generally see PFG as having a solid financial base, supporting its long-term stability.

Top 3 Weaknesses Identified by Analysts:

- Sensitivity to interest rate changes: Changes in interest rates can significantly affect PFG's profitability, representing a potential vulnerability.

- Competitive pressure: The financial services industry is fiercely competitive. Maintaining market share requires ongoing adaptation and innovation.

- Regulatory risks: Navigating the complex regulatory environment of the financial services sector is a continuous challenge, requiring significant compliance efforts.

Investment Implications and Future Outlook for PFG Stock:

The analysis of the 13 analyst ratings paints a mixed picture for PFG stock. While the average rating leans towards "Hold," the significant number of "Buy" ratings suggests potential for future growth. However, investors should be aware of the risks associated with the financial services sector, including interest rate sensitivity and regulatory uncertainty.

Short-term outlook: The short-term outlook for PFG stock is dependent on several factors, including overall market conditions and the company's near-term financial performance.

Long-term outlook: The long-term outlook for PFG appears to be positive, driven by its diversified offerings and established market position. However, success hinges on adapting to evolving market demands and maintaining a robust risk management strategy.

Investment recommendations: Investors with a higher risk tolerance and a long-term investment horizon may consider PFG stock. Those seeking lower risk should possibly consider other investment opportunities. Always conduct thorough due diligence before making any investment decision.

Conclusion:

Our analysis of 13 analyst ratings reveals a cautiously optimistic outlook for Principal Financial Group (PFG). While the company possesses several strengths, including a strong market presence and diversified product portfolio, it also faces challenges such as interest rate sensitivity and competitive pressure. The average "Hold" rating reflects this balance of potential and risk. Remember, this analysis is just one piece of the puzzle. Conduct your own thorough research, considering your individual risk tolerance and investment goals, before making any decisions regarding Principal Financial Group investment. Utilize additional resources like financial news, company filings, and independent analysis to form a comprehensive understanding of PFG stock and its suitability for your portfolio. Remember to always make informed investment decisions.

Featured Posts

-

Alcaraz En Montecarlo Celebracion Y Dominio En La Cancha

May 17, 2025

Alcaraz En Montecarlo Celebracion Y Dominio En La Cancha

May 17, 2025 -

I Megaloprepis Ypodoxi Toy Tramp Stin Saoydiki Aravia Xrysa Spathia Kai F 15

May 17, 2025

I Megaloprepis Ypodoxi Toy Tramp Stin Saoydiki Aravia Xrysa Spathia Kai F 15

May 17, 2025 -

Camisa 10 Nos Emirados Arabes Ex Jogador Do Vasco Mira Copa 2026

May 17, 2025

Camisa 10 Nos Emirados Arabes Ex Jogador Do Vasco Mira Copa 2026

May 17, 2025 -

Ankle Injury Update Jalen Brunsons Return Imminent

May 17, 2025

Ankle Injury Update Jalen Brunsons Return Imminent

May 17, 2025 -

Alan Carr And Amanda Holdens Renovated Spanish Townhouse On Sale For E245 K

May 17, 2025

Alan Carr And Amanda Holdens Renovated Spanish Townhouse On Sale For E245 K

May 17, 2025