Understanding Stock Market Valuations: BofA's Analysis

Table of Contents

BofA's Methodology for Stock Market Valuation Analysis

Bank of America employs a multifaceted approach to analyzing stock market valuations, incorporating a range of quantitative and qualitative factors. While they don't publicly disclose every detail of their proprietary models, their analysis heavily relies on a combination of established valuation metrics and macroeconomic forecasts.

- Description of BofA's preferred valuation models: BofA likely uses a blend of Discounted Cash Flow (DCF) analysis, which projects future cash flows to determine present value, and relative valuation methods, such as Price-to-Earnings (P/E) and Price-to-Book (P/B) ratios. They likely also incorporate more sophisticated models considering industry-specific factors and economic cycles.

- Mention any specific economic indicators or forecasts they incorporate: BofA's analysis incorporates key economic indicators like inflation rates, interest rate projections, GDP growth forecasts, and unemployment figures. These indicators significantly influence their assessment of future corporate earnings and discount rates used in DCF models.

- Highlight any unique aspects of their approach: BofA's extensive research capabilities and access to company-specific data likely provide a unique perspective. Their analysts probably conduct detailed fundamental analysis, incorporating qualitative factors like management quality and competitive landscapes into their valuation models. Their global reach also allows them to consider international economic influences on US stock market valuations.

Key Valuation Metrics and their Interpretation (according to BofA)

BofA's analysis centers around several key valuation metrics. While specific numbers fluctuate, understanding the methodology and interpretation is key.

Price-to-Earnings Ratio (P/E):

- Definition of P/E ratio: The Price-to-Earnings ratio is a valuation metric that compares a company's stock price to its earnings per share (EPS). It shows how much investors are willing to pay for each dollar of a company's earnings.

- Formula for calculating P/E ratio: P/E Ratio = Market Value per Share / Earnings per Share

- BofA's interpretation of current P/E levels: (Note: This section requires current data from BofA reports. Replace the bracketed information with actual data from a recent BofA report. For example:) "[BofA's recent reports suggest that the current market P/E ratio is [insert current P/E ratio], which is [higher/lower/similar] than the historical average of [insert historical average].]"

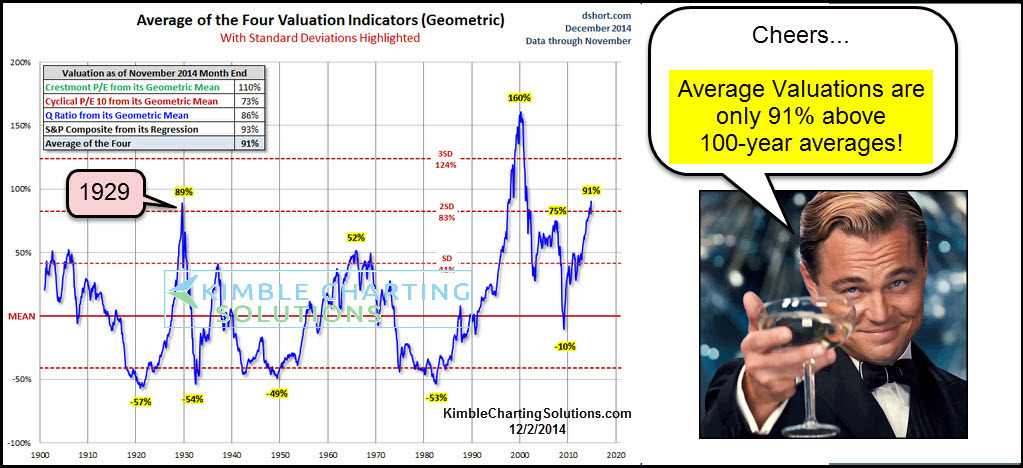

- Comparison to historical averages: Comparing the current P/E ratio to historical averages helps determine whether the market is currently overvalued, undervalued, or trading at a fair price. A high P/E ratio might indicate overvaluation, while a low P/E might suggest undervaluation.

Price-to-Book Ratio (P/B):

- Definition of P/B ratio: The Price-to-Book ratio compares a company's market capitalization to its book value of equity. Book value represents the net asset value of a company, calculated as assets minus liabilities.

- Formula for calculating P/B ratio: P/B Ratio = Market Capitalization / Book Value of Equity

- BofA's interpretation of current P/B levels: (Note: This section requires current data from BofA reports. Replace the bracketed information with actual data from a recent BofA report. For example:) "[BofA's analysis indicates that the current market P/B ratio is [insert current P/B ratio], which is [higher/lower/similar] to the historical average of [insert historical average] and industry benchmarks.]"

- Comparison to historical averages and industry benchmarks: Analyzing P/B ratios relative to historical averages and industry benchmarks allows for a more nuanced understanding of valuation. A high P/B ratio might signal market optimism, while a low P/B could indicate potential undervaluation or concerns about a company's assets.

Other Relevant Metrics:

- Brief explanation of each metric: BofA likely also considers metrics such as dividend yield (annual dividend per share divided by the stock price), PEG ratio (P/E ratio divided by the earnings growth rate), and enterprise value-to-EBITDA (EV/EBITDA) ratio (enterprise value divided by earnings before interest, taxes, depreciation, and amortization).

- BofA's findings regarding these metrics: (Note: This section requires current data from BofA reports.) [Insert BofA's findings on these metrics from their reports, linking to the source material if possible.]

- Relationship between these metrics and overall market valuation: These additional metrics provide a more comprehensive picture of market valuation, helping to confirm or challenge the insights derived from P/E and P/B ratios alone.

BofA's Outlook and Implications for Investors

BofA's overall assessment of current stock market valuations is crucial for investors. Their analysis combines quantitative metrics with qualitative factors to arrive at a conclusion.

- BofA's prediction for future market performance based on valuation analysis: (Note: This section requires current data from BofA reports.) [Insert BofA's prediction for future market performance based on their valuation analysis. Include specific details about expected market movements and reasons for their prediction.]

- Investment recommendations based on their findings (e.g., buy, hold, sell): (Note: This section requires current data from BofA reports.) [Summarize BofA's investment recommendations, clarifying if they suggest a bullish, bearish, or neutral stance. Reference specific sectors or asset classes.]

- Potential risks and opportunities highlighted by BofA: (Note: This section requires current data from BofA reports.) [Discuss potential risks and opportunities, such as specific economic factors, geopolitical events, or industry trends, that could influence future market performance.]

- Include any specific sectors or industries BofA highlights as particularly overvalued or undervalued: (Note: This section requires current data from BofA reports.) [Highlight specific sectors or industries identified by BofA as potentially overvalued or undervalued, providing reasons for this assessment.]

Conclusion

Understanding stock market valuations is crucial for successful investing. BofA's analysis, utilizing metrics such as P/E and P/B ratios, along with other key indicators, provides valuable insights into the current market landscape. Their findings – which include [briefly summarize key findings, referencing specific metrics and their implications] – offer investors a framework for making informed decisions. By carefully considering BofA's outlook and incorporating your own due diligence, you can navigate the complexities of stock market valuations and potentially improve your investment strategy. Remember to continue researching and monitoring stock market valuations to stay ahead of the curve. Learn more about effective strategies for understanding stock market valuations and make informed investment choices.

Featured Posts

-

Neues Escape Spiel Im Mueritzeum Ein Spannendes Abenteuer

May 31, 2025

Neues Escape Spiel Im Mueritzeum Ein Spannendes Abenteuer

May 31, 2025 -

Profiter D Un Jour En Mer Conseils Pratiques Pour Tous Les Marins

May 31, 2025

Profiter D Un Jour En Mer Conseils Pratiques Pour Tous Les Marins

May 31, 2025 -

Road To The Final Psg And Inter Milans Champions League Journey

May 31, 2025

Road To The Final Psg And Inter Milans Champions League Journey

May 31, 2025 -

Is It Possible To Bet On The Los Angeles Wildfires Exploring The Dark Side Of Gambling

May 31, 2025

Is It Possible To Bet On The Los Angeles Wildfires Exploring The Dark Side Of Gambling

May 31, 2025 -

Kostenlose Unterkunft Lockt Neue Einwohner In Diese Deutsche Stadt

May 31, 2025

Kostenlose Unterkunft Lockt Neue Einwohner In Diese Deutsche Stadt

May 31, 2025