Understanding The Canadian Dollar's Recent Volatility

Table of Contents

Global Economic Uncertainty and its Impact on the CAD

Global economic headwinds significantly influence Canadian Dollar Volatility. The interconnected nature of the world economy means that events far removed from Canada can directly impact the loonie's value. Two key global factors stand out: the strength of the US dollar and fluctuations in global commodity prices.

The Role of the US Dollar

The US dollar's strength often inversely affects the Canadian dollar due to the close economic ties and significant trade between the two countries. A stronger USD typically weakens the CAD. This relationship is driven by several factors:

-

Increased US interest rates impact the CAD negatively: As US interest rates rise, investors often move capital to higher-yielding US assets, decreasing demand for the CAD. This capital outflow weakens the Canadian dollar. Understanding these interest rate differentials is key to predicting CAD movement.

-

US economic performance directly influences demand for Canadian exports and, consequently, the CAD: A robust US economy typically leads to increased demand for Canadian goods and services, strengthening the CAD. Conversely, a weakening US economy reduces this demand, putting downward pressure on the loonie. Monitoring US economic indicators is therefore crucial for assessing Canadian Dollar Volatility.

-

Geopolitical events impacting the US economy often ripple into the Canadian market, creating CAD volatility: Global uncertainty, such as political instability or international conflicts, often affects the US dollar, which in turn impacts the CAD. This highlights the interconnectedness of global finance and the challenges in predicting Canadian Dollar Volatility.

Global Commodity Prices and their Influence

Canada's economy is heavily reliant on commodity exports, such as oil and lumber. Fluctuations in global commodity prices significantly affect the CAD's value. This dependence makes the Canadian dollar particularly vulnerable to shifts in the global commodities market.

-

Increased oil prices generally strengthen the CAD, while decreases weaken it: As a major oil producer, Canada's economy is closely tied to oil prices. Higher oil prices boost export revenues, increasing demand for the CAD.

-

Demand for other Canadian commodities like lumber, potash, and metals also affects the CAD's exchange rate: Fluctuations in the prices of these commodities directly impact Canada's trade balance and subsequently the Canadian dollar's value. Diversification within the commodity sector is therefore important for mitigating risk related to Canadian Dollar Volatility.

-

Global supply chain disruptions can drastically impact commodity prices and, in turn, the Canadian dollar: Unexpected events, such as pandemics or geopolitical crises, can disrupt global supply chains, leading to price volatility and impacting the CAD. Understanding these potential disruptions is crucial for managing Canadian Dollar Volatility.

Domestic Economic Factors Contributing to CAD Volatility

While global factors play a significant role, domestic economic conditions also drive Canadian Dollar Volatility. The Bank of Canada's monetary policy and political stability are key domestic factors.

Interest Rate Decisions by the Bank of Canada

The Bank of Canada's monetary policy decisions heavily influence the CAD. Interest rate hikes generally strengthen the currency, while cuts weaken it.

-

Market expectations regarding future interest rate changes also impact the CAD's short-term fluctuations: Anticipation of future rate adjustments can create volatility even before the Bank of Canada makes an official announcement. This emphasizes the importance of monitoring market sentiment alongside official announcements.

-

Inflation rates in Canada significantly influence the Bank of Canada's decisions and thus affect the CAD: High inflation generally leads to interest rate hikes to curb price increases, strengthening the CAD. Conversely, low inflation might lead to interest rate cuts, potentially weakening the dollar.

-

Analysis of economic indicators like GDP growth and employment numbers is crucial for predicting CAD movements: Strong GDP growth and low unemployment typically support a stronger CAD, while weaker economic data might lead to a weaker loonie. This underscores the importance of comprehensive economic data analysis for assessing Canadian Dollar Volatility.

Political and Geopolitical Risks

Domestic political instability or significant geopolitical events impacting Canada can create uncertainty and lead to CAD volatility.

-

Changes in government policy regarding trade or resource management can influence investor confidence and the CAD: Significant shifts in government policy can create uncertainty in the market, leading to volatility.

-

International conflicts or trade disputes involving Canada can trigger market uncertainty and CAD fluctuations: Geopolitical risks can significantly impact investor sentiment and the CAD's value.

-

Political risk assessments are crucial for understanding the potential impact on the Canadian dollar: A thorough understanding of political risks and their potential consequences is essential for managing exposure to Canadian Dollar Volatility.

Predicting and Managing Canadian Dollar Volatility

Predicting the precise movements of the CAD is challenging due to the complex interplay of global and domestic factors. However, understanding these factors allows for better risk management.

-

Predicting CAD movements is inherently difficult: The sheer number of variables makes precise forecasting extremely challenging. Instead, focusing on understanding the key drivers is more effective.

-

Diversification is crucial for investors: Diversifying investment portfolios across different asset classes and currencies helps mitigate risk associated with Canadian Dollar Volatility.

-

Hedging strategies are essential for businesses engaged in international trade: Businesses can use hedging techniques like forward contracts or options to protect themselves against adverse currency fluctuations.

Conclusion

The Canadian dollar's recent volatility is a complex issue influenced by a multitude of interconnected global and domestic factors. Understanding the interplay between global economic uncertainty, commodity prices, domestic economic policies, and geopolitical risks is crucial for navigating this dynamic market. While predicting the exact movements of the Canadian dollar is impossible, being aware of these key drivers allows for better-informed decision-making. By staying informed about Canadian Dollar Volatility and its influencing factors, individuals and businesses can better manage their exposure to currency risk. Continue to monitor economic indicators and global events to make informed decisions regarding your investments and business strategies related to the Canadian dollar.

Featured Posts

-

Analyzing The Business Model Why A Startup Airline Is Utilizing Deportation Flights

Apr 24, 2025

Analyzing The Business Model Why A Startup Airline Is Utilizing Deportation Flights

Apr 24, 2025 -

John Travolta Addresses Fan Concerns After Sharing Intimate Bedroom Photo

Apr 24, 2025

John Travolta Addresses Fan Concerns After Sharing Intimate Bedroom Photo

Apr 24, 2025 -

Bitcoins Btc Upward Trajectory Analyzing The Role Of Trumps Policies And Fed Actions

Apr 24, 2025

Bitcoins Btc Upward Trajectory Analyzing The Role Of Trumps Policies And Fed Actions

Apr 24, 2025 -

Independence Concerns Lead To 60 Minutes Executive Producers Exit

Apr 24, 2025

Independence Concerns Lead To 60 Minutes Executive Producers Exit

Apr 24, 2025 -

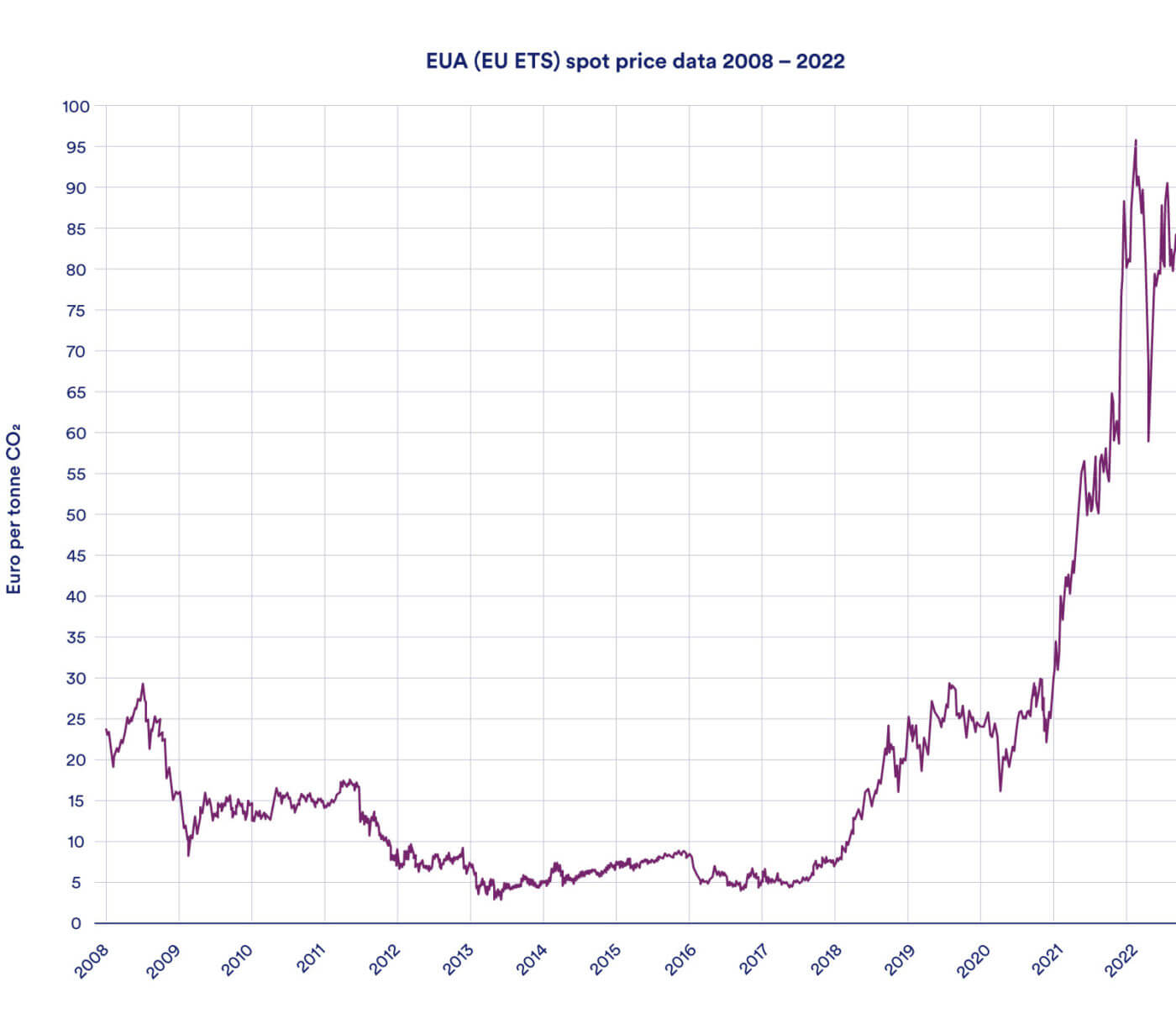

Spot Market In Focus Eus Strategy For Russian Gas Elimination

Apr 24, 2025

Spot Market In Focus Eus Strategy For Russian Gas Elimination

Apr 24, 2025

Latest Posts

-

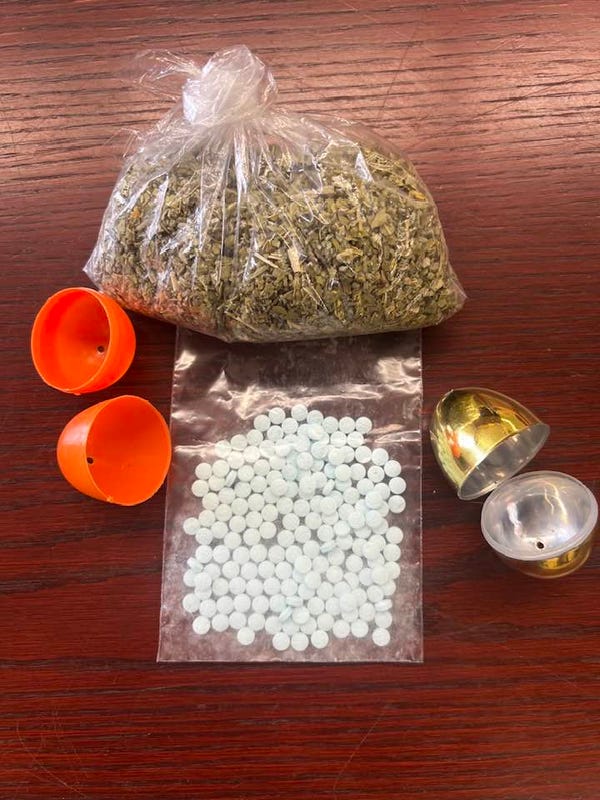

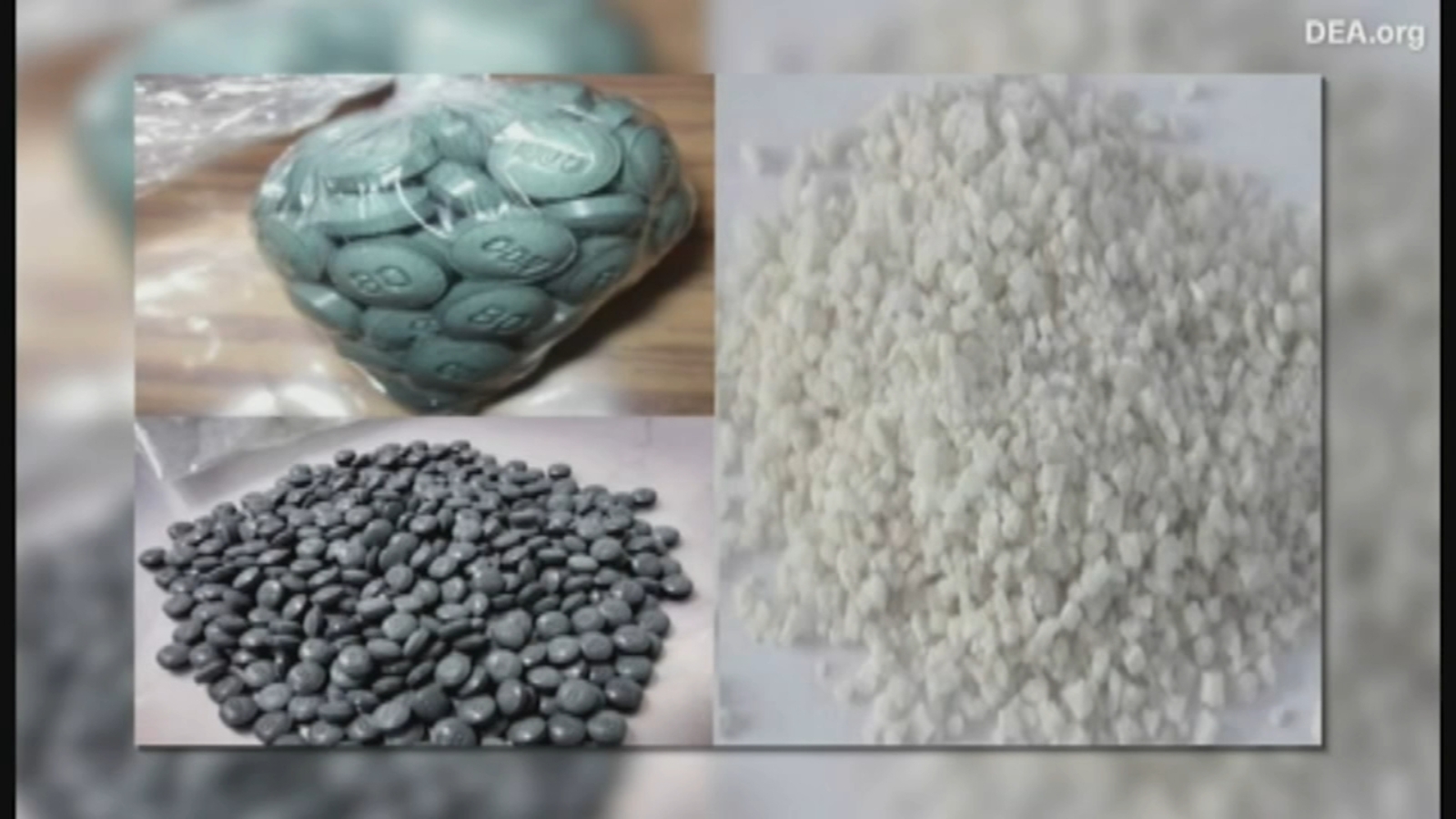

Fake Fentanyl Demonstration By Attorney General Sparks Debate

May 10, 2025

Fake Fentanyl Demonstration By Attorney General Sparks Debate

May 10, 2025 -

Ag Pam Bondi And The Epstein Files A Call For Public Vote

May 10, 2025

Ag Pam Bondi And The Epstein Files A Call For Public Vote

May 10, 2025 -

Attorney General Highlights Fake Fentanyl Threat

May 10, 2025

Attorney General Highlights Fake Fentanyl Threat

May 10, 2025 -

Attorney Generals Fentanyl Display A Deeper Look

May 10, 2025

Attorney Generals Fentanyl Display A Deeper Look

May 10, 2025 -

Should We Vote To Release Jeffrey Epstein Files Pam Bondis Decision Under Scrutiny

May 10, 2025

Should We Vote To Release Jeffrey Epstein Files Pam Bondis Decision Under Scrutiny

May 10, 2025