Understanding The CoreWeave, Inc. (CRWV) Stock Price Increase On Thursday

Table of Contents

Positive Earnings Report and Future Guidance

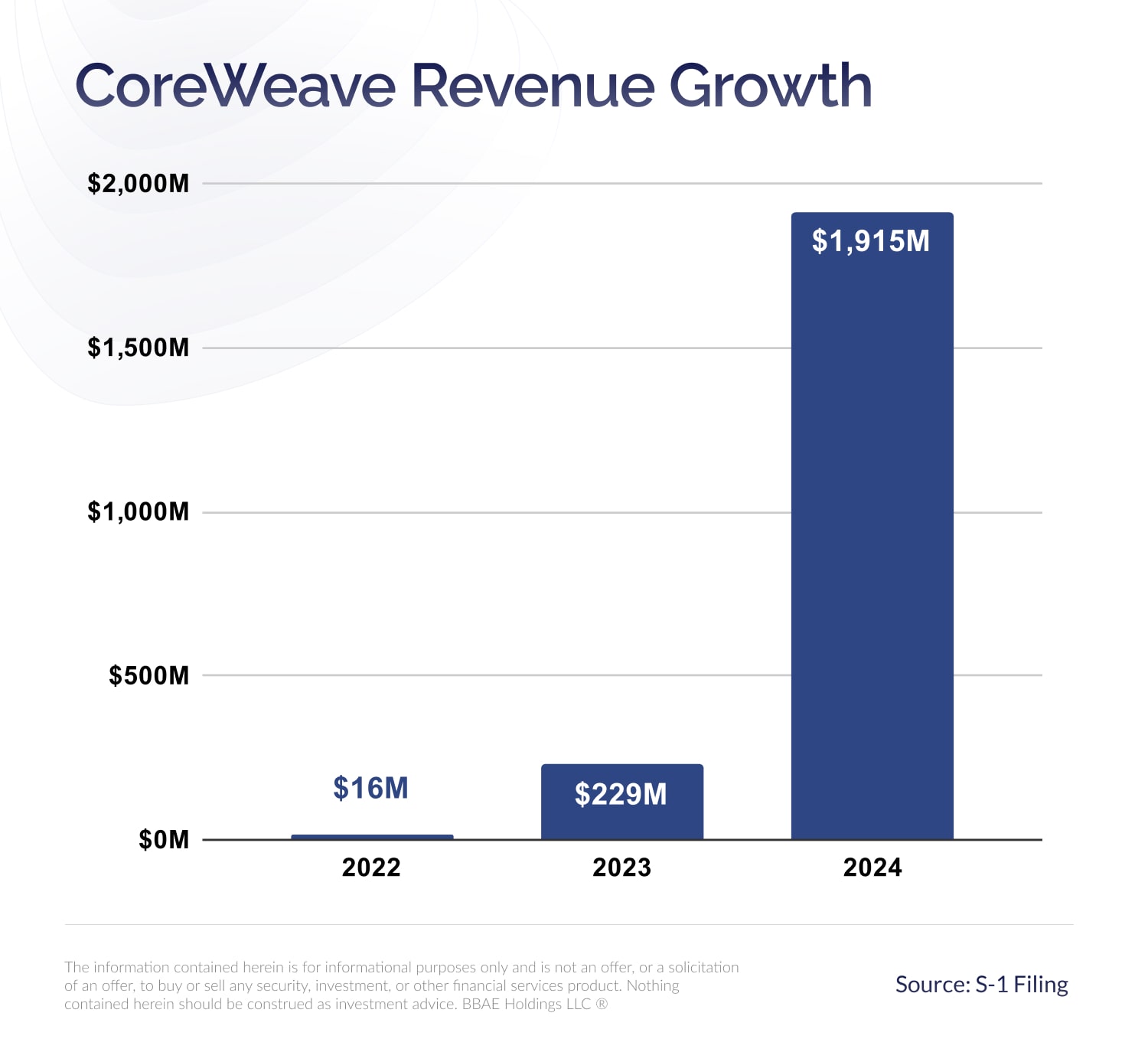

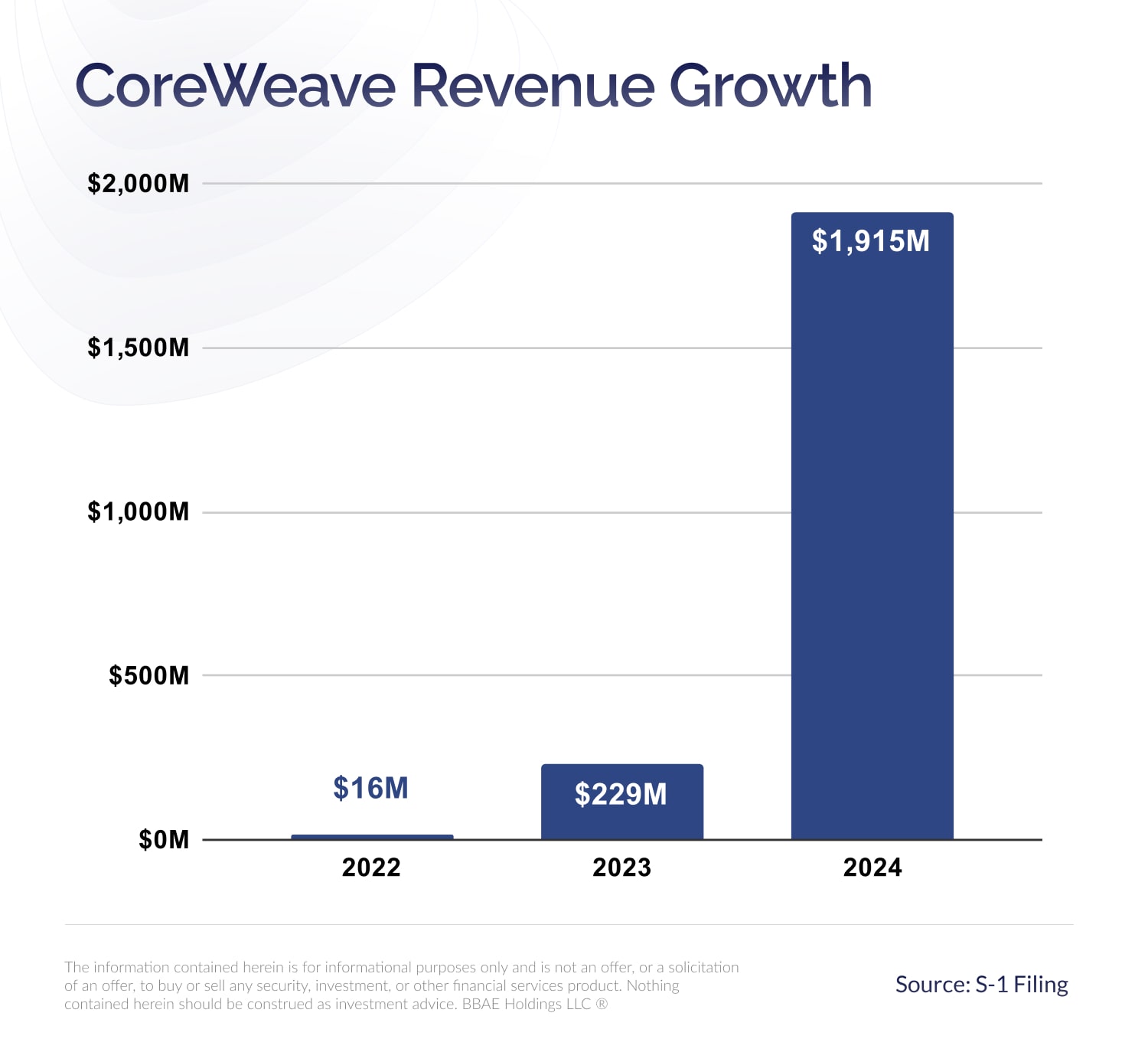

CoreWeave, Inc. (CRWV), a rapidly growing player in the cloud computing market, specializing in providing high-performance computing solutions, released its latest earnings report on Thursday, revealing strong financial performance that likely fueled the stock price surge. The report highlighted impressive growth across key metrics, significantly exceeding analyst expectations and painting a positive picture for the company's future.

- Revenue Growth: CoreWeave reported a substantial year-over-year revenue increase of X%, exceeding previous guidance. (Replace X with the actual percentage from the earnings report). This impressive growth demonstrates strong demand for its services.

- Earnings Per Share (EPS): While specific EPS figures would need to be sourced from the official earnings report, a positive EPS result or a significant beat of expectations would contribute greatly to investor enthusiasm. (Insert actual EPS data here if available).

- Future Guidance: The company's future guidance was particularly bullish, indicating continued strong revenue growth and profitability in the coming quarters. Upward revisions to previously announced expectations further boosted investor confidence. (Include specific details from the guidance).

- Analyst Reactions: Following the earnings release, several analysts reacted positively, upgrading their price targets and reiterating their buy recommendations for CRWV stock. Positive analyst commentary adds further weight to the positive market sentiment.

Impact of AI and the Growing Demand for Cloud Computing

CoreWeave's success is intrinsically linked to the explosive growth of artificial intelligence (AI) and the overall expansion of the cloud computing market. The company's specialized infrastructure, designed to handle the computationally intensive demands of AI workloads, positions it perfectly to capitalize on this burgeoning sector.

- AI Project Involvement: CoreWeave is actively involved in numerous high-profile AI projects, providing the crucial computing power required for training large language models and other AI applications. (Include specific examples if publicly available).

- Market Growth Statistics: The global cloud computing market is experiencing exponential growth, projected to reach [Insert Market Size and Growth Projection from a reputable source]. The AI segment within this market is also expanding at an extraordinary rate, driven by advancements in deep learning and machine learning.

- Competitive Advantage: CoreWeave's competitive advantage lies in its focus on high-performance computing, specialized infrastructure, and its strong relationships with key players in the AI industry. This allows them to offer tailored solutions that meet the demanding needs of AI development and deployment.

Analyst Ratings and Investor Sentiment

The positive earnings report was quickly followed by a wave of positive analyst ratings and a noticeable shift in investor sentiment. This combination strongly contributed to the CRWV stock price surge.

- Analyst Upgrades: Several major investment banks upgraded their ratings on CRWV stock following the earnings report, citing the strong financial performance and the company's position in the rapidly growing AI and cloud computing markets. (Include specific examples with links to the source).

- Institutional Investments: Increased institutional investment and significant trading volume further fueled the price increase, signaling strong belief in CoreWeave’s future prospects. (Include details on institutional investment if publicly available).

- Social Media Sentiment: Positive sentiment surrounding CRWV on social media platforms and financial news websites also played a role in driving up the stock price.

Technical Analysis of the CRWV Stock Chart (Disclaimer: This section is for informational purposes only and does not constitute financial advice.)

While fundamental analysis is crucial, a brief look at the technical aspects could offer additional context. A breakout above a key resistance level, coupled with a significant increase in trading volume, might have triggered a buying frenzy and amplified the price surge. (Describe any relevant chart patterns observed, but remember to clearly state that this is not financial advice).

Conclusion: Understanding the CoreWeave (CRWV) Stock Price Jump and Future Outlook

The significant increase in CoreWeave's (CRWV) stock price on Thursday can be largely attributed to a combination of factors: a strong earnings report exceeding expectations, the company's strategic positioning within the booming AI and cloud computing markets, and overwhelmingly positive analyst ratings and investor sentiment. Understanding these interconnected factors is crucial for investors seeking to analyze CRWV’s performance and future potential.

While this analysis offers valuable insights into the CoreWeave (CRWV) stock price increase, thorough due diligence is crucial before making any investment decisions. Continue your research and stay informed about CRWV's progress in the dynamic cloud computing market. Remember to consult with a financial advisor before making any investment decisions related to CRWV stock or any other security.

Featured Posts

-

Dexter Resurrection Why Fans Love This Villains Comeback

May 22, 2025

Dexter Resurrection Why Fans Love This Villains Comeback

May 22, 2025 -

Analyzing Core Weave Crwv S Positive Stock Performance On Wednesday

May 22, 2025

Analyzing Core Weave Crwv S Positive Stock Performance On Wednesday

May 22, 2025 -

Provence Walking Tour Mountains To Mediterranean Coast

May 22, 2025

Provence Walking Tour Mountains To Mediterranean Coast

May 22, 2025 -

Les Grands Fusains De Boulemane Rencontre Litteraire Avec Abdelkebir Rabi

May 22, 2025

Les Grands Fusains De Boulemane Rencontre Litteraire Avec Abdelkebir Rabi

May 22, 2025 -

Dexter Original Sin Steelbook Blu Ray Review Prepare For Dexter New Blood

May 22, 2025

Dexter Original Sin Steelbook Blu Ray Review Prepare For Dexter New Blood

May 22, 2025