Understanding The Current State: The Canadian Dollar's Exchange Rate

Table of Contents

Factors Influencing the Canadian Dollar Exchange Rate

Several interconnected factors influence the Canadian dollar exchange rate (CAD exchange rate). These include commodity prices, interest rate differentials, geopolitical events, and the strength of the US dollar.

Commodity Prices (Oil and Natural Gas)

Canada is a major exporter of oil and natural gas. The price of these commodities has a strong, direct correlation with the CAD exchange rate. When oil and natural gas prices rise on the global market, the demand for the Canadian dollar increases, strengthening its value. Conversely, a decline in commodity prices weakens the Loonie.

- Impact of OPEC decisions: Decisions made by the Organization of the Petroleum Exporting Countries (OPEC) regarding oil production significantly impact global supply and, consequently, the CAD exchange rate.

- Global demand for energy: Increased global demand for energy, often driven by economic growth in developing nations, tends to boost commodity prices and support the Canadian dollar.

- Effects of geopolitical instability: Geopolitical instability in oil-producing regions can disrupt supply chains and lead to price volatility, creating uncertainty in the CAD exchange rate.

For example, a period of heightened geopolitical tension in the Middle East can lead to a spike in oil prices, strengthening the CAD against other major currencies like the USD. Conversely, a global recession can dampen energy demand, pushing oil prices down and weakening the Canadian currency.

Interest Rate Differentials

The Bank of Canada (BoC) sets interest rates, influencing the attractiveness of Canadian investments. Higher interest rates relative to other major economies, such as the US Federal Reserve (Fed), tend to attract foreign investment, increasing demand for the Canadian dollar and strengthening its exchange rate.

- Impact of monetary policy: The BoC's monetary policy decisions directly impact interest rates and, therefore, the CAD exchange rate. Raising interest rates makes Canadian assets more attractive to foreign investors.

- Attractiveness of Canadian investments: Higher interest rates make Canadian bonds and other investments more appealing, boosting demand for the CAD.

- Effects of inflation: Inflationary pressures can prompt the BoC to raise interest rates to curb price increases, potentially affecting the CAD exchange rate.

Currently, the BoC's interest rate is [insert current BoC interest rate], compared to the US Federal Reserve's rate of [insert current Fed interest rate]. This differential impacts the USD to CAD exchange rate, influencing investment flows.

Geopolitical Events and Global Economic Conditions

Global events and the overall health of the global economy significantly impact the Canadian dollar. Trade wars, political instability, and global recessionary fears can all influence investor sentiment and the demand for the Canadian dollar.

- Impact of US-China trade relations: Trade tensions between the US and China can create global economic uncertainty, impacting the value of the Canadian dollar.

- Global recessionary fears: Concerns about a global recession can lead to a flight to safety, potentially strengthening the US dollar and weakening the CAD.

- Brexit's lingering effects: The ongoing consequences of Brexit continue to impact global markets and investor confidence, indirectly affecting the CAD exchange rate.

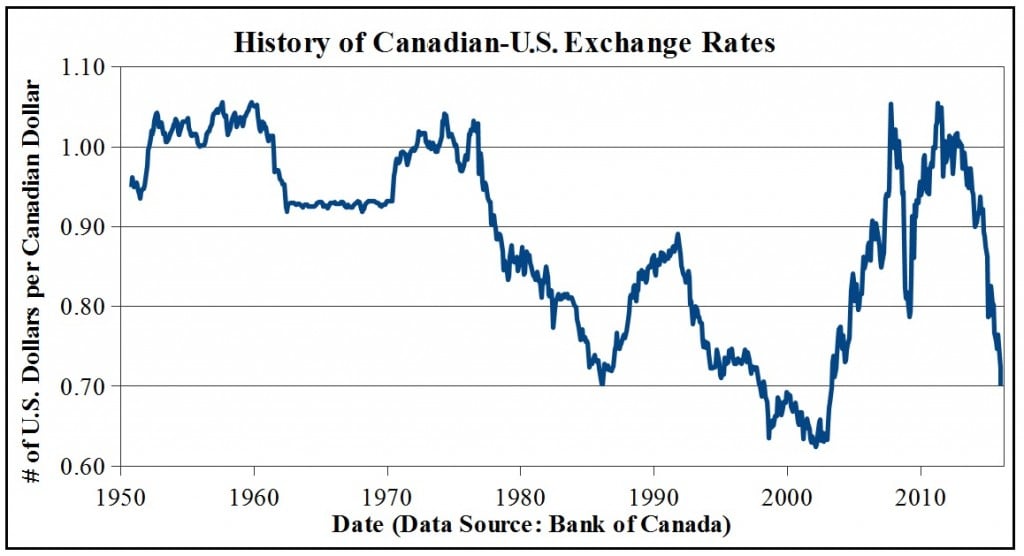

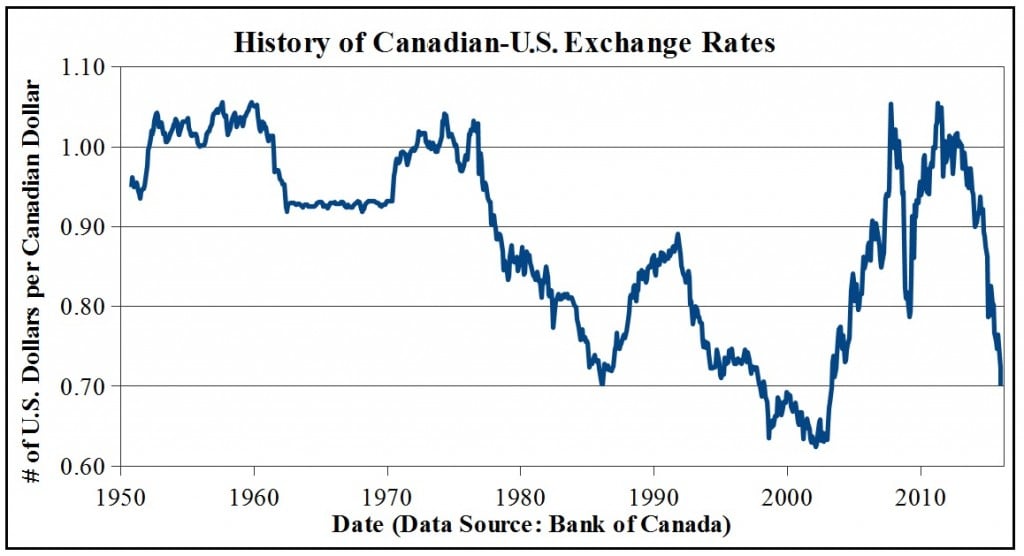

Historical data shows that periods of significant geopolitical uncertainty have often resulted in increased volatility in the Canadian dollar exchange rate.

US Dollar Strength

The US dollar's strength plays a crucial role in the CAD exchange rate, as the USD is the world's primary reserve currency. A strong US dollar typically puts downward pressure on the Canadian dollar, while a weakening USD tends to support the CAD.

- Impact of US economic performance: The strength of the US economy impacts the USD and, subsequently, the CAD exchange rate. Strong US economic growth typically strengthens the USD.

- Federal Reserve policy: The Federal Reserve's monetary policy decisions directly influence the USD's value and its impact on the CAD.

- USD’s role as a global reserve currency: The USD's dominance in global trade and finance means its fluctuations significantly impact other currencies, including the CAD.

Historically, periods of US dollar strength have often coincided with periods of weakness for the Canadian dollar.

Current State of the Canadian Dollar Exchange Rate

Recent Trends and Volatility

Recent trends in the Canadian dollar exchange rate against major currencies have shown [describe recent trends, e.g., increased volatility, periods of appreciation or depreciation against the USD, EUR, and GBP]. [Include a chart or graph visualizing recent exchange rate movements].

- Highlight significant highs and lows: Mention specific dates and exchange rates to illustrate key turning points.

- Periods of stability and volatility: Describe periods of relative stability and those marked by significant fluctuations.

Forecasting and Predictions (with caution)

Forecasting the future of the Canadian dollar exchange rate is inherently challenging, as it depends on many unpredictable factors. However, various financial analysts offer predictions, which should be viewed with caution.

- Summarize various predictions: Mention a range of predictions, highlighting different perspectives from various analysts and institutions.

- Cite reputable sources for forecasts: Acknowledge the sources of these predictions, ensuring transparency and credibility.

- Emphasize the limitations of these predictions: Stress the inherent uncertainty in economic forecasting.

Conclusion

The Canadian dollar exchange rate is influenced by a complex interplay of factors, including commodity prices (particularly oil and natural gas), interest rate differentials set by the Bank of Canada and other central banks, geopolitical events, and the strength of the US dollar. The current state of the CAD exchange rate reflects these various influences, with recent trends exhibiting [summarize recent trends: volatility, stability, appreciation, or depreciation]. Staying informed about these factors is critical for making informed decisions related to international trade, investments, and travel. To stay updated on the fluctuations of the Canadian dollar exchange rate and the Loonie's performance, monitor reliable financial news sources like the Bank of Canada website ([link to Bank of Canada website]). Understanding the Canadian dollar exchange rate is essential for navigating the complexities of the global economy.

Featured Posts

-

Jayson Tatum On Grooming Confidence And A Full Circle Moment

May 08, 2025

Jayson Tatum On Grooming Confidence And A Full Circle Moment

May 08, 2025 -

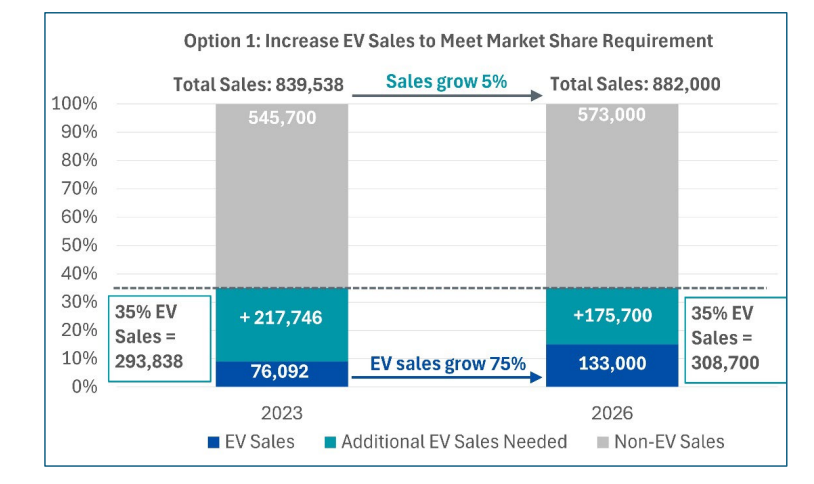

The Ongoing Battle Car Dealerships Resist Ev Sales Mandates

May 08, 2025

The Ongoing Battle Car Dealerships Resist Ev Sales Mandates

May 08, 2025 -

Prensa Sergio Hernandez Proximo Entrenador Del Flamengo

May 08, 2025

Prensa Sergio Hernandez Proximo Entrenador Del Flamengo

May 08, 2025 -

Stephen Kings Endorsement Boosts The Life Of Chuck Movie Trailer

May 08, 2025

Stephen Kings Endorsement Boosts The Life Of Chuck Movie Trailer

May 08, 2025 -

Dwp Cuts Benefits Letters Sent To Claimants From April 5th

May 08, 2025

Dwp Cuts Benefits Letters Sent To Claimants From April 5th

May 08, 2025