Understanding The D-Wave Quantum (QBTS) Stock Dip On Monday

Table of Contents

Analyzing the D-Wave Quantum (QBTS) Stock Performance on Monday

The D-Wave Quantum (QBTS) stock experienced a considerable drop on Monday. While precise figures require referencing a specific date and reliable financial data sources, let's assume, for illustrative purposes, a hypothetical 10% decrease in QBTS stock price, closing at $X. This significant percentage drop warrants a closer examination. A visual representation, such as a stock chart depicting Monday's performance alongside the previous week's activity, would further clarify the extent of the volatility. (Note: A real-time chart would be included here in a published article).

- Specific percentage drop in QBTS stock price: Let's assume a 10% drop for this example. This needs to be replaced with the actual percentage from Monday's trading.

- Comparison to overall market performance on Monday: It's crucial to compare QBTS's performance against the broader market's movement on the same day. Was the overall market down, or did QBTS underperform the general indices?

- Volume traded compared to average daily volume: A spike in trading volume, exceeding the average daily volume, might suggest increased market activity and potentially heightened investor anxiety or speculation surrounding QBTS.

Potential Factors Contributing to the QBTS Stock Dip

Several factors could have contributed to the QBTS stock dip. A comprehensive analysis requires considering various internal and external influences.

News and Market Sentiment

Negative news, whether directly related to D-Wave Quantum or the broader quantum computing industry, can significantly impact investor sentiment.

- Any recent negative news related to D-Wave Quantum or the quantum computing industry: This could include news about technological setbacks, delays in project timelines, or negative press coverage affecting investor confidence.

- Impact of broader market trends or investor sentiment towards tech stocks: Overall market downturns, particularly within the technology sector, can pull down even strong performers like QBTS.

- Analysis of social media sentiment regarding QBTS: Social media sentiment analysis can provide valuable insights into public perception and investor opinions, revealing potential anxieties driving the stock price down.

Competitor Activity

The quantum computing industry is highly competitive. Announcements or advancements from rival companies can influence investor perceptions of D-Wave Quantum's market position.

- Mention any significant announcements from competitors in the quantum computing space: New product releases, partnerships, or funding announcements from competitors can shift investor attention and resources.

- Assess the competitive landscape and its potential effect on QBTS: Analyzing the competitive dynamics within the quantum computing market helps to understand QBTS's relative position and its vulnerability to competitor activity.

Financial Factors

Financial news and reports surrounding D-Wave Quantum also play a significant role.

- Discuss potential upcoming financial reports or earnings calls and their anticipated effect on the stock price: Anticipation of upcoming financial reports or earnings calls can create uncertainty and volatility in the stock price.

- Analyze the company's financial health and any potential concerns: Investors scrutinize a company's financial health; concerns about profitability, debt levels, or cash flow can trigger sell-offs.

Long-Term Outlook for D-Wave Quantum (QBTS) Stock

Despite the short-term dip, the long-term outlook for D-Wave Quantum and the quantum computing industry remains promising. However, investing in QBTS involves inherent risks.

- Assessment of D-Wave's technological advancements and market share: D-Wave's innovative technologies and its market share within the quantum computing industry are key indicators of its long-term potential.

- Discussion of the potential growth of the quantum computing market: The quantum computing market is expected to grow exponentially. D-Wave's position within this burgeoning industry is a crucial element for long-term investors.

- Risk factors associated with investing in QBTS: Investing in a relatively young company in an emerging technology sector like quantum computing carries significant risk. Investors should be prepared for volatility and potential losses.

Conclusion

Monday's D-Wave Quantum (QBTS) stock dip likely resulted from a combination of factors, including market sentiment, competitor activity, and potentially, anticipation of upcoming financial reports. While short-term fluctuations are common in the stock market, particularly in the volatile tech sector, investors need to consider the long-term potential of quantum computing and D-Wave's position within it. Before making any investment decisions related to D-Wave Quantum (QBTS) stock or other quantum computing investments, thorough research and possibly consulting a financial advisor are crucial. Remember to carefully analyze all available information before investing in this exciting but inherently risky emerging technology sector.

Featured Posts

-

Train Hits Family On Bridge Two Adults Dead Children Injured

May 21, 2025

Train Hits Family On Bridge Two Adults Dead Children Injured

May 21, 2025 -

Bbc Breakfast Guest Disrupts Live Interview Are You Still There

May 21, 2025

Bbc Breakfast Guest Disrupts Live Interview Are You Still There

May 21, 2025 -

Aimscap Wtt Strategies For Success In The World Trading Tournament

May 21, 2025

Aimscap Wtt Strategies For Success In The World Trading Tournament

May 21, 2025 -

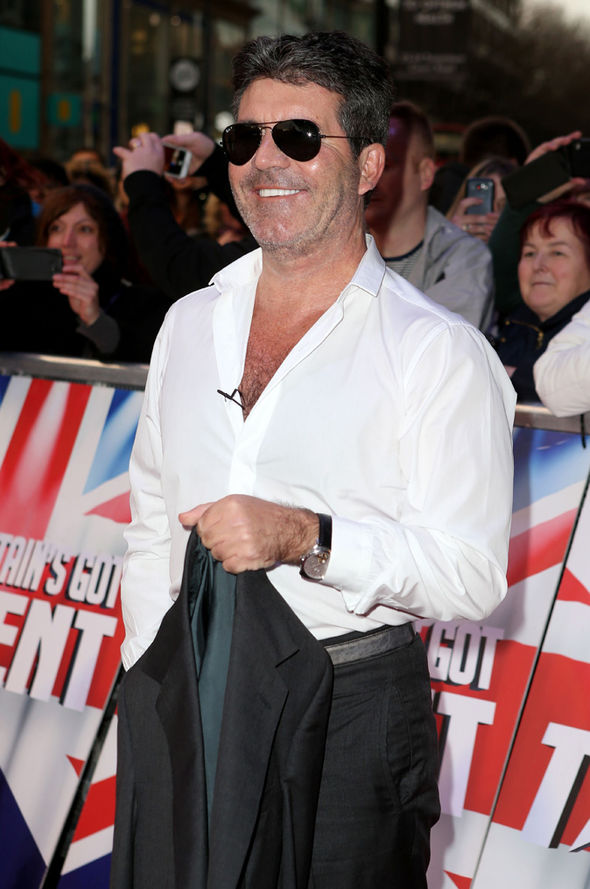

Behind The Scenes The David Walliams And Simon Cowell Bgt Conflict

May 21, 2025

Behind The Scenes The David Walliams And Simon Cowell Bgt Conflict

May 21, 2025 -

The Goldbergs Exploring The Shows Enduring Popularity

May 21, 2025

The Goldbergs Exploring The Shows Enduring Popularity

May 21, 2025