Understanding The Increased Volatility In Today's Stock Market

Table of Contents

Geopolitical Instability and its Impact on Stock Market Volatility

Geopolitical instability is a major contributor to current market fluctuations and heightened investment risk. The ripple effects of global events directly impact investor sentiment and market confidence, leading to significant stock market volatility.

The War in Ukraine and Global Supply Chains

The ongoing war in Ukraine has profoundly disrupted global supply chains, causing shortages of essential goods and skyrocketing energy prices. This has fueled inflation and significantly impacted various industries.

- Affected Industries: Energy, agriculture, manufacturing, and technology sectors have all experienced disruptions. Companies reliant on Ukrainian or Russian resources have faced substantial challenges.

- Specific Examples: The price of wheat and oil has surged, impacting food and transportation costs globally. Semiconductor production has been hampered, affecting the tech industry.

- Market Volatility: The uncertainty surrounding the conflict's duration and outcome contributes to significant market volatility, as investors grapple with unpredictable economic consequences.

Rising Geopolitical Tensions in Other Regions

Beyond the war in Ukraine, several other geopolitical hotspots add to the overall economic uncertainty and contribute to stock market volatility.

- US-China Relations: Ongoing trade tensions and political disagreements between the US and China create instability and uncertainty in global markets.

- Tensions in the Middle East: Conflicts and political instability in the Middle East continue to impact oil prices and global energy markets, creating further volatility.

- Market Uncertainty: The cumulative effect of these tensions is heightened market uncertainty, making it challenging for investors to predict market direction and manage their portfolios effectively.

Inflation and Interest Rate Hikes: Fueling Stock Market Volatility

Persistent inflation and subsequent interest rate hikes are powerful drivers of stock market volatility. These intertwined economic factors significantly impact investor behavior and market valuations.

The Impact of Rising Inflation

High inflation erodes purchasing power, reducing consumer spending and impacting corporate profitability. Central banks respond by raising interest rates to curb inflation, which has a significant cascading effect.

- Impact on Stock Valuations: Higher interest rates increase the discount rate used to value future earnings, leading to lower valuations for stocks.

- Reduced Consumer Spending: Inflation reduces disposable income, leading to decreased consumer spending, which hurts businesses and their stock prices.

- Decreased Business Investment: Businesses face higher borrowing costs, leading to reduced investment in expansion and innovation.

The Fed's Response and its Market Implications

The Federal Reserve (or other central banks globally) plays a crucial role in managing inflation. Its response, primarily through interest rate hikes, directly influences stock market volatility.

- Interest Rate Hikes: Increasing interest rates aims to slow down economic growth and curb inflation but can also trigger a recession.

- Increased Borrowing Costs: Higher interest rates increase borrowing costs for businesses and individuals, dampening economic activity and potentially impacting stock prices.

- Recessionary Fears: The risk of a recession due to aggressive interest rate hikes contributes significantly to market uncertainty and increased volatility.

Navigating Stock Market Volatility: Strategies for Investors

Effectively navigating periods of high stock market volatility requires a well-defined investment strategy and a disciplined approach.

Diversification and Risk Management

Diversifying your investment portfolio is crucial for mitigating risk. Spreading investments across various asset classes reduces the impact of any single investment's poor performance.

- Asset Classes: Diversification involves allocating funds across stocks, bonds, real estate, commodities, and other alternative investments.

- Correlation/Anti-correlation: Understanding the correlation between different asset classes is key. Some asset classes may perform well when others underperform, helping to balance out overall portfolio returns.

- Risk Management Tools: Using stop-loss orders to limit potential losses and hedging strategies can further mitigate risk during volatile periods.

Long-Term Investing vs. Short-Term Trading

Adopting a long-term investment strategy is generally recommended over short-term trading in volatile markets.

- Long-Term Perspective: A long-term perspective allows you to ride out market fluctuations and benefit from long-term growth.

- Emotional Decision-Making: Avoid impulsive decisions based on short-term market swings. Emotional trading often leads to poor investment outcomes.

- Disciplined Approach: Sticking to a well-defined investment plan and avoiding emotional reactions is crucial for successful long-term investing.

Seeking Professional Financial Advice

Seeking guidance from a qualified financial advisor is highly recommended, especially during periods of high stock market volatility.

- Risk Tolerance Assessment: A financial advisor can help assess your risk tolerance and create a personalized investment strategy aligned with your goals.

- Tailored Strategies: They can develop strategies to manage risk and navigate market volatility effectively.

- Expert Guidance: Professional advice provides valuable insights and support during uncertain economic times.

Conclusion

The increased volatility in today's stock market is primarily driven by geopolitical uncertainty, persistent inflation, and central bank responses, like interest rate hikes. Understanding these factors is crucial for effective investment management. Key takeaways include the importance of diversification, employing robust risk management strategies, and adopting a long-term investment approach. Furthermore, seeking professional financial advice is paramount for navigating the complexities of stock market volatility and creating a robust investment strategy tailored to your individual needs and risk tolerance. Understanding stock market volatility is crucial for navigating the current economic climate. Take control of your investments by learning more about effective strategies and consulting with a financial advisor today.

Featured Posts

-

Plan Your Visit Harrogate Spring Flower Show April 24 27 2025

Apr 25, 2025

Plan Your Visit Harrogate Spring Flower Show April 24 27 2025

Apr 25, 2025 -

Former Charlottesville Meteorologist Arrested Felony Sexual Extortion Charges

Apr 25, 2025

Former Charlottesville Meteorologist Arrested Felony Sexual Extortion Charges

Apr 25, 2025 -

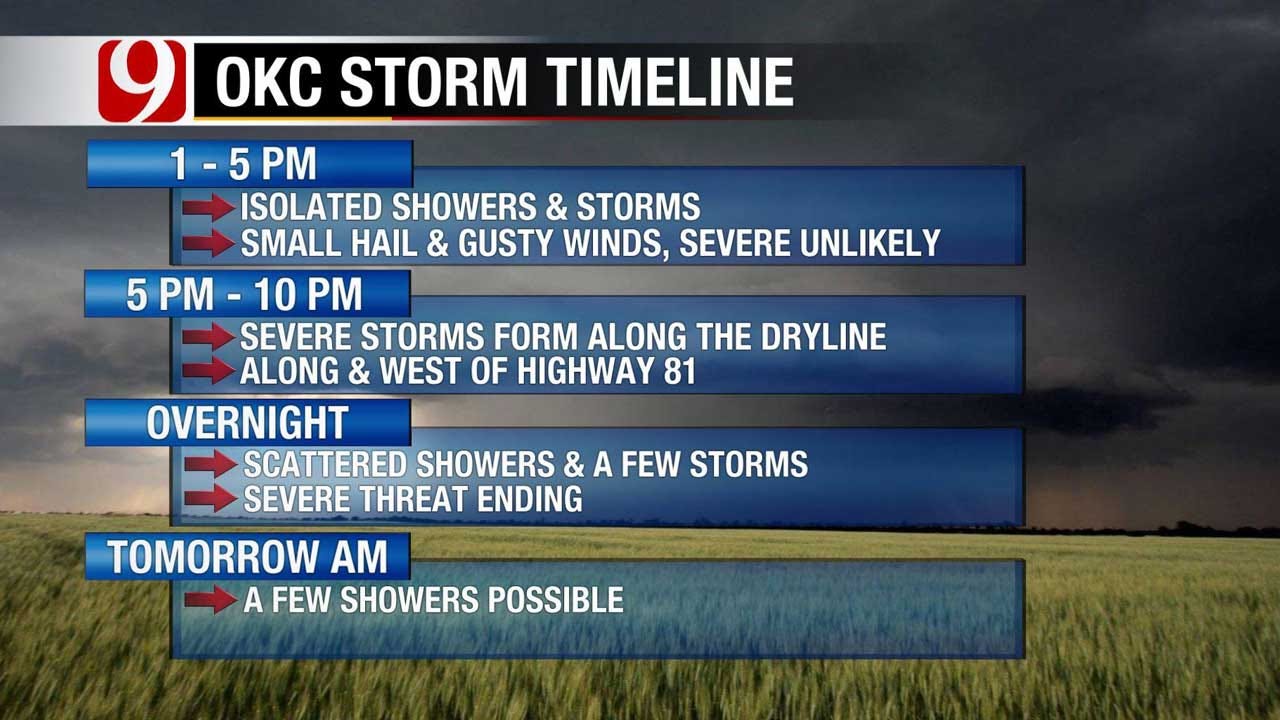

Wednesdays Oklahoma Storms A Timeline Of Expected Hail And Strong Winds

Apr 25, 2025

Wednesdays Oklahoma Storms A Timeline Of Expected Hail And Strong Winds

Apr 25, 2025 -

Sherwood Ridge Primary School Accommodates Faith Based Anzac Day Absence

Apr 25, 2025

Sherwood Ridge Primary School Accommodates Faith Based Anzac Day Absence

Apr 25, 2025 -

Sextortion Charges Against Meteorologist Josh Fitzpatrick A Comprehensive Overview

Apr 25, 2025

Sextortion Charges Against Meteorologist Josh Fitzpatrick A Comprehensive Overview

Apr 25, 2025