Understanding The Net Asset Value Of Amundi MSCI World II UCITS ETF USD Hedged Dist

Table of Contents

What is Net Asset Value (NAV) and How is it Calculated?

For ETF investors, the Net Asset Value (NAV) represents the net value of a single share in the fund. It's essentially the market value of all the assets the ETF holds, minus its liabilities, divided by the number of outstanding shares. Understanding your Amundi MSCI World II ETF's NAV is crucial for tracking performance and making sound investment choices.

The calculation is straightforward:

(Assets - Liabilities) / Number of Shares Outstanding = NAV

Let's break down the components:

-

Assets: These are the underlying investments held by the Amundi MSCI World II UCITS ETF USD Hedged Dist. This typically includes a diversified portfolio of global equities mirroring the MSCI World Index, with a currency hedge in place to mitigate USD fluctuations.

-

Liabilities: These are the fund's expenses and obligations, including management fees, administrative costs, and any other outstanding debts.

-

Number of Shares Outstanding: The total number of shares issued and currently held by investors.

Illustrative Examples:

- Assets: Holdings in Apple, Microsoft, Amazon, and other global companies comprising the MSCI World Index.

- Liabilities: Management fees charged by Amundi, administrative expenses, and any accrued expenses.

Factors Affecting the NAV of Amundi MSCI World II UCITS ETF USD Hedged Dist

Several factors influence the daily NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist:

-

Currency Fluctuations: The "USD Hedged" aspect is crucial. The ETF employs strategies to mitigate the impact of currency fluctuations between the underlying assets' currencies (likely a mix of global currencies) and the US dollar. However, these hedging strategies aren't perfect and can still be subject to minor effects. A stronger USD against other currencies could slightly decrease the NAV, while a weaker USD could have the opposite effect.

-

MSCI World Index Performance: The performance of the underlying MSCI World Index is the primary driver of the Amundi MSCI World II ETF NAV. Positive market movements in the index generally lead to an increase in the NAV, and vice-versa.

-

ETF Management Fees and Expenses: The ongoing management fees and operational expenses deducted from the fund directly impact the NAV. These fees are reflected in the daily calculation.

Specific Factors:

- Changes in the value of the underlying assets (e.g., stock price fluctuations).

- Currency exchange rate movements (despite the hedging strategy).

- Expense ratios and management fees charged by Amundi.

- Dividend distributions (which reduce the NAV but provide income to investors).

Where to Find the NAV of Amundi MSCI World II UCITS ETF USD Hedged Dist

The daily NAV for the Amundi MSCI World II UCITS ETF USD Hedged Dist is readily available from several sources:

-

Amundi Website: The official Amundi website is the most reliable source. Look for the fund's factsheet or dedicated page for the ETF. The NAV will typically be updated at the close of each trading day.

-

Financial News Websites: Many reputable financial news and data providers (like Yahoo Finance, Google Finance, Bloomberg) display real-time or end-of-day NAV information for ETFs.

-

Brokerage Platforms: If you hold the ETF through a brokerage account, the NAV will be displayed alongside your portfolio holdings.

Specific Sources:

- [Link to Amundi Website - replace with actual link]

- [Link to Yahoo Finance - replace with actual link – search for the ETF ticker]

- [Link to your brokerage platform - replace with actual link]

Understanding NAV and Investment Decisions

Monitoring the NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist is crucial for informed investment decisions.

-

Performance Tracking: Changes in the NAV directly reflect the ETF's performance over time. By tracking the NAV, you can assess the fund's growth and compare it to other investments.

-

NAV vs. Share Price: While the NAV and the ETF's share price should ideally be very close, slight discrepancies can occur due to intraday trading. However, significant differences should prompt further investigation.

-

Buy/Sell Decisions: Understanding NAV fluctuations helps in timing your buy and sell decisions. For example, a consistent drop in NAV may signal a need to re-evaluate your investment strategy.

Practical Advice:

- Use NAV to compare the Amundi MSCI World II ETF's performance against benchmarks or other similar ETFs.

- Understand that NAV fluctuations are normal, but significant or sustained drops may warrant a review of your investment plan.

- Consult a financial advisor for personalized guidance on your investment strategy.

Conclusion

Understanding the Net Asset Value (NAV) of the Amundi MSCI World II UCITS ETF USD Hedged Dist is vital for every investor. This article covered its calculation, influencing factors, where to find it, and how to use it in investment decision-making. Remember to regularly check the NAV of your Amundi MSCI World II UCITS ETF USD Hedged Dist holdings. For further guidance on Amundi MSCI World II ETF NAV, or any other aspect of ETF investment, don't hesitate to consult with a qualified financial advisor. By actively monitoring your Amundi MSCI World II ETF NAV and other key metrics, you can make better informed decisions and enhance your investment journey.

Featured Posts

-

Jejak Porsche 356 Dari Zuffenhausen Jerman Menuju Legenda

May 24, 2025

Jejak Porsche 356 Dari Zuffenhausen Jerman Menuju Legenda

May 24, 2025 -

Hihetetlenuel Draga Porsche 911 80 Millio Forint Az Extrak Ara

May 24, 2025

Hihetetlenuel Draga Porsche 911 80 Millio Forint Az Extrak Ara

May 24, 2025 -

H Nonline Sk Nemecke Firmy A Masivne Prepustanie Dosledky Hospodarskej Krizy

May 24, 2025

H Nonline Sk Nemecke Firmy A Masivne Prepustanie Dosledky Hospodarskej Krizy

May 24, 2025 -

Your Ticket To Bbc Radio 1 Big Weekend 2025 How To Buy

May 24, 2025

Your Ticket To Bbc Radio 1 Big Weekend 2025 How To Buy

May 24, 2025 -

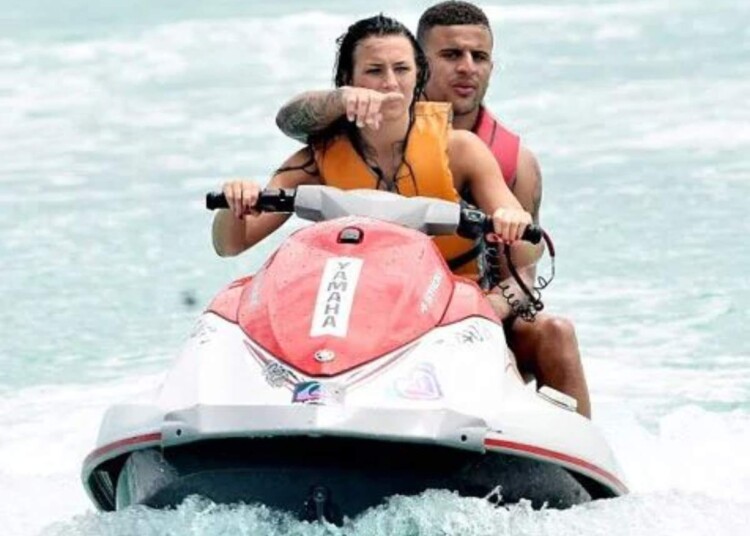

Kyle Walker Mystery Women And Annie Kilner Understanding Recent Events

May 24, 2025

Kyle Walker Mystery Women And Annie Kilner Understanding Recent Events

May 24, 2025

Latest Posts

-

Lady Gaga Hand In Hand With Fiance Michael Polansky At Snl Afterparty

May 24, 2025

Lady Gaga Hand In Hand With Fiance Michael Polansky At Snl Afterparty

May 24, 2025 -

New Measures In France Addressing Juvenile Crime Through Increased Penalties

May 24, 2025

New Measures In France Addressing Juvenile Crime Through Increased Penalties

May 24, 2025 -

Amira Al Zuhairs Stunning Zimmermann Debut At Paris Fashion Week

May 24, 2025

Amira Al Zuhairs Stunning Zimmermann Debut At Paris Fashion Week

May 24, 2025 -

Ex French Premier Challenges Macrons Leadership

May 24, 2025

Ex French Premier Challenges Macrons Leadership

May 24, 2025 -

Lady Gaga And Michael Polansky At Snl Afterparty

May 24, 2025

Lady Gaga And Michael Polansky At Snl Afterparty

May 24, 2025