Understanding The Recent Increase In Bitcoin Mining Operations

Table of Contents

Increased Institutional Investment in Bitcoin Mining

Large corporations and institutional investors are increasingly recognizing the potential of Bitcoin mining as a viable investment strategy. The emergence of publicly traded mining companies has further fueled this trend, providing a more accessible entry point for institutional participation in the cryptocurrency market. This influx of capital is significantly expanding mining operations worldwide, leading to a higher overall hash rate.

- Examples of large-scale mining operations: Companies like Riot Platforms, Marathon Digital Holdings, and Argo Blockchain are leading examples of publicly traded firms with substantial Bitcoin mining operations, demonstrating the growing institutional interest in the sector.

- Analysis of investment strategies in the mining sector: Institutional investors are adopting diverse strategies, ranging from direct investments in mining companies to the acquisition of mining hardware and the establishment of their own mining facilities.

- Impact of institutional investment on Bitcoin price: The increased involvement of institutional investors often leads to greater market stability and can positively influence Bitcoin's price, creating a virtuous cycle that further incentivizes mining activity.

The Growing Adoption of ASIC Miners and Specialized Hardware

Advancements in Application-Specific Integrated Circuit (ASIC) technology are revolutionizing Bitcoin mining. Newer, more efficient ASIC miners are significantly increasing the hash rate while simultaneously reducing energy consumption. This technological progress is a major driver behind the recent surge in Bitcoin mining operations.

- Comparison of older vs. newer ASIC miners: Modern ASIC miners boast significantly higher hash rates and lower power consumption compared to their predecessors, making Bitcoin mining more profitable and environmentally sustainable.

- Impact of technological advancements on mining profitability: The development of more efficient ASIC miners directly translates into increased profitability for mining operations, encouraging further investment and expansion in the sector.

- Discussion of energy efficiency improvements in ASICs: Continuous improvements in ASIC design are leading to a reduction in energy consumption per unit of hashing power, addressing environmental concerns associated with Bitcoin mining.

Geographic Shifts in Bitcoin Mining Locations

The pursuit of cheaper electricity is driving a significant geographical shift in Bitcoin mining locations. Mining operations are increasingly relocating to regions with abundant hydroelectric power or other low-cost energy sources. This relocation has significant environmental implications, both positive and negative.

- Examples of countries attracting Bitcoin mining operations: Countries like Kazakhstan, the United States (particularly in states with abundant hydroelectric power), and some parts of Canada have become attractive locations due to lower energy costs.

- Analysis of energy costs in different regions: The cost of electricity is a critical factor in determining the profitability of Bitcoin mining. Regions with lower energy costs attract a higher concentration of mining operations.

- Debate around the environmental sustainability of Bitcoin mining: The environmental impact of Bitcoin mining is a subject of ongoing debate. While the shift towards regions with renewable energy sources is a positive step, the overall energy consumption remains a significant consideration. The industry is actively exploring sustainable Bitcoin mining solutions.

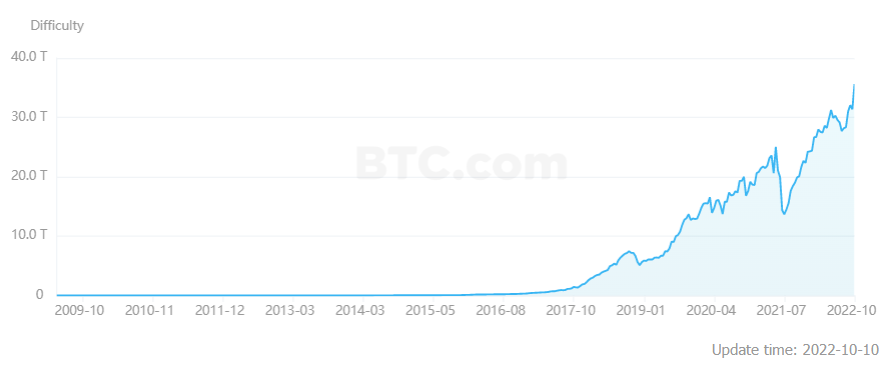

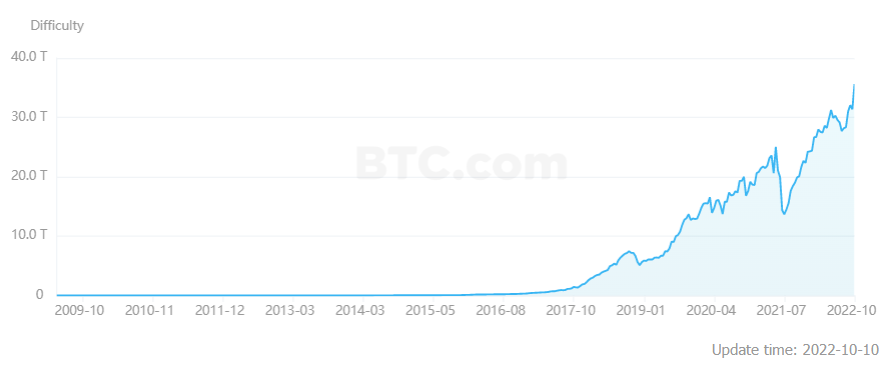

The Influence of Bitcoin's Price on Mining Activity

A strong correlation exists between Bitcoin's price and the profitability of mining operations. When the Bitcoin price increases, mining becomes more profitable, stimulating greater activity. Conversely, price drops can lead to decreased mining activity or even the shutdown of less profitable operations.

- Explanation of the relationship between Bitcoin price and mining rewards: The reward for successfully mining a Bitcoin block is fixed in Bitcoin, but its value in fiat currency directly correlates with the Bitcoin price. Higher prices mean higher rewards.

- Impact of market volatility on mining operations: Market volatility can significantly impact mining profitability. Sudden price drops can force miners to operate at a loss, potentially leading to the shutdown of some operations.

- Analysis of historical data showing price-mining activity correlation: Historical data clearly demonstrates a strong positive correlation between Bitcoin's price and the overall hash rate, indicating that higher prices incentivize increased mining activity.

Conclusion: Understanding the Future of Bitcoin Mining Operations

The recent increase in Bitcoin mining operations is a multifaceted phenomenon driven by a convergence of factors: significant institutional investment, continuous advancements in Bitcoin mining technology, geographical shifts towards cheaper energy, and the influence of Bitcoin's price. The future of Bitcoin mining will likely be shaped by ongoing technological innovation, further institutional adoption, and the evolving regulatory landscape. The environmental sustainability of Bitcoin mining will remain a critical focus.

To stay informed about this dynamic sector and its implications for the cryptocurrency market, further research into Bitcoin mining profitability and Bitcoin mining technology is strongly recommended. Understanding these trends is vital for anyone involved in or interested in the exciting and evolving world of Bitcoin mining operations.

Featured Posts

-

Ripple Xrp News Brazil Greenlights First Spot Xrp Etf Trumps Ripple Endorsement

May 08, 2025

Ripple Xrp News Brazil Greenlights First Spot Xrp Etf Trumps Ripple Endorsement

May 08, 2025 -

Pakstan Jely Dstawyzat Awr Gdagry Myn Mlwth Tyn Khwatyn Grftar

May 08, 2025

Pakstan Jely Dstawyzat Awr Gdagry Myn Mlwth Tyn Khwatyn Grftar

May 08, 2025 -

Thousands Face Increased Dwp Scrutiny Home Visit Numbers Double

May 08, 2025

Thousands Face Increased Dwp Scrutiny Home Visit Numbers Double

May 08, 2025 -

Dwp Breaks Silence On New Universal Credit Six Month Rule

May 08, 2025

Dwp Breaks Silence On New Universal Credit Six Month Rule

May 08, 2025 -

Seri Ata Na Vesprem Prodolzhuva Pobeda Nad Ps Zh

May 08, 2025

Seri Ata Na Vesprem Prodolzhuva Pobeda Nad Ps Zh

May 08, 2025