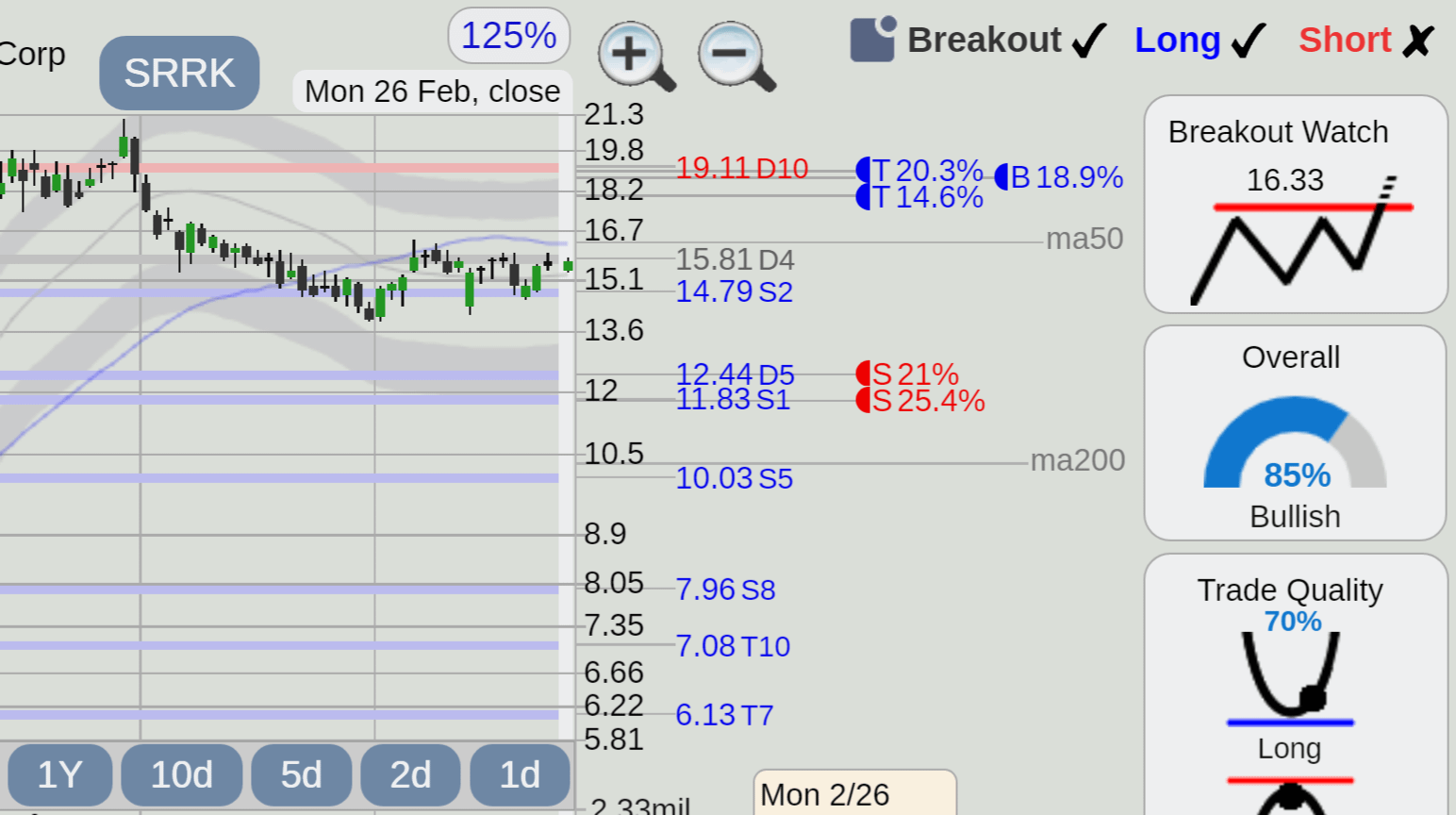

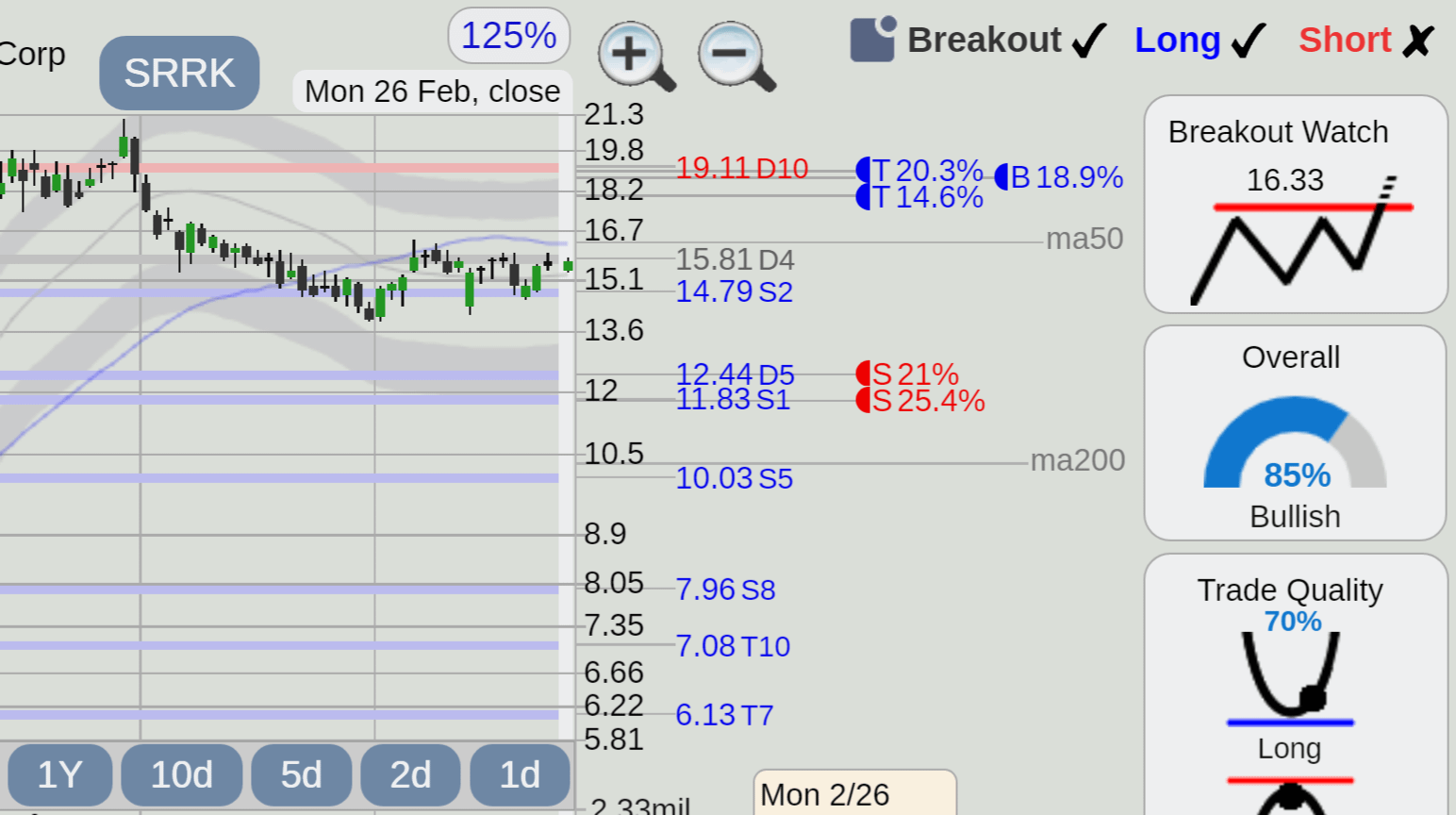

Understanding The Recent Scholar Rock Stock Price Drop

Table of Contents

Market-Wide Factors Affecting Scholar Rock's Stock Price

Several macroeconomic and industry-specific factors have contributed to the recent volatility in the biotech sector, impacting Scholar Rock's stock price along with many of its peers.

Broader Biotech Sector Downturn

The broader biotechnology sector has seen a downturn recently, impacting companies like Scholar Rock. This is reflected in the performance of relevant market indices such as the NASDAQ Biotechnology Index, which has experienced significant volatility. Several factors contribute to this overall decline:

- Increased regulatory scrutiny of biotech companies: Stringent regulatory requirements and increased scrutiny by agencies like the FDA can lead to delays in drug approvals and increased development costs, negatively impacting investor confidence and stock valuations.

- Reduced investor appetite for risk in the current economic climate: Rising interest rates and persistent inflation have made investors more risk-averse, leading them to shift away from high-growth, high-risk sectors like biotechnology in favor of more stable investments.

- Competition from other biotech firms impacting stock prices: The biotech industry is highly competitive, with numerous companies vying for market share. Intense competition can pressure pricing and profitability, affecting stock performance.

Overall Market Volatility and Investor Sentiment

Beyond the biotech sector, general market volatility and shifts in investor sentiment have also played a role. Geopolitical events, economic uncertainty, and changes in investor expectations significantly influence market sentiment and risk tolerance.

- Geopolitical events and their impact on market confidence: Global instability and uncertainty can trigger widespread sell-offs, impacting even fundamentally sound companies like Scholar Rock.

- Changes in investor expectations and future growth projections: Revised growth projections for the biotechnology industry as a whole, or for Scholar Rock specifically, can trigger downward pressure on stock prices.

- The role of short selling in driving down the stock price: Short selling, where investors bet against a stock's performance, can exacerbate downward price movements, particularly during periods of uncertainty.

Scholar Rock Specific News and Developments

In addition to broader market forces, several company-specific events may have contributed to the Scholar Rock stock price drop.

Recent Clinical Trial Results and Updates

The success or failure of clinical trials is a major driver of biotech stock prices. Any delays, setbacks, or negative results can significantly impact investor confidence.

- Specific details of positive or negative trial data: Transparency regarding clinical trial data is crucial. Any negative findings or unexpected challenges within the trials need to be carefully analyzed for their impact on the overall development timelines and market outlook.

- Discussion of the impact of these results on investor confidence: Investors rely on clinical trial data to gauge the potential success of a drug candidate. Negative results often lead to a significant sell-off.

- Analysis of the company's response to the news: The company's communication strategy and its response to both positive and negative news significantly impact investor perception and confidence.

Financial Performance and Guidance

Scholar Rock's financial performance and guidance also play a crucial role in shaping investor sentiment and the stock price.

- Key financial metrics and their performance compared to expectations: Metrics like revenue, earnings, and cash flow need to be analyzed against previous performance and industry benchmarks.

- Any revisions in financial projections provided by the management team: Any downward revisions in financial projections, particularly regarding revenue or profitability, will negatively impact the stock price.

- The implications of these financial results for future growth: The long-term implications of financial performance for future growth and sustainability of operations are key considerations for investors.

Management Changes or Corporate Actions

Changes in management or significant corporate actions can also impact investor confidence and the stock price.

- Details about any significant management changes: Changes at the top can signal uncertainty and may lead to a sell-off, particularly if there is a lack of clarity about the future direction of the company.

- Explanation of how these changes could impact future strategy: New leadership may bring about changes in strategy, potentially affecting investor confidence, positively or negatively.

- Assessment of the market's reaction to these events: The market's reaction to these changes, as reflected in the stock price, is a key indicator of investor sentiment.

Conclusion

This analysis has explored various factors contributing to the recent Scholar Rock stock price drop, encompassing both market-wide influences and company-specific developments. Understanding these intertwined factors is crucial for investors seeking to make informed decisions about SRRK. The interplay of broader economic conditions, industry trends, and Scholar Rock’s specific performance all contribute to the current market valuation.

Call to Action: While the recent Scholar Rock stock price drop presents challenges, it also offers opportunities for discerning investors. Continue to monitor Scholar Rock's progress, follow clinical trial updates, and conduct thorough due diligence before making any investment decisions related to the Scholar Rock stock price. Further research into the Scholar Rock Holding Corporation (SRRK) and its future prospects is highly recommended. Understanding the intricacies of the SRRK stock price and the factors influencing it is key to making sound investment choices.

Featured Posts

-

No More Cash On Uber Auto Does Upi Payment Still Work

May 08, 2025

No More Cash On Uber Auto Does Upi Payment Still Work

May 08, 2025 -

Vesprem So Desetta Pobeda Vo Ligata Na Shampionite

May 08, 2025

Vesprem So Desetta Pobeda Vo Ligata Na Shampionite

May 08, 2025 -

Nba Thunder Players Fire Shots At National Media

May 08, 2025

Nba Thunder Players Fire Shots At National Media

May 08, 2025 -

The Long Walk Movie Stephen Kings Classic Coming To The Big Screen

May 08, 2025

The Long Walk Movie Stephen Kings Classic Coming To The Big Screen

May 08, 2025 -

Dwps New Approach To Universal Credit Claim Verification

May 08, 2025

Dwps New Approach To Universal Credit Claim Verification

May 08, 2025