Understanding The Treasury Market After April 8th's Events

Table of Contents

The April 8th Events and Their Immediate Impact on Treasury Yields

April 8th witnessed significant turmoil in the banking sector, culminating in the failure of several regional banks. This triggered a rapid reassessment of risk across financial markets. The immediate consequence was a dramatic shift in the Treasury market, primarily driven by a flight to safety. Treasury yields, which represent the return on investment for Treasury securities, initially experienced a sharp decline. This reflected the increased demand for these perceived safe-haven assets.

- Increased demand for safe-haven assets like Treasuries: Investors, spooked by the banking crisis, flocked to the perceived safety of U.S. Treasury securities, driving up their prices and pushing yields down.

- Impact on short-term vs. long-term Treasury yields: The impact was most pronounced on short-term Treasury yields, particularly T-bills, as investors sought the most liquid and secure options. Long-term Treasury yields also fell, but to a lesser extent.

- Specific yield curve movements: The yield curve, which illustrates the relationship between Treasury yields across different maturities, flattened significantly, reflecting the increased demand for shorter-term securities.

- Reference to specific Treasury securities: This included a surge in demand for T-bills, 2-year notes, and even longer-term Treasury bonds as investors sought refuge from the uncertainty.

Analyzing the Flight to Safety and Increased Demand for Treasuries

The events of April 8th sparked a classic "flight to safety," a phenomenon where investors move their capital from riskier assets to safer havens during times of economic uncertainty. The Treasury market, backed by the full faith and credit of the U.S. government, became the primary beneficiary of this shift.

- Uncertainty in the banking sector: The instability in the banking sector fueled investor anxiety, prompting a massive shift towards the perceived safety of U.S. Treasuries.

- Investor sentiment and risk aversion: Risk aversion increased dramatically, pushing investors to favor low-risk, liquid assets like government bonds.

- Role of central bank interventions: Central bank interventions, including emergency lending facilities and assurances of liquidity support, further stabilized the situation but also influenced Treasury market dynamics.

- Impact on Treasury auctions and bidding: Treasury auctions experienced higher-than-expected demand, reflecting the intense appetite for these securities. Bidding was exceptionally competitive, further depressing yields.

Long-Term Implications for the Treasury Market and Interest Rates

The long-term implications of April 8th's events on the Treasury market remain to be seen, but several key factors suggest continued volatility and potential shifts in interest rates.

- Potential for continued volatility: While the immediate crisis may have subsided, lingering uncertainty could lead to continued volatility in the Treasury market. Geopolitical events and further economic data releases will likely continue to influence Treasury yields.

- Impact on inflation expectations: The events of April 8th could impact inflation expectations, affecting the Federal Reserve's monetary policy decisions and influencing long-term Treasury yields.

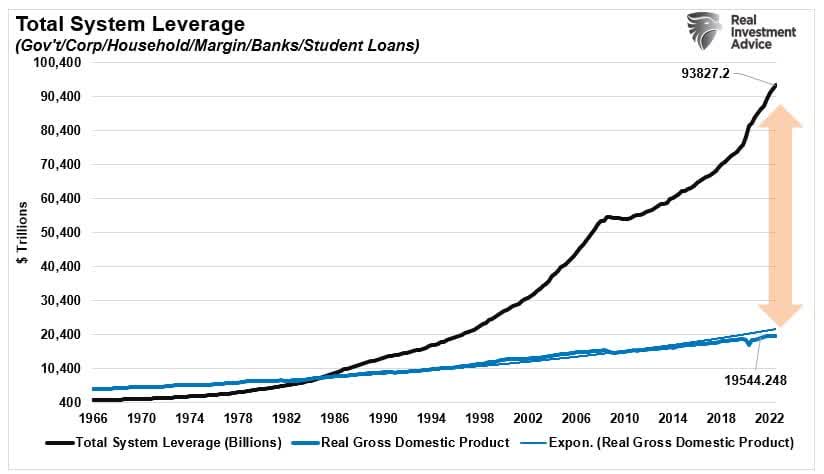

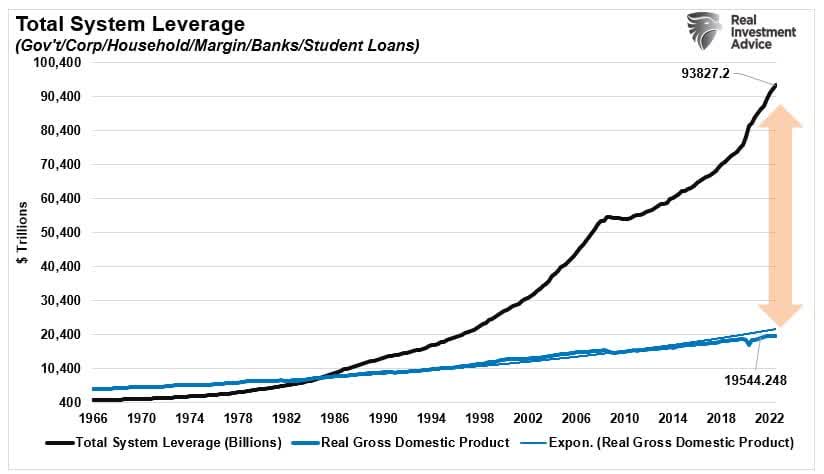

- Long-term implications for borrowing costs: Changes in Treasury yields directly impact borrowing costs across the economy, influencing everything from mortgage rates to corporate financing.

- Effects on other asset classes: The flight to safety impacted other asset classes, with investors pulling back from riskier investments like stocks and corporate bonds in favor of the relative security of the Treasury market.

Strategies for Navigating the Changed Treasury Market Landscape

The changed landscape necessitates a strategic approach for investors navigating the Treasury market. Risk management and diversification are key.

- Diversification within the Treasury market: Investors should diversify their holdings across different maturities and types of Treasury securities to manage risk effectively.

- Strategies for managing interest rate risk: Understanding and managing interest rate risk is crucial, given the potential for continued volatility in yields.

- Importance of due diligence and research: Thorough research and due diligence are paramount to making informed investment decisions in this dynamic environment.

- Potential investment opportunities in the current environment: While uncertainty persists, the current environment presents potential opportunities for investors with a long-term perspective and a keen understanding of Treasury market dynamics.

Conclusion

The events of April 8th had a profound and multifaceted impact on the Treasury market, triggering a significant flight to safety and influencing both short-term and long-term Treasury yields. Understanding these dynamics is critical for investors and market participants. The long-term implications remain uncertain, but continued volatility and shifts in interest rates are likely. Stay informed about the evolving Treasury market and its impact on your portfolio. Continue researching and understanding the implications of April 8th's events to make informed investment decisions in the Treasury market moving forward. Regularly monitor Treasury yield fluctuations and adapt your strategies accordingly.

Featured Posts

-

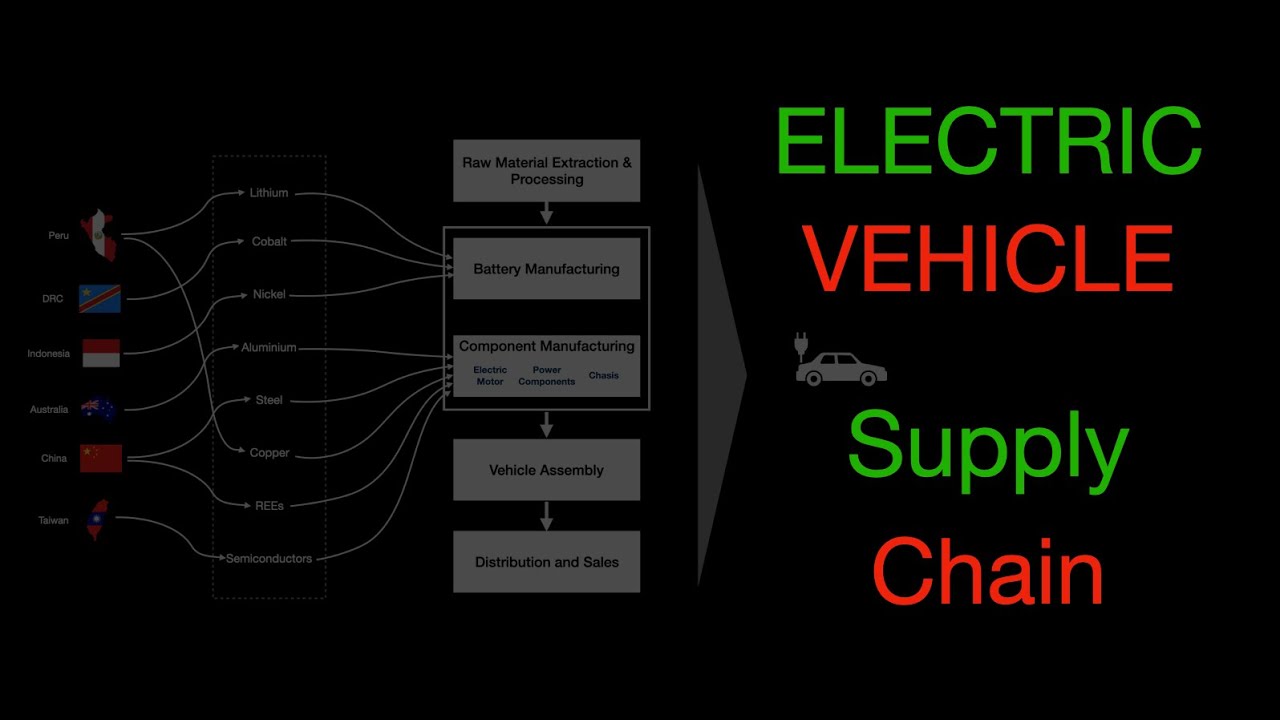

Dysprosiums Growing Importance In Electric Vehicles A Supply Chain Crisis

Apr 29, 2025

Dysprosiums Growing Importance In Electric Vehicles A Supply Chain Crisis

Apr 29, 2025 -

Reliance Industries Stock Jumps After Positive Earnings Report

Apr 29, 2025

Reliance Industries Stock Jumps After Positive Earnings Report

Apr 29, 2025 -

Nyt Spelling Bee Solution February 28 2025 Find The Spangram Here

Apr 29, 2025

Nyt Spelling Bee Solution February 28 2025 Find The Spangram Here

Apr 29, 2025 -

Secure Your Capital Summertime Ball 2025 Tickets Tips And Strategies

Apr 29, 2025

Secure Your Capital Summertime Ball 2025 Tickets Tips And Strategies

Apr 29, 2025 -

Fhi Rapport Medisinering Mot Adhd Og Utfordringer I Skolen

Apr 29, 2025

Fhi Rapport Medisinering Mot Adhd Og Utfordringer I Skolen

Apr 29, 2025