Understanding The Uber (UBER) Investment Landscape

Table of Contents

Analyzing Uber's Business Model and Revenue Streams

Uber's success hinges on its diverse revenue streams, extending beyond its flagship ride-sharing service. Understanding these components is key to assessing the Uber (UBER) investment landscape.

Ride-Sharing Dominance and Market Share

Uber's ride-sharing service remains its core business, commanding significant market share globally. However, its dominance varies regionally.

- Market Share Data: While Uber holds a leading position in many major cities, its market share fluctuates depending on competition from rivals like Lyft and local taxi services. Precise figures vary by region and require ongoing monitoring.

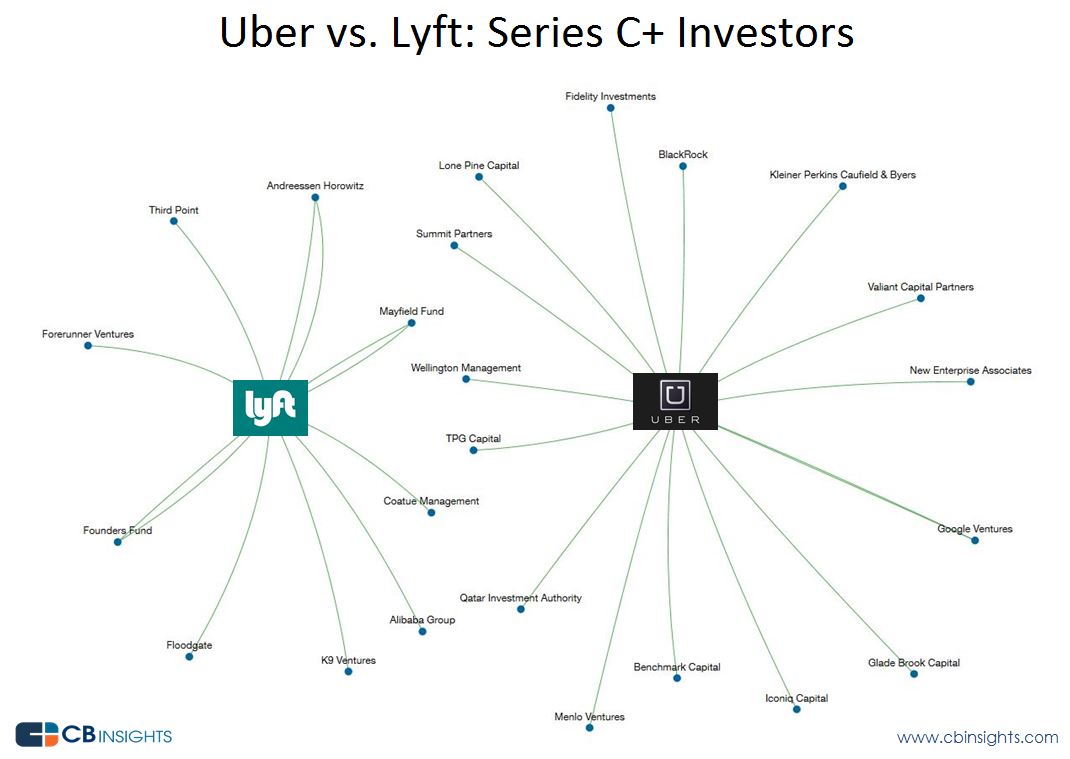

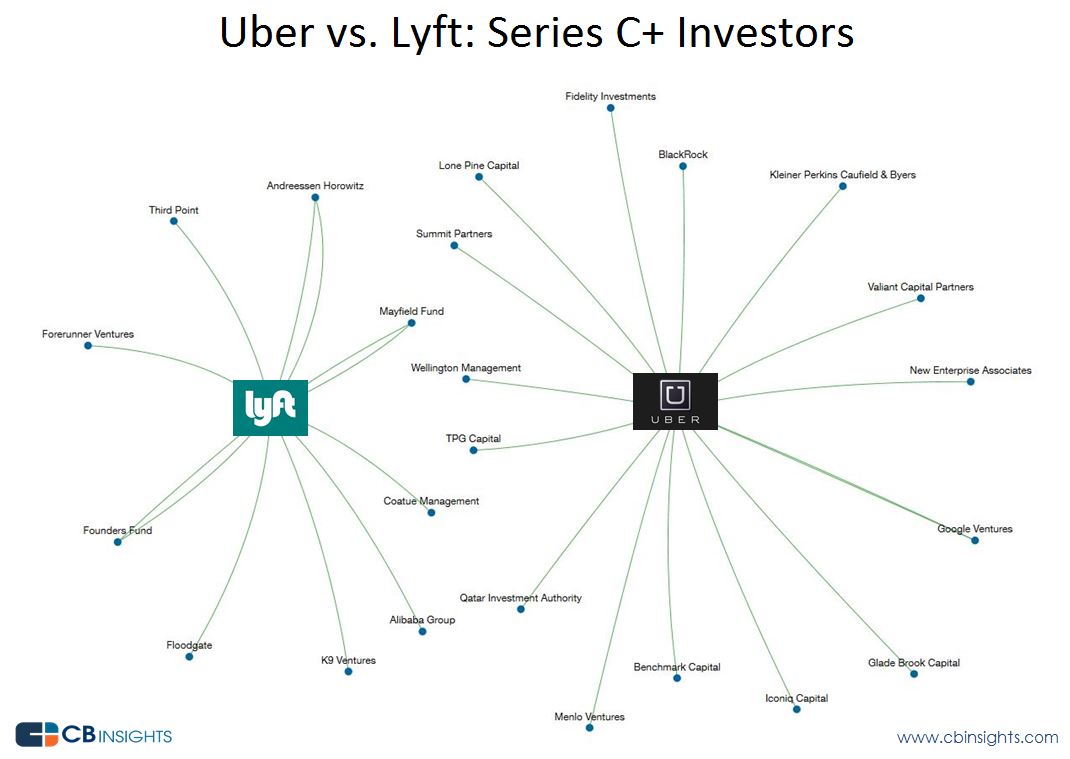

- Competitive Analysis: Lyft presents the most significant competition in the US, while other local players dominate certain international markets. Uber's competitive advantages include brand recognition, technological infrastructure, and a vast driver network. Disadvantages include regulatory hurdles and ongoing legal battles in various jurisdictions.

- Geographic Expansion Plans: Uber continuously expands into new markets, seeking growth opportunities in both developed and emerging economies. This expansion strategy, while offering potential for future growth, also involves significant investment and carries inherent risks.

Uber Eats and Delivery Services

Uber Eats, Uber's food delivery service, represents a substantial and rapidly growing revenue stream. Its performance is a critical aspect of the Uber (UBER) investment landscape.

- Market Share Compared to Competitors: Uber Eats competes fiercely with established players like DoorDash and Grubhub, battling for market share in a crowded and rapidly evolving industry. The competitive intensity impacts profitability and future growth potential.

- Expansion into New Delivery Categories: Uber is expanding beyond food delivery, exploring grocery delivery, and other categories. This diversification strategy aims to reduce reliance on a single revenue source and increase market reach. Success in these areas is crucial for future growth.

- Profitability Analysis: While Uber Eats contributes significantly to revenue, profitability remains a challenge, largely due to high operational costs and competitive pricing pressures. Analyzing its profit margins and unit economics is crucial for evaluating the long-term viability of this segment.

Freight and Other Emerging Businesses

Uber's diversification extends to Uber Freight, targeting the logistics and transportation industry. This strategic move significantly shapes the Uber (UBER) investment landscape.

- Market Analysis of the Freight Industry: The freight industry is large and fragmented, presenting opportunities for disruption and growth. Uber's technological expertise could potentially reshape this market.

- Uber's Competitive Advantages: Uber's existing technology platform and established network provide a competitive edge in the freight industry. However, successful entry requires substantial investment and overcoming the challenges of a complex and established sector.

- Potential for Growth and Profitability: The long-term potential of Uber Freight and other emerging businesses is significant, but it remains uncertain. Investors must carefully consider the risks and opportunities associated with these newer ventures.

Evaluating the Financial Performance of Uber (UBER)

A thorough analysis of Uber's financial performance is critical for understanding the Uber (UBER) investment landscape.

Key Financial Metrics and Indicators

Analyzing key financial metrics provides insights into Uber's operational efficiency and financial health.

- Analysis of Income Statements, Balance Sheets, and Cash Flow Statements: Scrutinizing these financial statements reveals trends in revenue growth, profitability (or lack thereof), operating expenses, and cash flow generation.

- Specific Ratios: Investors should focus on ratios like EBITDA margin (to assess profitability), debt-to-equity ratio (to assess financial leverage), and free cash flow (to gauge cash generation capabilities). These metrics provide a comprehensive view of the company's financial strength.

Profitability and Growth Projections

Uber's path to profitability is a key factor in the Uber (UBER) investment landscape.

- Analysis of Historical Growth Trends: Examining past performance, including revenue growth rates and market share changes, provides a basis for forecasting future performance.

- Forecasts from Reputable Financial Analysts: Consulting independent analyst reports offers valuable insights into future growth projections and potential challenges. These reports often incorporate various scenarios and sensitivities, offering a more nuanced perspective.

- Potential Risks and Uncertainties Affecting Future Performance: Factors like intense competition, regulatory changes, economic downturns, and technological disruptions can significantly impact Uber's future profitability and growth. Investors must account for these uncertainties when making investment decisions.

Assessing the Risks and Rewards of Investing in Uber (UBER)

Investing in Uber involves significant risks and rewards, demanding careful consideration within the Uber (UBER) investment landscape.

Regulatory and Legal Challenges

The regulatory environment surrounding ride-sharing and delivery services poses significant risks.

- Examples of Legal Battles: Uber has faced numerous legal challenges regarding driver classification, licensing, and data privacy. These legal battles can lead to substantial fines and operational disruptions.

- Regulatory Hurdles in Different Countries: Navigating varying regulations across different countries adds complexity and cost, impacting profitability and operational efficiency.

- Potential for Fines and Legal Settlements: The potential for hefty fines and legal settlements poses a considerable risk to Uber's financial stability.

Competition and Market Saturation

Intense competition and potential market saturation represent key risks within the Uber (UBER) investment landscape.

- Discussion of Key Competitors: Lyft, regional ride-sharing services, and established players in the food delivery and freight industries present significant competitive threats.

- Strategies to Combat Competition: Uber's ability to innovate, adapt, and leverage its technological advantages will be crucial in maintaining its competitive edge.

- Potential for Consolidation in the Industry: The possibility of industry consolidation through mergers and acquisitions could further impact Uber's market position and profitability.

Technological Disruption and Innovation

Technological advancements present both opportunities and threats for Uber.

- Emerging Technologies (e.g., Autonomous Vehicles): The development of autonomous vehicles could revolutionize the transportation industry, but also presents potential disruptions to Uber's business model.

- The Need for Continuous Innovation: Uber's long-term success depends on its ability to adapt to technological changes and remain at the forefront of innovation.

- Potential Risks of Technological Obsolescence: Failure to adapt to technological advancements could render Uber's existing services obsolete and negatively impact its market position.

Conclusion

Understanding the Uber (UBER) investment landscape requires a careful assessment of its complex business model, its financial performance, and the considerable risks and rewards involved. The company's diverse revenue streams offer potential for growth, but intense competition, regulatory challenges, and technological disruptions present significant hurdles. Before making any investment decisions, conduct thorough due diligence and consult with a qualified financial advisor. Understanding the intricacies of the Uber (UBER) investment landscape requires diligent research and careful consideration of the risks involved.

Featured Posts

-

Itb Berlin Kuzey Kibris Gastronomisi Duenyaya Tanitildi

May 19, 2025

Itb Berlin Kuzey Kibris Gastronomisi Duenyaya Tanitildi

May 19, 2025 -

Ufc 313 How To Watch Full Fight Card Breakdown And Ticket Information

May 19, 2025

Ufc 313 How To Watch Full Fight Card Breakdown And Ticket Information

May 19, 2025 -

Zheneva Primet Neformalnuyu Vstrechu Genseka Oon Po Kiprskomu Uregulirovaniyu

May 19, 2025

Zheneva Primet Neformalnuyu Vstrechu Genseka Oon Po Kiprskomu Uregulirovaniyu

May 19, 2025 -

Final Destination Bloodlines North America Box Office A 30 M Opening Weekend

May 19, 2025

Final Destination Bloodlines North America Box Office A 30 M Opening Weekend

May 19, 2025 -

Forum Du Logement Gencay Tout Savoir Pour Y Trouver Votre Futur Logement

May 19, 2025

Forum Du Logement Gencay Tout Savoir Pour Y Trouver Votre Futur Logement

May 19, 2025