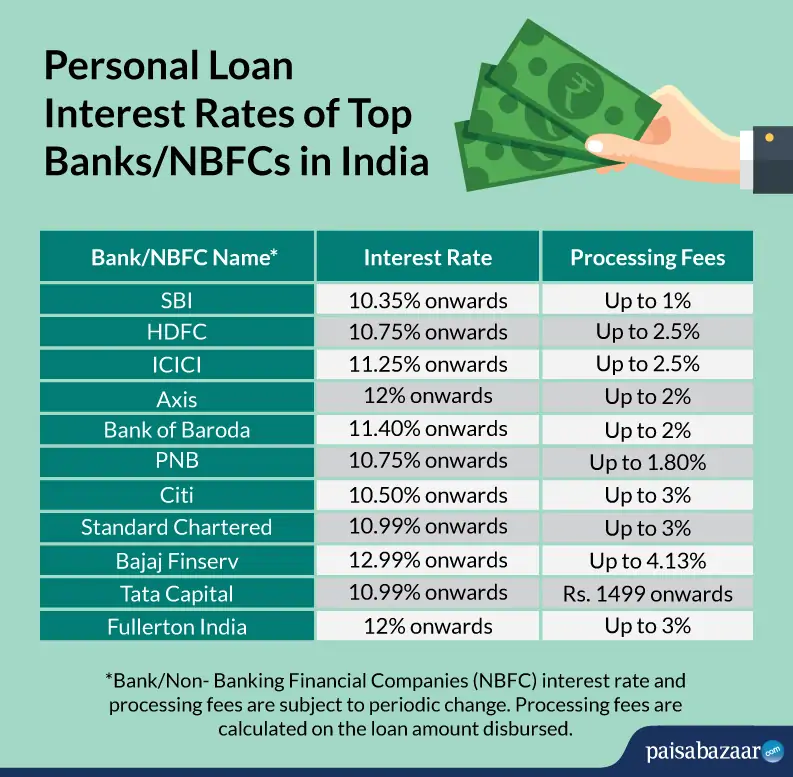

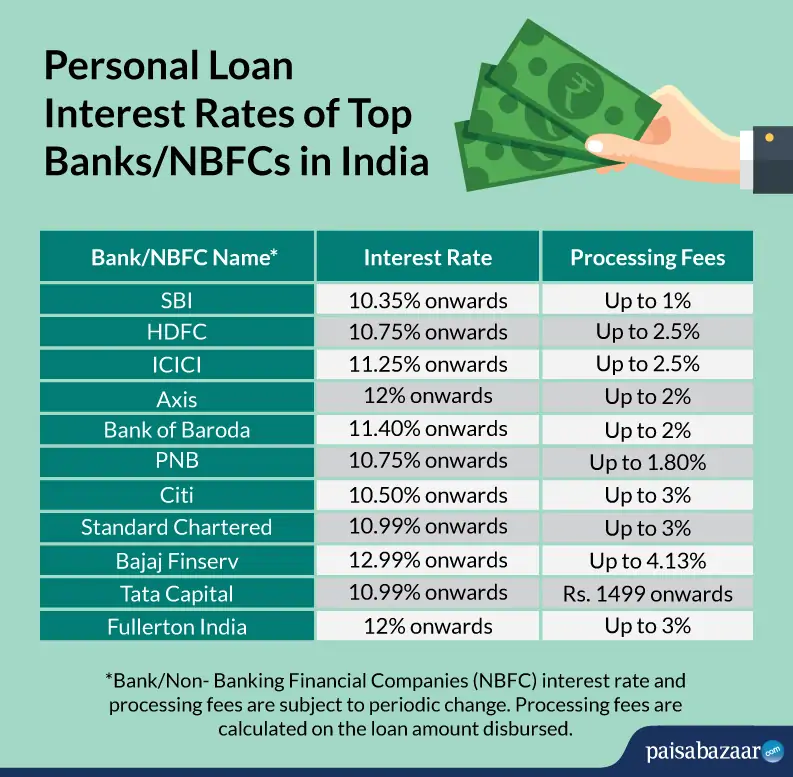

Understanding Today's Personal Loan Interest Rates

Table of Contents

Factors Influencing Personal Loan Interest Rates

Several key factors significantly impact the interest rate you'll receive on a personal loan. Understanding these factors empowers you to improve your chances of securing a lower rate and saving money over the life of your loan.

-

Credit Score: Your credit score is arguably the most influential factor. Lenders use your FICO score (Fair Isaac Corporation score) – a three-digit number representing your creditworthiness – to assess your risk. A higher credit score (generally above 700) indicates lower risk, resulting in lower personal loan interest rates. Conversely, a lower credit score increases your perceived risk, leading to higher rates. Improving your credit score before applying for a loan can significantly reduce your interest rate.

-

Debt-to-Income Ratio (DTI): Your DTI is the percentage of your monthly income dedicated to debt repayment. It's calculated by dividing your total monthly debt payments (including credit cards, mortgages, and other loans) by your gross monthly income. A lower DTI demonstrates to lenders your capacity to manage additional debt, making you a less risky borrower and potentially qualifying you for a better interest rate. Aim for a DTI below 43% for optimal results.

-

Loan Amount: Generally, larger loan amounts come with higher interest rates. Lenders perceive larger loans as riskier, requiring a higher rate to compensate for potential losses.

-

Loan Term: The loan term – the length of time you have to repay the loan – also impacts your interest rate. Longer loan terms (e.g., 60 months) result in lower monthly payments, but you'll end up paying significantly more interest over the loan's lifespan. Shorter terms (e.g., 36 months) mean higher monthly payments but lower overall interest costs.

-

Interest Rate Type (Fixed vs. Variable): Fixed-rate loans offer consistent monthly payments throughout the loan term, providing predictable budgeting. Variable-rate loans have interest rates that fluctuate based on market conditions, leading to potentially lower initial payments but the risk of increased payments later.

-

Lender Type: Different lenders – banks, credit unions, and online lenders – offer varying interest rates. Credit unions often offer more competitive rates to their members, while online lenders may provide convenience and potentially competitive rates, but always check the terms and conditions.

-

Economic Conditions: Prevailing interest rates set by central banks influence personal loan rates. When interest rates are high, personal loan rates tend to rise as well, reflecting the increased cost of borrowing for lenders.

Current Personal Loan Interest Rate Trends

Current personal loan interest rate trends are dynamic and influenced by macroeconomic factors. As of October 26, 2023, average interest rates for personal loans vary considerably depending on credit score and loan amount. Reputable financial websites like Bankrate and NerdWallet regularly publish data on average rates. For example, you might find average rates ranging from 7% to 25% APR, with higher credit scores securing rates at the lower end of this spectrum. Recent increases in the federal funds rate have generally pushed personal loan rates upward, though this impact varies among lenders. Predictions for future interest rate movements are uncertain and depend on various economic indicators, including inflation and unemployment rates. Always consult up-to-date resources for the most current information.

How to Find the Best Personal Loan Interest Rates

Securing the most favorable personal loan interest rates requires a proactive approach.

-

Shop Around and Compare: Don't settle for the first offer you receive. Compare offers from multiple lenders, focusing on the Annual Percentage Rate (APR), which reflects the total cost of borrowing, including interest and fees.

-

Improve Your Credit Score: Before applying, check your credit report for errors and take steps to improve your credit score if necessary. Paying down debt and making timely payments can significantly boost your score.

-

Negotiate: Once you've received loan offers, don't hesitate to negotiate with lenders for a lower interest rate. Highlight your strong financial standing and willingness to meet repayment obligations.

-

Consider Pre-qualification: Pre-qualification allows you to check your eligibility for a loan without impacting your credit score, helping you gauge the rates you might qualify for.

-

Look for Promotions: Some lenders offer promotional periods or discounts, such as lower interest rates for a limited time or discounts for certain types of borrowers.

Understanding APR (Annual Percentage Rate)

The APR is the annual cost of borrowing, expressed as a percentage. It's crucial to understand APR because it reflects the total cost, not just the interest rate. Fees and charges included in the APR might include origination fees, application fees, and prepayment penalties. For example, a loan with a 10% interest rate might have a 12% APR due to associated fees. Comparing APRs across different lenders ensures you're considering the complete borrowing cost, facilitating a more informed decision.

Conclusion

Securing a favorable personal loan interest rate hinges on several interconnected factors: your credit score, debt-to-income ratio, the loan amount and term, the type of lender you choose, and the prevailing economic conditions. By understanding these factors and actively comparing offers from multiple lenders, negotiating for the best terms, and improving your creditworthiness, you can significantly reduce your interest rate and save money in the long run. Start your search for the best personal loan interest rates today! Don't let high interest rates derail your financial goals. Use the information in this guide to compare offers and find the perfect personal loan for your needs.

Featured Posts

-

Dutch Conversion Of Vacant Office Buildings And Shops Into Homes Why Is Progress Stalling

May 28, 2025

Dutch Conversion Of Vacant Office Buildings And Shops Into Homes Why Is Progress Stalling

May 28, 2025 -

Assessing Alejandro Garnachos Manchester United Situation Transfer Or Stay

May 28, 2025

Assessing Alejandro Garnachos Manchester United Situation Transfer Or Stay

May 28, 2025 -

Ramalan Cuaca Bali Berawan Hujan Ringan Terbatas

May 28, 2025

Ramalan Cuaca Bali Berawan Hujan Ringan Terbatas

May 28, 2025 -

Prakiraan Cuaca 24 April 2024 Jawa Tengah Antisipasi Hujan

May 28, 2025

Prakiraan Cuaca 24 April 2024 Jawa Tengah Antisipasi Hujan

May 28, 2025 -

Martin Keown Arsenals New Striker Already Signed

May 28, 2025

Martin Keown Arsenals New Striker Already Signed

May 28, 2025