Understanding Weihong Liu's $675 Million Hudson's Bay Deal

Table of Contents

Who is Weihong Liu? A Deep Dive into the Investor

Weihong Liu is a relatively private investor, but his recent acquisition of Hudson's Bay reveals a significant player in the global real estate and investment landscape. Understanding his investment strategy is key to comprehending the implications of this $675 million deal. While details about his earlier career are scarce in public domain, his success is evident in his capacity to secure such a large-scale acquisition. His investment portfolio likely focuses on long-term value appreciation and strategic property development.

-

Key companies involved in his previous investments: While specifics remain largely undisclosed, his background suggests a focus on large-scale real estate projects and potentially other retail acquisitions, though the exact nature and scope of these remain unconfirmed.

-

His overall investment philosophy: Liu’s approach seems to prioritize strategically valuable assets with potential for significant growth, making the acquisition of Hudson's Bay a perfect fit for this philosophy. It indicates an interest in established brands with considerable property holdings, rather than solely focusing on rapidly growing startups.

-

His track record of success: Though details of his previous successes are limited publicly, the sheer scale of the Hudson's Bay acquisition speaks volumes about his financial acumen and strategic capabilities. This is a significant achievement, signalling a remarkable level of success in the high-stakes world of investment.

The Hudson's Bay Company: A History and its Current State

Hudson's Bay Company, a cornerstone of Canadian retail history, boasts a legacy spanning centuries. From its fur trading origins to its evolution into a major department store chain, the company has been a significant presence in the Canadian economic landscape. However, in recent years, Hudson's Bay faced challenges adapting to the changing retail environment, marked by increased online competition and shifting consumer preferences. These challenges led to financial struggles and eventually, the decision to sell.

-

Key milestones in Hudson's Bay's history: The company's rich history includes pivotal moments like its founding in 1670, its expansion across Canada, and its transformation into a modern department store retailer. Understanding this legacy provides context for its current state and the significance of the Weihong Liu acquisition.

-

Challenges faced by the company before the sale: The rise of e-commerce, changing consumer habits, and increased competition from both online and brick-and-mortar retailers significantly impacted Hudson's Bay's performance. This led to declining profitability and ultimately, the search for a buyer.

-

The company's assets and liabilities: Beyond its iconic retail stores, Hudson's Bay possesses a valuable portfolio of prime real estate properties in major Canadian cities. This real estate portfolio was a key attraction for Weihong Liu, potentially outweighing the challenges presented by the company’s retail operations.

Breakdown of the $675 Million Deal: Key Terms and Conditions

The $675 million acquisition agreement represents a significant transaction. While specific details regarding financing and conditions aren't publicly available in comprehensive detail, it is understood the deal involved a substantial cash payment. The process likely involved extensive due diligence and regulatory approvals before finalization. The impact on Hudson's Bay employees remains to be seen, but restructuring is anticipated.

-

Purchase price breakdown: The total $675 million likely encompasses not only the retail operations but also the considerable value of the company’s real estate holdings.

-

Payment schedule: The exact payment structure remains confidential. However, given the deal’s size, it likely involved a phased payment process to accommodate the complexities of such a large transaction.

-

Regulatory approvals required: Securing necessary regulatory approvals from Canadian authorities was likely a crucial step in completing the deal.

Future Implications: The Impact on Hudson's Bay and the Retail Landscape

The acquisition's long-term impact on Hudson's Bay and the wider Canadian retail landscape is a subject of ongoing speculation. Weihong Liu's plans for the company remain unclear, but several potential scenarios are likely. This could include restructuring operations, refocusing on specific retail strategies, or leveraging the existing real estate portfolio. This could affect the future of the iconic department stores, leading to changes in store locations, formats, and the overall brand.

-

Potential changes in store locations or formats: Some locations might be repurposed, sold, or redeveloped, potentially transforming them into mixed-use developments to enhance value.

-

Predicted changes in product offerings: Future product strategy may see shifts towards aligning with the investor's preferred direction, potentially impacting current selections.

-

The overall effect on employment in the sector: Restructuring may lead to changes in staffing, although the specific impact on employment remains to be seen.

Conclusion: Understanding the Significance of Weihong Liu's Hudson's Bay Deal

Weihong Liu's $675 million acquisition of Hudson's Bay is a pivotal moment in Canadian retail history. The deal highlights the evolving landscape of the retail industry and the importance of real estate in shaping business strategies. While many details remain undisclosed, the acquisition’s sheer scale and implications for Hudson's Bay and the broader market demand further scrutiny. Understanding Weihong Liu's investment strategy is crucial for predicting the future trajectory of this iconic Canadian brand. Stay informed about further developments in the Weihong Liu Hudson's Bay deal and similar retail acquisitions by subscribing to our newsletter for regular updates and insightful analyses of the ever-changing retail world.

Featured Posts

-

Setlist Fm Se Integra Con Ticketmaster Mejorando La Experiencia Del Usuario

May 30, 2025

Setlist Fm Se Integra Con Ticketmaster Mejorando La Experiencia Del Usuario

May 30, 2025 -

Manifestation A Bordeaux L Avenir De La Piste Secondaire De L Aeroport Remis En Question

May 30, 2025

Manifestation A Bordeaux L Avenir De La Piste Secondaire De L Aeroport Remis En Question

May 30, 2025 -

Ufc Heavyweight Unhappy With Jon Jones Comeback

May 30, 2025

Ufc Heavyweight Unhappy With Jon Jones Comeback

May 30, 2025 -

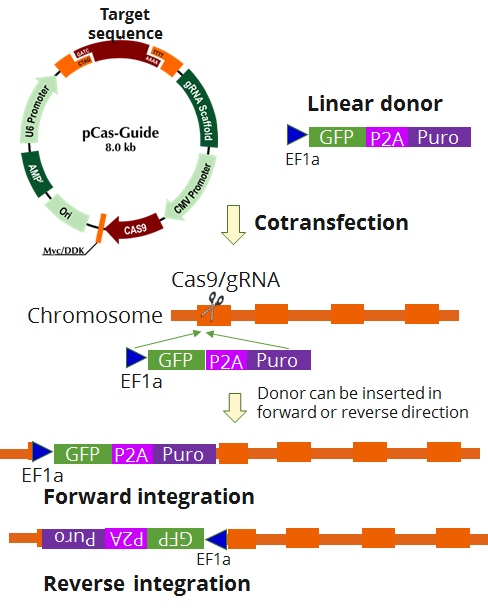

Crispr Technology Efficient Whole Gene Integration In Human Cells

May 30, 2025

Crispr Technology Efficient Whole Gene Integration In Human Cells

May 30, 2025 -

Nueva Integracion Setlist Fm Y Ticketmaster Mejoran La Experiencia De Los Fans

May 30, 2025

Nueva Integracion Setlist Fm Y Ticketmaster Mejoran La Experiencia De Los Fans

May 30, 2025