Understanding Your Updated HMRC Tax Code & Savings

Table of Contents

What is an HMRC Tax Code and How Does it Work?

Your HMRC tax code is a vital part of the Pay As You Earn (PAYE) system. PAYE ensures that income tax is deducted directly from your earnings before you receive your salary. This ensures that tax is paid regularly and avoids a large bill at the end of the tax year. Your tax code tells your employer how much tax-free income you're entitled to. This tax-free allowance is based on your personal circumstances and is adjusted annually.

- Key Components of a Tax Code: A typical tax code consists of numbers and letters. For example, 1257L. The numbers represent your personal allowance, while the letters indicate any adjustments or additional allowances.

- Tax Bands and Allowances: The UK has different tax bands, each with a specific tax rate. Your tax code determines which band your income falls into and how much tax is deducted. Your personal allowance is the amount you can earn tax-free.

- Examples of Tax Codes:

- 1257L: This is a common tax code indicating a standard personal allowance.

- 1100L: This code suggests a lower personal allowance, perhaps due to additional income or other factors.

- BR: This is a basic rate tax code. It indicates that your earnings will be taxed at the basic rate.

- Keywords: HMRC tax code, PAYE, tax bands, tax allowance, tax code examples

Understanding Your Updated HMRC Tax Code: Changes and Implications

Your HMRC tax code might change for several reasons:

- Change in Employment Status: Starting a new job, changing jobs, or becoming self-employed can affect your tax code.

- Changes in Personal Circumstances: Marriage, divorce, having children, or changes to your pension contributions can all trigger a tax code update.

- HMRC Adjustments: HMRC might adjust your tax code based on your previous tax year's return or if they identify discrepancies in your tax affairs.

An updated tax code can significantly impact your take-home pay. A higher tax code might result in less tax being deducted, while a lower one might mean more tax. You can easily check your tax code online via the HMRC website using your Government Gateway account.

- Keywords: HMRC tax code update, tax code changes, take-home pay, HMRC online services

Identifying Potential Tax Savings Based on Your HMRC Tax Code

Understanding your tax code opens doors to maximizing your tax savings. Several strategies can help you do this:

-

Pension Contributions: Pension contributions receive tax relief, reducing your overall tax bill. This effectively increases your savings by the amount of the tax relief.

-

Tax-Efficient Investments: Investing in ISAs (Individual Savings Accounts) allows you to grow your savings tax-free. Other tax-efficient investments may also exist depending on your individual circumstances.

-

Tax Relief: Tax relief reduces the amount of tax you owe. It's often available on various expenses, investments, or donations. Understanding how tax relief works with your tax code is essential for optimizing your savings.

-

Professional Financial Advice: If you're unsure about the best tax-saving strategies for your circumstances, seeking professional financial advice is highly recommended.

-

Keywords: tax savings, tax relief, pension contributions, ISA, tax-efficient investments, financial advice

Common HMRC Tax Code Problems and Solutions

Despite the best efforts, you might encounter problems with your HMRC tax code:

- Incorrect Tax Code: Receiving an incorrect tax code can lead to overpayment or underpayment of tax.

- Missing Tax Allowances: Failing to claim all your tax allowances can result in higher tax payments.

- Unexpected Tax Bills: Unforeseen changes to your tax code may result in unexpected tax bills.

To resolve these issues:

-

Contact HMRC Directly: Contact HMRC through their helpline or online services to clarify your tax code and report any discrepancies.

-

Review Your Tax Assessment: Carefully check your tax assessment for accuracy, and if you find any errors, appeal the assessment through the proper channels.

-

Keywords: HMRC tax code problems, incorrect tax code, tax assessment, appealing tax assessment

Conclusion: Take Control of Your Finances with Your HMRC Tax Code

Understanding your HMRC tax code is paramount to effective financial management. Regularly reviewing your tax code, taking advantage of tax relief and savings schemes, and seeking professional advice when needed will help you optimize your HMRC tax code and maximize your tax savings. Don't leave money on the table – check your HMRC tax code online today, understand its implications, and explore potential tax-saving strategies to gain better control of your finances. Optimize your HMRC tax code and maximize your tax savings!

Featured Posts

-

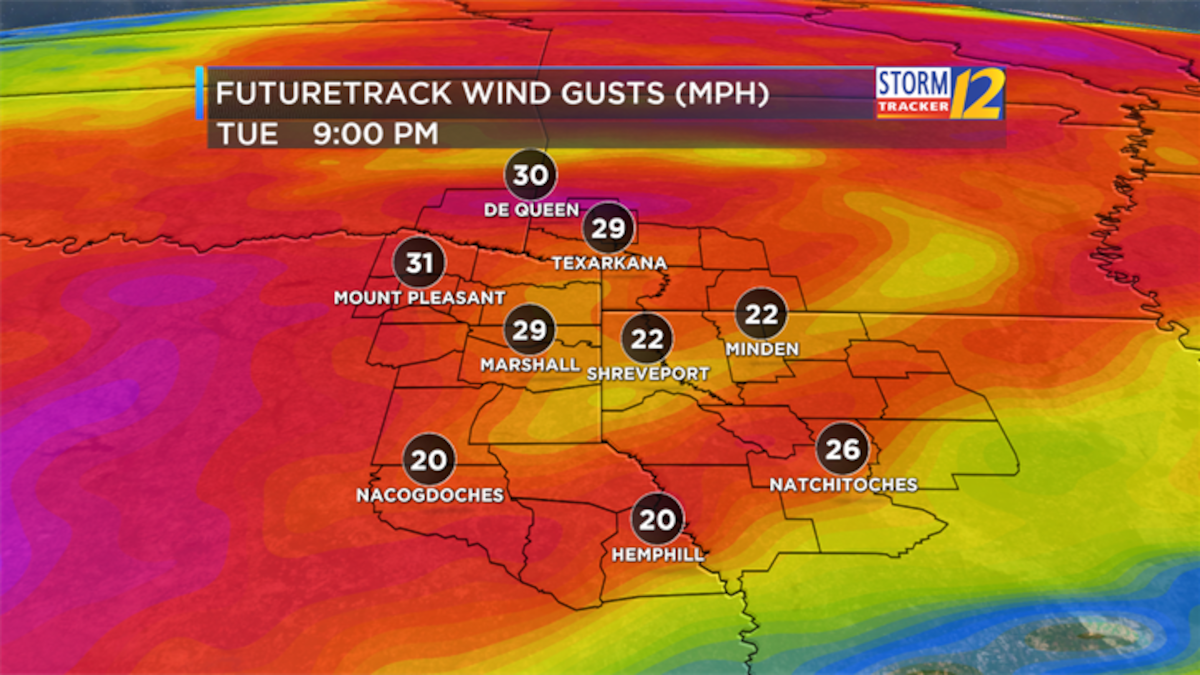

Your First Alert Strong Wind And Severe Storms Expected

May 20, 2025

Your First Alert Strong Wind And Severe Storms Expected

May 20, 2025 -

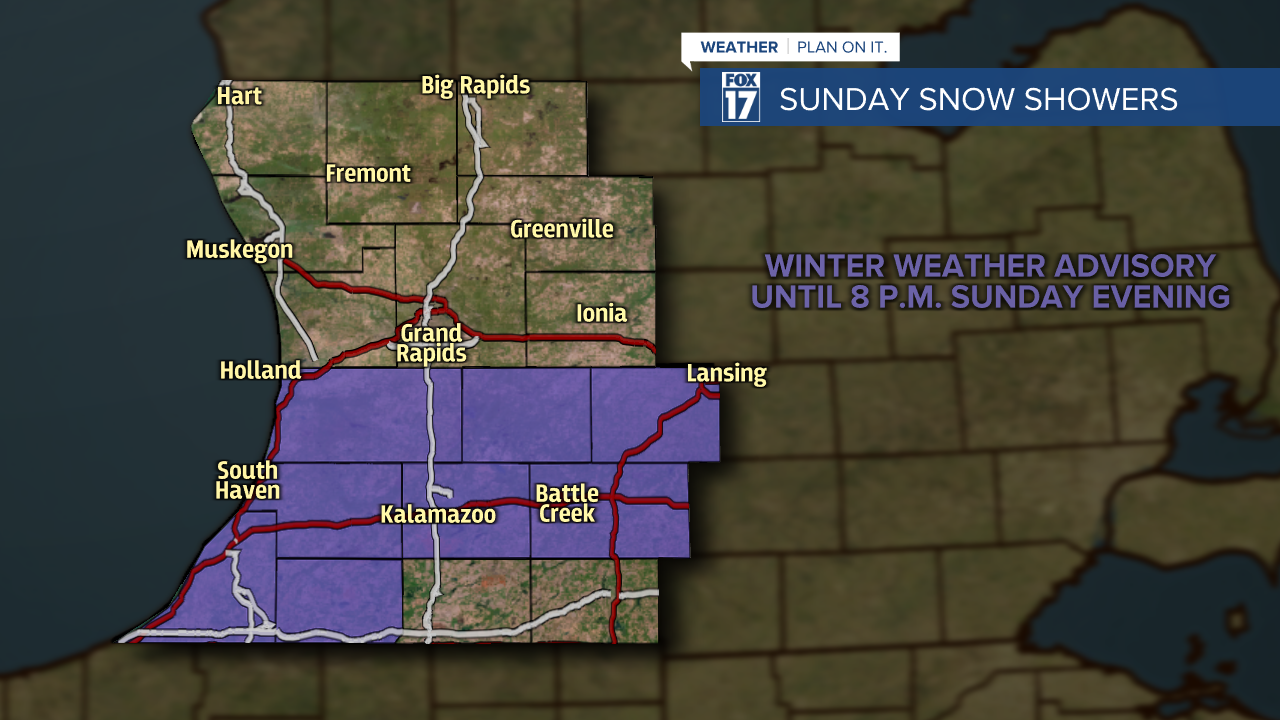

Staying Informed School Delays And Winter Weather Advisories

May 20, 2025

Staying Informed School Delays And Winter Weather Advisories

May 20, 2025 -

Tampoy I Martha Paleyei Gia Ton Gamo Tis

May 20, 2025

Tampoy I Martha Paleyei Gia Ton Gamo Tis

May 20, 2025 -

I Simasia Tis Megalis Tessarakostis Esperida Stin Kriti

May 20, 2025

I Simasia Tis Megalis Tessarakostis Esperida Stin Kriti

May 20, 2025 -

Starshiy Syn Mikhaelya Shumakhera Stal Ottsom

May 20, 2025

Starshiy Syn Mikhaelya Shumakhera Stal Ottsom

May 20, 2025