Unfunded Election Promises: A Recipe For Economic Slowdown

Table of Contents

The Direct Impact of Unfunded Spending on National Debt

Unfunded election promises directly translate into a ballooning national debt. When governments commit to spending without identifying a reliable source of revenue, they are forced to borrow money to cover the shortfall. This increased borrowing significantly impacts a nation's fiscal health and long-term economic prospects.

-

Increased borrowing to cover the shortfall: The government must issue bonds or seek loans from international lenders, increasing its overall debt burden. This debt needs to be serviced, meaning the government has to pay interest on its loans, which further strains the budget.

-

Reduced government spending on other crucial sectors due to debt servicing: A large portion of the national budget is then allocated to paying interest on the accumulated debt, leaving less money available for essential services like healthcare, education, and infrastructure. This can severely hinder a nation's development and social progress.

-

Higher interest rates as lenders demand higher returns for increased risk: As a country's debt increases, lenders perceive a higher risk of default. Consequently, they demand higher interest rates on loans, further increasing the cost of servicing the debt and creating a vicious cycle.

-

Examples of countries facing similar debt crises due to unfunded election promises: Greece's debt crisis in the early 2010s serves as a stark example of the devastating consequences of unsustainable government spending fueled by unfunded electoral pledges. Many other nations have faced similar challenges, highlighting the global nature of this economic problem. The resulting budgetary constraints often lead to austerity measures, which further impact economic growth.

Inflationary Pressures Fueled by Unfunded Promises

Increased government spending without a corresponding increase in productivity is a recipe for inflation. Unfunded election promises often lead to this scenario, creating a dangerous imbalance in the economy.

-

Increased demand without sufficient supply: When the government spends heavily without generating equivalent increases in production, it boosts aggregate demand without a matching increase in aggregate supply. This leads to a rise in prices as consumers compete for limited goods and services.

-

Devaluation of the currency due to increased borrowing: To fund the unfunded promises, governments often resort to extensive borrowing, which can lead to a devaluation of the national currency. A weaker currency makes imports more expensive, further fueling inflation.

-

Impact on purchasing power and cost of living: Inflation directly erodes purchasing power, meaning people can buy fewer goods and services with the same amount of money. The cost of living increases, impacting all segments of the population, particularly low-income households.

-

Examples of countries experiencing high inflation due to unsustainable government spending: Venezuela's hyperinflationary crisis in recent years stands as a cautionary tale, demonstrating the devastating impact of unfunded spending on a nation's economy and its citizens' well-being. Many countries throughout history have experienced similar inflationary spirals linked to unsustainable fiscal policies. Understanding monetary policy becomes critical in navigating these economic challenges.

Crowding Out Private Investment

Government borrowing to finance unfunded election promises directly competes with private sector investment. This "crowding out effect" has serious implications for long-term economic growth.

-

Higher interest rates making borrowing more expensive for businesses: Increased government borrowing pushes up interest rates, making it more expensive for businesses to secure loans for expansion, research, and development.

-

Reduced private sector investment leading to slower economic growth: With higher borrowing costs, businesses are less likely to invest, resulting in reduced economic activity and slower job growth. This ultimately hampers overall economic progress.

-

Negative impact on job creation and innovation: Reduced private investment translates into fewer jobs and less innovation, as businesses curtail expansion and research initiatives.

-

Examples of decreased private investment due to government debt: Numerous historical cases demonstrate the negative correlation between high government debt and reduced private investment. When governments consume a disproportionate share of available capital, it leaves less for the private sector to fuel its growth engine.

Loss of Investor Confidence and Capital Flight

Unfunded election promises erode investor confidence, both domestic and foreign. This uncertainty can lead to significant capital flight, further destabilizing the economy.

-

Uncertainty about future economic policies: Unfunded promises create uncertainty about the government's future fiscal policies, making investors hesitant to commit their capital.

-

Risk of default on government debt: Excessive borrowing increases the risk of a sovereign debt default, causing investors to withdraw their funds to avoid potential losses.

-

Withdrawal of foreign investment: Foreign investors are particularly sensitive to economic instability and may pull their investments out of a country with unsustainable fiscal policies.

-

Negative impact on currency exchange rates: Capital flight weakens the national currency, making imports more expensive and further damaging the economy.

Conclusion

Unfunded election promises represent a significant threat to economic stability. The resulting increase in national debt, inflationary pressures, crowding out of private investment, and loss of investor confidence can lead to a prolonged period of economic slowdown. Voters must critically assess the fiscal responsibility of political candidates and demand transparency regarding the funding mechanisms for their proposed policies. Rejecting candidates who make unrealistic, unfunded promises is crucial for ensuring long-term economic prosperity. Demand fiscal responsibility from your elected officials; don’t let unfunded election promises derail the economy.

Featured Posts

-

Clique Salon A Newton Aycliffe Top Ten Hair Salon As Featured In Echo

Apr 25, 2025

Clique Salon A Newton Aycliffe Top Ten Hair Salon As Featured In Echo

Apr 25, 2025 -

International Students Delete Op Eds In Anticipation Of Trumps Visa Changes

Apr 25, 2025

International Students Delete Op Eds In Anticipation Of Trumps Visa Changes

Apr 25, 2025 -

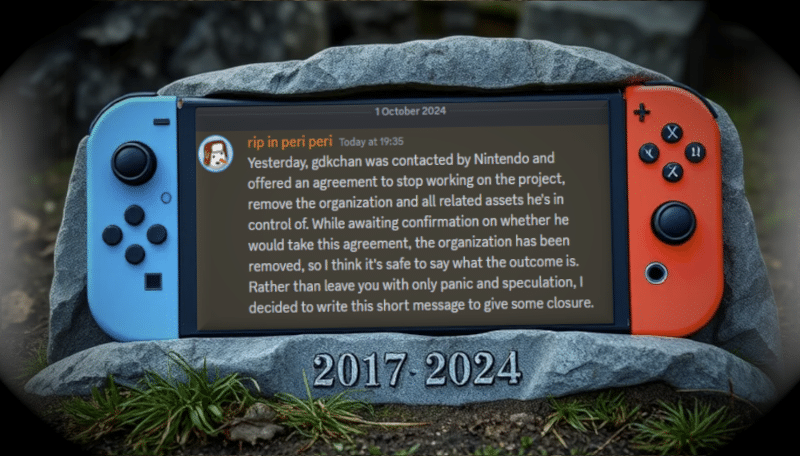

Ryujinx Emulator Shuts Down After Nintendo Contact What We Know

Apr 25, 2025

Ryujinx Emulator Shuts Down After Nintendo Contact What We Know

Apr 25, 2025 -

Dope Thief Episode 6 Review Will The Series Recover Before The Finale

Apr 25, 2025

Dope Thief Episode 6 Review Will The Series Recover Before The Finale

Apr 25, 2025 -

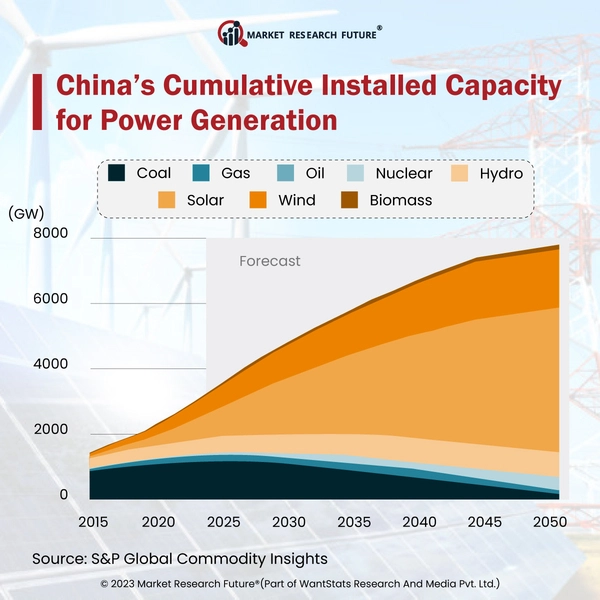

Chinas Potential End To Eu Lawmaker Sanctions A Financial Times Report

Apr 25, 2025

Chinas Potential End To Eu Lawmaker Sanctions A Financial Times Report

Apr 25, 2025