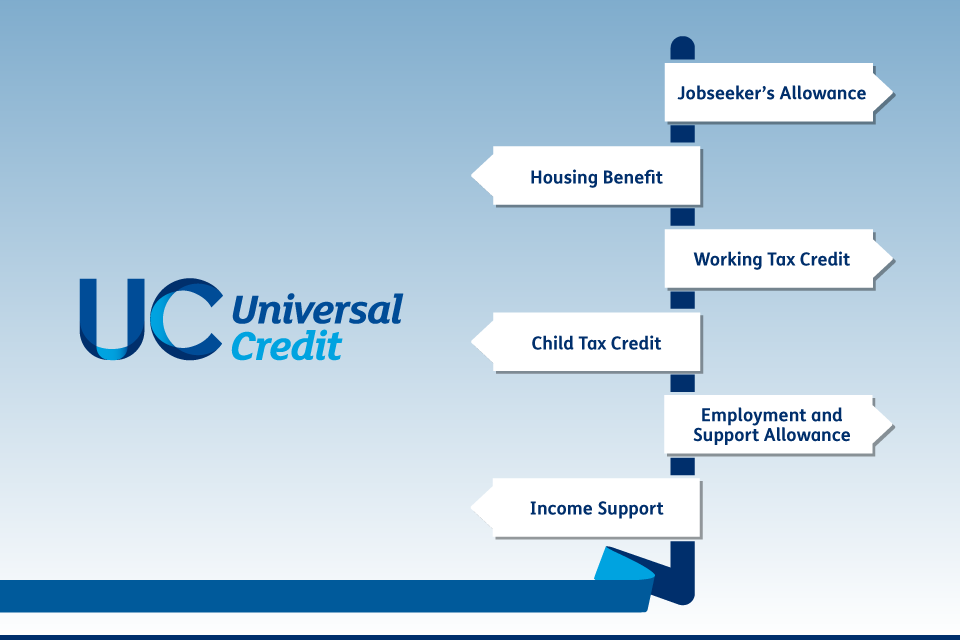

Universal Credit Changes: What Claimants Need To Know

Table of Contents

Increased Work Allowance

The government has recently increased the work allowance for Universal Credit claimants. This means you can earn more money before your benefits are affected. This increase is a significant change to the Universal Credit system and impacts the amount of earnings you can have before your payments are reduced.

- Previous Work Allowance Amounts: Before the changes, the work allowance was significantly lower, limiting the amount claimants could earn before seeing a reduction in their UC payments. Specific figures for those with and without children varied.

- New Increased Work Allowance Amounts: The new work allowance amounts are substantially higher. For those without children, the allowance has increased to £632. Claimants with children will see a higher threshold, with the exact amount varying based on the number of children. (Refer to the official government website for precise figures).

- Impact on Take-Home Pay: This increase in the work allowance means many claimants can earn more while still receiving some Universal Credit support. This improved take-home pay can lead to greater financial stability and potentially encourage more people to seek employment.

- Government Website Verification: For the most accurate and up-to-date information on the Universal Credit work allowance increase, please consult the official government website: [Insert Link to Official Government Website Here].

Changes to the Taper Rate

The taper rate – the rate at which your UC payments are reduced as your earnings increase – has also been adjusted. This change can significantly impact your overall benefit amount. A lower taper rate means you keep more of your earnings before your UC is reduced.

- Previous Taper Rate: The previous taper rate meant a larger percentage of your earnings was deducted from your UC payment, leaving some claimants with minimal additional income from working.

- New Taper Rate: The new taper rate is lower than before. This reduction means you retain a greater proportion of your earnings, offering a more significant incentive to work. (Again, check the official government website for the precise percentage).

- Examples of the Impact: Let's say you earn £1000 per month. Under the old taper rate, your UC payment reduction might have been significant. With the new, reduced taper rate, this reduction would be smaller, leaving you with a considerably higher net income.

- Implications for Budgeting and Financial Planning: This change to the Universal Credit taper rate requires careful budgeting and financial planning. While the increase is positive, it’s important to understand how the new rate affects your personal finances to avoid unexpected shortfalls.

Impact on Different Claimant Groups

The changes to Universal Credit don’t affect all claimants equally. Some groups will experience more significant benefits than others. Understanding the nuances is crucial.

- Impact on Single Parents: Single parents often face greater financial challenges. The UC changes, particularly the increased work allowance, offer crucial support in managing childcare costs and other expenses.

- Effects on Disabled Claimants: Disabled claimants may have specific additional needs and expenses. While the changes provide some relief, it's important for disabled claimants to ensure they access all available support and benefits to which they are entitled.

- Influence on Families with Multiple Children: Families with multiple children will benefit significantly from the increased work allowance and potentially the adjusted taper rate, contributing to greater financial stability.

- Specific Support for Vulnerable Claimants: Various organisations provide targeted support to help vulnerable claimant groups navigate the UC system. These organisations offer guidance and assistance in accessing the benefits and entitlements available.

Where to Find Further Information and Support

Knowing where to turn for help is crucial. This section provides links to reliable sources for further information and assistance regarding the recent Universal Credit changes.

- Official Government Website: The primary source of information is the official government website for Universal Credit: [Insert Link to Official Government Website Here]

- Reputable Charities and Organisations: Many charities and organisations offer valuable benefits advice. Search online for "benefits advice" or "Universal Credit support" to find organisations in your area. [Insert links to a few reputable organisations here]

- Contact Details for Helplines: Many helplines provide free and confidential advice on benefits and Universal Credit. Look for local and national helplines specific to your needs.

- Local Support Services: Your local council or community centre may offer assistance and support with navigating the Universal Credit system and understanding the recent changes.

Conclusion

The recent changes to Universal Credit have introduced significant alterations to work allowances and the taper rate, impacting claimants' benefits. Understanding these changes is vital for effective financial planning. It’s crucial to check your individual circumstances and seek advice if needed. Stay informed about further Universal Credit changes by regularly checking the official government website and seeking advice from reputable sources. Don't hesitate to seek help understanding how these Universal Credit changes affect you. Take advantage of the available resources to ensure you are receiving the support you are entitled to.

Featured Posts

-

Stephen Kings The Long Walk Movie Release Date Announced At Cinema Con

May 08, 2025

Stephen Kings The Long Walk Movie Release Date Announced At Cinema Con

May 08, 2025 -

Hong Kong Dollar Interest Rate Crisis Understanding The Post Intervention Drop

May 08, 2025

Hong Kong Dollar Interest Rate Crisis Understanding The Post Intervention Drop

May 08, 2025 -

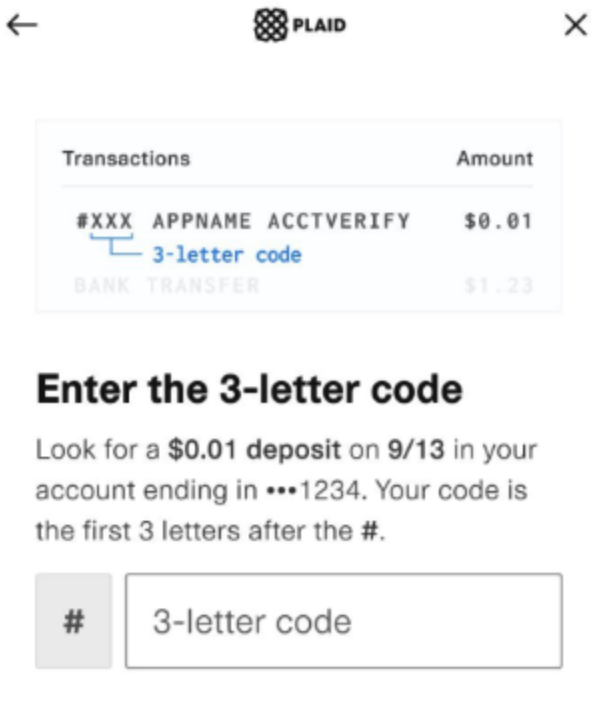

Dwp Alert Verify Your Bank Details For 12 Benefits

May 08, 2025

Dwp Alert Verify Your Bank Details For 12 Benefits

May 08, 2025 -

Brezilya Da Bitcoin Ile Maas Oedemek Avantajlar Dezavantajlar Ve Uygulama

May 08, 2025

Brezilya Da Bitcoin Ile Maas Oedemek Avantajlar Dezavantajlar Ve Uygulama

May 08, 2025 -

Les Corneilles Et Leur Etonnante Maitrise De La Geometrie Comparaison Avec Les Babouins

May 08, 2025

Les Corneilles Et Leur Etonnante Maitrise De La Geometrie Comparaison Avec Les Babouins

May 08, 2025