Unlocking Investment Opportunities: A Side Hustle Focused On Elon Musk's Private Holdings

Table of Contents

Understanding Elon Musk's Portfolio: Beyond Tesla and SpaceX

While Tesla and SpaceX dominate the headlines, Elon Musk's investments extend far beyond these publicly traded companies. His portfolio includes a diverse range of ventures, each presenting unique investment prospects and challenges. Key areas to consider include: The Boring Company, focused on infrastructure innovation; Neuralink, exploring brain-computer interfaces; and X Corp (formerly Twitter), a major player in social media and communication technology.

- High-Risk, High-Reward: Investing in these less-established entities inherently carries significant risk. Their valuations fluctuate dramatically based on market sentiment, technological advancements, and regulatory changes. Success is not guaranteed.

- Thorough Due Diligence is Crucial: Before considering any investment, exhaustive research is paramount. Understanding the business models, competitive landscapes, and financial projections of each venture is essential.

- Limited Public Investment Vehicles: Direct investment in many of Musk's private holdings is often restricted to accredited investors or through private placement offerings. Access to these opportunities may be limited.

- Challenges in Valuation: Obtaining accurate and reliable valuations for private companies can be extremely difficult. Information is often scarce and subject to interpretation.

Research and Due Diligence: Navigating the Information Landscape

Comprehensive research is the cornerstone of any successful investment strategy, especially when dealing with the complex and often opaque world of private company valuations. Before committing any capital, a thorough understanding of the target is crucial.

- Reliable News Sources: Stay updated through reputable financial publications, business news outlets, and industry-specific journals. Focus on sources known for accurate reporting and financial analysis.

- Market Trend Analysis: Analyze market trends in areas related to Musk's ventures. Identify emerging technologies, shifting consumer preferences, and potential disruptions that could impact their future performance.

- Risk Identification and Mitigation: Proactively identify potential risks, such as regulatory hurdles, competitive threats, and technological challenges. Develop strategies to mitigate these risks as much as possible.

- Legally and Ethically Seeking Information: While access to insider information is crucial, always ensure your methods remain within legal and ethical boundaries. Avoid any activity that could be considered insider trading.

Leveraging News and Social Media for Investment Insights

Social media and news outlets can offer valuable insights, but require careful discernment.

- Musk's Public Statements: Monitor Musk's tweets and public appearances for potential clues about future projects, strategic partnerships, and investment priorities. However, remember that his statements are often informal and shouldn't be taken as investment advice.

- Reputable Business News: Follow reputable business news sources dedicated to covering Musk's companies and their related industries.

- Social Listening Tools: Employ social listening tools to gauge public sentiment and market perception towards Musk's ventures. This can provide a sense of the overall market enthusiasm or skepticism.

- Beware of Misinformation: The internet is rife with misinformation. Always cross-reference information from multiple sources and verify its reliability before making investment decisions.

Potential Investment Strategies: Exploring Avenues for Participation

Given the private nature of many of Musk's holdings, direct investment is often challenging. However, there are indirect strategies to consider.

- Related Public Companies: Invest in publicly traded companies that collaborate with or directly benefit from Musk's ventures. This offers a less risky, more accessible entry point.

- Related Technologies and Industries: Identify companies operating in similar technological fields or related industries. Their success could be indirectly tied to the overall success of Musk's ecosystem.

- Crowdfunding or Seed Funding: If opportunities arise (and are accessible to you), consider participating in crowdfunding or seed funding rounds for startups aligned with Musk's interests. This often involves higher risk but potentially higher returns.

- Ethical Considerations: Be mindful of the ethical implications of investing in ventures that might be controversial or have a significant environmental impact.

Managing Risk and Diversification: A Crucial Aspect of Your Side Hustle

Investing in Elon Musk's ventures, even indirectly, is inherently high-risk. Proper risk management is paramount.

- Diversification: Diversify your portfolio across different asset classes and investments. Don't put all your eggs in one basket, especially not in a high-risk venture.

- Realistic Goals and Time Horizons: Set realistic investment goals and time horizons. Understand that significant returns might take time, and losses are possible.

- Emotional Discipline: Avoid emotional decision-making. Stick to your investment strategy even during periods of market volatility.

- Seek Professional Advice: Don't hesitate to consult with a financial advisor or investment professional for personalized advice tailored to your risk tolerance and financial goals.

Conclusion

Investing in ventures linked to Elon Musk offers significant potential for growth but demands a calculated approach. Through diligent research, careful risk management, and diversification, one can potentially unlock lucrative investment opportunities. Remember that this involves considerable risk, and losses are possible.

Call to Action: Start unlocking your own investment opportunities today. Begin researching Elon Musk's private holdings and develop a well-informed investment strategy tailored to your risk tolerance and financial goals. Remember to always conduct thorough due diligence before committing any capital.

Featured Posts

-

Seyfrieds Fiery Rebuttal Addressing Criticism Of Nepotism In Hollywood

Apr 26, 2025

Seyfrieds Fiery Rebuttal Addressing Criticism Of Nepotism In Hollywood

Apr 26, 2025 -

Mission Impossible Dead Reckoning Part Two Full Trailer Review

Apr 26, 2025

Mission Impossible Dead Reckoning Part Two Full Trailer Review

Apr 26, 2025 -

Access To Birth Control The Impact Of Over The Counter Availability Post Roe

Apr 26, 2025

Access To Birth Control The Impact Of Over The Counter Availability Post Roe

Apr 26, 2025 -

Santos Last Stand A Failing Defense

Apr 26, 2025

Santos Last Stand A Failing Defense

Apr 26, 2025 -

Ajaxs Europa League Hopes Suffer Setback After Frankfurt Defeat

Apr 26, 2025

Ajaxs Europa League Hopes Suffer Setback After Frankfurt Defeat

Apr 26, 2025

Latest Posts

-

Sudden Shift White House Withdraws Nomination Chooses Maha Influencer For Surgeon General

May 10, 2025

Sudden Shift White House Withdraws Nomination Chooses Maha Influencer For Surgeon General

May 10, 2025 -

Real Id Act Impacts On Summer Travel Plans

May 10, 2025

Real Id Act Impacts On Summer Travel Plans

May 10, 2025 -

Real Id Enforcement Your Summer Travel Guide

May 10, 2025

Real Id Enforcement Your Summer Travel Guide

May 10, 2025 -

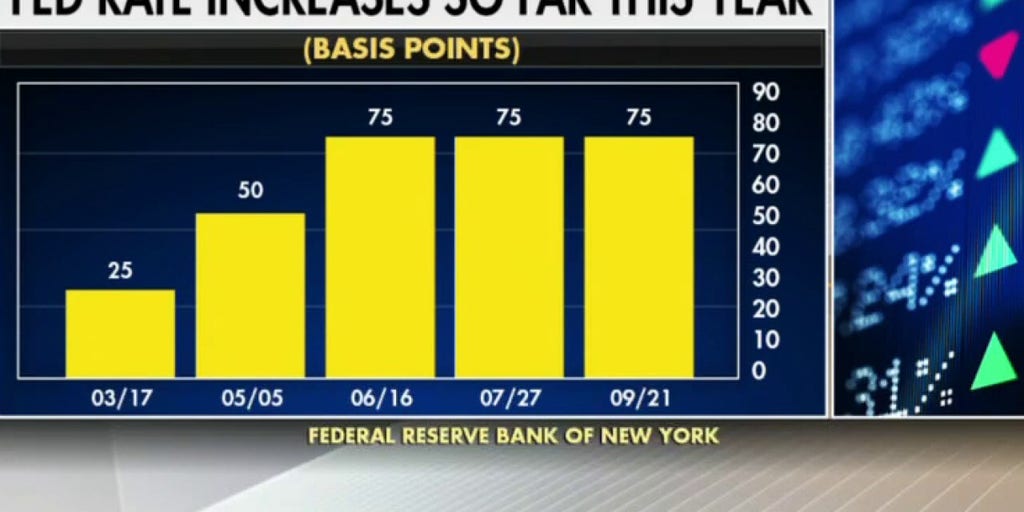

Why The Federal Reserve Lags Behind On Interest Rate Cuts

May 10, 2025

Why The Federal Reserve Lags Behind On Interest Rate Cuts

May 10, 2025 -

Police Save Choking Toddler Bodycam Footage Shows Dramatic Rescue

May 10, 2025

Police Save Choking Toddler Bodycam Footage Shows Dramatic Rescue

May 10, 2025