Unlocking Value: A Look At News Corp's Underappreciated Business Units

Table of Contents

News Corp operates across multiple sectors, including news and information, book publishing, and digital real estate. While its media properties often dominate the conversation, a closer examination reveals a wealth of opportunities within its less-discussed divisions. This analysis aims to highlight these undervalued assets and demonstrate their substantial contributions to News Corp's financial health and future growth.

News Corp's Digital Real Estate Portfolio: A Hidden Gem

News Corp's digital real estate holdings represent a significant, yet often overlooked, source of revenue and growth. This segment, primarily driven by Realtor.com and Move, Inc., boasts impressive market share and substantial potential for expansion.

The Power of Realtor.com and Move, Inc.

Realtor.com is a dominant force in the US real estate market, providing a crucial platform for agents and homebuyers alike. Its extensive reach and user-friendly interface contribute to its leading market position. Move, Inc., the parent company of Realtor.com, further strengthens its foothold in the digital real estate ecosystem.

- Market Capitalization: While not directly publicly traded, Realtor.com's contribution to News Corp's overall market cap is significant and often underrepresented in market analyses.

- Revenue Streams: Realtor.com generates revenue through advertising, subscriptions, and various other service fees. Move, Inc.'s diverse offerings contribute to a robust and resilient revenue stream.

- Competitive Advantages: Realtor.com benefits from strong brand recognition, a vast network of real estate agents, and a user-friendly platform, providing a significant competitive edge.

- Future Growth Projections: The ongoing digitization of the real estate industry suggests robust future growth for Realtor.com, especially given the potential for international expansion.

International Expansion and Diversification Opportunities

The success of Realtor.com in the US provides a strong foundation for international expansion. News Corp could leverage its existing infrastructure and expertise to replicate this model in other markets, partnering with or acquiring similar platforms globally. This could involve:

- Geographic Expansion Strategy: A phased approach, targeting key markets with high growth potential, could minimize risk and maximize return.

- Acquisition Targets: Identifying and acquiring established players in international markets could accelerate expansion.

- Potential Challenges: Navigating differing regulatory environments and adapting the platform to local market needs will be crucial for success. Potential synergies with other News Corp properties (e.g., data analytics) should also be considered.

News Corp's Book Publishing Division: A Steady Source of Revenue and Profit

HarperCollins Publishers, a key component of News Corp's portfolio, represents a consistent and substantial contributor to the company's bottom line. Its diverse portfolio and strong market position solidify its importance.

HarperCollins' Strong Market Position and Diverse Portfolio

HarperCollins holds a respected position within the global publishing industry. Its diverse portfolio spans various genres and formats, encompassing best-selling novels, educational materials, and more. This breadth mitigates risk and ensures a steady stream of revenue.

- Market Share Data: HarperCollins consistently maintains a significant share of the market, competing effectively with other major publishing houses.

- Bestseller Lists: The numerous bestsellers published by HarperCollins attest to its ability to identify and cultivate successful authors and titles.

- Profitability Metrics: The book publishing division consistently demonstrates healthy profitability, making it a reliable contributor to News Corp’s overall financial performance.

- Diversification Strategies: HarperCollins' strategic investments in diverse publishing segments help mitigate risks and capitalize on emerging trends.

Adapting to the Evolving Digital Landscape

HarperCollins has proactively adapted to the digital revolution in publishing. It has invested heavily in e-book and audiobook platforms, recognizing the changing consumption habits of readers.

- E-book Sales: HarperCollins has successfully integrated e-book sales into its revenue streams, showcasing a strong understanding of digital market trends.

- Audiobook Growth: Recognizing the increasing popularity of audiobooks, HarperCollins has made significant investments in this growing segment.

- Digital Marketing Strategies: Sophisticated digital marketing campaigns help reach new readers and promote its extensive catalog.

News Corp's News and Information Services: More Than Just News

While often associated with traditional print media, News Corp's news and information services encompass much more. The Wall Street Journal and Dow Jones provide essential financial news and data to a global audience, adding substantial value to the company’s portfolio.

The Value of Dow Jones and the Wall Street Journal

The Wall Street Journal remains a highly influential publication, commanding respect for its in-depth reporting and trusted brand. Its subscription model generates significant revenue and contributes heavily to News Corp’s profitability. Dow Jones's data services further solidify its position in the financial information market.

- Subscription Numbers: The WSJ maintains a substantial subscriber base, both print and digital, indicating strong brand loyalty and market demand.

- Digital Readership: The Wall Street Journal’s significant online presence shows adaptation to the digital media landscape.

- Revenue Streams: The WSJ generates revenue through subscriptions, advertising, and data services, creating a diverse revenue stream.

- Brand Valuation: The WSJ's strong brand recognition translates into significant intangible value for News Corp.

Strategic Partnerships and Diversification Efforts

News Corp continues to explore strategic partnerships and collaborations to expand its reach and diversify its offerings within the news and information sector.

- Partnerships: Collaborations with other businesses enhance the reach and impact of their content.

- Strategic Acquisitions: Targeted acquisitions could expand into new areas, like specialized data analytics or international news coverage.

- New Market Entry Strategies: News Corp might consider entering new markets or developing new content formats to capture wider audiences.

Conclusion: Unlocking the Full Potential of News Corp's Underappreciated Business Units

This analysis reveals that News Corp's underappreciated business units – digital real estate, book publishing, and news and information services – make substantial contributions to the company's overall value. These divisions demonstrate robust profitability, significant growth potential, and resilience in a dynamic market. Each possesses unique strengths and opportunities for future expansion.

Key takeaways include the market leadership of Realtor.com, the consistent profitability of HarperCollins, and the enduring influence of the Wall Street Journal and Dow Jones. Investing in a better understanding of News Corp's underappreciated assets is key to unlocking long-term value. We encourage further research into the individual financial performance of these units to gain a more comprehensive understanding of News Corp's true potential.

Featured Posts

-

Paris Fashion Week Amira Al Zuhairs Debut For Zimmermann

May 25, 2025

Paris Fashion Week Amira Al Zuhairs Debut For Zimmermann

May 25, 2025 -

Lino En Otono Inspiracion De Charlene De Monaco

May 25, 2025

Lino En Otono Inspiracion De Charlene De Monaco

May 25, 2025 -

The Hells Angels Motorcycle Club History Structure And Activities

May 25, 2025

The Hells Angels Motorcycle Club History Structure And Activities

May 25, 2025 -

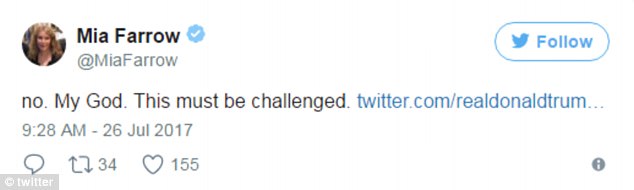

Mia Farrow On Trumps Address A 3 4 Month Deadline For American Democracy

May 25, 2025

Mia Farrow On Trumps Address A 3 4 Month Deadline For American Democracy

May 25, 2025 -

Thlyl Adae Daks Alalmany Wtjawzh Ldhrwt Mars

May 25, 2025

Thlyl Adae Daks Alalmany Wtjawzh Ldhrwt Mars

May 25, 2025